For B2B buyers comparing China vs Japan golf ball cost, this guide translates factory-side numbers into sourcing decisions. You’ll see where Surlyn two/three-piece and urethane three/four-piece balls overlap, why PU multi-layer costs diverge, and how labor, energy, yield, packaging, and scale shape FOB pricing, lead times.

Definitions used once up front: USGA conforming list = the published catalog of models legal for play; AQL levels (0.65/1.0/1.5) = standard acceptance sampling thresholds; CT (Characteristic Time) / CT test = the rebound-time limit used to control spring-like effect at impact.

What is the “core answer” behind China–Japan golf ball cost gaps?

TL;DR: For like-for-like constructions, China’s FOB is typically 20–30% lower with faster lead times. Surlyn two/three-piece segments overlap strongly; urethane multi-layer—especially four-piece—is materially cheaper and truly scalable in China, while Japan concentrates on premium house brands with smaller volumes and brand-led premiums.

Key dimensions at a glance (labor/energy/yield/materials/packaging/scale)

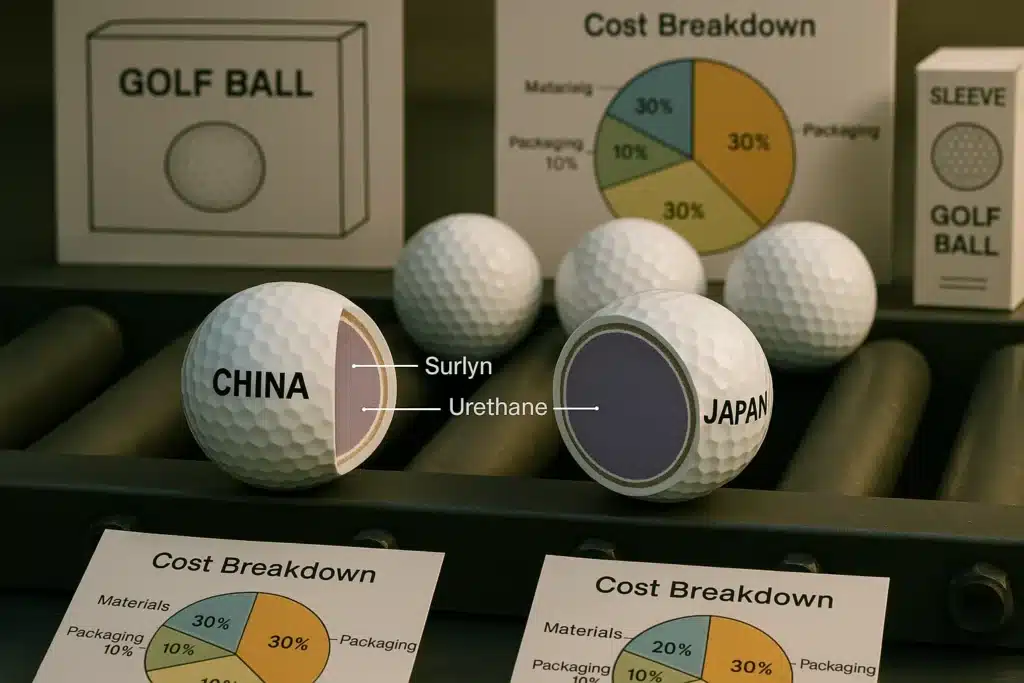

Think of golf ball manufacturing cost as six dials that move your unit FOB:

-

Labor: operator and technician wages, benefits, social costs.

-

Energy: kWh for mixing, injection, PU casting, ovens, curing, paint/UV.

-

Yield: scrap rate and rework driven by CT control, concentricity, and cover defects.

-

Materials: Surlyn/ionomer vs polyurethane systems, cores, mantles, inks.

-

Packaging: unit tray, sleeves, gift boxes, print layers, protective wraps.

-

Scale: line utilization, takt time, automation, purchasing leverage, cluster logistics.

In practice, labor + scale set the floor, energy + yield set the slope, materials + packaging set the ceiling.

Same-type comparison (2/3-piece Surlyn, 3-piece PU, 4-piece PU)

-

2-piece Surlyn: Lowest process complexity, high automation. China’s clusters compress labor content and overhead; Japan’s lines support domestic SKUs and add brand premium despite similar materials.

-

3-piece Surlyn: Extra mantle step tightens SPC and increases handling. China keeps advantage via higher volumes and shorter logistics radii for molds/inks/cartons.

-

3-piece PU: Casting slows takt and magnifies energy/yield differences. Japan pursues premium consistency at modest batch sizes; China balances automated casting with robust QA to deliver OEM volumes.

-

4-piece PU: The added mantle and multi-stage cure demand throughput and yield controls that China’s ecosystem sustains at scale.

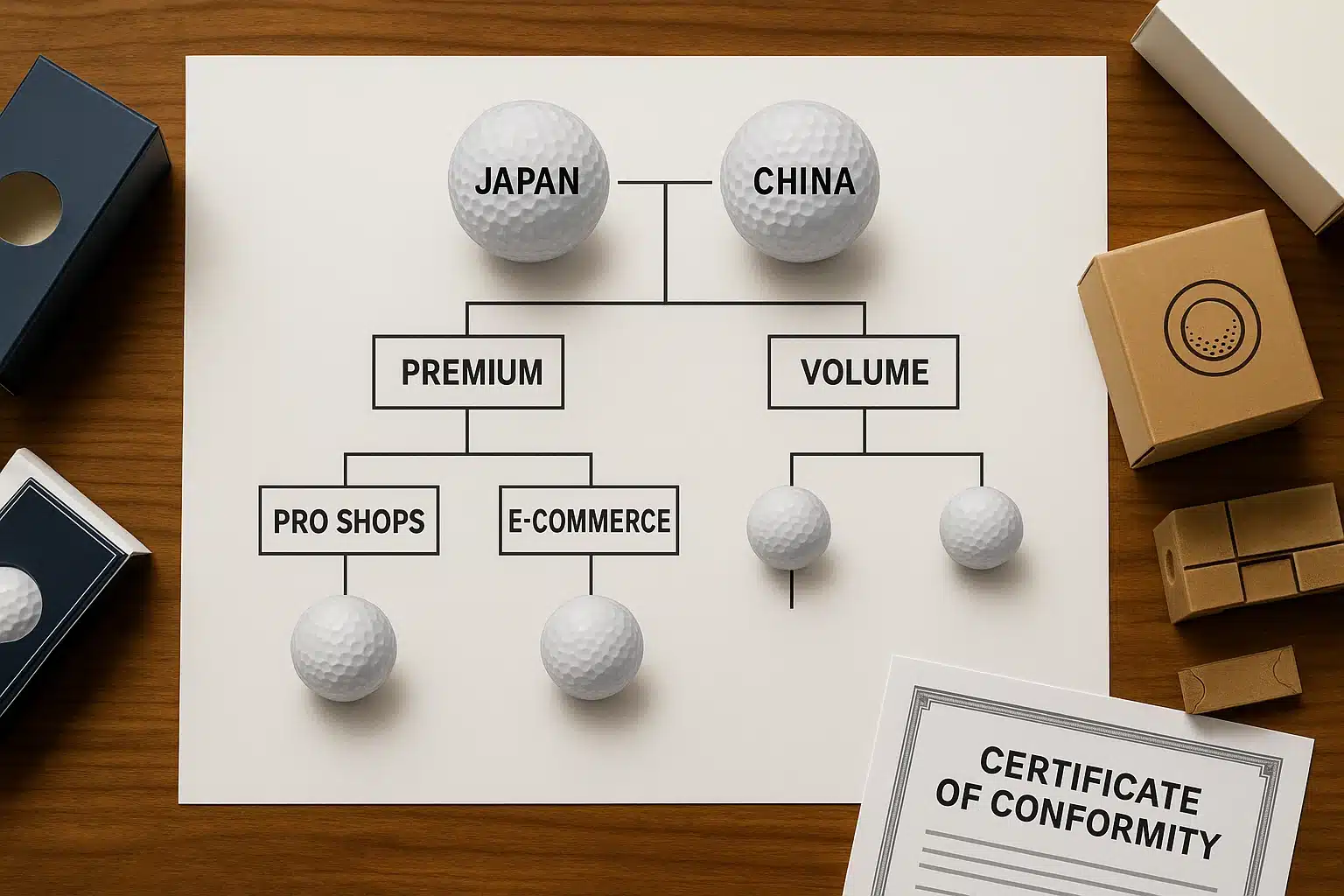

When to choose Japan vs China (decision tree)

-

Choose Japan for flagship story + maximum uniformity (tour-style 3-piece PU), smaller but exacting drops, and channels that monetize “Made in Japan.”

-

Choose China for volume, price-performance, and broad customization (2/3-piece Surlyn; 3/4-piece urethane) with dependable replenishment for retail and e-commerce programs.

Problem → Section: Overall judgment

If you’re deciding by channel: club pro shops and prestige gifting tolerate higher FOB for brand aura; chain retail and DTC convert better on comparable performance at lower landed cost—China wins most of those units.

Table 1 — Quick view of China–Japan cost gaps by construction and driver

Data window: Oct 2025; ranges vary by spec/volume.

| Construction | Labor Impact | Energy Impact | Yield Sensitivity | Material Delta | Packaging Delta | Net FOB Gap (JP vs CN) |

|---|---|---|---|---|---|---|

| 2-piece Surlyn | Medium | Low | Low | Similar | JP ≈ 1.5–2× | JP higher by ~20–30% |

| 3-piece Surlyn | Medium | Low–Med | Medium | Similar | JP ≈ 1.5–2× | JP higher by ~25–35% |

| 3-piece PU | High | High | High | PU systems similar | JP ≈ 1.5–2× | JP higher by ~30–50% |

| 4-piece PU | Very High | Very High | Very High | Similar | JP ≈ 1.5–2× | CN dominates volume/pricing |

✔ True — Price gap ≠ performance gap

Performance is driven by recipe (core chemistry, mantle stiffness, dimple pattern, cover hardness) and the line’s yield/SPC discipline. Origin does not automatically predict spin, speed, or feel. Test to spec, not to passport.

✘ False — “Japan-made always flies farther”

Flight and greenside behavior follow CT, COR, compression, and aerodynamic uniformity—achievable in both countries with the right controls.

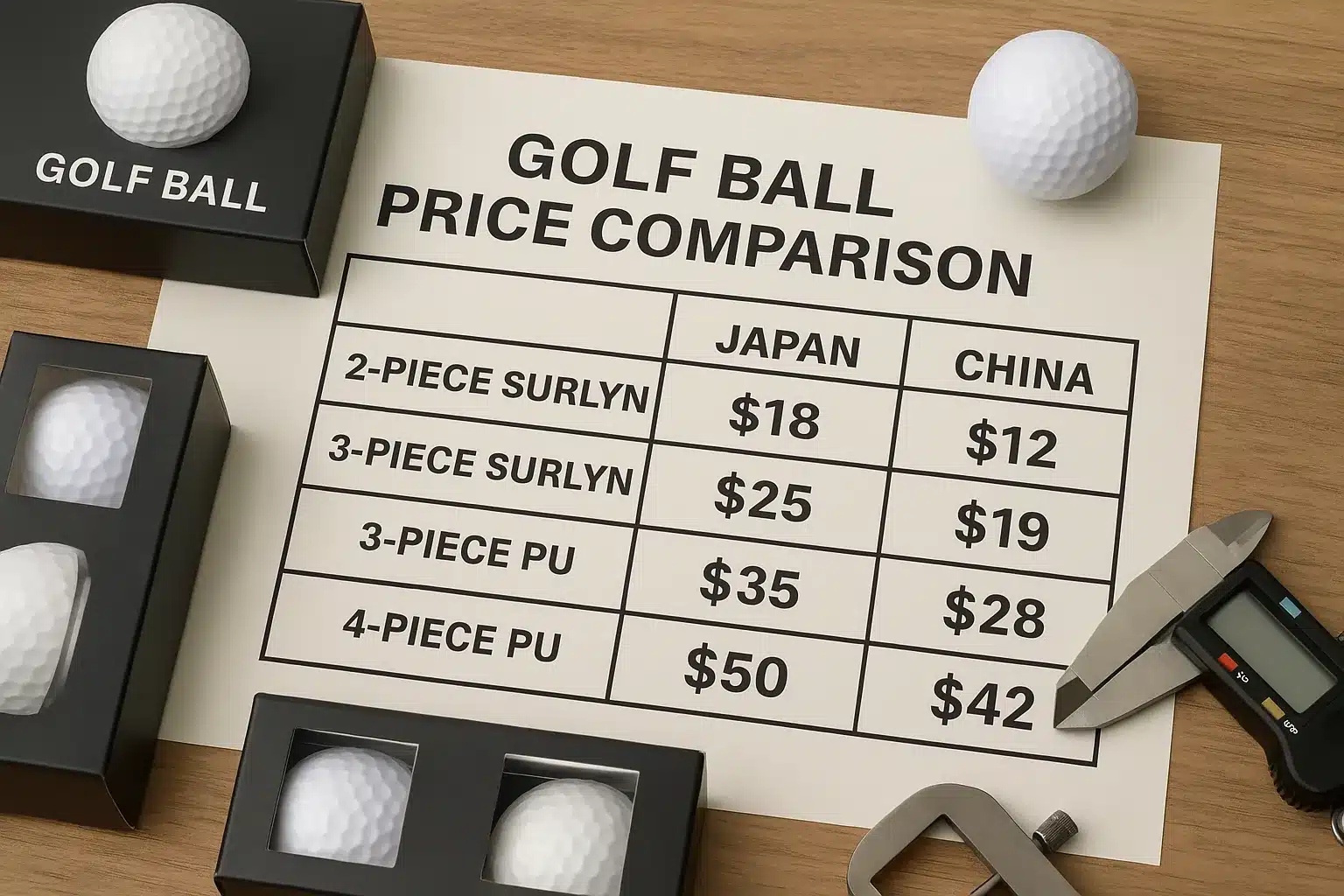

What are factory price ranges by construction (USD per dozen, FOB)?

2-piece Surlyn: Japan $18–25 vs China $10–15; 3-piece Surlyn: $25–35 vs $15–22; 3-piece PU: $35–45 vs $20–30; 4-piece PU: Japan not in mass production (> $45 small batches), China $30–45 with high-volume lanes at $28–32.

How these ranges form (yield/energy/scale)

-

Yield: PU cover rejection amplifies cost swings; a 3–5% scrap swing can move dollars per dozen.

-

Energy: Japan’s industrial kWh rates increase cure/paint layers; Surlyn is less exposed than PU casting.

-

Scale: China’s cluster utilization keeps overhead per unit low and stabilizes quotes even in peak seasons.

Sensitive adders: printing/packaging/testing

-

Printing: Multi-color pad prints add setups and rejects; metallic inks and matte/UV clearcoat consume line time.

-

Packaging: Gift boxes and premium textures double handling and can add $0.20–$1.50 per dozen quickly.

-

Testing: CT and weight audits add minutes per batch but often reduce rework—a net saver at volume.

Table 2 — Four constructions, China vs Japan price board (notes included)

Data window: Oct 2025; ranges vary by spec/volume.

| Construction | Japan FOB (USD/dozen) | China FOB (USD/dozen) | Notes |

|---|---|---|---|

| 2-piece Surlyn | 18–25 | 10–15 | Japan lines mostly domestic SKUs; China supplies global OEM basics and promos |

| 3-piece Surlyn | 25–35 | 15–22 | Mantle step and SPC add cost; China leverages scale |

| 3-piece PU | 35–45 | 20–30 | PU casting amplifies energy/yield deltas |

| 4-piece PU | >45 (R&D/small) | 30–45 (28–32 at volume) | Mass production centered in China; JP lacks scalable lanes |

✔ True — Price ranges are driven first by yield and scale, then energy

A small improvement in PU yield often saves more per dozen than a modest resin discount. Scale maintains steady overhead per unit, keeping quotes predictable even in peak season; high kWh costs widen the gap but rarely lead the dance.

✘ False — “Resin cost is the primary reason for wide price bands”

Resin prices are comparable globally; variability largely tracks scrap, takt time, and available capacity.

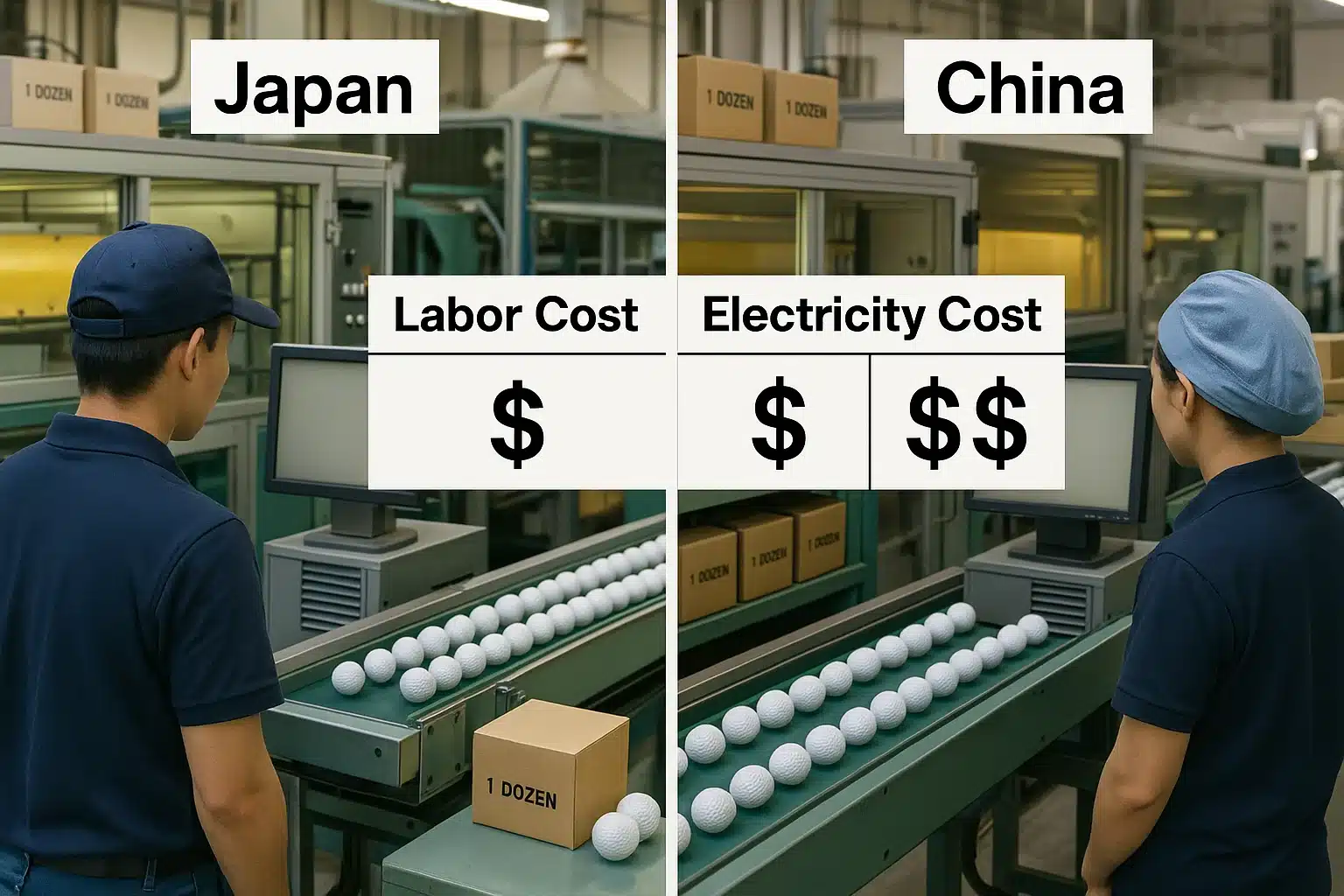

Where do manufacturing cost gaps come from: labor, energy, scale—what matters most?

TL;DR: Labor and scale dilution matter most; rough wage references: Japan $12–20 per hour vs China $3–6 per hour. Industrial power roughly $0.20/kWh vs $0.07–$0.10/kWh. PU casting’s slow takt and tight spec magnify these differences into the final FOB.

Labor cost estimate (per ball/per dozen/hour basis)

Assume 0.02 hours per ball of direct/indirect labor blended across molding, finishing, QC, and pack-out.

Table 3 — Labor cost estimate

Data window: Oct 2025; directional estimates for comparison.

| Country/Region | Labor cost (USD/hour) | Assumed hours/ball | Labor cost/ball (USD) | Labor cost/dozen (USD) |

|---|---|---|---|---|

| Japan | 12–20 | 0.02 | 0.24–0.40 | 2.88–4.80 |

| China (Zhejiang/Guangdong/Fujian) | 3–6 | 0.02 | 0.06–0.12 | 0.72–1.44 |

Automation trims variance, but line balancing matters more: automated Surlyn lanes hit the lower bound, while PU cells with manual touchpoints trend higher unless scaled.

How electricity and energy drive PU casting and cure

-

Cure ovens and dwell times: PU chemistry demands tight temperature control; longer dwell = more kWh per ball.

-

Paint & clearcoat: Air movement and UV bake cycles add cumulative kWh.

-

Net effect: A 2–3× kWh unit price difference compounds across several stations per ball in PU flow, causing a multi-dollar divergence per dozen versus Surlyn.

Materials & packaging: How do Surlyn vs PU and box specs change unit price?

TL;DR: PU covers cost more than Surlyn due to chemistry, slower takt, and higher scrap risk; packaging per ball in China runs about $0.0125–$0.1667 depending on grade, and roughly doubles in Japan. Premium gift boxes can materially lift your per dozen price.

Surlyn vs PU characteristics and cost structure

-

Surlyn/ionomer: Durable, cut-resistant, injection-mold friendly, fast cycle. Suits distance and all-purpose play.

-

Polyurethane: Softer feel, higher greenside spin, better short-game grip; casting and finishing drive up unit labor, energy, and yield sensitivity.

-

Net: Your golf ball manufacturing cost escalates not only from PU resin itself but the process it mandates.

Packaging ladder (basic / gift / premium custom)

Table 5 — Per-ball packaging cost by grade and country

Data window: Oct 2025; excludes assembly rejects and freight.

| Packaging Level | China (USD/ball) | Japan (USD/ball) | When to choose / Recommendation |

|---|---|---|---|

| Basic carton/sleeve | 0.0125–0.025 | 0.025–0.050 | Use for e-com basics, promos, practice packs |

| Mid-tier gift | 0.033–0.0667 | 0.0667–0.125 | Good for retail sets; ensure transit protection |

| Premium custom | 0.083–0.1667 | 0.1667–0.3333 | For corporate gifting and pro-shop prestige lines |

A premium box easily adds $0.36–$2.00 per dozen after assembly and rejects. Pressure-test packaging with drop tests to avoid returns.

Capacity & lead times: Who can sustain “continuous scale-up”?

China’s Zhejiang/Guangdong/Fujian clusters support 3/4-piece urethane at scale with 25–35-day lead times; Japan prioritizes house brands with 45–55-day cycles, offering small-batch flexibility but limited surge capacity for sustained mass programs.

Cluster advantages (molds/finishing/printing/cartons nearby)

China’s short logistics radius collapses wait times for molds, inks, and cartons. Nearby vendors speed trial-to-mass transitions and reduce downtime during ECNs. The result is higher line utilization and fewer slip-ups during seasonal ramps.

4-piece PU mass-production thresholds and automation

Four-piece urethane layers add complexity: mantle-to-core alignment, multiple cures, and more sensitive SPC bands. Automation helps, but only at ecosystem scale—dedicated casting banks, inline vision, and paint/UV capacity. This is why 4-piece urethane mass production sits primarily in China.

Table 6 — Lead time & peak capacity comparison

Data window: Oct 2025; typical steady-state ranges.

| Metric | Japan | China |

|---|---|---|

| Typical lead time (steady state) | 45–55 days | 25–35 days |

| Surge capacity for 4-piece PU | Limited | Strong |

| Cluster depth (molds/UV/cartons) | Moderate | High |

| Small-batch flexibility | High | Medium–High (with MOQ) |

✔ True — 4-piece PU needs ecosystem scale

Additional mantle, alignment windows, and multi-stage cure mean you must control scrap at every gate. Without cluster automation and available paint/UV lanes, unit costs explode and schedules slip.

✘ False — “Any PU-capable line can just add a fourth layer”

Capacity math breaks without end-to-end throughput and yield discipline.

Who should I choose: sourcing advice by market position/channel?

TL;DR: For flagship premium with brand storytelling, lean Japan (notably 3-piece urethane). For volume retail/DTC and private label, lean China (2/3-piece Surlyn; 3/4-piece PU). Bind pricing to USGA/R&A conformity and clear AQL thresholds to keep quality predictable.

Channel fit (clubs/pro shops/e-commerce/gifting)

-

Clubs & pro shops: Monetize brand aura; Japan makes sense if premium spin/feel narrative pays back.

-

E-commerce & chains: Scale and margin dominate; China wins with stable replenishment and customization speed.

-

Corporate gifting: Choose based on packaging quality and calendar control; often China with upgraded boxes.

Decision matrix — Channel × Origin recommendation

Data window: Oct 2025; pick based on channel economics.

| Channel/Goal | Japan | China | Recommendation |

|---|---|---|---|

| Flagship/brand aura | Strong | Medium | Japan for 3-piece PU hero SKU |

| Volume retail/DTC | Medium | Strong | China for 2/3 Surlyn; 3/4 PU |

| Gifting/premium sets | Strong | Strong | Either; China wins on cost with premium box |

| Speed to market | Medium | Strong | China cluster advantage |

| Tightest uniformity | Strong | Strong | Both capable; specify AQL and audits |

China-based OEM choices & MOQ

Below is a short list of China OEMs with MOQs: Grasbird (3–5k), Golfara (from 1k), MLG Sports (2–3k), Shenzhen Xintiantian (2–3k). Always prototype and lock AQL/packaging terms before volume.

Capacity/lead time/peak-season tactics

Pre-book Q4 windows by July with forecast bands. Approve alternate packaging in case carton vendors slip. Keep a color freeze two months before peak.

NDA/formulation/mold & IP boundaries

Sign NDAs that cover formulation variants, mold ownership, and logo/vector safety. If you fund tooling, define storage, maintenance, and transfer rights upfront.

Table 7 — China-Based Golf Ball Manufacturers with OEM MOQ

Data window: Oct 2025; verify capability and conformance at RFQ.

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xintiantian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

FAQ

Why is 4-piece urethane rarely mass-produced in Japan?

Because slower takt, tighter alignment windows, higher scrap, and heavier energy demand compound with smaller batch sizes, pushing unit costs above market tolerance; Japanese factories focus on premium house lines instead of sustained high-volume 4-layer production.

Japan’s strengths are brand protection and uniformity for premium SKUs. The fourth layer raises SPC overhead and kWh exposure without the scale to dilute fixed costs. The math is unforgiving if your goal is mass retail replenishment rather than boutique runs.

How much does Surlyn vs PU performance difference affect price?

Urethane can deliver softer feel and higher greenside spin, but it adds process time and waste risk; the final price delta depends on positioning and brand power rather than cover material alone.

Surlyn’s injection path is efficient and robust, which lowers costs. PU’s casting path is energy-intensive and slower, with stricter cosmetic gates. If your channel monetizes feel/spin and brand story, PU premiums are justified; for distance/value lines, Surlyn hits better margins without hurting conversion.

Can China-made PU balls meet tournament standards?

Yes—when models are built and audited to the USGA conforming list and AQL levels on CT/weight/concentricity, Chinese production reaches mainstream quality levels reliably.

Thousands of private-label and DTC SKUs have succeeded using Chinese OEMs. The decisive factor is not the country but the process discipline: enforce sampling, retain references, and periodic audits. Specify functional KPIs and require statistical reports per lot.

Are Japanese lead times inherently more stable?

They’re very stable for small batches but capacity-limited for large, continuous programs; China’s cluster depth supports sustained ramps at scale, especially in 3/4-piece urethane.

If your calendar needs 10k–50k units refreshed monthly, China’s ecosystem supports it with buffer lanes for coating and UV. Japan can excel in boutique runs, product care, and consistent cosmetics but may bottleneck in peak months for mass programs.

How low can MOQ go?

It depends on layers, printing, and packaging. Two-piece Surlyn can go lower; three/four-piece urethane typically requires higher MOQ. Best practice is sample → pilot → scale with pre-booked windows.

Discuss MOQ not just by total units, but by colorways and packaging variants. Lock artwork early and simplify sleeves/boxes to push MOQ down. Many Chinese OEMs meet test markets at 1k–3k while reserving capacity to scale quickly if take-rate is strong.

How much can packaging cost take of the unit price?

In China, per ball packaging runs roughly $0.0125–$0.1667; Japan is about double. Premium gift boxes lift per dozen price quickly, especially with inserts and special textures.

Packaging costs include printing, lamination, specialty coatings, die-cuts, inserts, and assembly rejects. Specify protective performance (drop/crush) and cosmetic AQL to prevent costly re-packs. Keep a simplified packaging spec on standby for replenishment orders.

How big is the labor differential’s impact, really?

Using 0.02 hours per ball, Japan’s labor costs work out to about $2.88–$4.80 per dozen, while China’s are roughly $0.72–$1.44 per dozen. Scale and automation widen this gap on PU lines.

Remember that indirect labor (maintenance, QC, material handlers) scales with complexity. PU lines, with more stops and careful handling, magnify labor differentials and drive a larger wedge in final FOB, particularly when yields fluctuate.

Conclusion

If your program monetizes brand prestige and top-tier consistency, Japan’s premium lanes—especially 3-piece urethane—can justify higher FOB with dependable cosmetic outcomes at boutique volumes. If your plan requires scalable FOB, fast lead times, and flexible customization, China’s clusters deliver on 2/3-piece Surlyn and 3/4-piece urethane with strong USGA/R&A conformity when tied to clear AQL.

You might also like — Top 10 golf ball manufacturers in Japan for OEM