Vietnam’s verified OEM golf ball makers are SM Parker (Vietnam), Vung Tau Orient (Feng Tay), Eagle Vina (export/assembly), and Advanced International Multitech Vietnam (limited output).

Fast list

| Factory | Location | Primary golf ball types | Primary export markets |

|---|---|---|---|

| SM Parker (Vietnam) | Vietnam; closely linked with Eagle Vina logistics | 3-piece TPU/PU retail lines (e.g., PXG Xtreme, Kirkland Performance+ V3) | North America (US/Canada) |

| Vung Tau Orient (Feng Tay) | Vũng Tàu, Bà Rịa–Vũng Tàu | 3–4-piece cast urethane (e.g., Mizuno RB Tour / RB Tour X); operates RZN | US, Japan, South Korea |

| Eagle Vina Co., Ltd. | Mộc Bài Economic Zone, Tây Ninh | Export/assembly node for finished balls/sets (HS 950632) | Costco Canada; PXG/Kirkland channels |

| Advanced International Multitech Vietnam | Nhơn Trạch, Đồng Nai | Limited ball output; group focus on composites/club heads | US and others (smaller quantities) |

What types of golf balls does Vietnam primarily make, how many per year, and where do they go?

Vietnam’s OEM output centers on retail-ready 3-piece TPU/PU, with a smaller stream of 3–4-piece cast urethane; 2023 exports under HS 950632 were ≈USD 45–49M, with the US as the largest destination by value and volume (≈tens of millions of units).

When I audit Vietnam programs, I see two clear tracks. First, 3-piece ionomer/TPU/PU retail balls engineered for consistency over huge, repeatable lots—tight compression windows, controlled paint stacks, crisp stamp alignment. This is the backbone that feeds member-store and big-box formats.

Second, tour-leaning cast urethane lines—smaller share but strategically important—where mixing/degassing discipline and curing windows must be documented to pass retailer inspections. The public attributions that circulate (PXG/Kirkland ties to SM Parker; Mizuno RB Tour/RB Tour X ties to Feng Tay’s Vung Tau Orient) mirror what I see in RFQs: Vietnam is trusted for high-stakes retail programs when the spec is stable.

For scale, I never rely on a single metric. I pair value with units:

- HS 950632 export value (2023): ≈ USD 45–49M across sources using compatible methods.

- US import count from Vietnam (2023): ≈ tens of millions of balls, which aligns with the retail focus.

- Top destinations by value: United States, then Japan, Canada, South Korea—all channels where documentation rigor and label accuracy are audited.

The operational takeaway for your plan: Vietnam can carry a locked-spec retail SKU for long stretches with excellent repeatability, but you must book earlier for peak windows and keep changeovers minimal.

✔ True — HS 950632 is the global 6-digit; US HTS 9506.32.0000 is the 10-digit US line

I cite both once, then stick to “HS 950632” for consistency across years and sources.

✘ False — Dollar values and unit counts are interchangeable

They measure different things. Use both to triangulate realistic capacity and pricing bands in your RFQ.

How do Vietnam-based golf ball manufacturers compare with China-based manufacturers?

Vietnam is best for duty-sensitive US retail runs with locked specs and steady repeats; China wins on speed, MOQ flexibility, packaging breadth, and high-mix agility from 2-piece promo through multilayer mid-premium.

Where a spec is frozen and retailer paperwork is heavy, Vietnam shines. Where a launch needs fast art turns, small lots, and multi-SKU gift sets, China shines.

Vietnam advantages

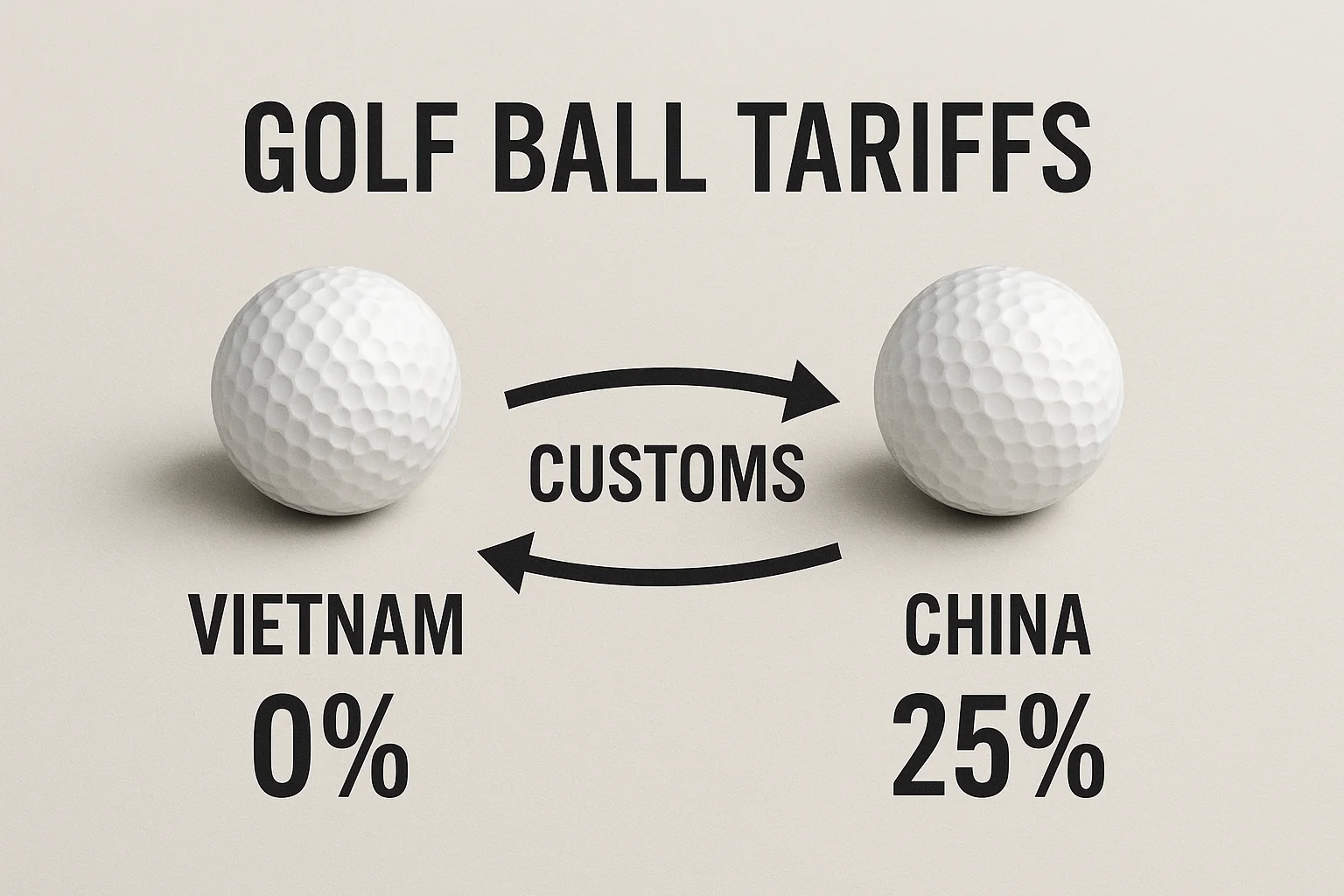

- Duty angle (US): Base 0% on HTS 9506.32; no Section 301 add-on for Vietnam origin.

- Consistency: Concentrated capacity with disciplined 3-piece retail lines.

- Brand-grade track record: Third-party attributions for PXG/Kirkland (3-piece) and Mizuno (cast urethane).

Vietnam disadvantages

- Capacity concentration: Peak-season windows can be rigid; earlier slotting is essential.

- Changeover friction: Frequent art/spec changes price in higher.

- Upstream dependence: Some inputs are imported; logistics hiccups bite harder.

China advantages

- Speed + MOQs: Easier 1–3K-dozen pilots and frequent variants.

- Packaging ecosystem: Sleeves, gift boxes, special finishes, and colorways at scale.

- Breadth: From 2-piece practice/promo to multilayer mid-premium across many price points.

China disadvantages

- US duty exposure: Section 301 List 4A (~7.5%) for China origin on top of base 0%.

- Perception risks: Some US channels prefer non-China origin narratives.

✔ True — “Ionomer” is the generic; Surlyn® is a brand

In RFQs, write “ionomer cover (e.g., Surlyn®/Iotek™)” to stay flexible and avoid single-brand lock-in.

✘ False — Cast urethane always beats ionomer

Cast urethane leads on spin/control for tour-leaning specs; ionomer is often smarter for durability and price in retail programs.

How does the US–China trade backdrop affect Vietnam and China golf ball makers?

For US-bound balls, HTS 9506.32 base duty is 0%; China origin adds Section 301 List 4A (~7.5%), nudging price-sensitive US programs toward Vietnam; packaging in Vietnam alone doesn’t change origin—CBP requires substantial transformation.

I live this section every day with buyers. Below is the version we put straight into quotes and SOPs—clean spacing, clear steps, no surprises.

Duty, origin, and why it changes sourcing math

- Base duty: Golf balls (HTS 9506.32) carry a 0% base US duty—regardless of origin.

- Section 301 overlay: China-origin balls generally add ~7.5% via Chapter 99 (List 4A). Vietnam-origin has no 301 add-on.

- Origin test: Substantial transformation decides COO. A change in name, character, or use is required. Core/cover molding typically defines origin; boxing alone in Vietnam does not.

What the landing-cost math looks like

- Vietnam origin (retail 3-piece ionomer): EXW 1.00 → base duty 0 → no 301 → + freight/insurance → landed X.

- China origin (same spec): EXW 1.00 → base duty 0 → +7.5% 301 on customs value → + freight/insurance → landed X + 0.075×(customs value).

Where Vietnam benefits—and where it doesn’t

- Benefit: Value-pointed US programs (member stores, club packs) stay inside a cleaner MSRP corridor with Vietnam origin.

- Neutral/Negative: For fast variant cycles or complex gift sets, Vietnam’s changeover friction and slot rigidity can erase the duty advantage; China’s converters turn faster.

Why the origin rule matters more than ever

COO disputes are expensive. If cores/covers are molded in China and only repacked in Vietnam, CBP will likely call it China origin. If molding is in Vietnam with finishing steps that confer character, it’s Vietnam origin. That’s why I insist on:

- Manufacturing flow maps that tie each process to a country.

- Broker opinions in writing before printing COO on cartons.

- Quotes that show HS 950632 / US HTS 9506.32.0000 and any Chapter 99 lines.

Compliance and audit pressure from US retailers

- Batch-linked lab data (compression, COR/initial velocity, durability, material declarations).

- Retention samples and a named AQL.

- Change-control logs whenever art or paint stacks change.

Timeline effects you should plan for

- First order: 45–75 days for a Vietnam 3-piece ionomer run; longer for cast urethane. Add transit/clearance.

- Repeat orders: Faster once the golden sample and cartons are locked; bottleneck becomes slot availability.

- Peak seasons: Vietnam windowing is tight; keep an already-qualified China backup to protect shelf dates if a retailer pulls forward.

A simple illustration (indicative only)

| Item | Vietnam origin (ionomer 3-piece) | China origin (same spec) |

|---|---|---|

| EXW unit cost | 1.00 | 1.00 |

| Customs value basis | 1.00 | 1.00 |

| Base duty (HTS 9506.32) | 0.00 | 0.00 |

| Section 301 (≈7.5%) | 0.00 | 0.075 |

| Freight/insurance (illustrative) | 0.06 | 0.06 |

| Indicative landed (pre-domestic) | 1.06 | 1.135 |

Numbers vary by program and Incoterms, but the structure is what matters. Multiplied across large volumes, duty overlays change which country makes financial sense for the exact same construction.

✔ True — Packaging in Vietnam does not usually change origin

If cores/covers are molded and finished in China and only boxed in Vietnam, origin remains China for US duty purposes.

✘ False — “Any work in Vietnam counts as Vietnam origin”

Only a substantial transformation confers origin. Light assembly or relabeling isn’t enough.

When should a B2B buyer source Vietnam-made golf balls, and when should they pick China-made?

Pick Vietnam for duty-sensitive US retail lines with locked specs and steady repeats; pick China for fast sampling, small-lot agility, frequent artwork changes, and complex packaging—especially when the destination isn’t the US.

When Vietnam makes the most sense

- US duty optimization: Vietnam origin avoids Section 301; landed math is cleaner for value-driven SKUs.

- Locked spec + repetition: Stable compression, paint stack, and packaging over multiple cycles.

- Brand-grade documentation: Big-box channels need tight labeling and compliance packs; Vietnam’s leading plants run that rhythm well.

- Tour-leaning urethane: Target urethane feel/control with retail consistency; book early and hold spec steady.

When China is the smarter move

- Speed & agility: Tight launch windows, 3-day printed samples, ≤10-day pilot lots.

- High-mix programs: Frequent colorways, tournament packs, and seasonal gift sets with minimal changeover pain.

- Lower MOQs: 1–3K-dozen orders with sane per-SKU pricing.

- Non-US destinations: When Section 301 isn’t a factor (EU/JP/ROW), China’s landed cost is hard to beat.

When to run a Vietnam + China hybrid

- Anchor + surge: Produce the anchor SKU in Vietnam; mirror critical tooling in China for samples and surges.

- Risk control: If a retailer pulls forward by two weeks, China covers while Vietnam stays on slot.

- Evidence-based comparison: Ask both sides for like-for-like constructions so you can compare COR, compression, and cover cosmetics apples-to-apples.

✔ True — MOQs depend on how often you change art/specs

Stable SKUs justify lower unit costs at higher MOQs; frequent variants push you toward China’s small-lot economics.

✘ False — First-order timelines define all future timelines

Once the golden sample and cartons are locked, repeats speed up significantly regardless of region.

What’s the key takeaway

A compact, verified roster of golf ball manufacturers in Vietnam serves US duty-sensitive lines—especially 3-piece TPU/PU and select cast urethane; China remains the champion for speed, MOQs, and packaging; a hybrid Vietnam+China plan often delivers the best price-to-agility ratio.

Whenever you have a rush OEM project or some creative ideas about packaging or printing, I believe Golfara might be able to offer you some useful insights. Here’s a quick look at the regular services we can provide:

- Low MOQ: from 1,000 pcs

- Samples: printed in 3 business days

- Production: small batches in ≤10 working days

- Design team: logo imprint & custom packaging

- Response: ≤12 hours with detailed quote & plan

You might also like — Top 4 Golf Ball Manufacturers in Taiwan for OEM