If you need a cost-true, compliance-aware plan for where to make which golf balls, here’s the headline: both the U.S. and China can produce 2–5 layer Surlyn/Urethane balls; the U.S. concentrates on brand-owned Tour-grade urethane, while China spans low-end to mid/high-end OEM with flexible MOQs and faster scaling. Always model landed cost with 301 tariffs and logistics before locking MSRP.

What products overlap between U.S. and China, and where do they differ?

Both can mass-produce 2/3-layer Surlyn and 3–5-layer urethane balls. The U.S. focuses on brand-owned Tour-grade lines; China covers low-end through mid/high-end OEM/ODM with flexible MOQs and faster scale-ups. As of Oct 2025, both origins can meet USGA-conforming requirements.

-

Overlap map: 2-piece Surlyn practice/distance, 3-piece Surlyn mid-tier, and 3–5 layer cast urethane premium.

-

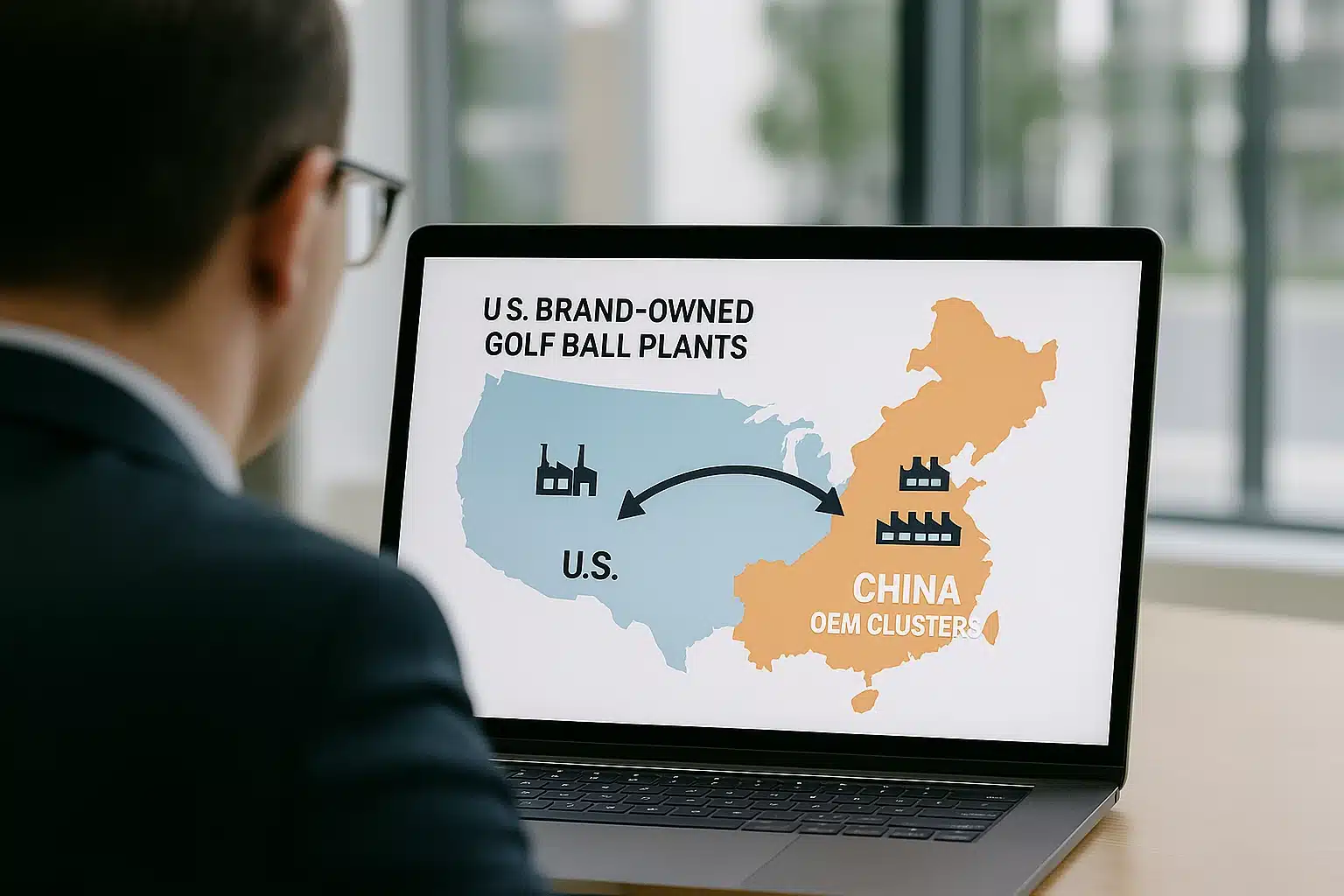

U.S.: Titleist, Callaway, Bridgestone, and TaylorMade operate domestic plants geared to their brands; minimal external OEM capacity.

-

China: OEM ecosystems in East/South China cover molding, paint, pad printing, and packaging under one roof; MOQs are flexible.

-

Dual-sourcing: pilot in the U.S. for hero SKUs, scale in China for volume to balance margin and capacity.

-

Compliance: USGA conforming lists include China-made models; origin alone doesn’t block event eligibility.

Overlap map (2-piece Surlyn to 5-layer urethane)

From entry 2-piece Surlyn to 5-layer Tour-grade urethane, both regions can build the portfolio. The U.S. specializes in Tour layers and brand-controlled consistency. China supports both Surlyn and urethane at multiple price points, with broader OEM openness and packaging integration for private labels and DTC programs.

Ball types × capability × OEM openness

| Ball Type | U.S. Capability | China Capability | OEM Openness | Typical Use |

|---|---|---|---|---|

| 2-piece Surlyn | Present, brand use | Broad, high-volume | High | Practice/distance/value |

| 3-piece Surlyn | Present | Extensive | High | Mid-tier retail |

| 3-layer urethane (cast) | Strong (Tour) | Mature OEM | Medium–High | Premium mid/high |

| 4–5 layer urethane | Strong (flagship) | Select factories | Medium | Tour-grade flagship |

Who makes what: U.S. brand plants vs China OEM ecosystem

U.S. brand plants emphasize high automation, R&D loops, and tolerance control for Tour-grade urethane; China’s OEM ecosystem provides end-to-end capacity with shorter MOQs and faster packaging/print coordination. Practically, hero SKUs stay domestic for narrative and consistency; broad catalogs mix China-origin SKUs to hit price bands.

Why overlap matters for dual-sourcing

Overlap enables risk hedging, blended margins, and channel-specific SKUs. You can prototype in the U.S. to nail feel and compression windows, then deploy China for mid/high-volume lines with cost-optimized landed economics. Consistency comes from unified BOMs, molds, paint stacks, and shared lab protocols—not geography.

✔ True — China delivers mid/high-end urethane at volume

Multiple Chinese plants run cast urethane with robust finishing lanes, supporting USGA-conforming models and brand-grade cosmetics.

✘ False — “China only makes low-end balls”

That gap closed; the real difference is brand-owned capacity in the U.S. versus OEM openness and cost bands in China.

Which country is strongest at which ball types?

U.S. excels at Tour-grade cast urethane with exceptional consistency and brand signaling. China leads in cost-optimized 2–3 layer Surlyn and scalable mid/high-end urethane OEM. Pick by SKU role: halo vs volume, and validate via feel testing and DPPM.

-

U.S. strengths: tight tolerances, automated finishing, deep R&D; ideal for flagship lines and pro-shop narratives.

-

China’s strengths: MOQs from pilot to mass, integrated packaging, competitive pricing; ideal for mid-tier breadth.

-

Volume leverage: China supports broad retailer assortments and DTC subscription SKUs with stable FOBs.

-

Consistency governance: with unified BOMs and mold maintenance, China-made urethane can match target windows.

-

Decision hook: halo/hero SKUs anchor in the U.S.; volume and value tiers deploy in China.

Category fit matrix

| Category | U.S. Strong | China Strong | Why |

|---|---|---|---|

| 2-piece Surlyn | Limited | Yes | Cost/scale, tournament packs |

| 3-piece Surlyn | Some | Yes | Mid-tier price points |

| 3-layer urethane | Yes | Yes | Tour feel vs cost balance |

| 4–5 layer urethane | Yes | Select | Flagship consistency vs availability |

✔ True — Higher price can reflect tighter QA and automation

U.S.-made Tour urethane often runs with lower dispersion in weight, compression, and paint stack.

✘ False — “Higher price always equals higher quality”

Measure against compression tolerance, DPPM, and logo registration—not just origin or price.

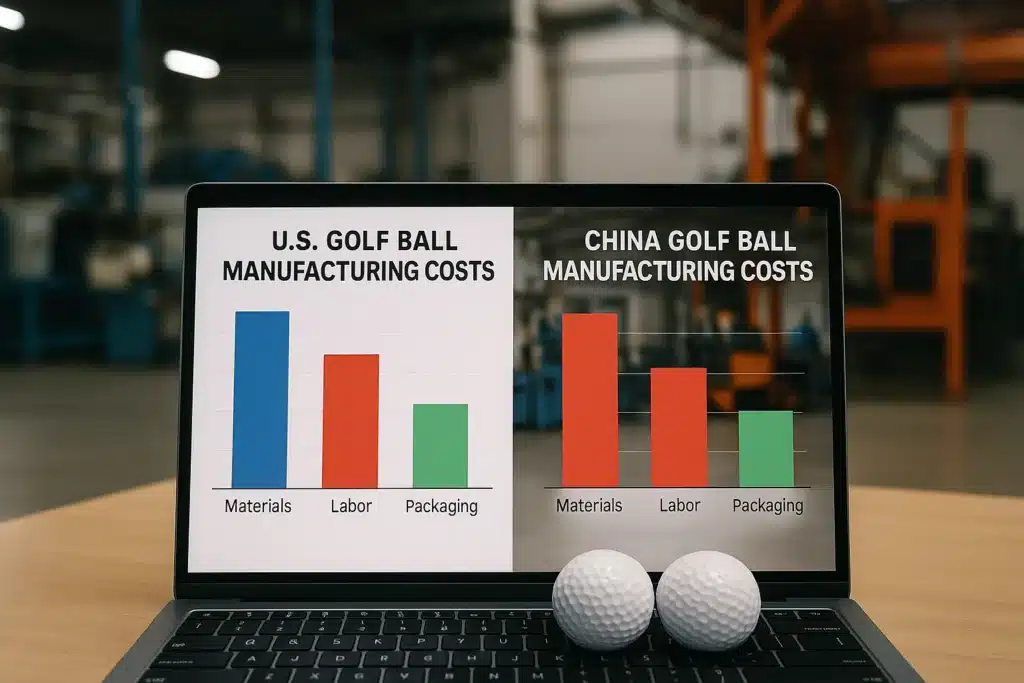

How do per-ball costs compare (materials, labor, electricity, packaging)?

For 3–4 layer urethane, China’s factory-stage unit costs typically undercut U.S. by ~30–60%, driven mainly by labor and slightly by materials/packaging; electricity is minor. As of Oct 2025; excludes overhead, duties, and freight.

-

Materials: U.S. ~$1.80–2.10; China ~$1.50–1.80 per ball.

-

Labor (factory allocation): U.S. ~$0.60–0.90; China ~$0.15–0.30.

-

Electricity: U.S. ~$0.035–0.050; China ~$0.030–0.045 per ball.

-

Packaging (simple single-ball box): U.S. ~$0.10–0.25; China ~$0.05–0.10.

-

Takeaway: materials + labor dominate COGS; electricity matters but is not the primary driver.

Cost summary — 3–4 layer cast urethane (factory stage)

| Cost Item | U.S. (per ball) | China (per ball) | Notes |

|---|---|---|---|

| Materials | $1.80–2.10 | $1.50–1.80 | Resin stack, cast urethane cover, finishing |

| Labor | $0.60–0.90 | $0.15–0.30 | Wage delta and automation |

| Electricity | $0.035–0.050 | $0.030–0.045 | Process energy, minor share |

| Packaging | $0.10–0.25 | $0.05–0.10 | Simple single-ball box |

| Subtotal | $2.54–3.30 | $1.73–2.24 | Excl. overhead/tax/duties/freight |

Typical split: materials + labor form the majority of factory subtotal, while electricity and simple packaging remain minor shares.

Per-dozen example (no tariffs, ex-overhead/freight)

-

U.S.: 12 × $2.54–3.30 → ~$30.48–$39.60 per dozen

-

China: 12 × $1.73–2.24 → ~$20.76–$26.88 per dozen

-

Gap: roughly ~$9.72–$18.84 per dozen before tariffs and freight

Materials ranges (Surlyn vs urethane) by country

-

U.S.: 2-piece Surlyn ~$0.30–0.45; 3–4 piece urethane ~$0.90–1.20 (materials share).

-

China: 2-piece Surlyn ~$0.25–0.40; 3–4 piece urethane ~$0.75–1.05 (materials share).

-

Drivers: cast urethane chemistry, mantle design, yield loss, and cosmetic rework rates.

Labor minutes per ball & wage deltas

-

2-piece: ~30–60 seconds; 3–4 layer urethane: ~60–120 seconds.

-

U.S. manufacturing wages are higher; automation reduces but doesn’t eliminate the delta.

-

China’s line design and multitasking operators keep allocated labor lower at scale.

Electricity consumption ranges (process-driven, small share)

-

2-piece: ~0.02–0.04 kWh; 3–4 layer urethane: ~0.03–0.06 kWh per ball.

-

Final finish ovens and curing drive the upper bound; efficiency projects can trim cents, not dimes.

Packaging ranges and brand impact

-

U.S. small-lot printed boxes sit at the higher end; China’s integrated print/box supply is cost-advantaged.

-

Cosmetic impact: box rigidity, color fidelity (Lab*), and varnish/UV can influence perceived quality and ASP.

✔ True — Materials and labor drive unit cost

Energy is meaningful but typically a minor contributor versus urethane systems and staffing.

✘ False — “Electricity is the largest cost component”

It rarely is; focus on resin stack, yield, and allocated labor.

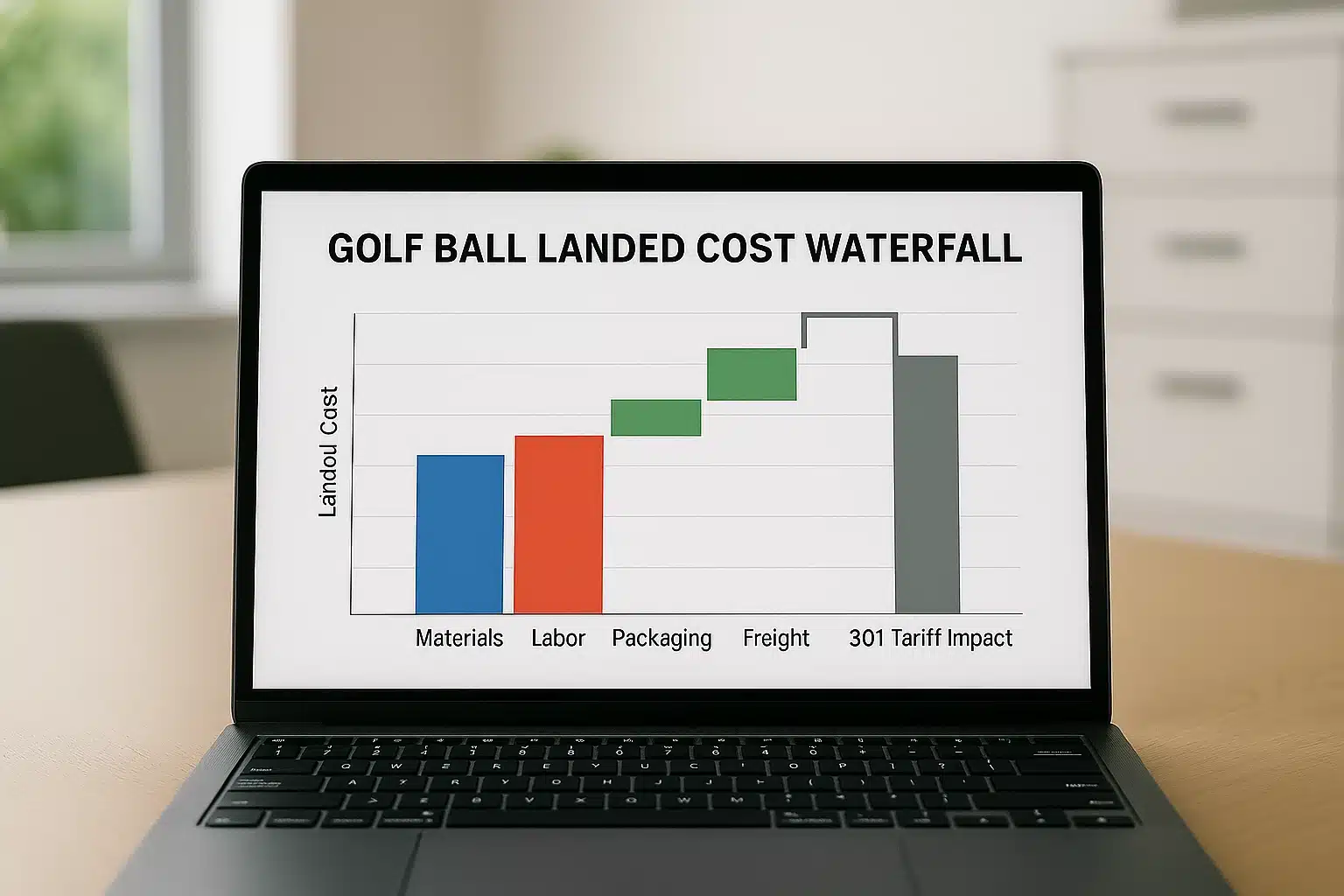

How do 301 tariffs and HTS codes change landed cost for U.S. buyers?

HTS 9506.32.00 MFN base duty is 0%, but Section 301 List 4A typically adds ~7.5% to China-origin imports. As of Oct 2025, verify USTR notices and model landed cost with tariffs and freight.

-

MFN base: 0% for golf balls; 301 surcharge applies to China-origin lines under List 4A.

-

Landed math: FOB China → Ocean/Insurance → +301% → Brokerage/Drayage → Delivered.

-

Sensitivity: 7.5% can compress margins by dollars per dozen; DTC channels may offset via scale and direct sales.

-

Risk: USTR adjustments or exemptions change the math; re-check before quoting seasons.

-

For U.S.-made balls, 301 doesn’t apply; domestic logistics and wages remain the main drivers.

Quick formula: FOB China → +Ocean/Insurance → +301% → +Brokerage/Drayage → Landed

Scenario calculator (example 3–4 layer urethane, per ball)

| Step | Amount |

|---|---|

| FOB China | $2.00 |

| Ocean + Insurance (alloc.) | +$0.08 |

| 301 surcharge (7.5% × $2.08) | +$0.156 |

| Brokerage/Drayage (alloc.) | +$0.04 |

| Landed (pre-warehousing) | $2.276 |

With 301: ~$27.31/dozen; Without 301 (same logistics): ~$26.43/dozen.

Per-dozen delta with 301

-

FOB $2.00/ball → Landed ~$2.276/ball → ~$27.31/dozen

-

Without 301 (same logistics): ~$26.43/dozen

-

Impact: ~$0.88/dozen from 301 alone, before warehousing and last-mile

Sensitivity: how a 7.5% surcharge shifts MSRP/ASP by tier

-

Value tier: thinner channel margins mean greater pricing pressure; a small MSRP lift risks conversion.

-

Mid-tier: feasible to absorb with packaging/print cost engineering and scale procurement.

-

Premium tier: origin narrative and review lift can sustain price integrity; measure returns and ratings.

Exemptions/changes risk & how to re-check (needs_evidence: true)

Monitor USTR dockets, HTS notes, and broker bulletins before seasonal quoting. Align your landed calculator with current effective dates, and keep alternative suppliers activated to avoid pricing shocks.

✔ True — MFN=0% doesn’t negate Section 301

China-origin golf balls under HTS 9506.32.00 face an additional 301 rate when applicable.

✘ False — “MFN duty covers everything”

MFN is the base; 301 is an additional surcharge layered on top.

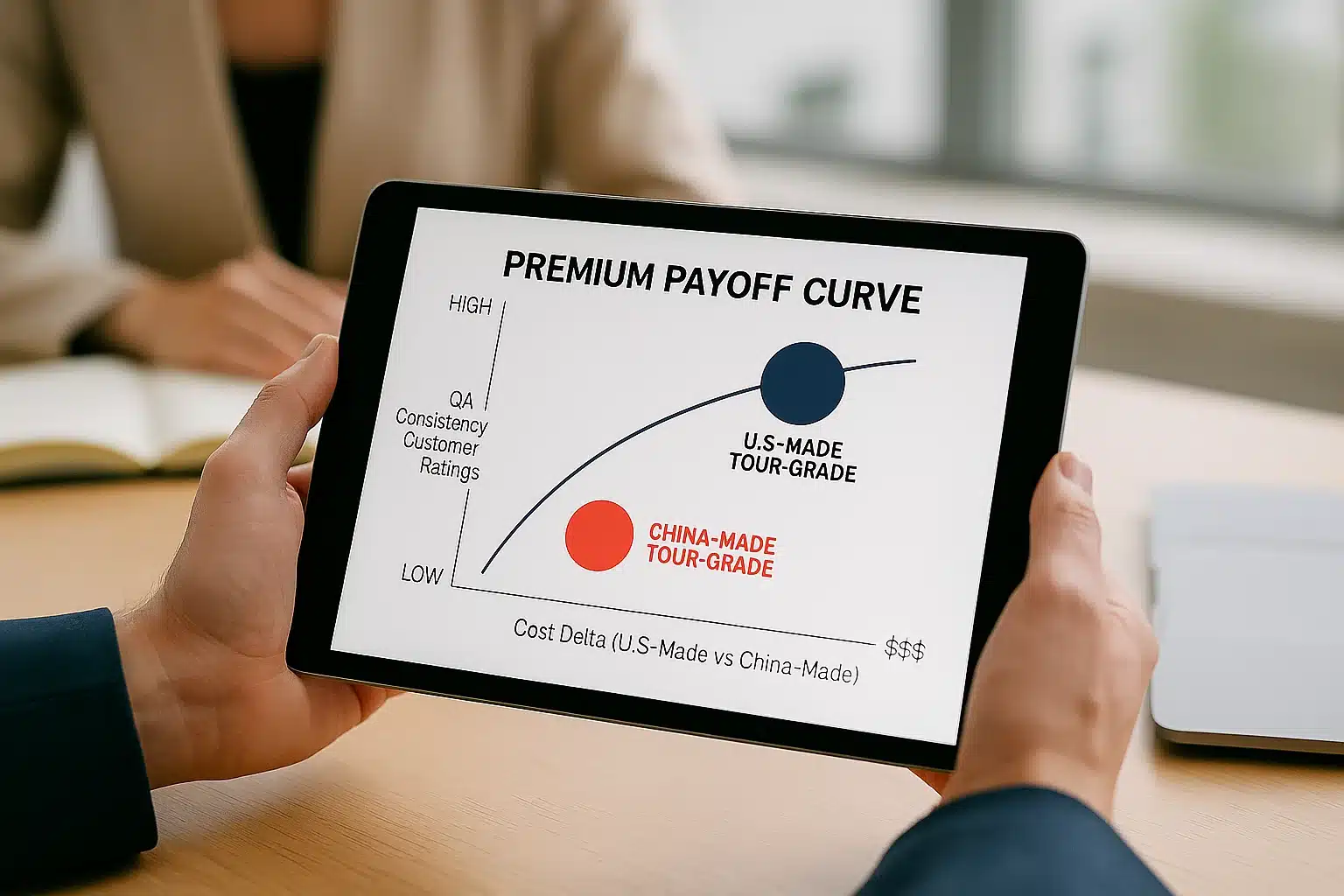

Yes for hero/flagship SKUs where top-tier consistency and brand storytelling matter; no for price-sensitive lines. Validate using A/B pricing, return rates, DPPM, and review lift.

-

Premium payoff: when compression dispersion, paint stack uniformity, and logo registration deliver perceptible feel and review gains.

-

Channel willingness-to-pay: pro shops and fittings embrace origin narratives; price-anchored channels do not.

-

Proof plan: blinded test lots, tolerance windows, and acceptance sampling to quantify lift.

-

When not worth it: entry and mid-tier Surlyn or aggressive-price urethane for mass retail.

-

Decision: tie origin to SKU role—halo vs volume—and measure post-launch KPIs.

Channel × willingness-to-pay × recommended origin

| Channel | WTP | Origin Guidance | Why |

|---|---|---|---|

| Pro shop/fittings | High | U.S.-made | Feel narrative and ratings |

| Specialty retail | Medium | U.S. hero + China volume | Price bands + halo |

| Mass retail | Low | China | Landed cost discipline |

| DTC subscription | Medium | China + test U.S. limited | Margin and churn control |

Which China OEM suppliers are suitable for pilots and scaling?

China offers flexible MOQs and full-layer capabilities for cost-sensitive or scaling SKUs. Run audit → matched samples → pilot MOQ → scale with change control.

Sourcing path: audit → matched samples (golden set) → pilot MOQ → scale with change control.

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xintiantian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

Sourcing path & sample alignment (compression, weight, Lab)

Start with an audit checklist and matched sample builds. Lock compression windows, weight tolerances, color Lab*, and gloss. Record mold IDs, paint stack thickness, and ink systems to stabilize appearance and feel across batches.

Pilot-to-scale gates (DPPM, Cpk, cosmetic defects)

Set acceptance thresholds for DPPM and Cpk on compression/weight. Track logo registration accuracy, paint voids, and cover blemishes. Require rolling 30/90-day QC reports and run quarterly round-robins to prevent drift.

Packaging/print co-development to hit retail specs

Align dielines, board grades, and varnish/UV early. Validate color using device-independent targets and rub/scratch standards. Finalize barcode placement and carton tests to satisfy retailer routing guides.

Audit checklist

| Dimension | What to Check | When to Choose |

|---|---|---|

| Spec & BOM | Core/mantle resins, cover chemistry, dimple/mold IDs | Before pilot |

| QA & Lab | Compression protocol, scales, color booth settings | Before PO |

| Finish | Paint stack, gloss window, logo registration | Pilot lots |

| Packaging | Lab* targets, board specs, artwork change control | Pilot lots |

| Change Control | NCR/CAPA flow, revision matrix, golden samples | Ongoing |

✔ True — Dual-sourcing can be consistent

Consistency comes from unified BOMs, molds, paint stacks, and lab protocols, not from geography.

✘ False — “Two origins guarantee variance”

Variance stems from unmanaged change; enforce shared specs and round-robin validation.

How should brands split production between the U.S. and China?

Use a hybrid: U.S. for halo/Tour-grade and demos; China for mid-tier and bulk. Standardize BOM, molds, paint stack, and lab protocols to keep look/feel matched across origins.

-

Decision matrix by buyer type: hero vs volume, ASP targets, review sensitivity, and seasonality.

-

QA/risk controls: golden samples, revision control, quarterly round-robins, and supplier scorecards.

-

Inventory strategy: U.S. retail favors domestic safety stock; global eCom benefits from China-origin direct fulfillment.

-

Packaging strategy: U.S. local prints for speed; China for cost and brand kits at scale.

-

Finance view: constantly update landed calculators with 301 changes and logistics rates.

Decision matrix

| Buyer Goal | Origin Mix | Why | When to Choose |

|---|---|---|---|

| Flagship Tour urethane | U.S.-led + China support | Consistency + brand story | Reviews drive ASP |

| Broad mid-tier catalog | China-led | Landed cost and MOQs | Multi-retailer rollout |

| DTC subscription | China + limited U.S. drops | Margin + retention + buzz | Season-long |

| Regional U.S. retail | U.S. safety stock + China backfill | OTIF, promo events | Peak demand windows |

FAQ

Are U.S.-made golf balls higher quality than China-made?

They can be—especially for Tour-grade urethane—when automation and QA reduce dispersion in compression, weight, and paint thickness. China-made urethane can also meet tight targets with unified BOMs and rigorous change control. Compare test data, not passports.

U.S. plants emphasize brand-owned process control and R&D loops, often delivering narrower tolerances. China’s premium OEMs can match feel and cosmetics when specifications are locked and validated with cross-plant round-robins. Use blinded tests and acceptance sampling, then monitor DPPM and review sentiment by SKU and batch.

What’s the real per-ball/per-dozen cost gap for 3–4 layer urethane?

At factory stage, China typically undercuts U.S. by ~30–60% per ball. Per dozen, expect roughly ~$10–$19 difference before tariffs and freight, depending on materials and labor allocations.

On a $2.00 FOB China example, 301 adds about $0.156 per ball at 7.5%, plus logistics allocations. Electricity contributes cents; materials and labor dominate. Model MSRP resilience using channel elasticity and review/return impacts.

How do 301 tariffs change landed cost for China-origin balls?

MFN base duty is 0% under HTS 9506.32.00, but Section 301 List 4A typically adds ~7.5% to China-origin imports. Include the surcharge, ocean/insurance, brokerage, and drayage in your landed calculator before quoting.

What MOQs are typical in U.S. vs China for custom logo SKUs?

China commonly supports 1,000–3,000-piece pilots and scales quickly; U.S. brand plants prioritize internal demand with limited OEM flexibility. For private labels and DTC, China’s broader supplier set and integrated packaging make pilots and color-matched reorders straightforward.

What lead times should I expect for pilots vs bulk in both countries?

Pilots can be fast in both origins if finishing lanes and packaging are pre-booked. Bulk is generally faster from China due to supply density and capacity; U.S. domestic time savings show in retail replenishment when safety stock exists.

Which QA metrics matter most (compression tolerance, DPPM, logo registration)?

Track compression tolerance/Cpk, weight, cover blemishes, logo registration, and paint stack thickness. Use Cpk thresholds, rolling 30/90-day DPPM, and incoming material certifications. Correlate QC with returns and star ratings to close the loop.

How to choose packaging source: U.S. local vs China integrated?

U.S. local printing wins speed on emergencies; China wins cost and brand-kit completeness at scale. Lock dielines and color targets early, and test rub/scratch durability. For national retail resets, China-origin cartons can be staged with factory-pack efficiencies.

Do USGA conformity listings accept China-made models?

Yes—USGA conforming lists include China-made models. Origin isn’t a blocker; the relevant factor is the conforming design and verified performance against the rules.

When does U.S.-made premium actually lift margin?

When your channel rewards origin and measured consistency—raising ASP and reducing returns. Pro-shop and fitting-heavy routes often justify the spread; price-anchored mass retail usually doesn’t. Confirm with A/B pricing and defect/return deltas.

Conclusion

Both origins can deliver 2–5 layer golf balls, but they serve different roles. U.S.-made Tour urethane supports hero SKUs with consistency and a compelling story; China-origin builds underpin cost-optimized mid/high-end assortments with flexible MOQs and integrated packaging. Use a hybrid plan—prototype or halo in the U.S., scale in China—governed by unified BOMs, molds, paint stacks, and lab protocols. Always model landed cost with current 301 settings, logistics, and channel willingness-to-pay before locking price architecture for the season.

You might also like — How to Choose a Reliable Golf Ball Manufacturer in China?