This guide benchmarks per-ball EXW (USD) costs for China vs Taiwan golf ball manufacturing in 2024–2025. Materials are near parity; the decisive gaps come from labor minutes, first-pass yield (FPY), and packaging ecosystems. You’ll see why China is the value base for Surlyn volume and why Taiwan anchors multilayer PU (cast-PU/TPU) lines.

Midpoint EXW per ball (2024–2025):

| Structure | Taiwan EXW (mid) | China EXW (mid) | Δ (TW–CN) |

|---|---|---|---|

| 2-piece Surlyn | $0.44 | $0.33 | $0.11 |

| 3-piece Surlyn | $0.45 | $0.34 | $0.11 |

| 3-piece PU (cast-PU/TPU cover) | $0.67 | $0.46 | $0.21 |

| 4-piece PU (cast-PU/TPU cover) | $0.68 | $0.47 | $0.21 |

Per-dozen equivalent (midpoints): 2-pc Surlyn TW ~$5.28 vs CN ~$3.96; 3-pc Surlyn $5.40 vs $4.08; 3-pc PU $8.04 vs $5.52; 4-pc PU $8.16 vs $5.64.

Quick Answer Box (2024–2025)

- Materials: parity—2-pc Surlyn $0.13–$0.17; 4-pc PU $0.20–$0.26

- Electricity: tiny—Surlyn 0.03 kWh; PU 0.06 kWh → $0.003–$0.008 per ball

- Labor: key gap—Surlyn $0.05 (TW) vs $0.03 (CN); PU $0.20 (TW) vs $0.08 (CN)

- Packaging: $0.18–$0.30 (TW) vs $0.10–$0.20 (CN)

- Value: China wins volume Surlyn; Taiwan wins multilayer PU consistency

- Portfolio: hybrid sourcing = lowest cost and highest review stability

Do China and Taiwan golf ball factories make the same types of balls?

Yes—both regions mass-produce 2- and 3-piece Surlyn and 3- to 4-piece polyurethane balls with multilayer PU (cast-PU/TPU) covers. Taiwan leads in multilayer PU “tour-grade” stability; China dominates high-volume Surlyn with faster turns and lower cost.

One-sentence takeaway (table below): Same structures, different edge performance—Taiwan’s strength is multilayer PU repeatability; China’s is Surlyn scale and speed.

| Structure | Taiwan Main Strength | China Main Strength | Typical Use Case |

|---|---|---|---|

| 2-piece Surlyn | Small batch, QC-focused | Mass volume, low cost | Range / Promo |

| 3-piece Surlyn | Balanced quality | Fast delivery | Mid-tier DTC |

| 3-piece PU | Stable, tight dispersion | Cost-saving version | Premium-adjacent / cost-down |

| 4-piece PU | High precision & FPY | Available at select top-tier plants; validate via CTQs/FPY | Tour balls |

Note: Leading Chinese plants can produce 3–4-layer PU at stable quality. Position them after CTQ/FPY audits (concentricity, hardness gradient, coating adhesion) to determine role and volume.

✔ True — Both regions make multilayer balls, but consistency differs

Taiwan’s multilayer PU lines typically show tighter dispersion and higher first-pass yield (FPY), which reduces rework and cosmetic rejects.

✘ False — “If both make 4-piece PU, performance is identical”

Capability ≠ consistency; layer symmetry and coating yields are decisive in robot test repeatability.

What are the material cost differences per golf ball (USD, 2024–2025)?

Materials are near-parity across the strait: Surlyn 2-pc ≈ $0.13–$0.17; PU 4-pc ≈ $0.20–$0.26. The true cost delta comes from labor minutes and yield, not resin list prices.

One-sentence takeaway (table below): Material parity means your EXW gap mainly tracks FPY and labor.

| Structure | Taiwan Material | China Material | Notes |

|---|---|---|---|

| 2-piece Surlyn | $0.13–$0.17 | $0.13–$0.17 | Similar ionomer sources |

| 3-piece Surlyn | $0.14–$0.18 | $0.14–$0.18 | Close parity |

| 3-piece PU | $0.20–$0.25 | $0.20–$0.25 | Coating FPY matters |

| 4-piece PU | $0.20–$0.26 | $0.20–$0.26 | Slightly more waste |

✔ True — “Equal resin price” does not mean “equal effective material cost”

Low FPY in PU coating multiplies paint/clear/ink usage and scrap, raising effective material per ball even when purchase price is similar.

✘ False — “Cheaper materials automatically produce cheaper balls”

Yield and labor minutes are amplifiers; they dominate total EXW when parity exists at resin level.

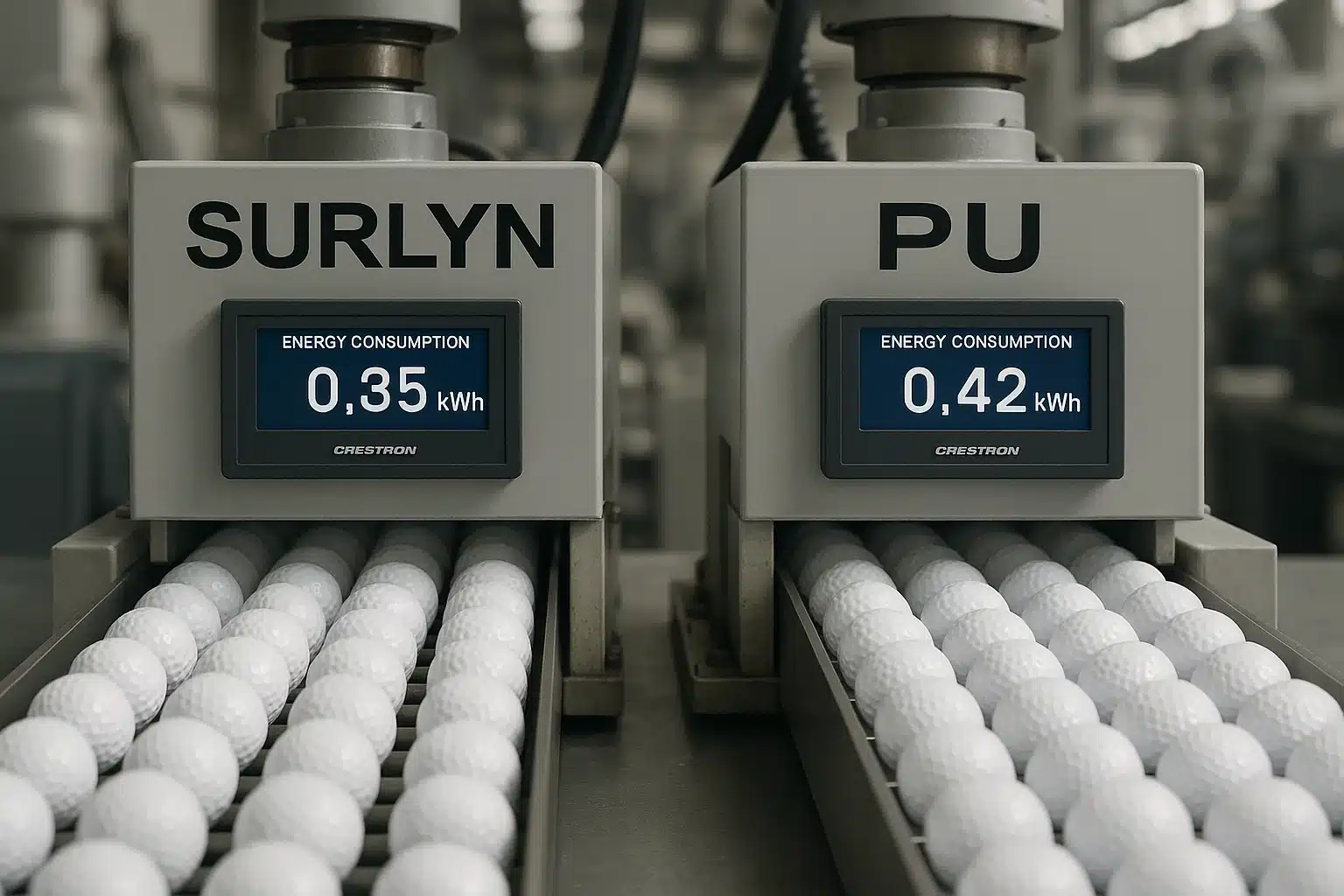

How do electricity costs differ in China and Taiwan?

Electricity is not a decision driver—just $0.003–$0.008 per ball. Taiwan’s industrial rate averages $0.14/kWh, China’s ~$0.088/kWh (2024–2025). At 0.03/0.06 kWh per ball (Surlyn/PU), the impact is minimal.

One-sentence takeaway (table below): Surlyn and PU consume ~0.03/0.06 kWh per ball; energy adds pennies, not dimes.

| Process (0.03/0.06 kWh guidance) | Energy Use (kWh/ball) | TW Cost | CN Cost |

|---|---|---|---|

| Surlyn molding/pressing | 0.03 | $0.004 | $0.003 |

| PU casting/curing | 0.06 | $0.008 | $0.005 |

Assumption note: 2024–2025 industrial electricity averages used for conversions; process energy derived from molding/cure energy models.

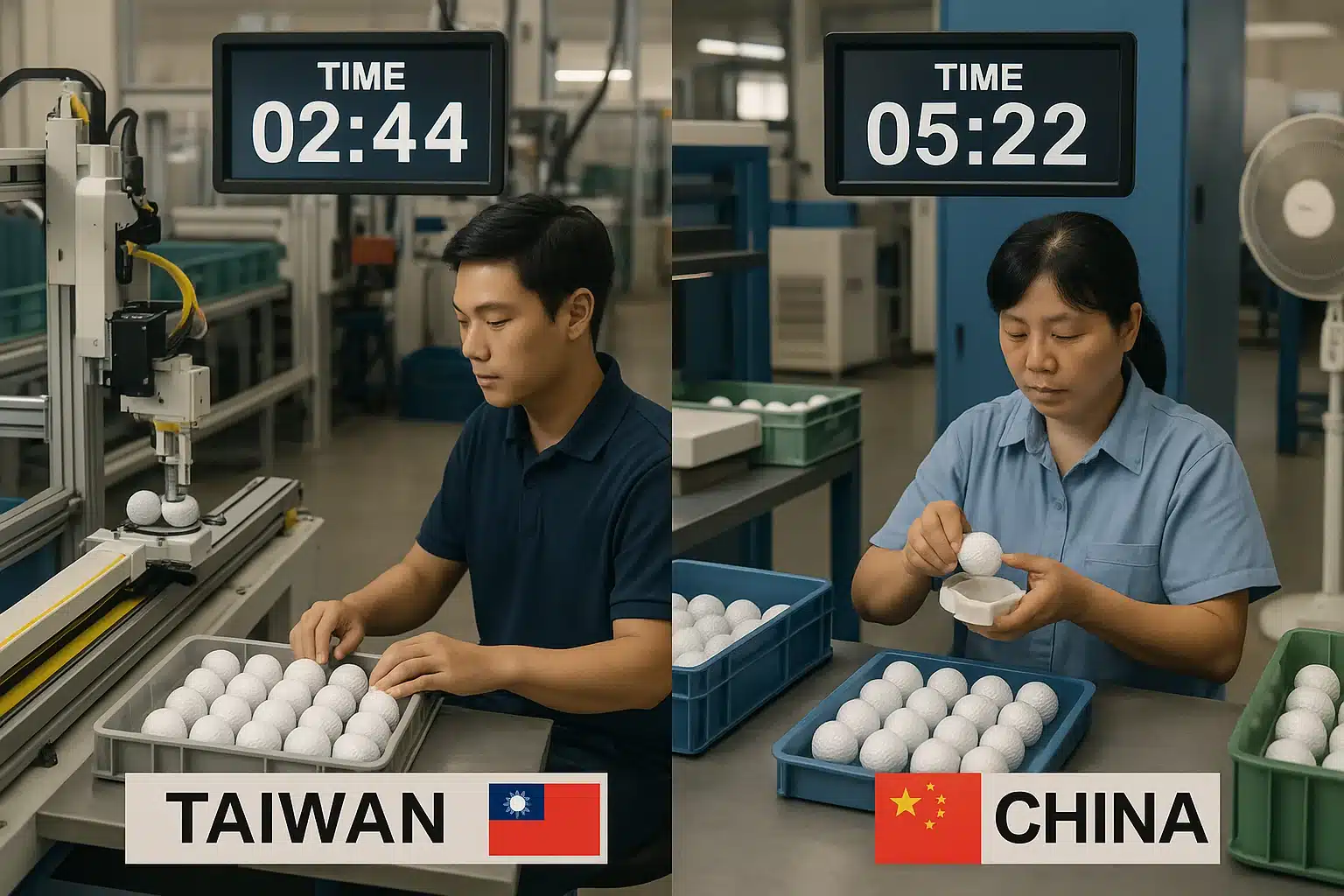

How much higher is labor cost in Taiwan than in China?

About 1.5–2× at the unit level. Surlyn labor ≈ $0.05 TW vs $0.03 CN; PU ≈ $0.20 TW vs $0.08 CN—driven by hourly wage baselines and slower, hand-intensive multilayer PU and coating steps.

One-sentence takeaway (table below): Labor minutes and PU cycle time create the largest, most persistent EXW gap.

| Structure | Labor Time (min/ball) | TW Cost | CN Cost |

|---|---|---|---|

| 2-piece Surlyn | 0.4–0.5 | $0.05 | $0.03 |

| 3-/4-piece PU | 1.2–1.5 | $0.20 | $0.08 |

Assumption note: Hourly labor reference $8/h (TW) and $3.7–$4.0/h (CN coastal); minutes per ball reflect direct assembly/inspection/coating touch time (2024–2025).

What about packaging cost differences?

China typically quotes $0.10–$0.20 per ball for packaging; Taiwan runs $0.18–$0.30 due to higher printing/handling costs and MOQs. For logo programs and retail sets, China offers better cost-to-flexibility and faster art-to-pack.

One-sentence takeaway: Packaging often equals or exceeds the labor delta—treat it as a primary lever, not an afterthought.

✔ True — Taiwan’s higher pack quotes mirror labor + printer MOQs

Multi-color pad printing and gift-box kitting carry higher prep and unit costs; plan budgets accordingly if premium packaging is central to your SKU.

✘ False — “Packaging is negligible”

At $0.10–$0.30 per ball, packaging can rival your China–Taiwan labor gap.

Is Taiwan’s higher cost worth paying for?

Yes—when you sell on performance and reputation. Taiwan’s multilayer PU (cast-PU/TPU) lines generally deliver tighter tolerance, cleaner cosmetics, and higher FPY, which supports premium dozen MSRP (≈ $35–$50/dozen) and lowers returns and review volatility.

One-sentence takeaway: Pay the premium when robot test dispersion, feel, and cosmetic rate move revenue.

Are Chinese golf balls lower quality or less accepted by Western markets?

No. As of 2025, U.S. import data consistently list both China and Chinese Taipei among top supply origins. Acceptance depends on the quality system (IQC/IPQC/OQC, COA, CTQ data) and PPAP-style approvals—not the country label. Channel visibility across U.S. retail and DTC listings has reflected this pattern in recent seasons.

One-sentence takeaway: Origin myths fade when CTQs, FPY, and traceability are enforced.

✔ True — Quality follows control, not the map

Lock specs; require CTQ control charts (core concentricity, cover hardness, weight, diameter), retained samples, and COA/CTP data per lot.

✘ False — “Western brands reject China origin”

Retail and DTC channels include numerous China-made Surlyn models and mixed-origin PU lines.

Which region is better for OEM outsourcing: China or Taiwan?

For premium/tour-grade multilayer PU (cast-PU/TPU), choose Taiwan. For mass OEM, logo, and practice/range balls, choose China. Taiwan fits quality-critical SKUs; China fits fast-turn, high-volume SKUs with integrated packaging and flexible MOQs.

One-sentence takeaway (table below): Match region to product role and lead-time risk.

| Buyer Type | Best Source | Typical Product | Lead Time |

|---|---|---|---|

| Global brand | Taiwan | 3-/4-piece cast-PU | 6–10 wks |

| Mid-size brand | China | 2-/3-piece Surlyn | 4–8 wks |

| Distributor/wholesale | China | Logo / Range balls | 3–6 wks |

2025 season: Lead time is calendar plus ecosystem. China shortens art-to-pack via integrated converters; Taiwan PU peaks stretch unless booked 8–12 weeks ahead.

Peak-season timeline (practical template):

T-12–10 wks: lock dielines/colors → T-9–8: confirm molds/ball specs → T-7–6: stage materials, pre-book coating → T-5–3: pilot lot + PPAP pack → T-2–0: mass run + packout → Ship.

Final Recommendation — Should B2B buyers choose China or Taiwan?

Run a hybrid play. Use China’s 2-/3-piece Surlyn for the “volume base” (cost coverage, replenishment speed). Anchor premium with Taiwan multilayer PU (cast-PU/TPU) for robot test consistency and review strength. That balances cost, perceived quality, and supply continuity.

One-sentence takeaway (numbers): Your per-ball EXW gap is typically $0.10–$0.20; deploy it strategically to buy stability where it pays.

-

2-piece Surlyn: TW ≈ $0.44 vs CN ≈ $0.33 (Δ $0.11)

-

3-piece Surlyn: TW ≈ $0.45 vs CN ≈ $0.34 (Δ $0.11)

-

3-piece PU: TW ≈ $0.67 vs CN ≈ $0.46 (Δ $0.21)

-

4-piece PU: TW ≈ $0.68 vs CN ≈ $0.47 (Δ $0.21)

Mini matrix — Buyer → Recommended origin (2024–2025):

| Buyer profile | China focus (Surlyn) | Taiwan focus (cast-PU/TPU) |

|---|---|---|

| Value-led, promo, range | ✅ Primary | — |

| Balanced DTC portfolio | ✅ Base SKUs | ✅ Flagship |

| Performance-led brand | — | ✅ Primary |

One-page total table — cost components and EXW midpoints (2024–2025)

One-sentence takeaway: Materials align; labor and packaging swing EXW, amplified by FPY and process control.

| Structure | TW Material | CN Material | TW Power | CN Power | TW Labor | CN Labor | TW Pack | CN Pack | TW EXW (mid) | CN EXW (mid) |

|---|---|---|---|---|---|---|---|---|---|---|

| 2-piece Surlyn | $0.13–0.17 | $0.13–0.17 | $0.004 | $0.003 | $0.05 | $0.03 | $0.18–0.30 | $0.10–0.20 | $0.44 | $0.33 |

| 3-piece Surlyn | $0.14–0.18 | $0.14–0.18 | $0.004 | $0.003 | $0.05 | $0.03 | $0.18–0.30 | $0.10–0.20 | $0.45 | $0.34 |

| 3-piece PU | $0.20–0.25 | $0.20–0.25 | $0.008 | $0.005 | $0.20 | $0.08 | $0.18–0.30 | $0.10–0.20 | $0.67 | $0.46 |

| 4-piece PU | $0.20–0.26 | $0.20–0.26 | $0.008 | $0.005 | $0.20 | $0.08 | $0.18–0.30 | $0.10–0.20 | $0.68 | $0.47 |

Assumptions (2024–2025, USD): TW power $0.14/kWh; CN power $0.088/kWh; labor TW $8/h, CN coastal $3.7–$4.0/h; process energy 0.03/0.06 kWh (Surlyn/PU); material ranges include coating/ink loss.

FAQ Section

Are Taiwan factories still recovering from the 2023 Launch Technologies fire?

As of the 2025 production season, most capacity is normalized, but multilayer PU remains more concentrated than Surlyn. Book peak windows early and maintain contingency transfer terms for premium SKUs.

Concentration risk didn’t vanish with recovery; PU casting and coating lines can bottleneck during Q2–Q3. Use rolling 12-week forecasts, pre-approve mirrored molds/materials, and keep a China Surlyn buffer for promotional/replenishment SKUs. This avoids missing seasonal retail resets when premium lines stretch.

Can Chinese plants produce cast-PU balls at tour quality?

Some top-tier Chinese factories can, but selection and validation are critical. Use PPAP-style submissions, FPY records, and CTQ control to decide whether to place flagship volumes.

Ask for robot test dispersion data, hardness by layer, cover-thickness variance, and coating cross-hatch/adhesion rates. Require per-lot COA/CTP with retained samples. If the numbers meet your dispersion and durability targets, China can serve premium-adjacent roles at lower EXW; otherwise, keep the tour-grade anchor in Taiwan.

How big is the cost gap in total EXW price per ball?

Expect ~$0.10–$0.20 per ball. The gap is narrower for Surlyn and wider for multilayer PU. Packaging spec (inks, boxes, finishes) and FPY can tighten or widen the spread.

At the dozen level that’s about $1.20–$2.40—often enough to influence buy-box dynamics or promo math. Model your exact paint/clear/ink and packaging choices because they can match or exceed the labor delta between regions.

Do Surlyn and PU balls require different QC systems?

Yes. PU multilayer needs tighter control of layer symmetry, curing, and coating, while Surlyn emphasizes core centricity and molding consistency. Audit plans should reflect those differences.

For PU: hardness gradient, cover thickness variance, coating FPY, gloss/DOI, yellowing resistance. For Surlyn: core centricity, diameter/weight distribution, ionomer blend uniformity. In both: SPC on CTQs, per-lot COA/CTP, and retained samples. Validate air-test dispersion with robot test cycles.

What certifications matter most for OEM partners?

ISO 9001 is the baseline; combine with material compliance (REACH, RoHS where applicable) and independent durability/coating tests. Packaging inks/substrates should meet your market’s standards.

Certs show process discipline, not outcomes. Review CAPA history, last surveillance results, and the factory’s measurement system analysis (MSA). Tie cert evidence to your PPAP sign-off so documentation matches the product you’ll ship.

Is hybrid sourcing common among DTC golf brands?

Yes. Many pair a China Surlyn value line with a Taiwan multilayer PU flagship. It protects margins, stabilizes reviews, and hedges capacity risk without confusing the consumer story.

Coordinate colorways and packaging to link the lines while keeping feel/performance distinct. Sequence review launches to give the flagship a clear stage, then ride conversion with the value dozen during promo windows.

How do you lock lead times during peak season?

Freeze artwork early, book capacity 8–12 weeks ahead, and stage packaging. Use penalties for late approvals on your side to keep gates honest.

Delays mainly come from coatings, printing, and kitting—not from core molding. Approve dielines quickly, avoid late color changes, and keep alternates for paint/varnish systems. Ask for line-loading snapshots before peak and confirm slot allocations in writing.

You might also like — How to Buy Golf Balls Directly from a Chinese Manufacturer?