Choose junior golf balls by matching swing speed to compression: <60 mph = 30–50; 60–75 mph = 50–70; 75–90 mph = 70–85. Use ionomer 2-piece for practice and urethane 3–4-piece for matches. For brands, China OEM offers low MOQs and USGA/R&A compliance in ~6–8 weeks.

Quick steps

- Measure swing speed.

- Pick compression: <60 = 30–50; 60–75 = 50–70; 75–90 = 70–85.

- Match use: Practice = ionomer 2-piece; Match = urethane 3–4-piece.

- OEM path: low MOQs, 45–60d lead time, submit to USGA/R&A.

What makes a good junior golf ball for training?

A good junior training ball matches the player’s swing speed with lower compression, forgiving flight, and durable covers; as skills grow, step up spin/cover quality for short-game control while keeping costs practical for higher loss rates.

A junior’s first win is contact quality, not tour-level spin. Training balls should be easy to launch, feel soft off the face, and resist scuffs from range mats. Keep the focus on compression match first; then layer in cover and spin once the player is striking consistently. As performance improves, upgrade the ball—don’t jump straight to adult tour urethane.

The junior ≠ mini adult principle (swing speed & compression)

Junior athletes generate less ball speed, so they need softer cores to “activate” rebound. Think of compression like a door spring: if it’s too stiff, the door barely moves. Under-compressing wastes energy and shortens carry. A well-matched low-to-mid compression ball lifts launch, stabilizes spin, and builds confidence.

Durability vs feel—why training needs differ from tournaments

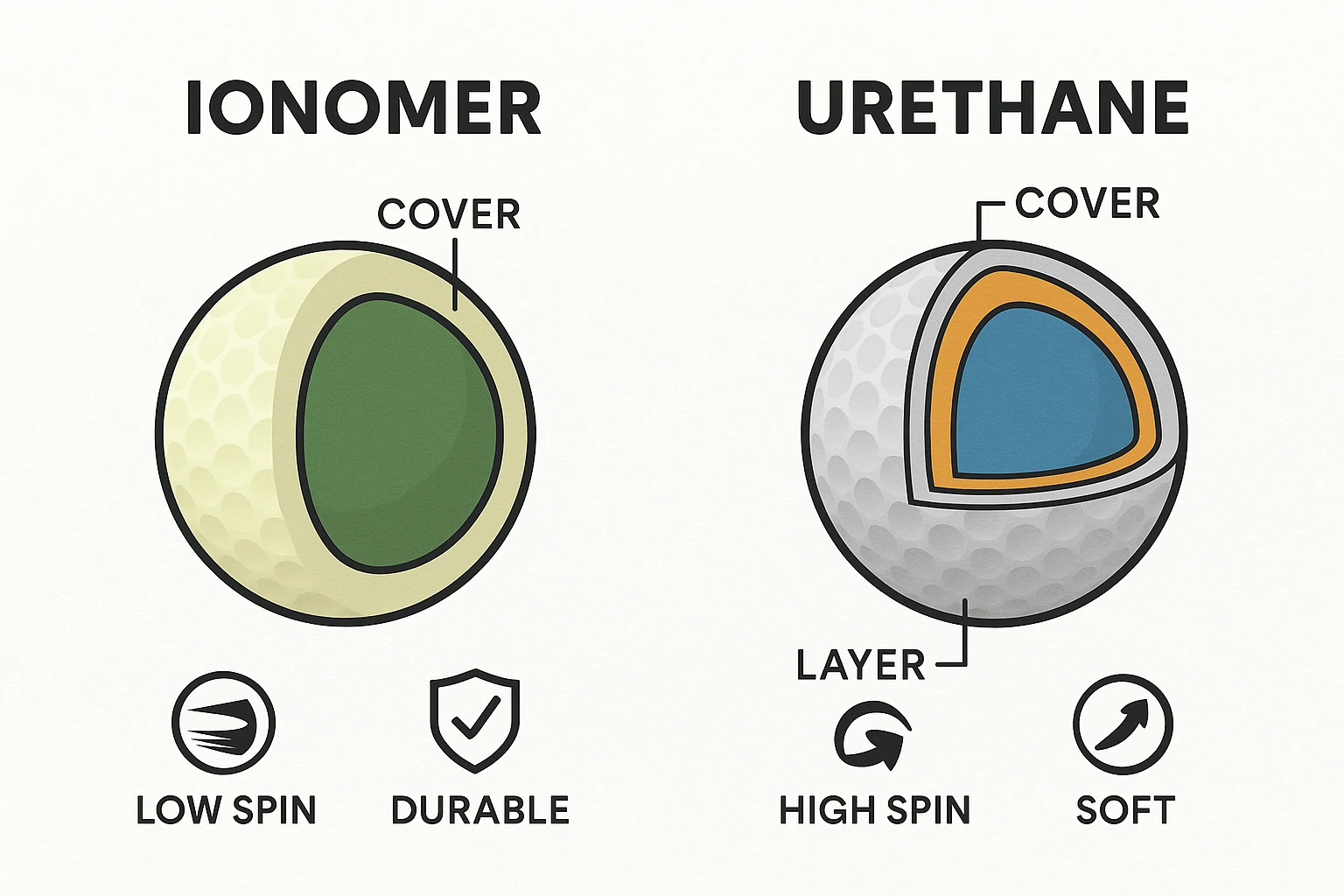

Training amplifies ball wear. Range mats, frequent wedge reps, and higher loss rates argue for ionomer covers (durable, straighter flight) in daily practice. Tournament days demand urethane (softer cover, more greenside spin) for scoring shots and predictable check. Use the right tool for the right job.

When to “graduate” to urethane tour models

Graduate when the player can compress a mid-compression core and control trajectories with wedges. Practical cues: 7-iron carry stabilizes, wedge contact is clean, and swing speed approaches 75–90 mph. Switch for events first, then—if budget allows—mirror that ball for the final prep sessions.

Key metric cheat sheet (training focus)

| Factor | Why it matters | Junior baseline |

|---|---|---|

| Compression | Energy match to swing speed | Lower for <75 mph |

| Cover | Durability vs spin | Ionomer for practice |

| Layers | Speed window & feel | 2-piece to start |

| Spin | Trajectory/short game | Add as skills grow |

✔ True — Low compression can fly farther for slow swings

At junior swing speeds, softer cores deform more, improving launch and carry. Distance gains come from better energy transfer and optimized spin loft.

✘ False — “Adult tour balls automatically go farther for juniors”

Too-stiff cores under-compress and feel harsh, often costing both carry and confidence.

How should parents and coaches choose by age and swing speed?

Start with age-speed bands: <60 mph (30–50 compression), 60–75 mph (50–70), 75–90 mph (70–85), ≥90 mph (85–100+). Test feel/launch; upgrade compression only when the player can consistently compress the core.

This is the fastest, most objective fit. Juniors change fast—recheck compression each season or when a growth spurt lands. Your test loop: confirm swing speed, shortlist by compression, evaluate flight/feel, then lock the SKU for the next training block.

Age bands 6–9 / 10–13 / 14–17

Use age to estimate, speed to decide. Younger kids (<60 mph) thrive on 30–50 compression 2-piece ionomer balls. Pre-teens (60–75 mph) step into 50–70 compression 2–3 piece builds. Teens (75–90 mph) ride 70–85 compression 3-piece soft-cover options, moving to urethane for match play.

Speed testing at range/monitor—fast, cheap methods

No monitor? Use launch clues: thin flight and low launch = too firm. With a monitor: take 5–10 swings with a mid-iron; average clubhead speed and ball speed. Map to the compression window, then A/B two models on carry and dispersion. Keep the winner for 6–8 weeks.

Fit by practice frequency: occasional / regular / high-intensity

Occasional (≤1×/week): durable 2-piece ionomer.

Regular (1–2×/week): soft-core 3-piece (more feel).

High-intensity (≥3×/week): urethane in match phases; ionomer for volume work.

Age × Speed × Compression × Structure × Example (quick pick table)

| Age | Speed (mph) | Compression | Layers | Cover | Example models |

|---|---|---|---|---|---|

| 6–9 | <60 | 30–50 | 2 | Ionomer | Srixon Soft Feel, Callaway REVA Jr, Volvik Vivid Lite |

| 10–13 | 60–75 | 50–70 | 2–3 | Ionomer | Bridgestone e6, Titleist TruFeel, TaylorMade Distance+ |

| 14–17 | 75–90 | 70–85 | 3 | Iono./Ure. | Bridgestone Tour B RX, Titleist Tour Soft, Chrome Soft X LS |

| 18+ | ≥90 | 85–100+ | 3–4 | Urethane | Pro V1/V1x, TP5, Srixon Z-Star |

✔ True — “Upgrade compression only when speed rises”

Compression should trail skill and speed gains, not lead them. A firmer core without speed adds mishits and spin inefficiency.

✘ False — “Harder means more advanced”

Match, don’t macho. Fit wins over labels.

Which specs matter most: compression, cover, layers, and spin?

Compression sets the energy match; cover controls feel/spin (ionomer = durable/straighter, urethane = softer/higher spin); layers fine-tune speed windows. Use ionomer 2-piece for practice, 3-piece soft cores for team play, urethane 3–4 piece for competition.

Compression is step one; cover is step two. Layers bring nuance—especially in the 70–85 compression band where many teens live. The goal is consistent launch, then controllable spin windows for approach and short game.

Ionomer vs urethane for juniors

Ionomer = tougher shell, straighter flight, lower spin; Urethane = softer feel, higher short-game spin. For training volume and budget control, ionomer dominates. For scoring, urethane delivers stopping power and predictable check.

2-piece vs 3-piece vs 4-piece—what changes

More layers ≠ automatic superiority. Additional layers adjust speed windows and feel, but only help if swing speed can engage them. Many juniors peak with forgiving 3-piece soft-core designs before stepping to tour builds.

Spin windows for approach/short game training

Teach spin by intent. Use ionomer during block practice to groove contact and flight. Switch to urethane in the two weeks pre-event to calibrate check-up and release on chips, pitches, and partial wedges.

Spec comparison (use case driven)

| Spec | Durability | Spin | Feel | Price band | Best use |

|---|---|---|---|---|---|

| Ionomer cover, 2-piece | High | Low | Firm-medium | $20–$25/doz | Entry/practice |

| Ionomer/soft core, 3-piece | Med-high | Mid | Medium | $27–$33/doz | School/club |

| Urethane, 3-piece | Medium | High | Soft | $40–$45/doz | Competition |

| Urethane, 4-piece | Med-low | High+ | Soft | $45–$48/doz | Elite events |

✔ True — “Layer count tunes performance windows”

A third layer can smooth launch and add mid-iron stability for teens in the 70–85 mph band.

✘ False — “Three layers always beat two”

Only if swing speed and strike quality can engage the design.

Should practice and match play use different balls?

Yes—use durable, lower-cost balls for daily practice and urethane tour-style balls for matches; this mix preserves wallet, trains fundamentals, and gives consistent competition feedback.

Separation keeps your fundamentals consistent and your budget sane. Use a “two-bucket” system: practice bucket (ionomer) for volume, tournament bucket (urethane) for scoring feels. Plan consumption to avoid running out before peak season.

Two-bucket inventory strategy for juniors

Bucket A (Practice): 2-piece ionomer for mats, range, and casual rounds.

Bucket B (Match): 3–4 piece urethane for qualifiers, league, and ranked events.

Label sleeves clearly and coach athletes to respect the split.

Switching protocol pre-tournament week

Two-week switch-over: 10–14 days before an event, hit short-game reps and 9-hole sessions with the match ball. Keep practice balls for block range work to save the urethanes for scoring touches.

Annual consumption planning & cost control

Most juniors use ~2–5 dozen/year (6–12 rounds, losing ~2–3 balls/round). Split spend 70/30 (practice/match) for most households; 60/40 for high-frequency players.

Two-bucket annual budget (illustrative)

| Frequency | Practice (doz/yr) | Match (doz/yr) | Total spend (USD) |

|---|---|---|---|

| Occasional (≤1×/wk) | 2 | 1 | ~$95–115 |

| Regular (1–2×/wk) | 3 | 2 | ~$160–205 |

| High-intensity (≥3×/wk) | 4 | 3 | ~$230–305 |

Note: USD approximate retail; EU prices may include VAT.

✔ True — “Practice and match balls can coexist without confusion”

Use labeled sleeves and pre-round routines. The pre-event switch ensures touch calibration without wasting premium balls during block practice.

✘ False — “Switching ruins feel memory”

Short pre-event calibration restores feel quickly—common in college and junior elites.

Is the junior golf ball market worth entering now?

Yes—U.S. juniors reached ~3.7M on-course in 2024 (+48% vs 2019); Europe trends mildly up; Japan/Korea stable-strong with higher ASP. Global junior ball spend baseline ≈ $690–700M/year, led by the U.S. and Europe.

Signals are durable: U.S. girls reached ~35% of junior golfers; LPGA*USGA Girls Golf has impacted 1M+ girls; school/community programs and Topgolf/range funnels keep the pipeline wide. Europe grows via federations and club memberships. Japan/Korea show elite performance depth and higher-end gear preferences (soft compression, premium fabrics), aided by Korea’s screen-golf culture.

Region snapshot—US / EU / JP / KR

-

U.S.: ~3.7M juniors on-course (2024), +48% vs 2019; girls ~35%—largest and most certain growth engine.

-

Europe: R&A added “junior” to global scope; 2024 trend mildly up, participation broad but many non-9/18-hole formats, implying lower on-course share.

-

Japan/Korea: Adult base ~8.1M (JP) / ~5.4M (KR) golfers; strong youth pipelines; Korea swept 2024 R&A Junior Open.

Price/volume bands and ASP differences

U.S./EU: large volume, mid ASP (practice/social weight).

JP/KR: smaller volume, 20–30% higher ASP (mature training culture, premium bias).

Demand drivers—girls’ participation, schools, screen golf

Girls’ share rising, school/club programs expanding, and screen-golf + dense ranges (KR) increase training frequency—direct tailwinds for soft-compression balls and junior bundles.

Regional market model (2024/25 baseline)

| Region | Juniors on-course (M) | Dozen/yr (baseline) | ASP (USD/doz) | Baseline | Conservative | Optimistic |

|---|---|---|---|---|---|---|

| USA | 3.7 | 3.0 | 30 | $333.0M | $199.8M | $610.5M |

| Europe | 3.7 | 3.0 | 27 | $299.7M | $177.6M | $555.0M |

| Japan | 0.36 | 3.0 | 28 | $30.2M | $15.4M | $65.6M |

| Korea | 0.31 | 3.0 | 26 | $24.2M | $12.9M | $49.3M |

As of 2025; inputs from federation trends and on-course share assumptions. Baseline global junior ball spend ≈ $690–700M/yr.

✔ True — “Volume ≠ ASP”

The U.S./EU deliver scale but mixed formats depress ASP; JP/KR monetize higher via premium bias and training intensity.

✘ False — “More juniors automatically mean higher price”

Price is shaped by use-case mix, taxes/VAT, channels, and brand stack.

Sourcing Playbook: OEM steps, MOQ, lead time & compliance

China factories can make junior balls and support OEM/ODM with low-to-mid MOQs; plan samples, compression tuning, and artwork together; submit models to USGA/R&A lists via brand owners to enable junior tournament legality.

China’s share of global golf ball OEM/ODM production exceeds 70% by output. Factories in Guangdong, Fujian, and Zhejiang support 2–4 piece balls, 30–90 compression, pad/laser printing, and custom packaging.

OEM/ODM workflow—brief → samples → testing → mass prod

Brief (spec & use case) → Lab samples (compression bands) → Field tests → Artwork/packaging → Pilot (PPAP) → Mass production → Post-market QA. Align training vs tournament SKUs early to avoid rework.

Typical MOQs, timelines, and cost drivers

-

OEM (private-label): 3,000–5,000 pcs; logo/packaging/colorways.

-

ODM (custom design): from 10,000 dozen for new molds/formulas.

-

Small trial: 1,000–3,000 pcs for testing or compliance submission.

-

Lead time: sampling 7–10 days; mass production ~45–60 days after approval.

-

Cost drivers: cover material, layer count, printing colors, packaging, QA scope.

Compliance: USGA/R&A Conforming List process & tips

-

Who submits: brand/rights holder.

-

What: ~12 balls/model + technical data (weight, diameter, COR/initial velocity, symmetry, flight).

-

When: allow ~6–8 weeks for test cycles and listing updates.

-

Where it matters: AJGA, JGA/KLPGA junior tours, US Kids, and R&A Junior Open—conforming balls mandatory.

USGA/R&A Conforming Lists update monthly; re-check the current list before junior events.

China Golf Ball Factory landscape (examples, CN):

| Province | Factory | City | Notes |

|---|---|---|---|

| Guangdong | Greenswing | Shenzhen | OEM/ODM balls & accessories |

| Fujian | JTS Sports | Xiamen | 2/3/4-piece OEM, logo & packaging |

| Fujian | Albatross Sports | Zhangzhou | OEM balls & practice lines |

| Zhejiang | Ningbo Golfara | Ningbo | 2/3/4-piece Manufacturing & export; OEM/ODM |

✔ True — “Conformity depends on design + submission”

USGA/R&A listing is model-specific. Many China-made balls already appear on conforming lists—country of origin is not a barrier.

✘ False — “China-made can’t be conforming”

Ensure proper samples, paperwork, and timeline.

FAQ

Do juniors need urethane balls?

Not always—use ionomer for training volume and urethane when short-game spin matters in events.

For weekly practice and casual rounds, ionomer saves budget and holds up on mats. Pre-event and tournament play benefit from urethane’s softer feel and higher greenside spin. Many teams run a split: ionomer 70% of the time, urethane 30% around competition windows.

What compression is right at 65–70 mph?

Target 50–70 compression with 2–3 piece builds; validate with carry and dispersion.

At 65–70 mph, softer cores improve deformation and energy transfer. Start with two candidates (e.g., 55 and 65 compression), hit 10-ball sets, and compare average carry and shot pattern. Keep the model that lifts launch and tightens grouping.

How many dozen should a junior budget yearly?

Plan 2–5 dozen/year depending on rounds and loss rate; split practice vs match buckets.

Most juniors play 6–12 rounds and lose ~2–3 balls/round. Occasional players need ~3 dozen; regulars ~5; high-intensity athletes may exceed this in peak season. Keep a reserve sleeve for qualifiers to avoid last-minute substitutions.

Can OEM models enter USGA/R&A junior events?

Yes—if the specific model is on the Conforming Golf Ball List.

Submission is by the brand/rights holder, not the factory. Each model is tested for size, weight, velocity, symmetry, and flight. Once listed, that model is legal for junior tours and qualifiers governed by USGA/R&A conditions of competition.

What MOQs and lead times are realistic?

OEM 3,000–5,000 pcs; sampling 7–10 days; mass production 45–60 days after approval.

ODM with new molds/formulas may require higher MOQs (e.g., 10,000 dozen) and longer ramps. Cost shifts with cover material, layers, print colors, and packaging. Reserve factory capacity before peak seasons.

Are Europe/Japan/Korea attractive for youth balls?

Yes—but approaches differ: U.S./EU scale; JP/KR premium.

Europe’s growth leans on clubs/federations and has more non-traditional formats. Japan/Korea feature mature training infrastructures and screen-golf density, supporting higher ASP and frequent practice purchases—even with smaller junior populations.

Will low compression hurt distance later?

No—fit today, progress tomorrow; you’ll step up compression as speed rises.

Low compression lets current speed fully engage the core. As athletes grow and speeds increase, moving to firmer balls restores optimal launch and spin. It’s a ladder, not a trap.

Is screen golf practice transferable to course play?

Partially—great for reps and contact; calibrate short-game and course strategy outdoors.

Use simulators for volume swings and feedback loops. Before events, shift into on-course sessions to tune lies, green firmness, and wind. Match-ball calibration still matters in the final prep period.

Conclusion

Fit compression to swing speed, split practice vs match inventories, and time market entry toward U.S./Europe volume with China OEM agility and USGA/R&A compliance—this is the fastest path to junior ball results and commercial traction.

If you’re exploring private-label junior golf balls, lock specs, sample two compressions; we can help coordinate sampling, artwork, and submission timing.

You might also like — How to Request Samples from a Chinese Golf Ball Manufacturer?