Wiring money to a new factory can feel like jumping without a net. Most losses come from preventable gaps: weak verification, editable banking instructions, and paying before proof exists.

Safe payment to a Chinese golf ball manufacturer is a control process. Verify the legal entity and beneficiary name, lock bank details in a signed contract/PI annex, pay by milestones tied to PSI and shipping documents, and treat any bank change as high-risk—confirm via phone/video before paying.

The 4 control steps

- Verify identity: legal entity + beneficiary name match (contract/PI/bank).

- Lock instructions: bank details fixed in a signed annex (not “just email”).

- Stage releases: pay by measurable milestones (sample approval → PSI pass → shipping docs).

- Hard-stop changes: any bank change needs out-of-band verification (no email-only approval).

This guide turns first-order payment anxiety into a finance-friendly SOP you can standardize and audit for golf ball OEM sourcing.

Quick definitions

- T/T (wire transfer): bank-to-bank payment to a company account.

- PI (Proforma Invoice): payment instruction document that should match your contract/PO.

- Beneficiary name: the legal recipient name on the bank account (must match the supplier entity).

- Escrow/Trade Assurance: funds held and released after delivery/confirmation under current rules.

- L/C (Letter of Credit): bank payment against compliant documents (documentary compliance).

Why does paying a China factory feel so risky?

If it’s your first overseas OEM order, the fear is rational: you can’t “charge back” a shipment. But most losses are avoidable when you treat payment as controlled release—not a leap of faith.

Paying safely isn’t about avoiding T/T—it’s about preventing two failures: paying the wrong beneficiary and releasing funds before you have objective proof. Standardize verification, lock banking details, use staged milestones, and require inspection before the balance to make risk manageable and auditable.

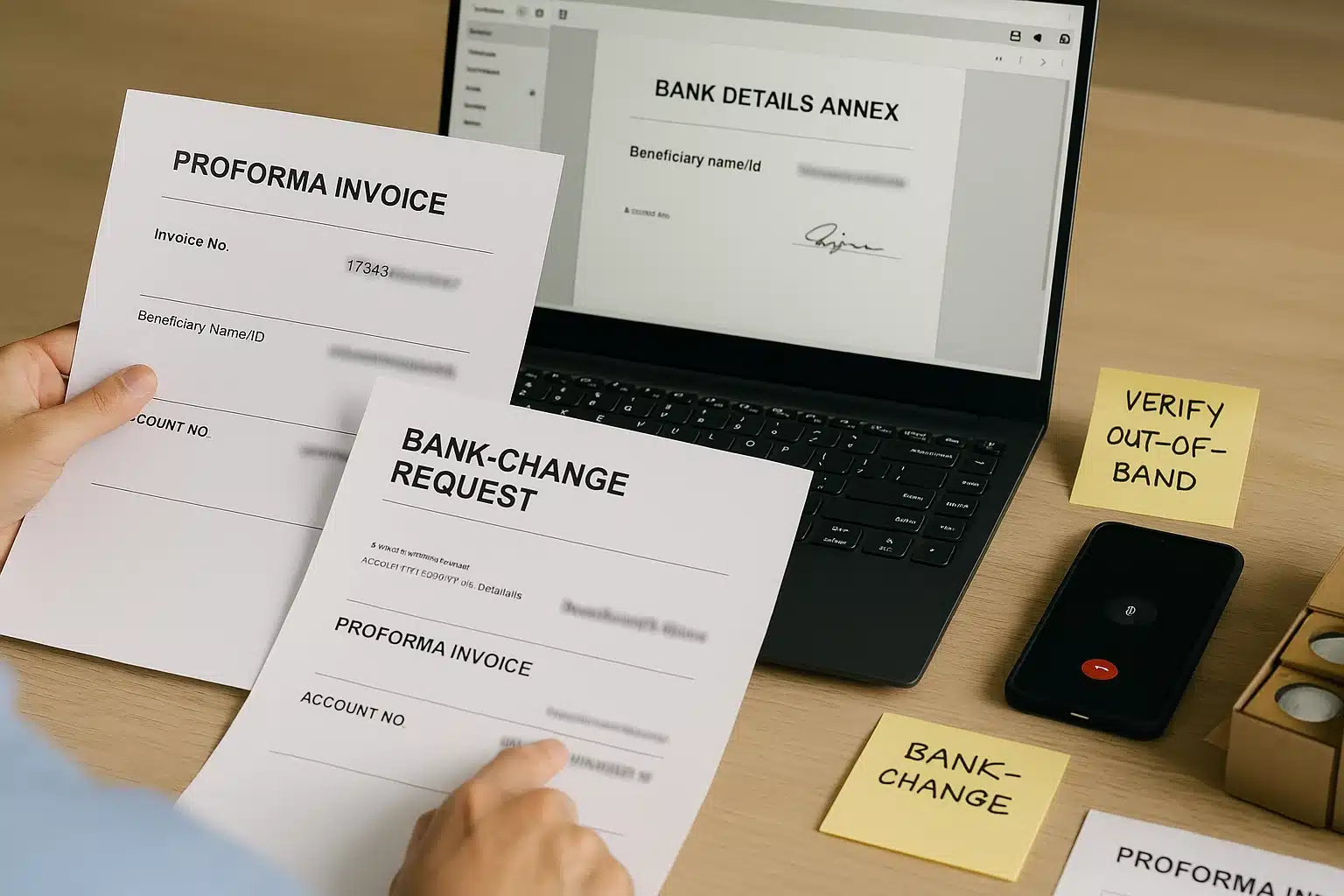

The most common modern failure mode is a mid-deal change to payment instructions (often linked to BEC patterns), so treat any bank-detail change as a “stop and verify” event (FBI/IC3 guidance on Business Email Compromise).

What scams actually show up in B2B payments?

Most buyers imagine a factory disappearing, but many losses happen when payment instructions get changed. Build controls that assume that possibility.

- Invoice edits / beneficiary substitution

- Look-alike domains or compromised email threads

- “Urgent” requests that bypass approvals

- Any bank-change request triggers a hard stop

Which payment methods are safest for new orders?

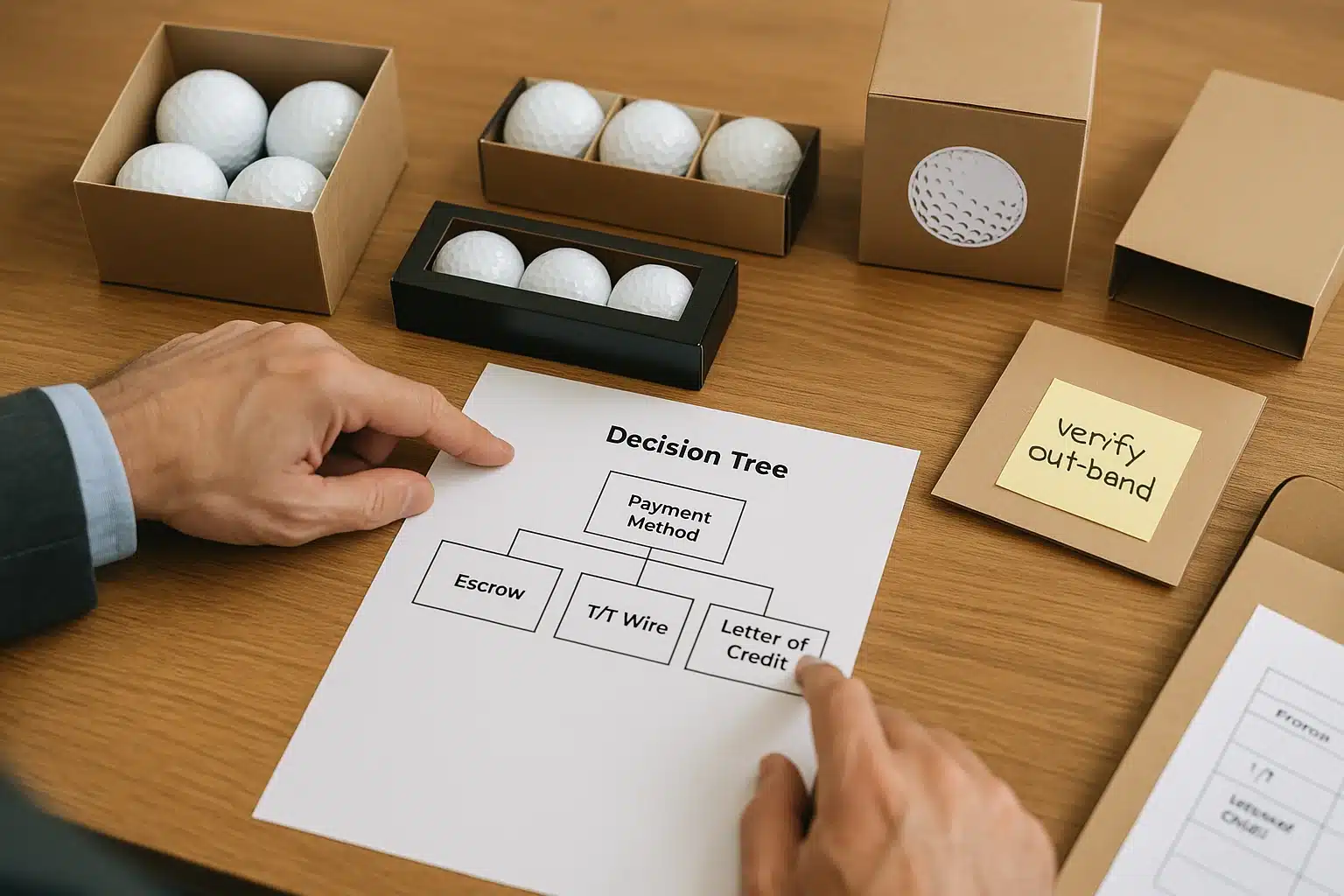

Payment methods are tools, not guarantees. The safest option depends on what you’re paying for (samples, tooling, bulk production) and how much proof you can require before you release funds.

For first-time golf ball OEM orders, match method to risk: use escrow (Trade Assurance) when you need extra protection and the order qualifies, use T/T to a verified company account for most bulk settlements, and consider L/C when value is high enough to justify document-based bank control.

In practice, “safe” comes from the controls your team can execute consistently. Sourcing should verify the legal entity and confirm who you’re actually buying from; AP should lock the beneficiary name and bank details in the vendor file; QC should define what “pass” means (spec annex + sample approval) and provide PSI evidence; logistics should provide shipping proof you can verify. Choose a payment rail only after those owners and artifacts are defined—otherwise no method is truly “safe.”

How to match method to order size and risk

Use a simple rule: less trust = more third-party control (escrow) or document triggers (L/C). As trust grows, T/T becomes simpler—if your bank-lock rule never changes.

| Scenario | Best-fit method | Why it fits | Trade-offs | When to choose / Recommendation |

|---|---|---|---|---|

| Samples / small trial | Card/PayPal or small T/T | Fast admin for small value | Higher fees | Validate performance quickly |

| Tooling / mold-related fees | T/T to verified company | Funds pre-production work | Hard to reverse | Pay only after signed approvals |

| Bulk first order | Escrow (if eligible) or T/T | Practical acceptance + controllable | Escrow may not fit all customs | Use inspection gate before balance |

| High-value order | L/C | Bank pays on compliant docs | Paperwork and time | Use when bank control is worth it |

What are standard golf ball OEM payment terms?

If you don’t know what “normal” looks like, every request feels suspicious. In golf ball OEM, standard terms exist because suppliers incur real work and cost before shipment is possible.

A deposit-plus-balance schedule is common in custom golf ball manufacturing because suppliers pay upfront for setup, materials, and readiness before goods can ship. What matters is whether your contract defines lead time start, the QC condition for the balance, and the documents that trigger final release.

To avoid disputes, define two things in the same document: what starts lead time, and what triggers final release. Many factories count lead time from deposit received + artwork/spec confirmation, not from “PO date,” because production cannot start without locked inputs. Your safest move is to write those start conditions into the contract/PI annex, then gate the balance on PSI and verifiable shipping proof. That way delays and “we assumed” arguments don’t turn into payment pressure.

Tooling/mold payments should be a separate milestone with written acceptance criteria (drawing/spec approval, sample approval, and what happens if the sample fails).

How to write payment triggers into the PI

Your leverage is language. Make payment conditional on measurable milestones—not vague promises.

- Deposit trigger: PI accepted + spec annex attached (construction, packaging, artwork file version)

- Balance trigger: pass pre-shipment inspection + shipping doc provided (draft B/L or forwarder confirmation)

- Bank change rule: out-of-band verification + signed amendment before any update

✔ True — Incoterms are not payment terms.

FOB/CIF/DDP allocates delivery responsibilities and risk handover. Payment milestones must be agreed separately and tied to evidence (inspection + shipping documents) (ICC Incoterms® 2020).

✘ False — “If it’s FOB/DDP, the payment timing is implied.”

Always ask for the payment clause and lock release triggers in writing.

How do you pay safely, step by step?

Here’s the repeatable protocol that prevents most payment disasters. It works whether you pay by T/T, escrow, or L/C—because the safety lives in verification and release gates.

Pay safely by controlling release gates: verify the supplier entity and beneficiary name, lock bank details in the contract/PI annex (signed), pay in stages tied to measurable milestones, and require pre-shipment inspection before the balance. Treat any bank-detail change as a hard stop until independently verified.

✔ True — Pre-shipment inspection is a release condition.

Use PSI to decide whether the balance is released before goods leave factory control—not to argue after shipment.

✘ False — Photos and a packing list are enough evidence.

Treat them as supporting docs; release requires an inspection pass plus shipping proof you can verify.

The 7-step secure payment checklist

Don’t “trust” a supplier—verify evidence. Never release funds without matching identity, locked instructions, and objective proof.

- Verify legal entity (registry); save record.

- Match beneficiary name to that entity.

- Lock bank details in the contract/PI annex (signed); treat any change request as high-risk and verify out-of-band before updating.

- Stage payments by written milestones only.

- Inspect pre-shipment before paying balance.

- Release final funds on shipping documents.

- If fraud suspected: bank first, then report.

Assign owners per gate; pause payment on any mismatch. For wire visibility, ask your bank about SWIFT gpi tracking and the payment’s UETR (Unique End-to-end Transaction Reference), where supported.

What are the biggest red flags before you pay?

Unsafe payment requests follow patterns. Your goal is to spot them before money moves—then force the deal back into a controlled path (or walk away).

Do not pay if the supplier asks for a personal account, pushes Western Union/crypto, won’t provide consistent legal-entity documents, or keeps changing payment instructions by email. Treat any bank-change request as a hard stop until independently verified, and keep releases tied to inspection and shipping evidence.

✔ True — Manufacturer vs trading company changes your controls.

If the legal beneficiary isn’t the producer, risk rises because funds and production control are split. Clarify who receives funds and who accepts QC terms, then tighten inspection and dispute language.

✘ False — “It doesn’t matter who I pay as long as someone ships.”

Who you pay must match who can enforce your QC and delivery terms.

A short “don’t pay” list (built for AP checklists):

- Beneficiary name mismatch (contract/PI vs bank recipient)

- “Urgent” last-minute bank change, especially only by email

- Request to pay a personal account or unrelated entity

- Push toward Western Union/crypto for bulk settlement

- Inconsistent legal entity details or refusal of basic documents

- Refusal of pre-shipment inspection for first order

- Slow, illogical, evasive answers to verification questions

FAQ

Is it safe to wire money (T/T) to China for a first order?

Yes—if you wire to a verified company beneficiary and you control releases with milestones. T/T is common in B2B settlement; the safety comes from identity checks, locked bank details, and a balance payment that depends on inspection and shipping evidence.

Make it role-based: sourcing verifies the legal entity; AP locks the beneficiary name and bank details; QC owns PSI; logistics provides shipping proof. If any artifact is missing or inconsistent, pause payment and escalate—don’t “fix it” by accepting email assurances. Make any bank-detail change require a second approver in AP.

What deposit percentage is normal for custom golf balls?

30% is a common deposit level for custom golf balls, but it varies by supplier and project (e.g., tooling, packaging complexity, first order vs repeat). The key is to make the deposit conditional: lock specs and artwork, define lead-time start, and release the balance only after PSI pass + verifiable shipping documents.

Tie each release to a deliverable: approved spec/sample, inspection pass, then shipping documents. Keep a versioned spec annex attached to the contract so “pass” doesn’t drift between teams. If the factory changes materials or packaging after approval, reset the sample milestone before releasing more funds.

How do I verify a Chinese manufacturer’s legal entity quickly?

Cross-check the company’s legal name and Unified Social Credit Code in official public records, then ensure the beneficiary name on the bank account matches that verified entity. If the name changes across license, contract, and bank details, pause payment until reconciled.

Sourcing should ensure the same legal name appears on the contract/PI; AP should save proof of beneficiary-name match in the vendor file. If the supplier asks to pay a different entity, require a written explanation, a signed amendment, and a second internal approver—or don’t pay. Do not create a vendor record until the legal name matches across all documents.

What if the supplier emails me a ‘new bank account’ after we signed the PI?

Stop processing immediately. Treat any bank-detail change as high-risk and verify it through an independent channel (phone/video) using a known contact path. Do not approve changes solely in email, and require a signed amendment before paying.

AP sets a hard stop; sourcing confirms via a verified phone number/video; then you update the signed bank annex only after independent confirmation. Keep an audit trail with the PO (call log, signed amendment, internal approval). Never update bank details without a call log plus a signed amendment (for U.S. victims, report through IC3).

Can I release the balance after I see photos and a packing list?

Usually no for a first order. Photos and packing lists help, but they’re not objective proof of conformity. Use pre-shipment inspection or third-party sampling before releasing the balance, then tie final payment to shipping documents you can verify.

QC owns PSI evidence; AP releases only after “pass” plus verifiable shipping proof that matches the contract party. If you can’t inspect, reduce the first order size and tighten acceptance criteria instead of paying early. This keeps speed without turning the balance into an unsecured bet.

Does USGA/R&A conformance status affect payment risk?

It can be a capability signal, but it’s not a payment shortcut. Controls stay the same: verified beneficiary, locked bank details, staged milestones, and inspection before the balance. Use conformance frameworks mainly to write measurable acceptance criteria.

Use conformance to write tighter, testable requirements in your annex, then validate them through inspection. Payment gates don’t change whether a product is listed or not, because documentation risks are separate from performance capability. If conformance status matters, verify the latest official information at the time of purchase.

Conclusion

Safe payments don’t come from luck—they come from repeatable gates. Once your process is standardized, sourcing becomes predictable—even with new suppliers.

To pay Chinese golf manufacturers safely, standardize your controls: verify the legal entity and beneficiary name, lock bank details in the contract/PI annex (and in your AP vendor file), pay in stages tied to inspection and shipping documents, and treat any bank-change request as a hard stop requiring independent verification. Start with a small trial order, then scale as performance stays consistent.

You might also like — What’s the True Landed Cost When Importing Golf Balls from China (DDP Guide)?