Sending golf ball design files to a China OEM can feel risky—one leak can clone your brand. The safest route is a contract-first, staged-release process you can audit and repeat.

To safely share your golf design with a China OEM, treat IP as supply-chain risk: verify the legal entity, sign a China-ready NNN, release files in stages with least-privilege access, lock mold ownership and custody in the PI, and confirm mold exclusivity before mass production.

Below is the exact workflow buyers use to prevent copycats, protect tooling, and keep their Amazon/DTC brand defensible—without turning the project into legal gridlock.

You can’t “unsend” CAD files. If the supplier isn’t verified and your disclosure rules aren’t written, your design can spread internally—or get recreated externally—before you even approve a sample.

The buyer-safe approach is a repeatable 5-step protocol: verify the real legal entity first, use a China-ready NNN (not only an NDA), disclose files in stages with least-privilege access, lock private mold ownership and custody in the PI, and verify exclusivity with a third-party mold audit before mass production.

To safely share golf designs with a China OEM, follow these steps:

- Verify the manufacturer’s legal entity and age (10+ years preferred).

- Sign a bilingual NNN Agreement (not just an NDA).

- Separate design files from production staff access.

- Clarify Mold Ownership in the Proforma Invoice (PI).

- Use a third-party mold audit/verification to confirm mold exclusivity.

How you keep this moving fast:

-

Ask for entity proof before files: “Please confirm the China legal entity name (CN), unified social credit code, registered address, and bank account name that will sign our NNN and PI.”

-

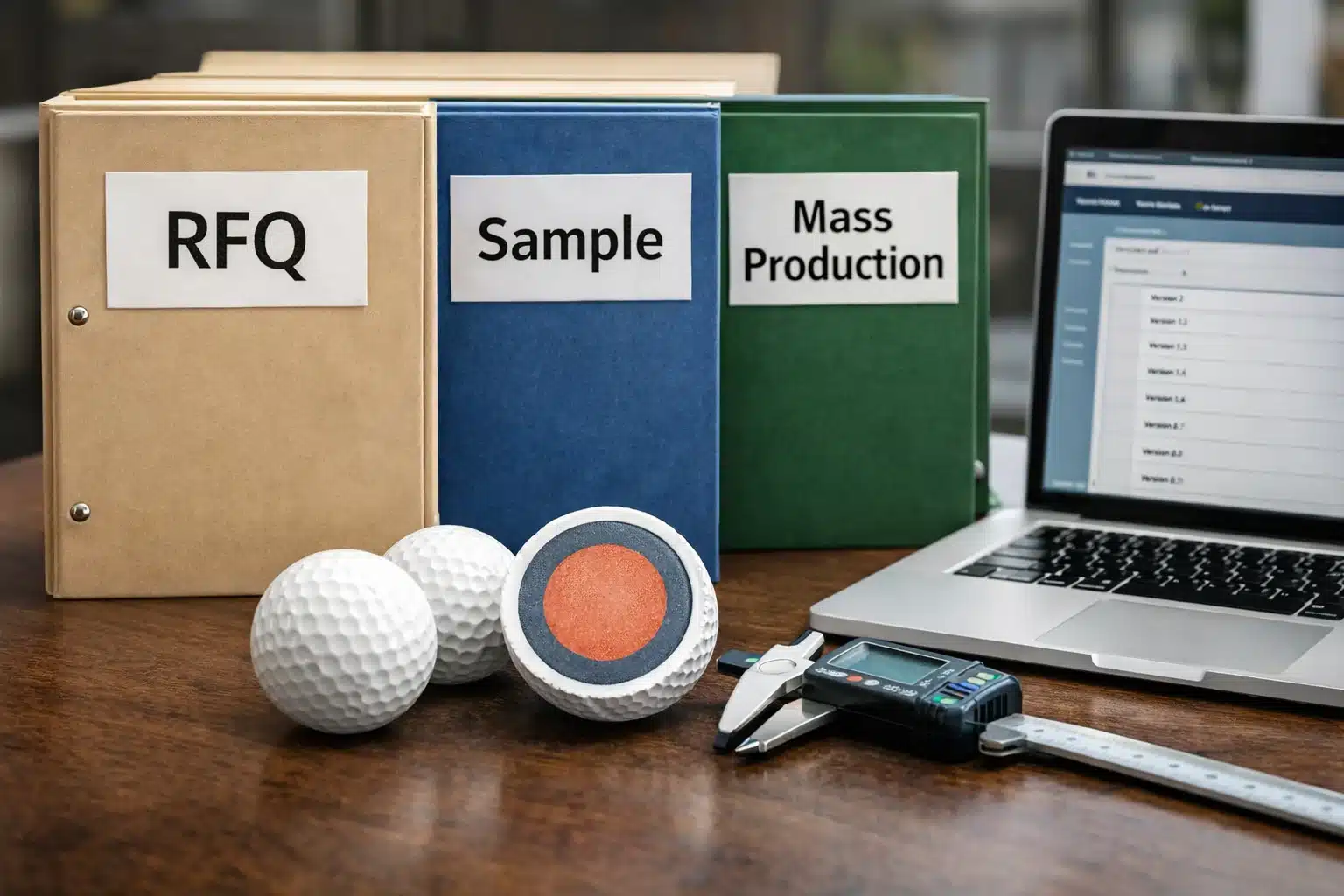

Share in gates: RFQ pack (masked), sample pack (enough to tool/test), then production pack only after terms are signed and responsibilities are clear.

-

Mini buyer scenario: You’re launching a DTC ball with a fixed marketing budget and a hard inventory deadline, and you also sell on Amazon—so a look-alike can hit your margins and listing stability immediately. You choose staged disclosure because you need speed and a defensible evidence trail if hijackers or copycats appear. You optimize for “prevent + prove,” not “hope + react.”

-

Don’t chase the lowest quote: bargain suppliers are more likely to cut corners on QC and discipline, which can hurt your brand even if they never steal your files

✔ True — “Contract-first, then files” is the normal pro workflow

It protects you from both bad intent and accidental leakage. More importantly, it creates a repeatable system your team can run across suppliers and SKUs.

✘ False — “If a supplier seems friendly, an NDA is enough.”

Friendliness doesn’t prevent non-use, bypass, or internal oversharing. Your controls do.

Why do most NDAs fail for China OEM projects?

Many buyers sign a Western-style NDA and assume they’re protected. Then they discover it didn’t stop non-authorized use, didn’t prevent bypassing them, and wasn’t drafted for China-centered enforcement.

Broadly speaking, an NDA alone often underperforms in China OEM projects because it focuses on secrecy—not non-use or non-circumvention. A China-ready NNN adds “don’t use” and “don’t bypass,” ties obligations to the correct China legal entity, and is structured for local enforceability without promising outcomes.

What actually breaks, and what to do instead:

-

Wrong signer = weak leverage. If the contract is signed by a trading entity or the wrong legal name, enforcement gets complicated fast. Make the stamped party match the factory’s legal entity details.

-

NDA ≠ non-use. If you fear “they’ll make it for someone else,” your document must explicitly cover non-use, not only confidentiality.

-

Don’t dilute the core. Some counsel sources warn that making NNN terms “mutual by default” can weaken buyer protection when you’re the primary disclosing party. A buyer-safe stance is: we sign buyer-binding NNN + tooling ownership/custody + no-circumvention; we don’t sign unlimited liability or penalties with no scope.

Practical wording habit: say “structured for China enforceability” rather than “guaranteed enforceable.” That keeps you credible and compliant.

If you share everything upfront, you increase leak risk. If you share too little, sampling stalls. The answer is staged disclosure with clear deliverables, owners, and access rules.

Use a three-stage release: RFQ pack (masked dimensions), sample pack (enough for prototype tooling), and production pack (full CAD + critical parameters). Assign a named approver per stage, keep a simple version log, and apply least-privilege access so only the builders for that stage can view files.

-

RFQ pack: performance targets, construction class (2/3/4-piece), cover type, print/pack scope, and masked geometry. Enough for pricing and feasibility—without handing over the crown jewels.

-

Sample pack: limited CAD for tooling + test plan + acceptance criteria. If the supplier needs more, ask “what decision does that unlock?” and release only what unlocks that decision.

-

Production pack: full CAD and final spec only after: (1) NNN signed, (2) PI terms locked, (3) sample approved, (4) file access list confirmed.

✔ True — Staged disclosure can be faster than oversharing

Clear gates reduce back-and-forth and stop “send everything” requests. You approve faster when each stage has a defined deliverable and pass/fail criteria.

✘ False — “Sending full CAD upfront saves time overall.”

It often creates rework and exposure if terms, access scope, and tooling rules aren’t already locked.

To sound (and operate) like a de-risked supply chain, borrow standard language: treat drawings as “documented information” that needs version control, retention, and access limits (ISO 9001 guidance concept), and apply least-privilege access as a default security principle (NIST “least privilege” concept).

How do you protect logos, CAD, and dimple patterns?

Not all “design” files carry the same risk. A logo leak can damage your listing fast; a dimple/core leak erodes product differentiation over time—often without obvious proof.

Separate your assets into brand assets (logos, packaging, artwork) and technical assets (CAD, dimple geometry, layer structure, process parameters). Use trademark/platform evidence to defend brand assets, and use trade-secret-style controls for technical assets: least-privilege access, compartmentalization, and proof of controlled custody.

Asset-by-asset controls you can apply today:

-

Brand assets: keep AI/source files in-house; share print-ready PDFs only; use supplier-specific filenames; watermark drafts; store dated product/packaging photos for platform evidence.

-

Technical assets: compartmentalize (artwork team ≠ core spec team); release only what each role needs; keep a master spec under internal control and release copies through your log.

-

Amazon clarity (don’t overpromise): Brand Registry helps platform enforcement and evidence hygiene, but it does not stop off-platform manufacturing misuse. Contracts + staged disclosure + tooling custody are still your core shield.

If you sell DTC + Amazon, treat this as compliance: “protecting your design” also means “protecting your listing evidence chain and account stability,” not just winning an argument later.

Who owns the mold, and how do you prove it?

Tooling is where IP becomes physical. If mold ownership and custody aren’t written, a “private mold” can quietly behave like a “public mold” used for others.

If you pay a tooling fee, define mold ownership, labeling, storage location, access limits, and audit rights in writing—inside the PI/contract—and confirm it with photos and third-party mold verification. Ownership isn’t just payment; it’s documented custody plus verifiable access control.

Make ownership “stick” in practice:

-

Public mold vs private mold (buyer-safe definition): public molds are factory-owned and reusable; private molds are client-owned, uniquely coded, segregated, and auditable. If a quote is “too cheap,” ask what proves it’s private.

-

Proof beats promises: request mold ID coding rules, restricted storage photos (labels redacted), and a sign-out/access log.

-

Why this matters in golf balls: molds influence surface features and consistency, so mold custody is a quality control choke point as well as an IP choke point.

Use this clause checklist to keep PI language auditable:

| Clause | Why it matters | What to write | Proof artifact | Recommendation |

|---|---|---|---|---|

| Ownership | Prevents “shared tooling” claims | Tooling paid = client-owned | PI + tooling invoice | Always for differentiation |

| Labeling | Prevents silent reuse | Unique mold ID + client code | Mold ID photos | Before first run |

| Custody | Controls physical access | Segregated, restricted storage | Storage photo/log | Required for “private” |

| No-use | Blocks copycat runs | No production for others | Contract clause | Non-negotiable |

| Audit right | Makes it verifiable | Third-party mold verification | Audit report | Before mass + periodic |

What red flags mean you should stop sharing?

The biggest losses happen when buyers ignore early warning signs. If the supplier won’t sign, won’t identify the real entity, or pushes “send full CAD now,” pause before you disclose.

Stop sharing when a supplier refuses China-ready terms, hides the signing legal entity, pressures you for full CAD before any agreement, won’t show facility proof, or quotes suspiciously cheap tooling that hints at shared molds. Treat these as de-risking failures—not negotiation quirks.

The anchors buyers actually use:

-

Industrial-belt sanity check: Golf ball OEM clusters in China commonly concentrate in Guangdong, Zhejiang, and Fujian—a supplier outside those areas isn’t automatically bad, but you should verify harder.

-

MOQ + timeline anchors: for custom orders, China benchmarks often show 2-piece MOQ ~1,000–3,000 and 3-piece MOQ ~3,000–5,000, with production time (excluding shipping) frequently around 12–18 days (2-piece) or 18–28 days (3-piece) for ~3,000 pcs, depending on print/pack complexity.

-

Peak months: queues commonly tighten around 4–6 and 9–11. If you must buy in peak periods, use staged disclosure and add verification gates—don’t loosen them.

✔ True — Trading-company risk is an IP risk

If you can’t identify who owns production and molds, you can’t control who sees your files. Entity clarity is part of IP protection, not a separate “admin step.”

✘ False — “If they say ‘factory’ and show photos, it’s safe.”

Photos don’t prove signing entity, custody control, or audit access. Ask for verifiable specifics.

FAQ

Does an NDA work in China?

Broadly speaking, an NDA can help, but an NDA alone is often not enough for China OEM risk because it focuses on secrecy—not non-use or non-circumvention. Most buyers layer a China-ready NNN plus staged disclosure, access control, and tooling clauses.

In practice, “works” depends on execution: the correct China legal entity signs, the language is usable (often bilingual), scope and remedies are clear, and your workflow shows “reasonable measures” (who received what files, when, and why). If your real fear is “they’ll make it for someone else,” non-use matters as much as confidentiality.

What is an NNN agreement for China?

An NNN agreement adds three obligations—Non-Disclosure, Non-Use, and Non-Circumvention—so the supplier can’t leak your information, can’t use it to compete, and can’t bypass you to your channels or customers. It’s commonly used before sensitive file sharing.

Think of it as “NDA + two missing protections.” Non-use addresses copycat production. Non-circumvention addresses bypass risk when you reveal channels, customers, or brand strategy. Keep it tied to the correct legal entity and pair it with staged disclosure for real-world effectiveness.

Who owns the mold if I pay for it?

In principle, if you pay the tooling fee, you should own the mold—but ownership “sticks” only when the PI/contract defines ownership, labeling, custody, no-use, and audit rights, and you keep proof (photos/logs/audits). Payment alone is not the control system.

Buyers get trapped when “private mold” is a label, not a custody reality. Your safest approach is to make it auditable: unique mold ID, segregated storage, controlled access, and third-party mold verification before mass production. That’s how you reduce the “shared mold” risk without relying on trust.

How do I stop a factory from selling my product?

You reduce the risk with layers: a buyer-binding NNN, staged disclosure with least-privilege access, and verifiable mold custody (third-party mold verification before mass production). No single document stops every bad actor, but combined controls are harder to bypass.

Start with prevention (don’t release production-grade CAD early), then add verification (mold ID + storage proof + audit right). If you’re worried about brand damage, pair IP controls with first-order quality controls like PSI (pre-shipment inspection) for early mass lots, since buyers—not factories—carry the reputational cost.

Should I send full CAD files before paying a deposit?

Usually, no. Full CAD before terms increases leak risk without guaranteeing faster sampling. A safer approach is staged disclosure: RFQ pack to price, sample pack to tool, then full CAD only after the NNN/PI terms and responsibilities are clear.

If a supplier claims they “must have everything now,” ask what decision that unlocks. Often they can quote and prototype with a masked RFQ pack and a controlled sample pack. You can still move fast with expiring links, watermarked drafts, and a simple file release log—without giving away the full production blueprint.

What proofs should I keep for Amazon Brand Registry and takedowns?

Keep a clean evidence chain: trademark ownership/authorization, real product or packaging photos, consistent brand identifiers, and dated invoices/production records. Brand Registry supports reporting tools, but it does not replace factory-side contract controls and staged disclosure.

A practical rule: if you want takedowns to go smoothly, don’t treat documentation as an afterthought. Save dated packaging photos early, keep your approved artwork versions, and store invoices that match the brand presentation. These are the “boring” artifacts that make enforcement faster when hijackers appear.

Can I share “masked” drawings first and still get accurate quotes?

Yes—if you mask strategically. You can protect sensitive geometry while still sharing what drives cost: construction class, material family, print complexity, packaging scope, and test requirements. Then you release details after the NNN and stage gates are in place.

Quote accuracy improves when your RFQ is structured: list what’s fixed (materials, print count, packaging type) and what’s staged (full CAD, final tolerances). Many OEM projects move faster when buyers share less—but share it cleanly with a timeline for what comes next.

What if the supplier insists on a mutual NDA/NNN?

Don’t auto-agree. Mutual terms can dilute buyer protection when you’re the party disclosing the sensitive design. A safer approach is a buyer-binding NNN for your disclosures, and a separate, tightly scoped agreement if the supplier truly needs protection.

If they insist on “mutual or nothing,” treat it as a signal to slow down. Offer a professional compromise: you’ll respect their standard process know-how, but your design files require non-use and non-circumvention to be meaningful. Always have licensed counsel review final contract language for your transaction.

Conclusion

Sharing a great golf design shouldn’t feel like gambling. But without contract-first discipline and controlled disclosure, you’re trusting luck instead of a system.

Protecting your golf design is a repeatable de-risking workflow: verify the real factory entity, sign China-ready terms, disclose in stages with least-privilege access, lock mold ownership and custody in writing, and verify mold exclusivity before mass production. The goal isn’t perfect safety—it’s defensible control and predictable outcomes.

Compliance note: This article provides practical process and risk-control guidance and does not constitute legal advice. For contract drafting or enforceability, consult licensed counsel.

You might also like — How to Verify Golf Ball Quality Control: A 7-Step Factory Audit Checklist