China is typically 5–15% cheaper after yield and scale effects, and scales 4-piece PU faster; Vietnam adds EVFTA derisking and origin premium when KPIs prove out.

Buyers comparing china vs vietnam golf ball cost need decision-grade clarity: who’s cheaper by construction, who ramps faster in peak season, and when a Vietnam origin premium or EVFTA routing truly pays back. This guide turns factory realities—labor, electricity, materials, packaging, yield, and cluster depth—into FOB pricing anchors, a per-ball cost model you can hand to suppliers, and a sourcing playbook for dual-sourcing.

What is the core answer on China–Vietnam costs and capacity overlap?

2/3-piece Surlyn and 3-piece PU can be mass-produced in both countries; 4-piece PU is mature at scale in China and emerging in Vietnam (often within brand-tied lines). At like-for-like specs, Vietnam’s per-ball total cost is often 5–15% higher; China’s strengths are cluster scale, supplier radius, and faster, steadier lead times. Vietnam adds derisking and origin story value.

Overlap vs differences (2/3 Surlyn, 3 PU, 4 PU)

-

2-piece Surlyn: High automation, both origins capable; China dominates global OEM volumes; Vietnam fits regional freight and EU access narratives.

-

3-piece Surlyn: Both capable; China’s material purchasing and local auxiliaries typically land lower total cost at volume.

-

3-piece PU: Vietnam lines exist (including brand-linked ecosystems); China runs the widest OEM spectrum with proven automation and SPC.

-

4-piece PU: China maintains broad, open OEM mass production; Vietnam is building capability, currently narrower in open OEM slots.

When to pick Vietnam vs China (by channel/positioning)

-

Pick Vietnam for risk-hedging (EVFTA/market access), premium origin storytelling, and when brand-bound lines are required.

-

Pick China for volume retail/DTC, faster replenishment, broad customization, and price-performance.

Dual-sourcing play (workhorse + premium)

Run China as the workhorse (major SKUs) and Vietnam as premium/derisk (hero SKUs or EU-priority lanes). Mirror KPIs and AQL, blind-test pilots, then freeze specs before scale.

*Table 1: Construction × origin × advantage (quick view).

| Construction | China strengths | Vietnam strengths | Notes |

|---|---|---|---|

| 2-piece Surlyn | Scale, low FOB, fast replenishment | Regional freight wins; EU access story | Both highly automated |

| 3-piece Surlyn | Material leverage; short supplier radius | Competitive regional supply | CN often edges at volume |

| 3-piece PU | Broad OEM, automation, SPC history | Brand-linked capacity; lower kWh | Yield discipline decides |

| 4-piece PU | Mature mass production, open OEM | Emerging, brand-tied lines | Fewer open OEM lanes in VN |

✔ True — Origin story ≠ performance

Performance follows recipe, CT control, concentricity, weight, compression, and yield. Country of origin helps marketing but can’t replace SPC and ball-lab proofs.

✘ False — “Lower kWh automatically means lower FOB”

Scale, supplier radius, and yield often outweigh a few cents of electricity difference at the unit level.

What are indicative FOB price ranges by construction (USD per dozen)?

2/3-piece Surlyn are close across origins, with China usually lower; 3-piece PU pricing tracks yield and kWh exposure; 4-piece PU favors China on scale-discount and stability, while Vietnam mostly aligns with brand-tied capacity.

2/3-piece Surlyn — automation & logistics radius

Automation compresses touch time and defects. China’s clusters shorten the logistics radius for molds/inks/cartons, stabilizing quotes. Vietnam can win on freight to nearby markets and EU narratives.

3-piece PU — yield/energy variability

Casting/finish add dwell time and cosmetic scrap risk. kWh differences matter, but yield history and parallel stations move dollars per dozen faster.

4-piece PU — scale discount & stability

Every extra layer multiplies cure/alignment gates. China keeps multiple parallel casting/UV/paint lanes online, which sustains quotes and lead times; Vietnam’s open OEM lanes are fewer.

FOB range drivers (factor → typical impact):

-

Metallic inks → +$0.10–$0.30/dozen (setup + reject risk)

-

Multi-layer clear coats (matte/UV) → +$0.20–$0.50/dozen (extra bake/handling)

-

Gift set packaging → +$0.60–$1.50/dozen (inserts + assembly rejects)

-

Artwork changes/reprints → +1–3% cosmetic rejects (pushes effective FOB)

-

Expedited slots → +$0.20–$0.80/dozen (overtime/line changeover)

Table 2: Indicative FOB ranges by construction (USD per dozen, FOB). Ranges exclude freight/insurance/duties/VAT. FOB pricing = on-board at port; seller clears export; buyer pays ocean/insurance/onward.

| Construction | China FOB (USD/dozen) | Vietnam FOB (USD/dozen) | Notes |

|---|---|---|---|

| 2-piece Surlyn | 10–15 | 10–16 | VN can match at basics; CN wins at scale |

| 3-piece Surlyn | 15–22 | 16–23 | CN often 1–2 USD/doz lower at volume |

| 3-piece PU | 20–30 | 21–32 | Yield/kWh drive spread; brand lanes price firmer |

| 4-piece PU | 28–45 (28–32 at volume) | 30–46 | CN scale discount and steadier schedules |

Mini-table — Artwork complexity cost adders (per dozen, typical)

| Item | Time/Reject Impact | Typical Adder |

|---|---|---|

| Metallic/pearlescent inks | Extra pass; mis-registration risk ↑ | +$0.10–$0.30 |

| Multi-layer clears (matte/UV) | Added bake; dust defects ↑ | +$0.20–$0.50 |

| Gift set with inserts | Handling + rework ↑ | +$0.60–$1.50 |

| Seasonal artwork change | Reprint/rejects ↑1–3% | Varies with AQL |

✔ True — Packaging & artwork are primary volatility drivers

Sleeves, boxes, finishes, and logo complexity add handling and reject exposure, moving totals by dollars per dozen quickly.

✘ False — “Resin price decides the range”

Resin is globally banded; the big movers are yield, takt time, and parallel capacity.

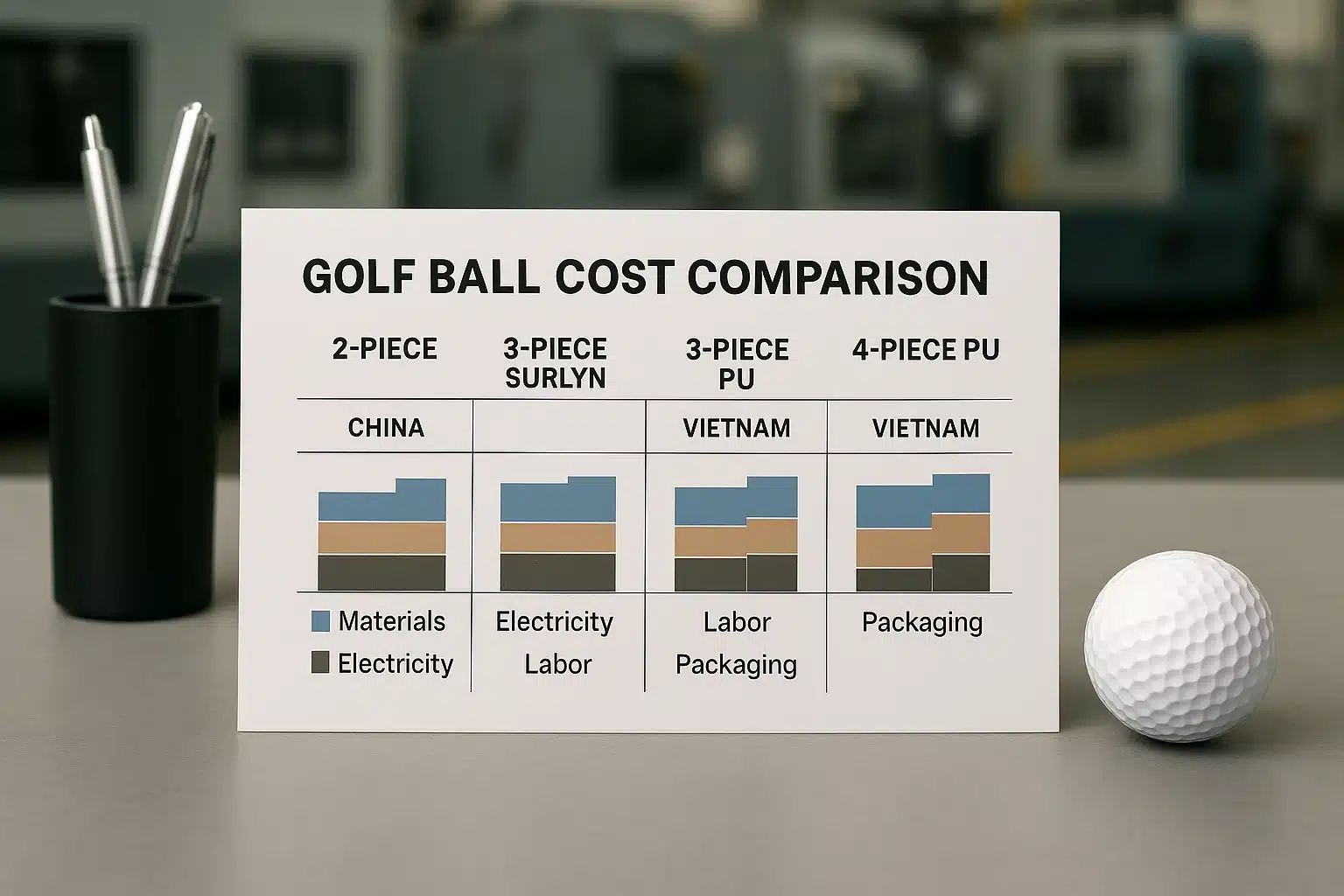

Where do manufacturing cost differences come from: labor, electricity, materials, packaging?

Materials share is similar (~40%). The biggest gaps arise from labor/electricity structures amplified by scale and yield; Vietnam’s packaging trends slightly higher. Medians put Vietnam 5–15% above China per ball at like-for-like specs.

Cost drivers (factor → typical effect):

-

Labor rate & touchpoints → +$0.72–$1.44/dozen per $3/h delta (at 0.02 h/ball)

-

Electricity (kWh × dwell) → +$0.06–$0.36/dozen swing in PU lines (multi-station)

-

Yield ±3% in PU → $0.60–$1.20/dozen effective shift (scrap + rework)

-

Supplier radius → Late-stage scrap ↓; quote stability ↑

-

Packaging tier → +$0.20–$1.50/dozen depending on box/finish

Electricity benchmark: VN $0.075–0.085/kWh vs CN $0.088–0.112/kWh

VN’s nominal kWh can be lower, but multi-station dwell and re-sprays easily swamp minor kWh deltas unless yield is tightly controlled.

Factory-burdened labor: VN ≈ $3.5/h vs CN ≈ $5.0/h

Direct labor per ball is small, but indirect labor and supervision rise with PU complexity; line balancing and automation dictate the realized gap.

Materials & supplier radius → scrap/rework

Shorter supplier radius (inks/cartons/molds) reduces waiting and mismatch risks. CN’s clusters compress delays and late-stage scrap, often beating nominal VN kWh/labor advantages.

Packaging tiers (basic/gift/premium)

VN tends to price packaging a touch higher at like-for-like quality; premium textures and inserts magnify variance.

Table 3: Cost drivers comparison (CN vs VN). directional references.

| Metric | China | Vietnam |

|---|---|---|

| Electricity (USD/kWh) | ~0.088–0.112 (mid ~0.100) | ~0.075–0.085 (mid ~0.080) |

| Factory labor (USD/h, burdened) | ~5.0 (typical) | ~3.5 (typical) |

| Materials share of total | ~40% | ~40% |

| Packaging (USD/ball, basic) | ~0.020 | ~0.025 |

Unit cost model per ball (USD): 2-piece Surlyn, 3-piece Surlyn, 3-piece PU, 4-piece PU

Using the given assumptions (power/ball, labor hours/ball, mid packaging), 2/3-piece Surlyn costs are close across origins; for 3/4-piece PU, Vietnam looks slightly better on labor/kWh, yet China’s yield/scale/supplier radius can match or beat in real programs.

Method: supplier backfill by line item

Send the matrix (materials, kWh, labor hours, packaging) and have suppliers backfill each cell. Divergences reveal “water” quickly—especially on scrap, rework, and artwork adders.

Sensitivity: yield ±3% impact (PU magnifier)

A small scrap swing in PU flows moves dollars per dozen materially; test pilots must report cosmetic and functional reject breakdowns.

Sampling vs mass production: parameter drift and spec freeze

Pilot-to-mass drift is common; freeze the recipe + artwork ladder before locking price. Attach retain samples and histogram reports.

Table 4: 2-piece Surlyn unit cost model (USD per ball).

| Cost item | China (USD/ball) | Vietnam (USD/ball) |

|---|---|---|

| Materials | 0.34 | 0.35 |

| Electricity (0.10 kWh) | 0.010 | 0.008 |

| Labor (0.015 h) | 0.075 | 0.053 |

| Packaging (basic) | 0.020 | 0.025 |

| Subtotal | 0.45 | 0.44 |

Table 5: 3-piece Surlyn unit cost model (USD per ball).

| Cost item | China | Vietnam |

|---|---|---|

| Materials | 0.50 | 0.52 |

| Electricity (0.15 kWh) | 0.015 | 0.012 |

| Labor (0.018 h) | 0.090 | 0.063 |

| Packaging (basic) | 0.020 | 0.025 |

| Subtotal | 0.63 | 0.62 |

Table 6: 3-piece PU unit cost model (USD per ball).

| Cost item | China | Vietnam |

|---|---|---|

| Materials | 1.04 | 1.06 |

| Electricity (0.30 kWh) | 0.030 | 0.024 |

| Labor (0.025 h) | 0.125 | 0.088 |

| Packaging (basic) | 0.050 | 0.050 |

| Subtotal | 1.25 | 1.22 |

Table 7: 4-piece PU unit cost model (USD per ball).

| Cost item | China | Vietnam |

|---|---|---|

| Materials | 1.20 | 1.23 |

| Electricity (0.35 kWh) | 0.035 | 0.028 |

| Labor (0.030 h) | 0.150 | 0.105 |

| Packaging (basic) | 0.050 | 0.050 |

| Subtotal | 1.44 | 1.41 |

Capacity and lead time: who sustains continuous scale-up?

China 2–3w/25–40d with deep clusters; Vietnam 3–5w/35–55d, more brand-tied.

Cluster radius: near-sourcing vs imports

China’s molds/inks/cartons are nearby, shrinking waits and variance; Vietnam can import more items, stretching takt during changeovers.

4-piece PU automation/UV/paint bottlenecks

Extra mantle + multiple cures require parallel lines and stable ovens/UV. China’s multi-lane banks reduce queueing; Vietnam can hit quality but has fewer open OEM slots.

Peak-season tactics: VMI, pre-built cores, simplified packaging

Use vendor-managed inventory for sleeves/boxes, pre-build cores/mantles, and pre-approve a simplified box fallback that releases throughput when time windows compress.

Table 8: Lead time & capacity comparison (CN vs VN).

| Metric | China | Vietnam |

|---|---|---|

| Sampling lead time | 2–3 weeks | 3–5 weeks |

| Mass production lead time | 25–40 days | 35–55 days |

| 4-piece PU surge | Strong, multi-OEM | Emerging; brand-tied slots |

| Cluster depth | High | Moderate (more imports) |

Pay premiums for high-end, derisking, and compliance narratives (EVFTA, market access) when KPIs show tangible gains (CT/weight/concentricity/compression) and lower returns. For volume/DTC, China typically converts better margin.

When it’s “worth it”

EU/US risk-hedging, EVFTA duty planning, or brand-bound lines where Made in Vietnam elevates perceived quality—and you can show measurable KPI deltas or lower RMAs.

When it’s “not worth it”

High-elasticity channels or aggressive price competition where origin stories don’t translate into conversion or ASPs.

Quantifying the premium

Use CT, weight, concentricity, compression histograms plus return-rate changes to justify premiums in dollars per dozen.

Table 9: Scenario matrix — channel/goal × KPI attainment × price elasticity × origin suggestion.

| Channel/Goal | KPI sensitivity | Price elasticity | Suggested origin |

|---|---|---|---|

| Prestige/pro shops | High | Low–Med | Vietnam or dual-sourcing |

| Chain retail | Medium | Medium | China for line breadth |

| DTC/value | Medium | High | China for margin & speed |

| Corporate gifting | High (cosmetic) | Medium | Either; box spec drives choice |

OEM openness, MOQs, and who is a better fit?

China is the open OEM engine with flexible MOQs and faster parallel developments; Vietnam is more brand-system and schedule constrained. Small/medium brands and wholesalers fit China best for speed and breadth.

MOQ/tooling/box thresholds

China offers lower practical MOQs and quicker art/box cycles; Vietnam’s slots are often brand-reserved and less flexible for small-lot tests.

Parallel scheduling for logo/colored shells/gift boxes

Co-schedule print/paint/pack in China’s clusters to compress calendar time; in Vietnam, plan longer changeovers and approvals.

Table 11: Fit comparison (CN vs VN).

| Dimension | China | Vietnam |

|---|---|---|

| Open OEM access | Broad | Narrower, brand-tied |

| MOQ flexibility | High | Medium–Low |

| Sampling speed | Faster | Slower |

| Artwork/pack turns | Faster | Slower |

FAQ

Vietnam’s kWh is lower—why can total cost still run 5–15% higher?

Scale utilization, yield, supplier radius, and packaging/overhead often outweigh a few cents of kWh. A 2–3% PU scrap swing can move dollars per dozen—faster than kWh deltas.

Can Vietnam mass-produce 4-piece PU reliably?

Capability is emerging; open OEM breadth and multi-line concurrency are still behind China. Evaluate automation, parallel UV/paint capacity, and historical yields before committing seasonal ramps.

What are the best commercial reasons to choose Vietnam?

EVFTA advantages, US/EU derisking, and premium origin storytelling—but tie the premium to CT/weight/concentricity/compression improvements and lower returns.

How do lead-time differences affect replenishment?

China 2–3 weeks sampling/25–40 days mass vs Vietnam 3–5 weeks/35–55 days. Dual-source, pre-book windows, and keep a simplified packaging fallback to turn capacity into shipped units.

Conclusion

For scale, speed, and customization breadth, China’s clusters deliver 2/3-piece Surlyn and 3/4-piece PU at compelling FOB with steadier calendars. For derisking, EVFTA routing, and premium origin stories, Vietnam can earn a premium—when KPIs (CT, weight, concentricity, compression) and lower returns prove it. The resilient move is often dual-sourcing: China for throughput, Vietnam for prestige and risk hedge—both locked to the USGA/R&A conforming list, explicit AQL levels, and a contract that prices yield and schedule, not just resin.

You might also like — How to Negotiate MOQ with Chinese Golf Ball Manufacturers?