Materials run $0.15–$0.32 per ball in both countries. Indonesia is slightly cheaper on power ($0.004–$0.008/ball) and labor ($0.02–$0.05), while China wins on packaging flexibility and open OEM capacity for 3/4-layer Urethane—enabling faster pilots, lower MOQs, steadier timelines, and often a lower total US landed cost.

You’re choosing between China and Indonesia for golf ball OEM. The real call isn’t “country pride”—it’s per-ball cost (materials, power, labor, packaging) and OEM practicality (MOQ, lead time, and how easy it is to actually book capacity). Below is a decision-first guide to keep your launch timing and landed cost controllable.

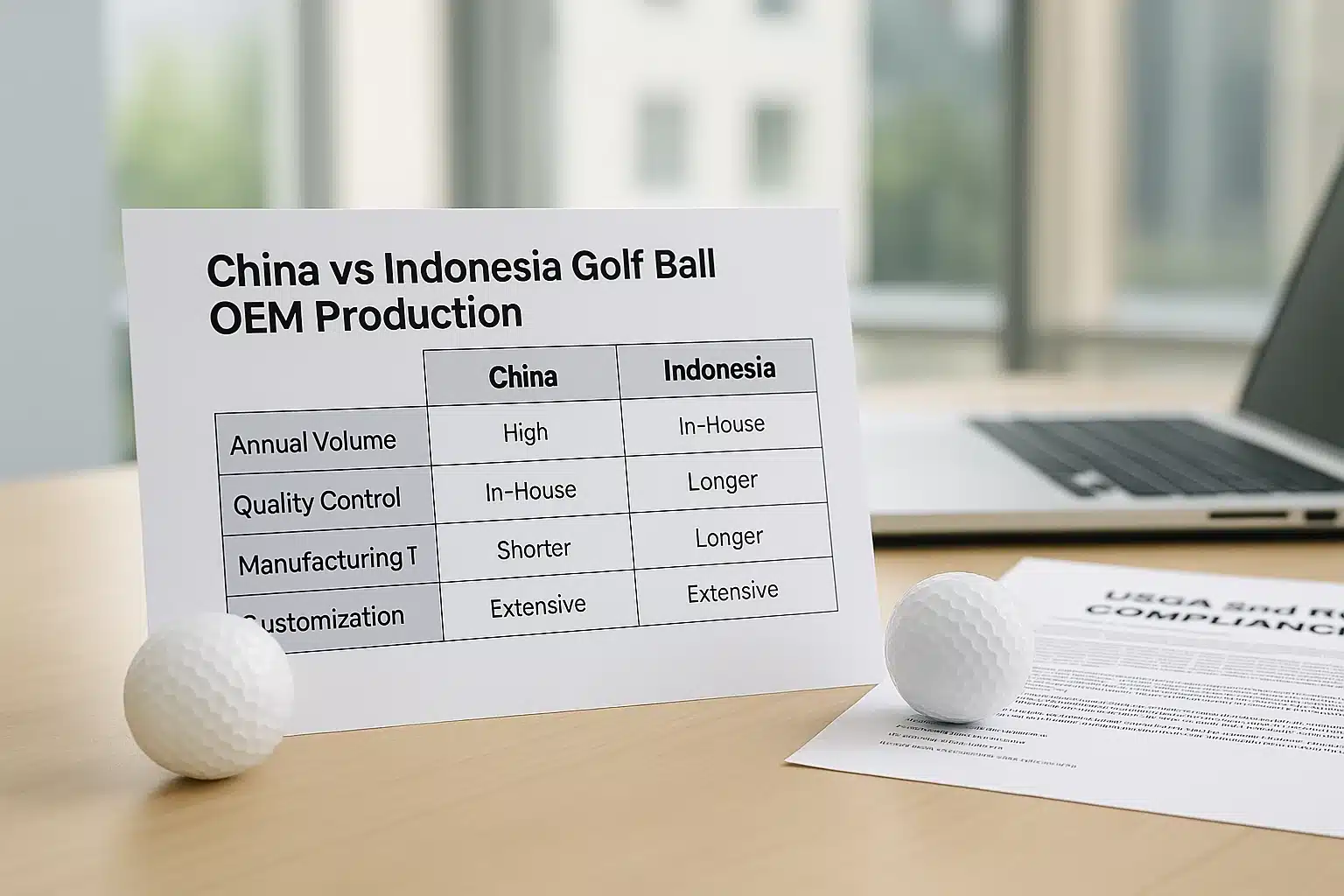

What can each country mass-produce today (2/3 Surlyn vs 3/4 Urethane)?

Both can mass-produce 2/3-piece Surlyn. For 3/4-layer Urethane, China offers broad, openly available OEM capacity at scale. Indonesia’s multi-layer capability is proven (e.g., SRI/Dunlop) but external OEM windows are limited and harder to book—so predictable MOQs and dates for third-party projects usually favor China.

Production overlap & gaps(2/3 Surlyn;3/4 Urethane)

China and Indonesia both run 2/3-piece Surlyn reliably; China adds widely accessible 3/4-layer Urethane for external OEM. Indonesia can make multi-layer Urethane, yet external slots are scarce, with capacity concentrated in affiliated brands. Outcome: stability for third-party projects leans China for multi-layer.

Country × Structure × OEM Openness × Maturity

| Country | Structure | OEM Openness | Maturity |

|---|---|---|---|

| China | 2/3-piece Surlyn | Open, common | High |

| China | 3/4-layer Urethane | Open, multi-supplier | High |

| Indonesia | 2/3-piece Surlyn | Mostly in-house/affiliated | Medium–High |

| Indonesia | 3/4-layer Urethane | Limited external OEM | High (in-house) |

✔ True — Indonesia can build multi-layer Urethane

Capability is proven in major affiliated lines; the constraint is external OEM access, not technique.

✘ False — “Indonesia can’t do multi-layer”

It can; the practical issue is booking third-party capacity and timing.

Problem → Can I reliably secure external multi-layer capacity?

If you need open OEM for 3/4-layer Urethane with predictable MOQ and dates, China is more straightforward. Indonesia works if you’re inside an affiliated ecosystem or can accept limited booking windows.

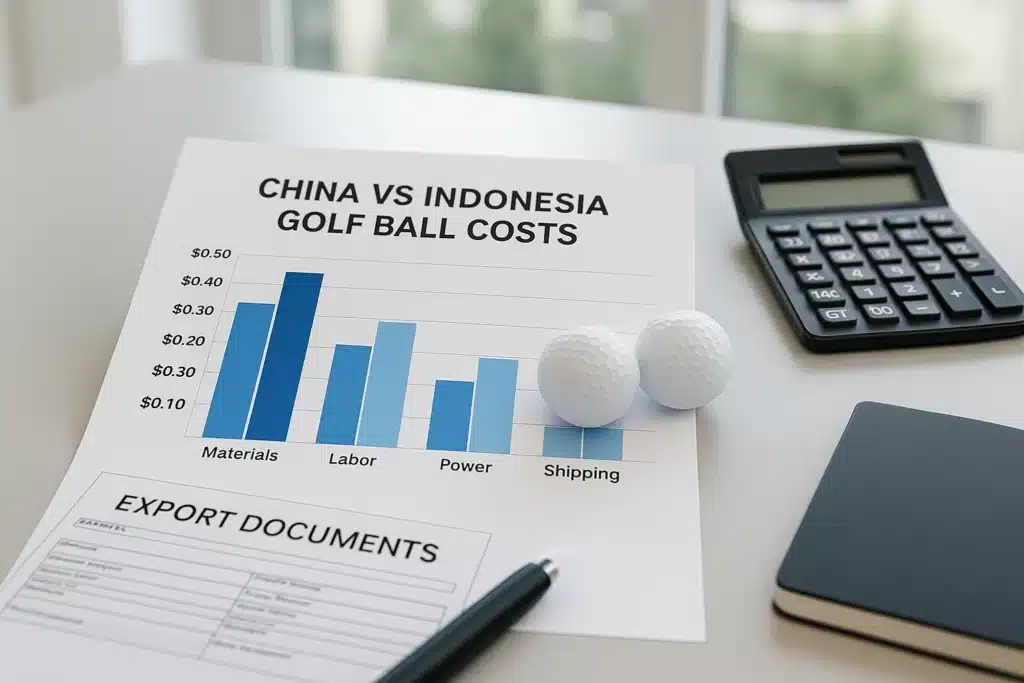

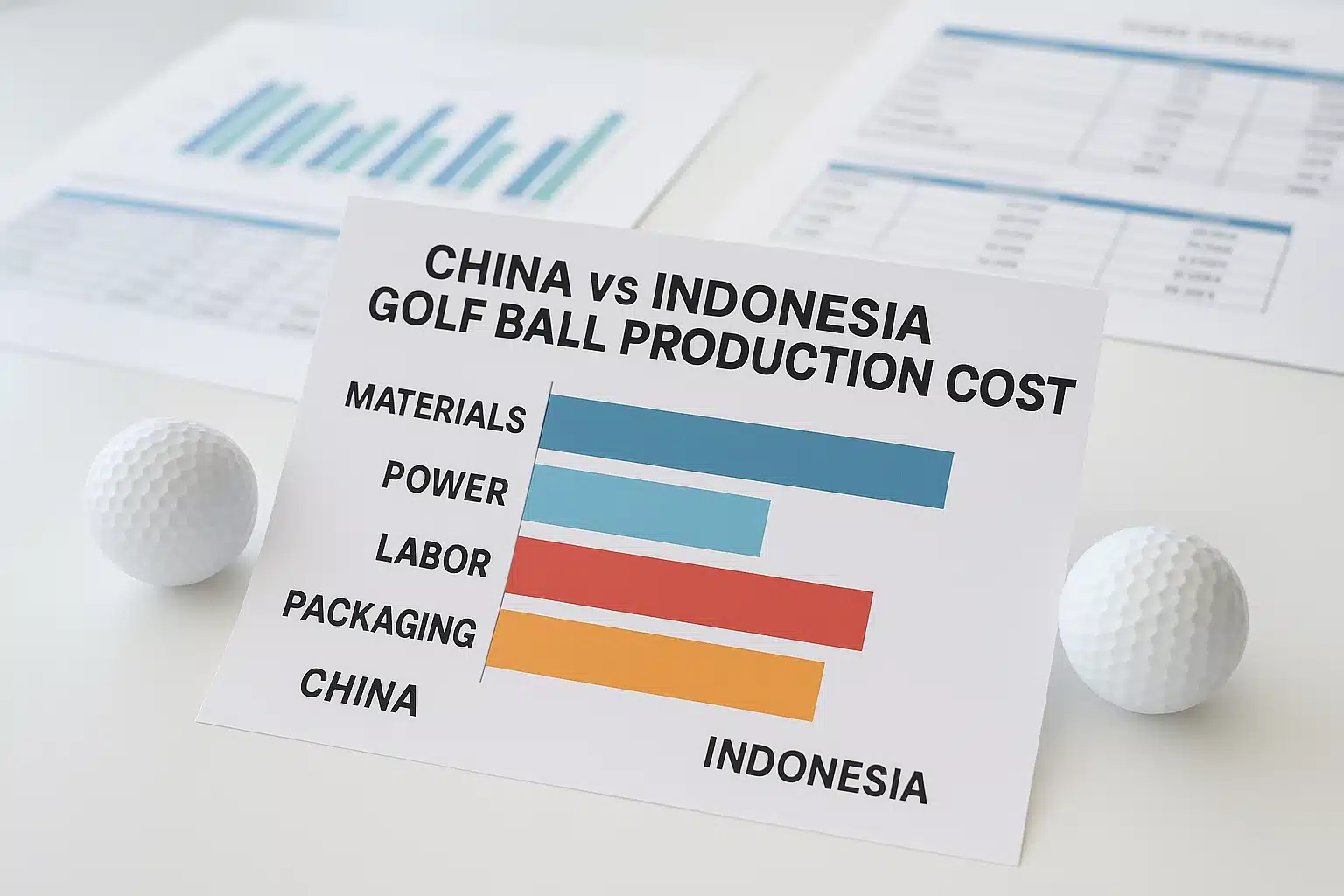

How do per-ball costs compare: labor, materials, power, packaging?

Materials are broadly similar between countries. Power is slightly cheaper in Indonesia (~$0.004–$0.008/ball vs China ~$0.005–$0.013). Direct labor trends lower in Indonesia (~$0.02–$0.05 vs China ~$0.05–$0.12). Packaging is typically more flexible and lower-MOQ in China. For multi-layer OEM, China’s open capacity keeps the total more predictable.

Materials per ball(2/3 Surlyn;3/4 Urethane)

Use USGA-constrained weights and typical layer mass. 2-piece Surlyn commonly lands ~$0.15–0.20/ball. 3-piece Surlyn ~$0.15–0.22. 3-layer Urethane ~$0.18–0.28. 4-layer Urethane ~$0.20–0.32. Surlyn/ionomer, TPU/cast Urethane, PBR, ZDA are global commodities, so country deltas are modest.

Electricity per ball(0.06–0.12 kWh × local tariff)

Molding/curing/finishing uses ~0.06–0.12 kWh/ball. At typical industrial tariffs, Indonesia yields ~$0.004–0.008/ball, China ~$0.005–0.013. Power alone rarely swings the decision; yield and rework overshadow small tariff gaps.

Direct labor(0.8–1.5 min/ball)

Assume 0.8–1.5 minutes/ball in mid-automation lines. Indexed to current wages: Indonesia ~$0.02–0.05/ball vs China ~$0.05–0.12/ball. Automation level and inspection staffing (CT/X-ray/wet gauges) can move you toward the lower or upper bound.

Packaging(mono carton/sleeve/gift sets)

China offers broader finishing menus and lower MOQs for boxes, sleeves, dividers, and kits, often easing per-ball packaging to ~$0.08–0.20. Indonesia is ~$0.10–0.22 for comparable small runs; local printing/kitting is improving but may be less consolidated for complex kits.

Yield swings total by $0.02–$0.05/ball on multi-layer Urethane.

Four Pillars × Country × Range + Yield Sensitivity(±2% Rework)

| Pillar | China (USD/ball) | Indonesia (USD/ball) | Sensitivity (±2% rework) | When It Matters Most |

|---|---|---|---|---|

| Materials | 0.15–0.32 | 0.15–0.32 | Low–Medium | Layer count & cover type |

| Power | 0.005–0.013 | 0.004–0.008 | Low | High-temp cure cycles |

| Labor | 0.05–0.12 | 0.02–0.05 | Medium | Manual touchpoints/QA |

| Packaging | 0.08–0.20 | 0.10–0.22 | Medium | Small kits & print SKUs |

✔ True — Materials are globally priced

Per-ball differences usually come from gram weight and yield, not origin.

✘ False — “Indonesia’s materials are substantially cheaper”

Commodity inputs like Surlyn, TPU, PBR, and ZDA track global markets.

Problem → I want the four pillars and sensitivity.

Use the table above as a budget card; then stress-test ±2% rework. In multi-layer Urethane, repaint/recure loops can quietly add $0.02–0.05/ball if control plans are weak.

Will OEM availability and compliance affect US landed cost and timelines?

Yes. Indonesia’s multi-layer lines skew in-house/affiliated, so third-party OEM availability directly affects slotting and launch timing. Compliance is governed by the USGA/R&A conforming list, which controls tournament/retail acceptance. Origin doesn’t equal quality; process control and listed models are what matter.

USGA/R&A monthly conforming list: purpose and relevance

Only listed models are accepted for regulated play and mainstream retail. Treat the list as your market passport: select an on-list spec or plan time for listing. Keep the model name/markings consistent and maintain batch equivalence when you roll new lots.

How OEM openness impacts landed cost & time(alternates, sampling, slotting)

Limited external OEM windows mean extra sampling, alternate-factory validation, or slot delays. Each adds cost: duplicated tooling, paint/print plates, and small-lot logistics. A China-plus-Indonesia split can hedge narrative and timing, but ensure spec parity to avoid duplicate COAs.

OEM Availability × Validation Step × Time/Risk

| OEM Openness | Key Step | Typical Time Impact | Risk to US Launch |

|---|---|---|---|

| Open (China) | Sample → Pilot | Low–Medium | Lower; alternates exist |

| Limited (Indonesia) | Slot booking → Pilot | Medium–High | Higher; reschedule risk |

| Mixed (Dual-source) | Cross-QMS alignment | Medium | Manageable with COA parity |

✔ True — Listing ≠ perfection

USGA/R&A listing is the entry ticket; ongoing CT/Compression/COR control keeps your lots salable.

✘ False — “Listed models never need QA”

Batch variance still happens; hold to capability targets and COA review.

Which country fits my scenario: DTC launch, events, or retail?

For 3/4-layer Urethane + fast launch + negotiable MOQ, pick China. If you’ve secured an affiliated Indonesia factory or need ASEAN origin storytelling, choose Indonesia but pre-book slots. For cost-effective 2/3-piece Surlyn, China is usually smoother given packaging and delivery integration.

Scenario matrix(DTC launch/retail/events/specialty)

Start from launch speed and QA bandwidth. China suits DTC sprints and multi-SKU kits. Indonesia fits affiliated programs or ASEAN origin narratives, provided you secure priority. Specialty constructions may start in China for tooling/paint options, then consider Indonesia once documentation and yields stabilize.

Scenario × Suggested Country × Core Reason × Watch-outs

| Scenario | Country | Core Reason | Watch-outs |

|---|---|---|---|

| DTC launch (new Urethane) | China | Open OEM, fast pilot | Paint queue, plate prep |

| Retail refresh (Surlyn) | China | Cost/MOQ/packaging depth | Color control across lots |

| Events/gifting | Indonesia (if in-house print) | Quick reprint of own models | Limited custom tooling |

| Specialty (tour Urethane) | China → Indonesia (phase 2) | Tooling breadth → origin story | Dual COA equivalence |

✔ True — “Small orders can work in Indonesia”

If it’s in-house model relabel/print, timing is good. Full OEM with new molds tends to be project-based.

✘ False — “Small orders automatically suit Indonesia”

External OEM windows and plate/tool lead times still apply.

What MOQ and lead times should I expect in peak season?

China: 2/3-piece Surlyn commonly 1–3.6k/color; 3-layer Urethane 5–20k (pilot 1–1.5k negotiable). Peak season can extend to 70–90 days. Indonesia: in-house relabel/print ~3 weeks; full OEM with new molds is often project-based with few public MOQ quotes.

Off-peak vs peak(Apr–Sep)

Expect Apr–Sep to strain paint/print/pack lines. China mitigates with multiple open vendors; Indonesia’s external slots are tighter. If you must land by May, lock plates/art early and secure carton kitting capacity.

New molds / compounds / coating temperature control

New covers or pigments need temperature windows validated on the coating line; Urethane thickness targets must hold Cpk ≥1.33 before you scale. New molds can add 1–3 weeks if polishing iterations are needed.

Structure × MOQ × Build Time(China vs Indonesia)

| Structure | China MOQ | China Build Time | Indonesia MOQ | Indonesia Build Time |

|---|---|---|---|---|

| 2-piece Surlyn | 1–3.6k/color | 15–25d (off-peak) | In-house models | ~3 weeks (relabel/print) |

| 3-piece Surlyn | 3–10k | 20–35d | Limited external OEM | Project-based |

| 3-layer Urethane | 5–20k (pilot 1–1.5k) | 30–60d | Limited external OEM | Project-based |

| 4-layer Urethane | 10–30k | 45–75d | Limited external OEM | Project-based |

✔ True — “Relabel/print” ≠ full OEM

Relabeling leverages existing ball specs; full OEM introduces tooling, compounding, and validation.

✘ False — “Relabel = OEM”

Lead time and risk profiles are very different.

How to verify quality fast before scaling orders?

Run a 3-step path: sample → pilot → mass. Gate with CT/X-ray for concentricity, cover thickness Cpk ≥1.33, compression window, and COR. Prefer a USGA-listed model, then lock batch-to-batch checks to sustain retail acceptance and warranty safety.

Pilot sample size & scale-up thresholds

Pilot ≥1–2k balls typically exposes paint and print variability. Scale only after you hit yield and Cpk targets over at least two shifts. Reconfirm weight/compression stability before booking peak-season capacity.

COA fields template(Compression/COR/CT/cover thickness/weight)

Lock COA fields and acceptance limits so alternates can match: Compression, COR, CT/X-ray, cover thickness by pole/equator, weight, dimensional checks, paint/print adhesion. With these set, supplier changes won’t derail listings.

One-page COA Template(Fields/Method/Target/Action)

| Field | Method | Target | Action on Out-of-Spec |

|---|---|---|---|

| Compression | Standard gauge | e.g., 85–95 | Hold lot, adjust core cure |

| COR | Velocity rig | ≥ spec | Re-cure or scrap per SOP |

| CT/X-ray | Imaging | No off-center | Sort; root cause core centering |

| Cover thickness | Mic/ultrasonic | Cpk ≥1.33 | Tool re-polish; re-paint |

| Weight | Scale | 45.2 g ± | Sort; adjust mix/curing |

✔ True — Listed models still need batch QA

USGA listing proves design legality, not lot quality.

✘ False — “Listing = no inspection”

Stay disciplined on compression/COR and CT-based concentricity.

Which China OEMs serve small-to-mid orders (quick view)?

Below are representative China OEMs covering 2/3/4-layer (including Urethane) with friendly MOQs—ideal for fast sampling and pilot runs. Compared with Indonesia’s limited external windows, these are easier to land small-to-mid orders.

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xinjintian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

✔ True — MOQs can flex

Pilot volumes and phased shipments are negotiable, especially off-peak.

✘ False — “MOQ is fixed forever”

Bring forecast and artwork readiness; it improves your odds.

FAQ

Can Indonesia do stable 4-layer Urethane for third-party OEM?

Yes, the technical capability exists and runs stably in affiliated lines; the constraint is access. For third-party OEM, booking windows are tighter, and projects often proceed on a case-by-case basis with sampling gates and calendar dependencies.

Indonesia’s multi-layer Urethane lines deliver strong yields for their own ecosystems. For external brands, you’ll need earlier slot commitments, clear COA targets, and realistic art/plating dates. If origin or affiliation is strategic, plan for pilot first, then scale once Cpk and rework rates are known.

Who is cheaper per ball for multi-layer Urethane?

Direct inputs are similar; Indonesia is marginally lower on power and labor, while China wins on packaging flexibility and open OEM capacity. In practice, China often delivers the lower total due to faster sampling, alternates, and fewer rescheduling costs.

Where projects slip is time—waiting for capacity, duplicating tools, and repeating paint/print approvals. Those soft costs can add $0.02–$0.05/ball and delay revenue. China’s open vendor network helps avoid these drags, especially near peak.

What MOQ can I negotiate for a first Urethane run in China?

Typical published MOQs are 5–20k for 3-layer Urethane, but pilots around 1–1.5k are negotiable with locked artwork, forecast, and a clear plan to scale if KPIs are met.

Suppliers often open a pilot lane when you commit to COA thresholds and a follow-on PO. Secure mold readiness, plate files, and packaging die-lines before slotting. Off-peak timing increases flexibility.

How fast can I launch before the April–September peak?

If artwork and plates are ready, a China pilot can be 3–5 weeks off-peak; peak season or new molds can stretch to 8–12 weeks. Indonesia in-house relabels can be ~3 weeks; full OEM is project-based with fewer public timelines.

Compress timelines by locking art early, pre-booking paint/print, and freezing specs. New Urethane colors or cover thickness shifts require temperature window checks to hold Cpk and gloss.

Does USGA listing guarantee retail acceptance?

It’s the ticket in, not a guarantee. Retailers still expect consistent compression, COR, weight, and finish quality across lots—documented by a clean COA.

Use the listing to clear compliance, then protect reputation with batch equivalence. Keep markings consistent, record test lots, and avoid mid-season spec drifts that trigger re-qualification.

Are materials cheaper in Indonesia?

Not meaningfully. PBR, ZDA, ionomer, TPU, and cast Urethane follow global pricing. Per-ball differences come from gram weight, scrap, and rework rates—not the country.

Focus on layer mass control and paint rework drivers. A stable coating window can save more than any nominal raw delta.

If I need ASEAN origin for brand narrative, is Indonesia viable?

Yes—especially via affiliated plants—provided you secure capacity early and accept that external OEM slots are limited. Plan a pilot first, with clear COA targets and a calendar buffer.

You’ll get the origin story and strong technical results, but be realistic on slot timing and tool/art readiness. A dual-source approach can hedge seasonality.

Conclusion

If you need 3/4-layer Urethane with speed and flexibility, China is the safer OEM hub—open capacity, lower MOQs, and easier alternates. Indonesia delivers excellent quality inside affiliated ecosystems and for origin-led narratives, but third-party windows are tighter. Decide by per-ball math + OEM practicality; then lock COA gates before scaling.

You might also like — How Much Does It Cost to Import Golf Balls from China? (2025 Guide)