China is typically 10–20% cheaper per ball at like-for-like specs and scales 4-piece PU; Thailand suits premium brand lines and origin storytelling.

Buyers comparing China vs Thailand golf ball cost want a clear, decision-ready map: which origin is cheaper by construction, who scales faster, and when a “Made in Thailand” story earns its keep. This guide turns factory-side realities—labor, energy, yield, packaging, and scale—into FOB price anchors and sourcing playbooks that survive peak season.

What is the core answer on China–Thailand cost differences?

China leads on scale and unit cost in 2/3-piece Surlyn and 3-piece PU; Thailand overlaps on these but focuses more on premium brand lines. For 4-piece PU, China runs mature mass production; Thailand’s capacity ties closely to branded factories. Same-spec estimates put Thailand about 10–20% higher per ball.

Overlap and divergence (2/3 Surlyn, 3 PU, 4 PU)

-

2-piece Surlyn (ionomer): Substantial overlap. China dominates global OEM volume; Thailand can serve regional supply or freight optimization.

-

3-piece Surlyn: Both origins capable; low barrier, automation-friendly.

-

3-piece PU: Thailand hosts world-class brand lines (e.g., Titleist plants); China also runs large OEM flows.

-

4-piece PU: China offers broad, open OEM mass production; Thailand likely capable within brand systems, with fewer open OEM lanes.

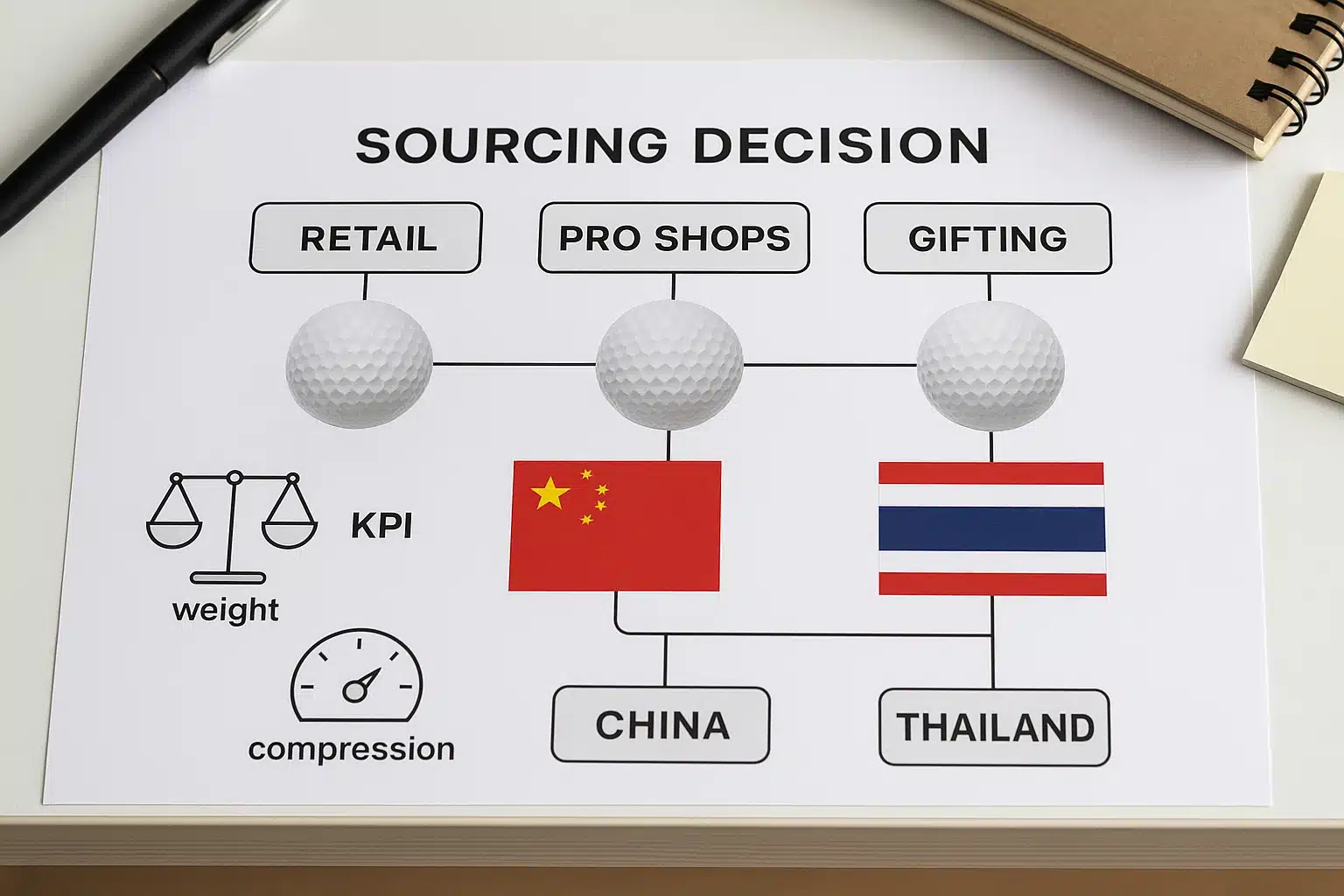

When to choose Thailand vs China (by channel & positioning)

-

Choose Thailand for premium flagships where origin story and tour-line proximity strengthen price realization in Europe/Asia.

-

Choose China for volume retail/DTC where price-performance, replenishment speed, and customization breadth drive sell-through.

Dual-sourcing strategy

Run China as volume anchor and Thailand as premium/back-up. Lock identical KPIs across both and blind-test pilot lots before locking the matrix.

| Construction | China (Zhejiang/Guangdong/Fujian) | Thailand |

|---|---|---|

| 2-piece Surlyn | Scale, lowest FOB, fast replenishment | Regional supply, freight-friendly to SE Asia/Aus/EU |

| 3-piece Surlyn | Scale with stable yields | Capable; often used to balance regional flows |

| 3-piece PU | Large OEM capacity, automation | Premium brand lines, strong consistency narrative |

| 4-piece PU | Mature mass production across OEMs | Brand-tied capacity; fewer open OEM options |

✔ True — Premium origin ≠ automatic performance gain

Performance follows recipe (core/mantle chemistry), CT control, compression window, and yield discipline. Origin helps the story but does not replace SPC and test results.

✘ False — “Thai-made always beats China-made”

Either origin can hit elite specs; proof lives in CT, weight, roundness, concentricity, and spin/launch testing.

What are the FOB price ranges by construction (USD per dozen)?

2/3-piece Surlyn: both origins can supply, China usually lower. 3-piece PU: price hinges on yield/energy. 4-piece PU: China has scale-driven pricing and quicker cycles; Thailand’s volumes align with brand lines more than open OEM mass.

2/3-piece Surlyn ranges and drivers

-

2-piece: Fast cycles, high automation, thin yield risk. China usually wins on FOB via line utilization and cluster logistics.

-

3-piece: Mantle adds SPC and handling but remains automation-friendly; Thailand competitive regionally; China typically lands lower.

3-piece PU ranges and the role of energy/yield

Yield swings (cosmetics, cover defects) and kWh rates push dollars per dozen. Thailand may carry slightly higher energy and packaging costs; China’s cluster mitigates overhead per unit.

4-piece PU scale discount logic

Every added layer compounds cure time, alignment windows, and rework risk. China’s ecosystem maintains enough parallel stations to dilute fixed costs and stabilize quotes; Thailand’s brand-focused capacity offers consistency but less open surge bandwidth.

Problem → Section: Price anchors

Tie every quote to construction + AQL levels + lead time windows; do not haggle price detached from yield and schedule.

Table 2: Indicative FOB ranges by construction (China vs Thailand).

| Construction | China FOB (USD/dozen) | Thailand FOB (USD/dozen) | Notes |

|---|---|---|---|

| 2-piece Surlyn | 10–15 | 11–16 | China scale advantage; Thailand may win freight in SE Asia |

| 3-piece Surlyn | 15–22 | 16–24 | Both capable; China often lower by 1–2 USD/doz |

| 3-piece PU | 20–30 | 22–33 | Yield/energy drive variance; brand lanes in TH price higher |

| 4-piece PU | 28–45 (28–32 at volume) | 32–48 (brand lanes) | CN mass-production access; TH often tied to brand capacity |

✔ True — Packaging/printing materially shifts the range

Gift boxes, special textures, and multi-color logos add handling time and reject risk that show up as dollars per dozen. Simplifying sleeves/boxes can claw back $0.20–$1.50 per dozen. Artwork complexity (metallic inks, layered clear coats) is a hidden cost amplifier that also raises reject rates.

✘ False — “Resin cost explains most price bands”

Global resin pricing is comparable; the big movers are yield, kWh, and scale utilization.

Where do manufacturing cost differences come from: labor, electricity, materials, packaging?

Labor and electricity are the main gap; materials see small global variance; packaging in Thailand trends slightly higher. Using a 3-piece PU benchmark, Thailand often lands 10–20% above China depending on energy and yield.

Labor model (0.02 h per ball)

Assume 0.02 h/ball blended across molding, finishing, QC, and pack-out:

-

China: $4–6/h ⇒ $0.08–$0.12 per ball (≈ $0.96–$1.44 per dozen).

-

Thailand: $6–9/h ⇒ $0.12–$0.18 per ball (≈ $1.44–$2.16 per dozen).

Electricity’s amplification in PU casting/bake/UV

PU demands dwell stability across casting, oven, and UV cure. A 2–3× delta in kWh unit price magnifies across stations, turning line minutes into real dollars per dozen.

Materials share (~40%) and global availability

Ionomer and PU systems are broadly available; pricing deltas are narrower than many assume. Final cost hinges more on how efficiently material goes through the line (scrap, rework, re-spray).

Packaging tiers (basic/gift/premium)

Per-ball packaging estimates (basic sleeves to premium gift sets) run slightly higher in Thailand due to inputs and handling, especially on specialty finishes.

*Table 3: Labor, electricity, packaging comparison.

| Metric | China | Thailand |

|---|---|---|

| Typical factory labor cost (USD/h) | 4–6 | 6–9 |

| Industrial/commercial electricity (USD/kWh) | ~0.088–0.097 | ~0.10–0.14 |

| Packaging (USD/ball, basic to premium) | 0.03–0.08 | 0.04–0.10 |

Using 3-piece PU as the yardstick: unit cost decomposition (per ball)

Under a representative assumption, China ≈ $0.83 per ball and Thailand ≈ $0.99 per ball. The delta mainly comes from labor and kWh rates. Real projects vary with automation, supplier radius, and yields.

Materials: sensitivity of the 40% assumption

At 40% of total, moving material usage/yield by a few points changes cents per ball. Recipe freezes early in RFQ prevent later creep.

Electricity: 0.5 kWh per ball × unit price

Assuming 0.5 kWh/ball across bake/cure/UV:

-

China: 0.5 × $0.089 ≈ $0.0445

-

Thailand: 0.5 × $0.12 ≈ $0.0600

Labor: $5/h vs $7.5/h × 0.02 h

-

China: 0.02 × $5 ≈ $0.10

-

Thailand: 0.02 × $7.5 ≈ $0.15

Packaging: basic carton with simple print

-

China: $0.05 per ball

-

Thailand: $0.06 per ball

Table 4: Example 3-piece PU unit cost build (USD per ball).

| Cost Item | China Estimate (USD/ball) | Thailand Estimate (USD/ball) | Notes |

|---|---|---|---|

| Materials (40% share) | 0.64 (of $1.60) | 0.72 (of $1.80) | Recipe & usage efficiency dominate |

| Electricity (~0.5 kWh) | 0.0445 | 0.0600 | Dwell time & oven/UV tuning matter |

| Labor (0.02 h) | 0.10 | 0.15 | Automation/load balancing reduce variance |

| Packaging (basic) | 0.05 | 0.06 | Premium tiers add materially |

| Subtotal | 0.8345 | 0.9900 | Excludes logistics; FOB focus |

✔ True — These are estimation models, not factory quotes

Use the model to set RFQ anchors and to compare apples to apples. Validate with pilot runs and attach AQL/KPI schedules so prices don’t drift post-award.

✘ False — “Any plant will match this math”

Real numbers depend on automation, yield history, and packaging/print complexity.

Capacity and lead time: who sustains continuous scale-up?

China’s coastal clusters (Zhejiang/Guangdong/Fujian) support 3/4-piece PU scale with typical 25–45-day production cycles; Thailand’s brand lines are strong and freight-advantaged for EU/Asia but run slower (sampling 4–6 weeks, mass 45–60 days).

Cluster & supplier radius (molds/inks/cartons)

China’s tight supplier radius shortens wait times for molds, inks, and cartons, helping keep takt high and line utilization steady during peaks.

4-piece PU automation & yield thresholds

Additional mantle + multi-stage cure require inline vision and disciplined SPC gates. China’s ecosystem supplies enough bake/UV lanes to prevent bottlenecks; Thailand meets high-end brand standards but offers fewer open OEM slots.

Peak-season scheduling & buffer inventory

Pre-book Q4, freeze colorways early, and approve simplified packaging fallbacks that unlock throughput while preserving KPI conformance.

Table 5: Lead time & capacity comparison.

| Metric | China | Thailand |

|---|---|---|

| Sampling lead time | 2–3 weeks | 4–6 weeks |

| Mass production lead time | 25–45 days | 45–60 days |

| 4-piece PU surge capacity | Strong, multi-OEM | Strong within brands; limited open OEM |

| Supplier/cluster depth | High | Moderate–High (brand-centric) |

How should I choose?

Flagship/brand narrative in EU/Asia → Thailand or dual-sourcing; volume retail/DTC/private labels → China. Bind prices to the USGA/R&A conforming list, AQL levels, and KPIs (weight/CT/concentricity/compression) to keep quality predictable.

Channel fit (clubs/pro shops/e-commerce/gifting)

-

Clubs & pro shops: Monetize origin and consistency aura; Thailand can lift ASPs.

-

E-commerce & chains: Margin and speed win; China’s scale and customization breadth shine.

-

Corporate gifting: Either origin works; box quality and calendars decide.

KPI bundle (weight ±0.2 g, CT dispersion, compression band)

Lock weight ±0.2 g, CT dispersion vs CT limit, compression window (e.g., 80–95), roundness, concentricity, cover hardness, and dimple uniformity. Tie to AQL levels (0.65/1.0/1.5) and seasonal process audits.

Table 6: Decision matrix — Channel × Origin recommendation.

| Channel/Goal | Thailand | China | Recommendation |

|---|---|---|---|

| Flagship/brand aura | Strong | Medium | Thailand or dual-sourcing |

| Volume retail/DTC | Medium | Strong | China |

| Gifting/premium sets | Strong | Strong | Either; box spec drives choice |

| Speed to market | Medium | Strong | China |

| Tightest uniformity | Strong | Strong | Both can hit; enforce KPIs & AQL |

Case & proof points: Thailand’s Titleist plant (Ball Plant IV) and China’s OEM role

Thailand hosts Titleist Ball Plant capacity serving premium lines; China is the open OEM engine for 3/4-piece PU across numerous brands and private labels.

OEM openness & MOQ flexibility

China’s factories serve a wider spectrum from entry Surlyn to complex PU with flexible MOQs and faster art/packaging turns; Thailand’s capacity is often brand-committed with fewer small-lot slots.

Table 7: Brand-owned vs open OEM differences.

| Dimension | Brand-owned plants (Thailand example) | Open OEM network (China example) |

|---|---|---|

| Access for small brands | Limited | Broad |

| Packaging/art turns | Longer, controlled | Faster, flexible |

| Price elasticity | Lower | Higher |

| Surge capacity | Prioritized to brand SKUs | Reservable with forecasts |

China OEM options & MOQ

Grasbird (3–5k), Golfara (from 1k), MLG Sports (2–3k), Shenzhen Xintiantian (2–3k). Always prototype and lock AQL/packaging terms before volume.

Capacity/lead time/peak strategy

Pre-book windows, freeze colorways two months ahead, and keep a simplified sleeve spec on standby.

NDA/formulation/mold & IP

Clarify recipe variants, tooling ownership, maintenance, storage, and transfer rights before PO.

Table 9: China-Based Golf Ball Manufacturers with OEM MOQ.

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xintiantian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

FAQ

Is Thailand’s origin premium worth paying?

For flagship/tour-style lines in EU/Asia, yes—origin story plus proven consistency can lift ASPs. For volume retail/DTC where elasticity is high, China usually drives better net margin.

Make sure the price delta converts into measurable KPIs and lower return rates. Without performance you can feel or test, origin premiums fade quickly in crowded retail.

Can Thailand mass-produce 4-piece urethane?

Yes within brand systems; as an open OEM option, China remains broader at scale. Thailand’s capacity is strong but commonly prioritized for brand portfolios.

If you need continuous replenishment at tens of thousands per month, China’s multi-OEM network makes scheduling and surge clauses more practical.

Are materials the main source of price differences?

No. Materials are typically ~40% of the total and globally comparable. The big movers are labor, electricity, yield discipline, and scale utilization—especially on PU casting and finishing.

Focus negotiations on yield, takt, and packaging complexity before chasing resin pennies.

How should I set KPIs and AQL?

Lock weight ±0.2 g, CT dispersion vs CT limit, compression window (e.g., 80–95), concentricity, roundness, and cosmetic AQL levels at 0.65/1.0/1.5. Add periodic process audits.

Attach histograms to pilot approvals and require retains. Separate cosmetic from functional AQLs to avoid rework vortexes.

How different are the lead times?

Sampling: China 2–3 weeks vs Thailand 4–6 weeks. Mass: China 25–45 days vs Thailand 45–60 days.

Plan buffers for Q4 and pre-approve a simplified box to convert capacity into shipped units during crunches.

Will dual-sourcing reduce risk?

Yes—mirror KPIs, pre-book windows, and define switch triggers tied to yield/lead-time breaches; include fallback packaging.

Dual-sourcing turns calendar risk into a manageable lever, especially for seasonal programs.

Conclusion

If your strategy hinges on brand aura and premium storytelling, Thailand’s brand-adjacent lines can justify higher FOB on a hero SKU—provided you can prove consistency with CT/weight/concentricity and a stable compression window. If your plan is scale, speed, and customization breadth, China’s clusters deliver 2/3-piece Surlyn and 3/4-piece PU at compelling FOB with dependable lead times.

You might also like — Top 4-piece Urethane Golf Ball Manufacturers in China (2025)