As global buyers search for reliable Chinese golf ball OEMs, one question always comes first: “How good are the balls you make? Can they match Titleist or Callaway?” The honest answer: there is a gap, but it’s smaller than most people think. This article answers two questions buyers care about most: How good are Chinese golf balls today, and can they truly be used in tournaments?

Are Chinese golf balls any good?

Yes. When design, materials, and QC are executed properly, Chinese golf balls can reach tournament standards. Origin doesn’t decide quality—engineering and consistency do.

For B2B use—coaching programs, retailers, range operators, and DTC brands—China now delivers reliable two-piece ionomer balls, durable range balls, and high-quality custom logo lines. Multilayer cast-urethane “tour-style” products are growing fast as factories adopt automated casting, closed-loop coating, and in-line inspection.

When did golf ball manufacturing start in China?

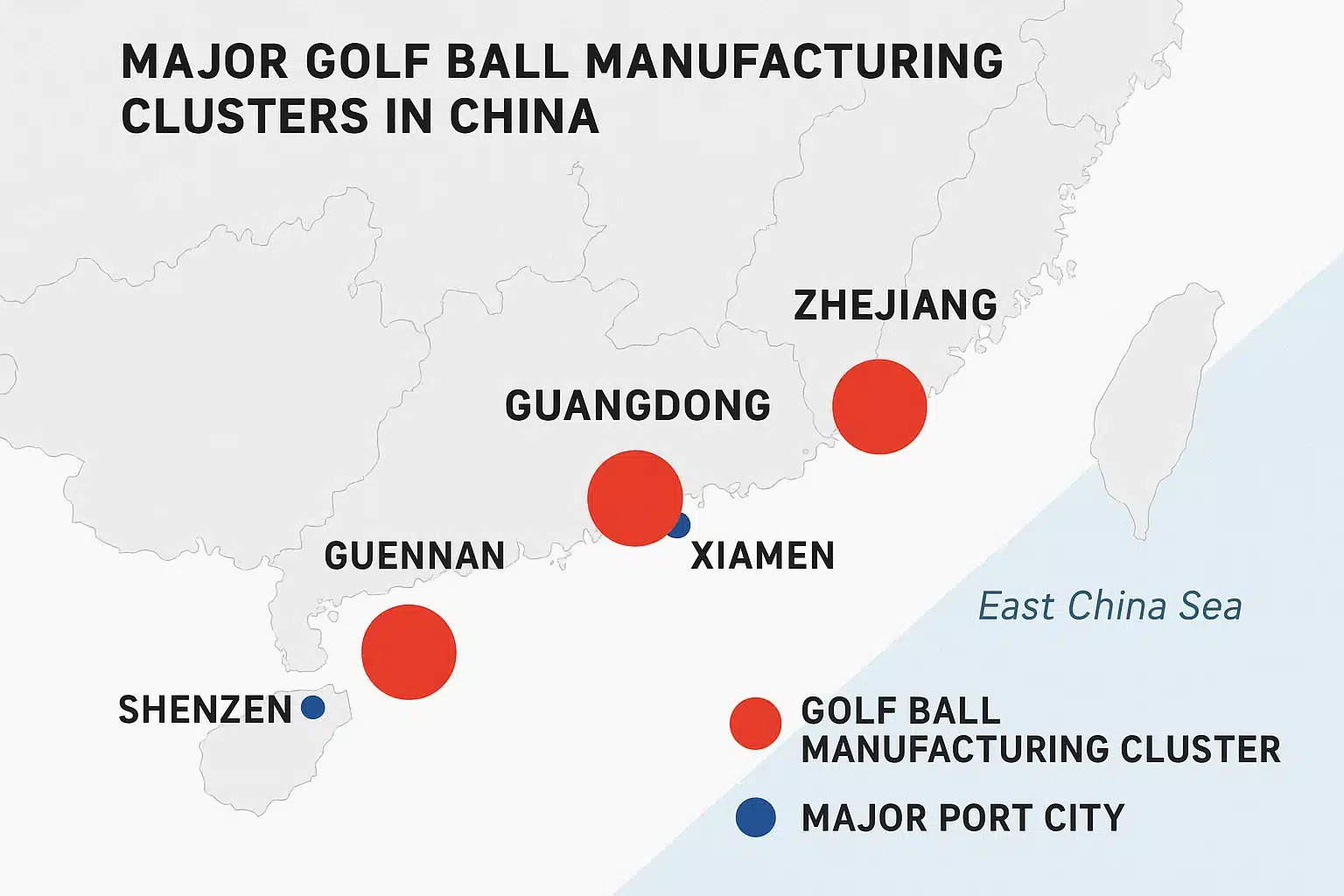

Late 1990s to early 2000s. Early OEM clusters formed in Xiamen and Dongguan, then expanded to Ningbo, Taizhou, and nearby cities as raw materials, tooling, molding, coating, and printing built into a complete supply chain.

The pathway mirrored broader sports-goods outsourcing: start with two-piece ionomer balls where injection and finishing dominate the cost curve; move into 3–4 layer builds and small-batch customization; then introduce cast-urethane lines, automated coating, and better metrology. Today you can find suppliers for value-driven practice balls and for collaborative R&D on multilayer urethane.

Top 10 Golf Ball Manufacturers in China for OEM

| Manufacturer | Location | MOQ |

|---|---|---|

| GTS Golf (China) LLC | Dongguan | 5000 pcs |

| JTS (Xiamen) Sports Equipment Co., Ltd. | Xiamen | 3000 pcs |

| Ningbo Yihong Sporting Goods | Ningbo | 3000 pcs |

| Xiamen MLG Sports Equipment Co., Ltd. | Xiamen | 3000 pcs |

| Xiamen Yopral Sports Goods Co., Ltd. | Xiamen | 5000 pcs |

| XJT Golf (Shenzhen) | Shenzhen | 5000 pcs |

| Xiamen Liying Industrial | Xiamen | 5000 pcs |

| Youli Sports Equipment (Dongguan) | Dongguan | 3000 pcs |

| TH-Sport (Xiamen) | Xiamen | 5000 pcs |

| Ningbo Golfara | Ningbo | 1000 pcs |

How big is China’s golf ball industry today?

As of 2025, China can mass-produce 2–4 layer constructions covering range, practice, custom logo, and tour-style cast-urethane balls. Manufacturing is concentrated in Guangdong, Fujian, and Zhejiang, supported by mature ports and export operations.

-

Mid-market ionomer and range balls remain high-volume staples.

-

Cast-urethane multilayer output is rising, driven by DTC brands and private-label programs.

-

Supply chains cluster near Shenzhen/Guangzhou/Hong Kong, Xiamen, and Ningbo ports, enabling both large MOQs and flexible smaller repeat buys.

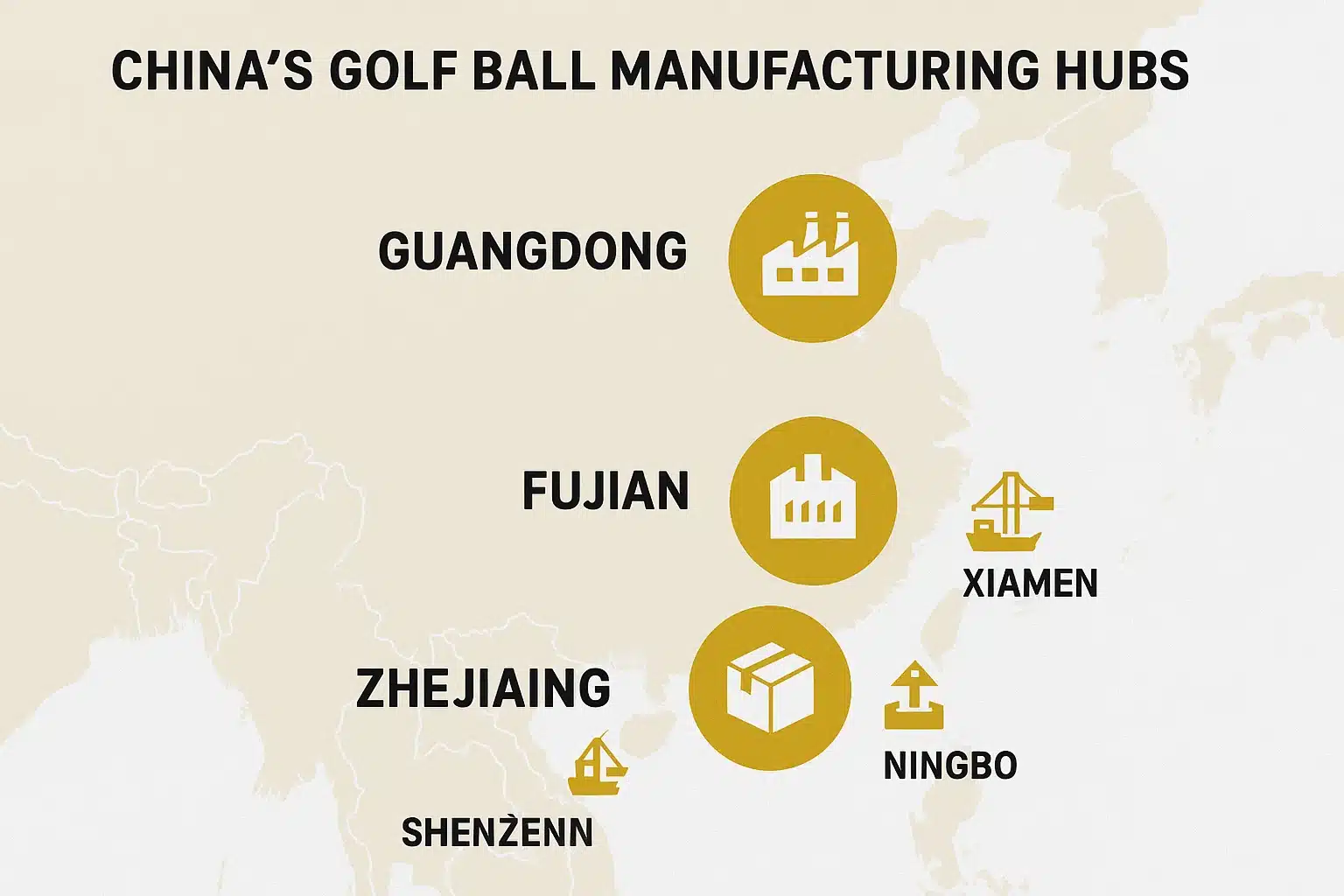

China’s three main golf ball manufacturing hubs

Each province serves a different buyer profile. Guangdong scales stable mass production; Fujian emphasizes flexible multi-layer customization; Zhejiang blends new urethane capacity with strong packaging and gift-set integration.

| Province | Core products | Typical layers/materials | New capabilities / process highlights | Best-fit scenarios |

|---|---|---|---|---|

| Guangdong | Ionomer & urethane multilayer balls | ✅ 2–4 layers, Ionomer + Cast Urethane | Fully automated casting; tour-level core capability | Mid/high-end OEM, brand partnerships, stable mass production |

| Fujian | Tour-style custom balls / hybrid formulas | 3–4 layers, Ionomer and Urethane | Flexible processes, strong customization; quick small-batch changeover | High-mix premium customization / special formulations |

| Zhejiang | Custom balls + new urethane capacity | ✅ 2–4 layers including Urethane | Precision coating lines; best-in-class packaging integration | Brand gifting, event bundles, light tour-level orders |

Can Chinese golf balls be used in tournaments?

Yes. Tournament use depends on whether the exact model is on the USGA/R&A Conforming Ball List, not where it was made. Many Chinese factories have proven tour-grade capability through compliant models; the key is matching your production batch to the certified build.

What buyers should lock in:

-

Certification is model-based, not factory-based.

-

Listing is annual; typical maintenance cost USD 1,000–1,500 per model per year.

-

Not renewing does not mean the ball becomes non-compliant; it only disappears from the latest list.

-

A prior “conforming” result shows technical capability; re-testing under your brand is common for tournament use.

✔ Fact — USGA/R&A conformity is model-based and annual

If the factory keeps the same materials, molds, and process, performance does not change just because a listing lapses. You can re-submit under your own brand when tournament use is planned.

✘ Misconception — “Lapse = not legal anymore”

A lapse means the model may not appear on the current list, not that the ball’s build has changed. Verify model name + year, re-test samples, and lock the certified build in your PO.

How do Chinese-made balls compare with top brands like Titleist?

The remaining gap is about extreme tolerances and batch consistency. Our Golfara 3-piece cast-urethane ball measures 90 ±6 compression; Titleist Pro V1 often controls compression to about ±3. If Pro V1 scores 10/10 overall, ours is roughly 8/10—close enough for most B2B programs.

| Metric | Golfara 3-Layer Urethane | Titleist Pro V1 | Difference |

|---|---|---|---|

| Compression | 90 ±6 | 90 ±3 | Slightly looser tolerance |

| Construction | 3-layer Cast Urethane | 3-layer Cast Urethane | Same class |

| Flight stability | ~±2.5% | ~±1.2% | Small but measurable |

| Value for money | High | Lower | Strong cost advantage |

✔ Fact — Finishing directly affects price and schedule

Double coats, UV layers, multi-color pad printing, or gift boxes typically add $0.05–$0.15 per ball and 5–10 working days. Production bottlenecks are usually paint/print lanes, not core molding.

✘ Myth — “Only core design determines cost and lead time”

List coating, printing, and packaging as separate line items in quotes and schedules, and lock the process window and timing in your PO to prevent late changes and overruns.

How to find factories in China that can produce tournament-level golf balls?

Focus on Guangdong, Fujian, and Zhejiang. Verify real test capability, review conformity records, and lock formulation and process windows before mass production. Sample first, then bind specs and tolerances in your PO and QA addendum.

1) Choose the right region

Prioritize Guangdong, Fujian, Zhejiang—mature ecosystems for multilayer core molding, urethane casting, coating, and testing.

2) Verify equipment and process capability

Ask factories for proof of:

- Compression testers

- COR/initial-velocity measurement

- Temperature/humidity stability labs

- Vacuum casting and automated coating/printing lines (photos/video are fine)

3) Check conformity records

- Request USGA/R&A reports or historical list screenshots.

- Match model name + year.

- If listing has lapsed but materials, molds, and process are unchanged, treat it as tour-grade capability and re-test under your brand if needed.

USGA/R&A certification cost & timeline overview

| Item | Amount (USD) | Notes |

|---|---|---|

| Sample testing | $500–800 | Sample build, shipping, and internal lab checks (compression, symmetry, initial velocity) |

| USGA official fee | $1,000–1,500 / model / year | Annual fee to remain on the Conforming Ball List |

| Timeline | 6–8 weeks | Typical time from submission to listing |

| Models certified per factory/year | 2–3 | Most factories certify only core SKUs to control cost |

4) Practical checklist for buyers

| Checkpoint | Why it matters | How to execute |

|---|---|---|

| Sample testing | Confirms performance & tolerance | 12-ball random sampling (compression/IV/symmetry) |

| Batch consistency | Stability in mass production | Ask for batch data; keep control charts and retains |

| Conformity record | Tournament-level capability | Collect USGA/R&A report or list screenshot |

| Metrology lab | Process discipline | Request equipment photos and calibration logs |

| Contract terms | Risk control | Lock BOM, process window, AQL, change control, remedies |

FAQ

Are Chinese golf balls USGA approved?

They can be—approval is model-specific, not country-specific. If the exact model is on the USGA/R&A Conforming Ball List and your batch matches the certified build, it’s tournament-legal.

Many factories submit key SKUs, then renew annually only when commercially necessary. If a listing has lapsed, re-testing under your brand restores visibility while keeping the same BOM and process window. Put conformity warranties into your contract to align expectations.

What’s the difference between Chinese and American-made golf balls?

Top U.S. models still lead in ultra-tight tolerances and batch consistency. Chinese models win on value, customization, and speed. Construction and materials can be identical; the difference is process capability at the extremes.

If you require elite-level uniformity, specify tighter tolerances, audit the factory, and use PPAP-style controls for mass production. For retail, academies, and DTC brands, China’s cost-quality balance is hard to beat without sacrificing conformity.

Can OEM balls from China be used in PGA tournaments?

Yes—if the model is listed and your batch matches it. PGA events follow the USGA/R&A Conforming Ball List, so legality hinges on model conformity rather than manufacturing location.

Coordinate with your OEM to lock the exact formulation, molds, and finishing stack used in the submission. Mirror those controls in production lots destined for tournament play and keep retained samples for traceability.

How can I verify a Chinese golf ball manufacturer’s quality control?

Request evidence and test it yourself: lab equipment photos, calibration logs, sample data (compression/IV/symmetry), and a change-control policy. Then run independent 12-ball tests and lock specs in the contract.

Add AQL sampling to your PO, require batch COAs with compression/weight ranges, and keep retains for trend analysis. Require written approval for any material, mold, or process changes that could affect performance.

What’s the typical lead time for OEM golf balls in China?

Plan for 30–45 days for two-piece ionomer and 45–60 days for multilayer urethane, plus shipping. Complex finishing (multi-color prints, gift boxes) can add 5–10 working days.

Coating and printing lanes are common bottlenecks. Lock artwork and packaging early, and book production slots before peak seasons to avoid congestion.

Do Chinese golf balls carry R&A certification?

Yes—R&A works alongside USGA on the same Conforming Ball List framework. A model listed by either authority is considered conforming under the unified rules.

For European or UK events, ensure the exact model name and year match the published list. If you private-label, re-submit under your brand to avoid confusion at events and in marketing claims.

Conclusion

Chinese golf balls are now a practical, compliant, and cost-effective option for most B2B programs—as long as you choose the right factory and control consistency.

Tournament legality depends on model conformity, not country of origin, so always lock the certified build, validate samples, and enforce specifications in your PO.

With mature manufacturing hubs across Guangdong, Fujian, and Zhejiang, buyers can balance quality, lead time, and pricing without sacrificing performance.

The remaining gap with flagship brands lies mainly in extreme tolerances—and it’s narrowing fast as Chinese processes improve year by year.

You might also like — How to Choose a Reliable Golf Ball Manufacturer in China?