US and China can both produce excellent golf ball molds; the “better” one is the mold you can prove stays stable at scale. Stability means repeatable dimple geometry, controlled parting lines, and documented repair-to-reference recovery—so a hybrid model (US critical inserts + China production) can deliver premium consistency with manageable cross-border risk.

“US vs China” sounds like a binary choice—until you’re the one living through batch drift, cosmetic rejects, unexpected downtime, and duty surprises right when you move from sample testing to volume order.

Once you stop arguing about origin and start deciding which component controls variance—and how you verify and maintain it—you can build a sourcing plan that’s measurable, auditable, and scalable.

Are US golf ball molds better than China’s?

US and China can both produce “better” molds—if stability is proven and re-checkable. US tooling tends to win when critical cavities/inserts are built and maintained under tight, auditable controls; China tooling can be equally capable when the factory can prove stable process control and verification at scale.

The real pain isn’t where a mold was made—it’s that “good-looking” samples can hide unstable production. When you scale, small shifts in geometry, surface finish, or shut-off condition can show up as flight drift, cosmetic defects, and rework that quietly eats your margin.

If you want a decision rule that holds up in a buyer meeting, treat “mold origin” as a secondary variable. The primary variables are:

-

What tooling surface actually defines performance variance (typically dimple geometry + concentricity).

-

Whether that surface can be measured the same way every time (repeatable method + calibrated tools).

-

And whether repairs restore the reference (before/after verification, not “trust me”).

One more trap: buyers often assume “premium feel” is purely a mold question. It isn’t. Your material/process route (for example, TPU injection vs. cast thermoset urethane) changes what “good control” looks like—especially for cosmetics and print durability. Even when the tooling is excellent, release-agent residue or inconsistent cleaning can create adhesion failures that show up later as logo peeling or paint scuffing.

✔ True — “Better” is measurable stability, not a country label.

If you can’t verify dimple repeatability, parting-line control, and repair response time with auditable outputs, you’re buying opinions. Put deliverables (reports, logs, calibration proof) ahead of origin claims.

✘ False — “US-made mold automatically means a premium ball.”

Premium outcomes come from the mold plus process control, periodic re-checks, and documented maintenance—especially after early wear and any re-polish cycles.

So the decision isn’t “US or China.” It’s: which components must never drift, which steps benefit from China’s ecosystem (production, finishing, packaging), and what evidence proves the system stays locked when you ramp.

Which mold parts decide dimple consistency?

Buyers often say “the dimples changed” after scaling—and blame the factory. More often, the bottleneck is specific: cavity geometry, insert finish, concentricity control, and how those are measured and re-verified after wear or polish.

Dimple consistency is rarely a “whole mold” problem—it’s a cavity geometry problem. Treat the cavity insert (and its surface finish) as the critical asset: define what must be measured (3D dimple profile, concentricity) and what triggers a stop-and-fix before drift becomes a “new normal.”

A practical way to structure your tooling decision:

-

Critical tooling assets (lock these): cavity inserts, the datum features that control alignment, and any geometry that drives aerodynamic repeatability.

-

Localizable components (allow flexibility): mold base, cooling layout, fixtures—provided they don’t compromise the critical references.

Why this matters: a “looks OK” sample can pass casual inspection while hiding early-stage instability. The fix is to lock a repeatable inspection bundle and require periodic re-checks tied to cavity ID (unique cavity identifier) so you can detect and correct drift before it becomes a batch-wide surprise.

Dimple Consistency Control Plan (buyer-side view)

| Decision dimension | What can drift | What to verify | Deliverable | Acceptance / next step |

|---|---|---|---|---|

| Dimple depth/shape | Tool wear, re-polish variation | 3D dimple scan/profiling | Dimple profile report | Set sampling cadence + trigger for re-polish re-qualification |

| Parting line/flash | Shut-off wear, alignment shift | Visual standard + gauge | Photo standard + gauge log | Define rework limit + corrective action workflow |

| Concentricity | Core offset, cavity alignment | CT/X-ray or equivalent | Concentricity report | Define fail disposition (hold/rework/scrap) |

| Diameter/weight | Material variation, process drift | Dimensional + weight checks | Measurement log | Trend review + process adjustment rule |

| Print/paint durability | Release residue, surface prep drift | Cross-cut adhesion test (cross-hatch) or equivalent method (conditions + rating agreed) | Adhesion test record | Link failures to cleaning/release SOP updates |

Decision takeaway: don’t argue about “precision” in the abstract. Require proof that (1) inserts are measured the same way every time, (2) measurement tools are calibrated, and (3) any polish/repair creates a before/after trail you can audit.

Also require a report format that includes: measurement date, instrument model/serial, calibration certificate ID, sample cavity ID, and a clearly labeled before/after comparison page reference. Include a document revision ID so re-checks after any tool touch are comparable.

Can US molds + China production scale safely?

Hybrid programs look simple on paper—until you scale. That’s when custody, IP exposure, repair responsibility, and downtime risk show up. If nobody “owns” the mold asset in a cross-border way, one scratch or shut-off issue can stop the line while people argue about blame.

The hybrid model scales when you separate what must never drift (critical inserts + reference samples + measurement method) from what benefits from China’s ecosystem (production, finishing, packaging). It fails when there’s no custody baseline, no PM cadence, no PM log, and no spare-parts/repair-file plan—because overseas downtime is rarely a tooling problem alone; it’s an information problem.

A scalable hybrid setup usually includes:

-

A serial-numbered insert/cavity ID system tied to batch records

-

A defined PM cadence (preventive maintenance cadence) with photo records

-

A PM log requirement (dated entries + abnormality photos)

-

A spare kit strategy aligned to the mold BOM (wear parts, vent inserts, seals, etc.)

-

A “repair pack” expectation (what files/tools are needed to restore the reference)

-

Clear rules on subcontracting (especially around critical steps) to reduce variance and IP exposure

✔ True — “Hybrid” can mean inserts, not whole molds.

You don’t have to ship an entire US mold overseas to get US-level geometry control. A common hybrid approach is controlling the critical inserts + verification while leveraging China for stable production and secondary processes.

✘ False — “Hybrid automatically reduces downtime.”

Downtime drops only if you plan for local repairability: spare parts, repair references, and before/after verification. Without that, hybrid can add complexity and slower fault resolution.

Decision Matrix for Mold Strategies

| Pain/decision dimension | Option A: Full China | Option B: Hybrid (US insert) | Option C: Full US |

|---|---|---|---|

| Quality bottleneck | Depends on factory controls | Lock insert geometry | Lock everything |

| Downtime/repair | Fastest local repair | Needs spare insert/repair plan | Overseas repair lag |

| IP exposure | Contract + process controls | Structural control (critical insert) | Local control |

| Scale stability | Varies by tier | Best balance | Capex-heavy |

| Evidence you must require | Dimple report (with cavity ID labels) + batch traceability (by lot and cavity ID) + PM log (dated, photo-backed) | Insert measurement report (with cavity ID labels) + spare kit list + repair before/after verification pages | Local measurement outputs + repair SLA evidence + periodic re-check plan (documented triggers) |

Decision next step: end the debate with evidence—require traceability by cavity ID, a periodic re-check rule that triggers maintenance, and a “back to reference” verification step after any repair or re-polish.

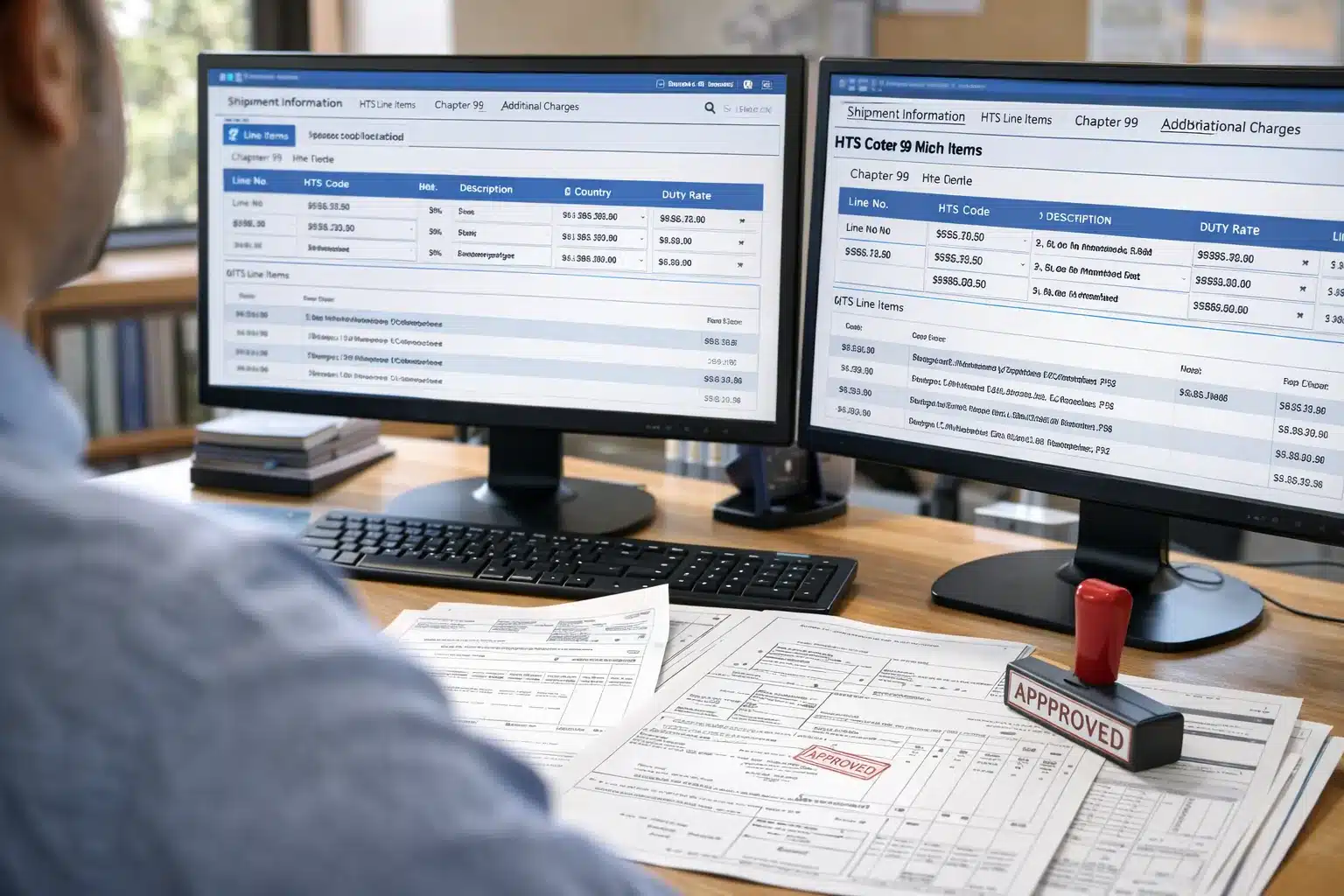

What duties apply to China-made golf balls in the US?

For golf balls (HTS 9506.32.0000), Chapter 99 entry treatment is what usually determines your landed-cost risk—not the base line alone. Ask your broker to provide the entry worksheet screenshot (showing HTS + the specific Chapter 99 line used on this entry), plus a short line-item rationale explaining why that Chapter 99 line was applied and how origin was determined. Treatment can change—verify at the time of entry.

Your broker should run an entry-level check to confirm (1) origin, (2) whether Section 301 Chapter 99 treatment applies, and (3) whether your product description matches any active exclusion heading. Keep the outputs in your procurement file so the same logic can be repeated for future entries.

To make your procurement notes read like a compliance team wrote them, separate classification from treatment:

-

Classification: the base HTS line you’re declaring (e.g., 9506.32.0000).

-

Treatment: whether a Chapter 99 provision adds duty, changes a rate, or applies an exclusion—based on origin and the rules active at the moment of entry.

HTS 9506.32 + Chapter 99 Entry Checklist (as of 2026-01-07)

| What to check | Where it shows up | Why it matters | Deliverable to request | Next step |

|---|---|---|---|---|

| Base classification | HTS line (e.g., 9506.32.0000) | Sets baseline duty | Classification reference for product | Confirm with broker before booking |

| Chapter 99 treatment | Chapter 99 line(s) used on entry | Drives additional duty or relief | Entry worksheet screenshot + line-item rationale | File it for repeatable future checks |

| Additional duty rate | Rate tied to the applied treatment | Changes landed cost | Rate confirmation on entry docs | Update landed-cost model + margin |

| Exclusion match | Product-specific exclusion heading | May remove additional duty | Exclusion heading + match rationale | Verify active on entry date |

| Country of origin | COO documentation | Wrong COO = penalty risk | COO documentation set | Align COO logic before production |

✔ True — Exclusions are limited and specific.

Even when exclusions are extended, they’re not a blanket waiver for an entire HTS line. Treat exclusions as “match-the-description” items and verify them at entry with the Chapter 99 heading that applies that day.

✘ False — “If exclusions exist, my HTS line is automatically excluded.”

Automatic assumptions cause expensive surprises. The safe habit is entry-level verification with a broker and documentation that shows the exact Chapter 99 line used.

Compliance mindset that scales: bake a one-page “entry packet” expectation into your SOP (classification reference, origin docs, Chapter 99 line confirmation, and exclusion check). It’s cheap insurance before you ship volume.

Who fixes your mold when it’s in China?

“Overseas mold ownership” anxiety is rational: the tool is valuable, fragile, and central to your variance control. If you ship tooling or inserts without custody terms and a repair workflow, you’re effectively outsourcing the definition of “good enough” to whoever is under pressure to keep the line running.

A mold overseas isn’t an asset unless it’s maintainable. Define custody (serial + cavity ID + arrival photos), a clear PM cadence, and repair responsibility so that if a cavity gets scratched or shuts off poorly, the factory can restore the reference fast—with documented before/after verification.

A buyer-friendly custody + PM program usually includes:

-

Custody baseline: serial number + cavity ID + arrival-condition photos + baseline notes.

-

Traceability: cycle counter or an agreed batch-record method tied to cavity ID.

-

PM cadence: cleaning/anti-rust/inspection routines with a PM log.

-

Spare kit: springs/pins/bushings/O-rings/vent inserts aligned to the mold BOM.

-

Data retention: every PM/repair records cause, action, and before/after comparisons.

-

Golden master: one reference sample + the measurement method used to prove “back to reference.”

The key is not perfection—it’s response. If a problem happens mid-run, you want rapid diagnosis, controlled intervention, and a clear “back to reference” proof step. That’s how you protect schedule certainty and prevent emergency repairs from quietly redefining your spec.

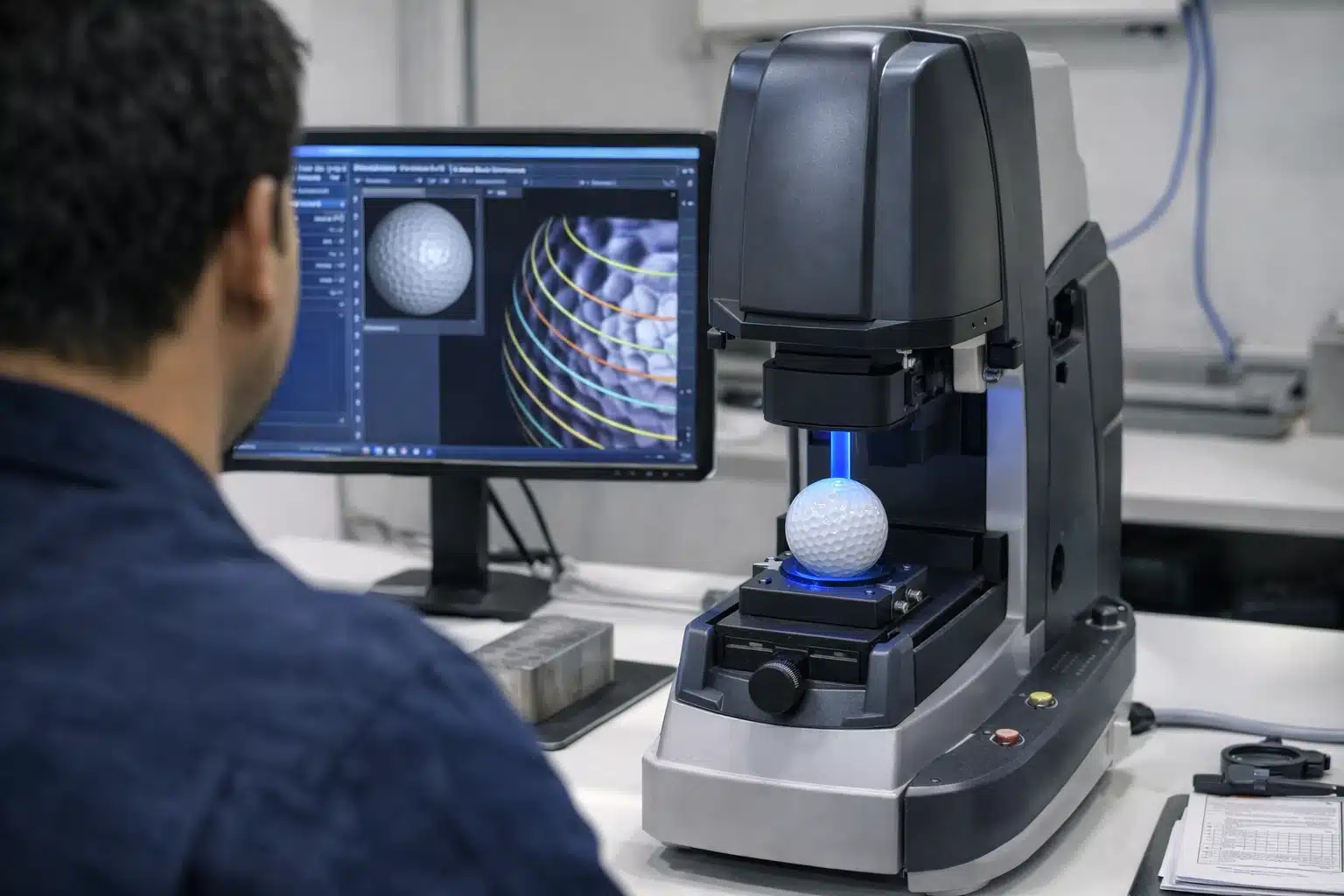

How can you verify mold precision remotely?

If you can’t visit the factory, you can still buy with confidence—but only if you ask for outputs, not promises. Remote verification is a discipline: define the measurements, define the reporting format, define who can verify it (you or a third party), and define what happens when data drifts.

Remote verification works when you request evidence of repeatability—reports, calibration proof, and before/after comparisons. Your baseline is a first-article inspection pack (dimple geometry + concentricity + core/cover checks) plus a cosmetics standard with controlled photo conditions, followed by periodic re-checks that prove batch stability.

Before you negotiate price, screen capability:

- Can they run your material/process route consistently (and document it)?

- Do they have (or can they access) the equipment and controls to produce verifiable outputs?

- Can they tie production to cavity ID and keep traceable batch records?

Remote Verification Pack by Risk Level

| Risk | What to request | Deliverable | Who can verify | Pass/fail next step |

|---|---|---|---|---|

| First article risk | Dimple 3D + CT/X-ray + key dimensions | Report set | Third-party lab or buyer | Approve / hold |

| Cosmetics risk | Lighting/photo standard + sample board | Photo pack | Buyer QC | Rework / adjust |

| Scale risk | Periodic re-check cadence | Trend charts | Factory + buyer | Trigger PM / corrective action |

| Tool change risk | Before/after on any polish/repair | Comparison report | Buyer or third party | Re-qualify / resume |

✔ True — Remote verification succeeds when you buy outputs, not promises.

If your supplier can produce repeatable reports (with calibration proof) and you set clear pass/fail rules, you can make volume decisions without factory visits.

✘ False — “A factory can guarantee precision without data.”

Precision claims only matter if you can re-check them after wear, repairs, and scaling. Require before/after verification whenever tooling is touched.

RFQ verification action (one-pack request you can use):

Provide a remote-verifiable precision + stability pack: (1) dimple 3D profile report (before/after), (2) CT/X-ray concentricity report, (3) first-article plan + measurement list, (4) calibration certificates for gauges, (5) mold maintenance log template + spare-parts BOM, (6) cosmetic inspection standard (lighting, photos).

Set sign-off roles: factory QC signs the pack, and leave a countersign/review line for your team or a third-party lab before volume approval. Require a document revision ID so the same pack can be re-checked after any tool touch.

Decision takeaway: this isn’t about demanding “US-level precision.” It’s about demanding a closed loop where drift is visible early, fixes are controlled, and “back to reference” is proven with the same measurement method every time.

FAQ

Can I ship my own molds/inserts to a Chinese factory?

Yes—but treat tooling as an owned asset with custody, access control, and a repair plan, not as “free equipment” the factory manages informally.

Start with a custody baseline (serial number, cavity ID, arrival photos, and a cycle counter approach). Define preventive maintenance and repair responsibility in writing: who diagnoses, who can touch files, and how “before/after” proof is produced after any polish or repair. Finally, require traceable batch records tied to cavity ID so you can correlate drift to tooling, not guess.

How do I reduce IP risk for a unique dimple pattern?

Use structural controls, not only contracts: isolate the critical insert, limit file access, and reduce subcontracting on critical steps.

In practice, that means hybridizing around what matters most: keep critical inserts and reference measurements under your control, while the factory runs production under acceptance criteria you can verify remotely. Favor suppliers that can keep critical steps consolidated and traceable, and keep a “golden master” reference (sample + measurement method) so you can detect any unauthorized drift.

Are TPU-injection urethane covers the same as cast urethane?

They’re different process routes; your decision should match your feel/performance target and the durability controls you can verify.

The risk isn’t just “which is better.” It’s whether the chosen route is executed with consistent surface prep and contamination control. Release agents and cleaning discipline can quietly drive adhesion failures (print/paint durability) even when the ball initially looks perfect. Require a documented process flow and an agreed adhesion verification method as part of acceptance criteria.

What’s the minimum test package for first article vs mass production?

First article needs full geometry + stability proof; production needs a lighter “drift detection” bundle with clear triggers.

For first article, prioritize geometry and alignment proof: dimple 3D profile, concentricity evidence (CT/X-ray or equivalent), key dimensions, and a controlled cosmetics standard. For mass production, simplify to the checks that catch drift early: periodic dimple spot-checks, cosmetics photo standards, and trend reviews tied to cavity ID—plus a rule that triggers maintenance and re-qualification when drift appears.

What’s the biggest scaling trap in hybrid manufacturing?

Downtime—specifically when the “critical asset” can’t be repaired locally with the right references, spare parts, and before/after verification.

Hybrid programs fail when a line stops and the factory lacks the repair references (files, electrodes, programs) or a spare kit aligned to the mold BOM. The fix is boring but powerful: plan local repairability, require documented PM cadence and a PM log, and demand “back to reference” proof after any intervention.

Conclusion

US molds aren’t automatically “better,” and China molds aren’t automatically “riskier.” The winning choice is the one you can verify, maintain, and keep stable at scale—especially around cavity inserts, measurement methods, and repair response.

If you anchor decisions on deliverables (verification reports, calibration proof, maintenance logs, and entry-level duty checks), the US-vs-China debate turns into a clear, auditable sourcing strategy.

You might also like — How to Verify Golf Ball Quality Control: A 7-Step Factory Audit Checklist