Yes — you can buy golf balls directly from a Chinese manufacturer even for 1,000–2,000 pcs. The key is verifying a real factory in known clusters, matching your order size to a mid-scale producer, and setting realistic expectations on price, printing, packaging, and lead time. This Q&A turns those points into a small-buyer playbook you can use today.

-

Yes—1k–2k pcs is viable. Work with a mid-scale factory, not a mega plant.

-

Keep specs practical. Start with 1-side pad printing + white box + sticker.

-

Plan the timeline. Packaging/slotting, not molding, controls ship date—especially Aug–Q4.

Why are we writing this Q&A now?

We’re writing this because many inquiries ask whether factories will accept small OEM orders (≈1,000–2,000 pcs) and whether printing and packaging remain feasible at low MOQs; the short answer is yes when you choose a mid-scale factory and keep specs and schedule realistic.

We’ve seen repeated RFQs for 2,000 pcs—or less—and the common line is, “My order is small; can I order directly from your factory?” The concern is valid. Smaller B-buyers worry they won’t be valued. This article removes that fear and shows exactly how small-batch OEM works, where the flexibility is, and where conditions apply. You’ll learn how to verify genuine factories from home, what “right-sized” means, which printing methods match small runs (with USD ranges), why lead time is about scheduling not molding, and how to package cleverly to avoid box-vendor MOQs when you buy golf balls directly from a Chinese manufacturer.

What will you learn in the next 5 minutes?

You’ll learn how to verify real factories remotely, when 1k–2k orders are practical, which printing method fits your artwork and budget, why small batches don’t always ship faster, and which packaging keeps MOQ and cost in check for your first run.

By the end, you’ll have a repeatable checklist, copy-and-paste tables for RFQs, and a fast print-method selector. You’ll also know exactly what to send to get a useful quote—files, sizes, positions, packaging preference—so your factory can respond quickly with method, cost range, and a realistic timeline.

Why does a small direct order often make business sense?

A first order of 1,000–2,000 pcs lets you validate product-market fit with modest cash outlay, avoids middleman friction, and keeps communication close to the production line—exactly what you want when you buy golf balls directly from a Chinese manufacturer.

Going direct aligns your unit economics with real production constraints. Start with one-side, one-color pad printing and white box + sticker to keep risk low. Once demand stabilizes, layer in multi-color art and retail boxes without re-engineering the whole process.

Key Takeaway: Small direct orders work when you pick a mid-scale factory and keep specs practical.

How do you identify a “real” Chinese golf-ball manufacturer without traveling?

Verify the factory’s cluster location, check for a focused ball-only product scope with credible workshop media, and test response speed and technical depth via email; real factories talk materials, compression windows, dimple patterns, and clear-coat thickness—and reply fast.

Step 1 — does the address match a known industrial cluster?

Legitimate factories typically sit inside China’s golf-ball clusters; if a supplier lists a non-cluster downtown office yet claims to manufacture, treat it as a caution flag and probe further before you buy golf balls directly from a Chinese manufacturer.

| Cluster (China) | Representative Cities / Ports | Typical Capabilities | Notes for Buyers |

|---|---|---|---|

| Greater Pearl River Delta | Shenzhen, Dongguan / Yantian, Shekou | 2–3-layer Surlyn/TPU mass OEM; strong printing & gift-box pairing; some 3–4-layer tour-like | Great for practice/promotional balls and fast packaging pairs |

| Southern Fujian (Xiamen–Quanzhou–Zhangzhou) | Xiamen Port | 2–4-layer OEM; flexible MOQs; mature printing/box supply | Good for e-commerce sets and rapid small-batch development |

| Eastern Zhejiang (Ningbo–Taizhou) | Ningbo–Zhoushan Port | 2–3-layer Surlyn/TPU; some cast-urethane multi-layer | Suits small-to-mid runs, incl. PU-cover “tour-leaning” |

| Shandong Peninsula (Qingdao–Weihai–Yantai) | Qingdao Port | 2–3-layer & driving-range balls; US/EU focus | Long export history for distributor lines |

| Western China (Chengdu) | Air freight / rail-sea | Multi-SKU specialty balls (floating, night-glow) + 2–3 layers | Niche/SKU-rich programs and gift orders |

Step 2 — does the website read like a factory or a catalog?

Real factories focus on golf balls and show workshop media (molding, coating, pad-printing), plus technical pages on covers (Surlyn/TPU/PU), dimple counts, and compression; broad “everything golf” catalogs usually indicate a trading company.

Scan for a narrow SKU range, production photos/video, and credible technical terms. Confirm the business address lines up with a cluster. Look for adhesion tests, alcohol-wipe, and durability notes. These signals appear naturally when you buy golf balls directly from a Chinese manufacturer with in-house lines.

Step 3 — does email responsiveness reveal engineering depth?

Send two practical emails—ask for logo size limits (mm), recommended print method for your artwork, and the adhesion tests they use; then ask for MOQ and lead time by printing method and packaging type; concise, technical replies within 24–48h are factory tells.

Factories can answer 15–18 mm logo sweet spots, pad vs. UV vs. DTF trade-offs, and clear-coat thickness targets on the first pass. Traders often write “we will check with factory,” which inserts days of delay. Use this to filter suppliers before you invest sampling time.

| Supplier Type | What You’ll See on Site | Typical Product Breadth | Strengths | Trade-offs | Best Use Case |

|---|---|---|---|---|---|

| Manufacturer (Factory) | Production photos/videos; workshop lines | Mostly golf balls + printing | Technical depth; consistent quality; direct cost | MOQ rules; fewer accessories | Performance-oriented OEM where ball specs matter |

| Trading Company | “One-stop” catalogs: balls, bags, clubs | Wide multi-SKU | Flexible MOQs; ready sourcing | Extra margin; variable tech depth; indirect replies | Gift sets, bundles, low-urgency multi-SKU projects |

Key Takeaway: Verify cluster location, factory-floor media, and fast, technical email replies before sampling.

✔ True — You can place 1,000–2,000 pcs direct orders with the right mid-scale factory

Mid-sized manufacturers that focus on golf balls routinely accept small OEM runs if you’re flexible on packaging and timeline, and your artwork is factory-ready.

✘ False — “All factories only want 100k+ pcs”

Top-tier mega factories prioritize very large volumes, but many specialized producers build their business around small and mid-sized OEM batches.

Will a factory accept my 1,000–2,000 pcs order directly?

Yes—mid-scale factories routinely accept 1k–2k orders when you align on price, packaging, and scheduling; mega plants chase 100k–300k+ lots, so your best fit is the specialist who lives in the 1k–20k band and communicates like an engineer.

What conditions typically apply to small direct orders?

Expect conditions around right-sized factory selection, unit price realism, simplified packaging, and scheduling room; small ≠ instant because lines must finish current runs before slotting yours.

| Condition | What It Means | Why It Exists | How You Can Adapt |

|---|---|---|---|

| Right-sized factory | Mid-scale factories value small batches | Mega plants pursue huge volumes | Shortlist mid-scale producers with small-order case studies |

| Realistic per-unit price | Small batch = higher unit cost | Setup/changeovers/manual steps | Optimize art (1 color), consider one-side print |

| Simple packaging | Avoid fully custom 4-color boxes at first | Box vendors have MOQs (e.g., 500+) | Choose bulk/mesh/white box + printed sticker |

| Time for scheduling | Small ≠ instant | Lines must finish current runs | Order 2–4 weeks ahead; avoid peak months if possible |

What is the price reality at low MOQs?

Unit price rises at 1k–2k because setups, changeovers, and hand-work get spread over fewer balls; keep logos simple, positions minimal, and methods efficient to control cost.

| Cost Element | 1,000 pcs (typical) | 2,000 pcs (typical) | Notes |

|---|---|---|---|

| Ball (2–3 layer Surlyn/TPU) | Quote-dependent | Quote-dependent | Performance tier varies by spec |

| Printing (Pad 1-color) | ~$0.07–$0.10/ball | ~$0.05–$0.08/ball | +$0.02–$0.04/ball for 2nd color |

| Printing (UV Direct CMYK) | ~$0.12–$0.22/ball | ~$0.10–$0.18/ball | White base +$0.02–$0.03/ball |

| Printing (UV-DTF) | ~$0.12–$0.20/ball | ~$0.10–$0.16/ball | Clear coat +$0.01–$0.03/ball |

| One-time fees (method-specific) | Pad $60–$160; UV $20–$50; UV-DTF $20–$60 | Same | Plates/films/jigs/setup; reuse lowers re-order cost |

| Packaging (bulk/mesh/white box) | Low incremental | Low incremental | Full-color boxes raise MOQ & lead time |

Key Takeaway: 1k–2k pcs is acceptable—align on price, packaging simplicity, and scheduling headroom.

✔ True — What MOQ really reflects in manufacturing

MOQ is driven by material batches, machine setup cost, and packaging runs. Flexibility is possible—but it trades off with price, timing, or customization scope.

✘ False — “MOQ is arbitrary or laziness”

Treating MOQ as made-up numbers creates friction; it’s grounded in real line economics and supplier capacity planning.

What lead time should small batches plan for, and why?

Small batches don’t always ship faster. The bottlenecks are production slotting, seasonal queues, and packaging lead times—not the few days to mold, coat, and print the ball. Plan around the longest pole, which is often gift boxes in peak season.

What truly drives the schedule for 1k–2k pcs?

Lead time includes order/file confirmation, slotting, ball production + curing, printing, packaging/QC, and a peak-season buffer; the “ball-making” days are rarely the long pole.

| Stage | Typical Duration | Notes for 1k–2k pcs |

|---|---|---|

| Order & file confirmation | 1–3 working days | Vector files (AI/PDF/SVG) save days |

| Production slotting | 3–7 working days | Lines must finish prior runs |

| Ball production + curing | 3–5 working days | Core/cover rarely are the bottleneck |

| Printing & finishing | 2–5 working days | Pad/UV/DTF choice affects cycle time |

| Packaging & QC | 2–4 working days | Fancy boxes may add 10–15+ days |

| Peak-season buffer (Aug–Q4) | +5–10 working days | Queues increase across steps |

Reorders run faster (plate/film reuse)

-

Plate/film/jig reuse trims both cost and approval time; confirm reuse policy in your PO.

-

Typical reorders skip artwork approval and hit shorter slotting windows.

-

Pre-book packaging (stickers/white boxes) to keep boxes from becoming the long pole.

✔ True — What “lead time” actually includes

Lead time covers material readiness, QC buffer, printing setup, and packaging—plus the line slot. Accurate planning means accounting for all parts, not just molding days.

✘ False — “Once I pay, production starts right away”

Slots must be scheduled and jigs prepared; rushing risks quality or missed windows.

Key Takeaway: Lead time is driven by slotting and packaging; small ≠ instant, especially in peak season.

Which printing methods and costs work best at low MOQ?

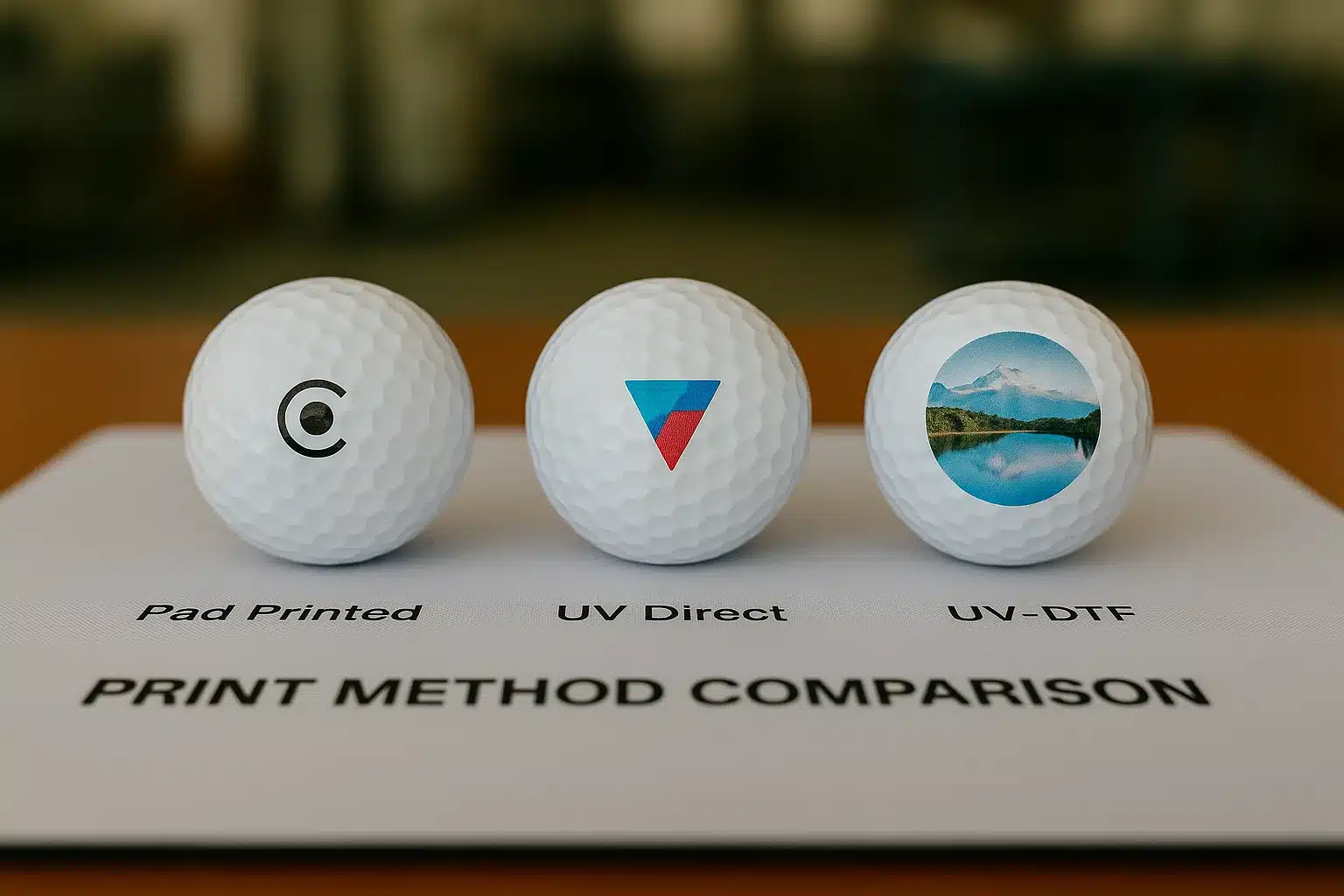

For 1k–2k pcs, use Pad Printing for 1–2 color logos, UV Direct for gradients/multi-color or fine text, and UV-DTF for photo-level or multi-position artwork; unit costs vary by complexity and clear-coat strategy.

What is the best at-a-glance recommendation?

Match your artwork and budget to the method: pad printing is cheapest and rugged for simple marks; UV Direct handles detail without plate fees; UV-DTF carries photo-level art but needs a sealing coat and more labor per unit.

| Method | Best For | Unit Cost (USD/ball) | One-time Fees | Pros | Cons |

|---|---|---|---|---|---|

| Pad Printing (Tampo) | 1–2 solid colors, corporate marks | ~$0.07–$0.10 (1k), ~$0.05–$0.08 (2k) | Plate/jig: $60–$160 | Lowest cost; high throughput; robust adhesion | Multicolor registration is harder; no gradients |

| UV Direct | Full color/gradients/fine text | ~$0.12–$0.22 (1k), ~$0.10–$0.18 (2k) | Setup: $20–$50 | No plates; high detail; supports variable data | Needs white underbase + thin clear coat for durability |

| UV-DTF / Waterslide | Photo-level, multi-position | ~$0.12–$0.20 (1k), ~$0.10–$0.16 (2k) | Film/tooling: $20–$60 | Highest design freedom; hugs dimples well | Manual application; faint edge visibility; clear coat advised |

✔ True — Clear-coat should be thin and consistent

Keep total top-coat around 10–25 μm to improve abrasion resistance without clogging dimples or altering feel.

✘ False — “Any amount of clear is fine”

Over-thick coats affect aerodynamics. Specify the range in your PO and validate with batch QC snapshots.

Quick “If…Then” selector (bookmark this)

| If your artwork is… | And your priority is… | Then choose… | Because… |

|---|---|---|---|

| 1–2 solid colors | Lowest unit cost | Pad Printing | Cheapest, robust, fast cycles |

| Gradients/multi-color | Detail & flexibility | UV Direct | No plates, high detail, quick changes |

| Photo-level or multi-position | Design freedom | UV-DTF | Film carries complex art; clear coat seals |

Key Takeaway: Pad = cheapest/simple; UV = complex/flexible; UV-DTF = photo-grade (seal with thin clear-coat).

How should you package small orders to keep MOQ and cost in check?

For your first run, choose bulk/mesh/white-box + sticker; avoid full-color custom boxes that trigger 500+ box MOQs and extend lead time beyond the ball production itself when you buy golf balls directly from a Chinese manufacturer.

Which options fit low MOQs and early timelines?

Bulk cartons, mesh bags, and white boxes with printed stickers hit the sweet spot of speed, cost, and semi-retail presence without tripping vendor MOQs.

| Packaging Option | MOQ Tendencies | Cost Impact | Pros | Watch-outs |

|---|---|---|---|---|

| Bulk (carton) | Very low | Lowest | Fastest, simplest | Not retail-ready |

| Mesh bag | Low | Low–mid | Gift-friendly, range-ready | Limited graphics area |

| White box + printed sticker | Low | Low–mid | Semi-retail look, flexible | Sticker size/resolution constraints |

| Full-color custom box | Box vendor MOQ 500+ | Highest | Retail-grade | Long lead; high setup; mismatch with 1–2k balls |

✔ True — Test on the exact ball finish you’ll ship

Different clears and surface energies behave differently. Run adhesion and alcohol-wipe tests on your actual production ball, not a look-alike sample.

✘ False — “A sample on another ball is good enough”

Ink systems interact with specific clears. Insist on samples printed on your chosen ball spec before releasing mass production.

Key Takeaway: First run: bulk/mesh/white-box + sticker; avoid full-color boxes that trigger high MOQs.

What buyer FAQs

Can I order directly with only 1,000 pcs?

Yes—many mid-scale factories accept 1,000–2,000 pcs if printing and packaging stay practical; unit price is higher than mass orders, but total cash outlay is ideal for market tests.

Start with one-side, one-color pad printing and white box + sticker. This combination avoids box-vendor MOQs, reduces changeovers, and speeds slotting while keeping your brand visible.

Which printing method is best for small orders?

Pad Printing for 1–2 color logos; UV Direct for gradients/multi-color or fine text; UV-DTF for photo-level or multi-position art with a thin clear-coat; each balances cost, speed, and flexibility differently.

If you need variable numbering, UV Direct is often the most efficient. For the boldest corporate marks at the lowest unit cost, pad printing wins. For complex sponsor art or multiple placements, UV-DTF provides the most design freedom.

Why isn’t the lead time faster for small orders?

Scheduling, not ball-making, is the bottleneck; packaging frequently dictates the ship date, and peak season adds queue time; the ball itself may take days, but line slots and gift-box schedules control the calendar.

Secure a line slot early and confirm which step is the long pole. If you must hit a date, simplify packaging or split shipments: balls first, gift boxes later.

How do I verify a real factory from home?

Check the address against known clusters, look for factory-floor media and a focused product scope, and test for fast, technical email replies; real factories speak materials and tolerances, traders speak catalogs.

A downtown office in a non-cluster city that also claims “factory” is a caution flag. Probe with production questions about cover materials, dimple counts, and clear-coat thickness.

✔ True — Small orders still carry real risk

Trial orders can face delays or QC issues without clear terms. Treat 1k–2k programs with the same discipline—samples, PO terms, inspections—as larger waves.

✘ False — “A small order means no risk at all”

Risk doesn’t disappear at low volume. Clear specs, print tests, and packaging choices still decide outcomes.

What should you send to get a fast, useful quote?

Send quantity (1k/2k), vector logo (AI/PDF/SVG), print size (mm), positions (1-side/2-side), and packaging preference (bulk/mesh/white box); you’ll receive a recommended print method, unit cost range, one-time fees, a stage-by-stage timeline, and packaging options that fit your MOQ.

| Field | Example |

|---|---|

| Quantity | 1,000 pcs (single-side print) |

| Artwork | AI/PDF/SVG, logo 18 mm |

| Printing | Pad (1 color) / UV (CMYK) / UV-DTF |

| Positions | 1 side (add 2nd side if needed) |

| Packaging | White box + sticker / Mesh / Bulk |

| Target Ship Date | 2025-MM-DD |

| Tests Required | Adhesion + alcohol-wipe; clear-coat 10–25 μm |

That packet allows engineering to pick the method (pad, UV, or DTF), confirm the jig, and reserve a production slot. It also avoids back-and-forth about formats and speeds your first PO.

One-sentence takeaway: Small OEM orders (1,000–2,000 pcs) are practical when you pick a mid-scale factory, match artwork to the right print method, simplify packaging, and book early; prove demand first, then layer complexity as volumes grow.

Key Takeaway: Send a tight RFQ packet (qty, vector art, size, positions, packaging) to get a useful quote fast.

About Golfara – A Professional Golf Ball Manufacturer in China

Since 2012, Golfara has manufactured and exported a full range of golf balls in China—from range models to game and tour-spec constructions. If you’re considering sourcing golf balls from China, feel free to contact us. Whether or not you place an order with us, we’re happy to share practical, professional advice on specs, compliance, packaging, and landed-cost planning.

- ✅ Low MOQ: We are willing to start the business with trial orders (1000–2000 pcs are acceptable).

- 🧪 Flexibility: We keep flexible and practical policies—everything is open to discussion.

- ⚙️ Expertise: You will work directly with an experienced and professional manufacturer.

- 🎨 Value: We offer moderate prices with a low-risk starting point.

- 💬 Response: ≤12 hours with full quote & roadmap

You might also like — Can Chinese Manufacturers Produce Tour-Grade Golf Balls?