If you’re weighing China vs Korea for OEM golf ball production, the short answer is this: China remains the cost-optimized base for scaling mid-tier and volume SKUs, while Korea commands a premium for high-precision urethane balls, small-batch agility, and brand signaling. The right split depends on your target segment, MOQ, and launch timing.

At-a-Glance (Oct 2025, est., ex-overhead/duties/freight)

| Country | 3–4 layer urethane (per ball) | Typical MOQ (custom logo) | Best For | Watchouts |

|---|---|---|---|---|

| China | ~$1.88 | ~1,000–3,000+ | Mid-tier & volume SKUs | Change control, peak-season queues |

| Korea | ~$2.51 | Small premium batches | Flagship feel/QA, halo runs | Unit cost, slotting capacity |

Per-dozen math and component breakdown are detailed in the “costs” section below.

What types of golf balls overlap between China and Korea?

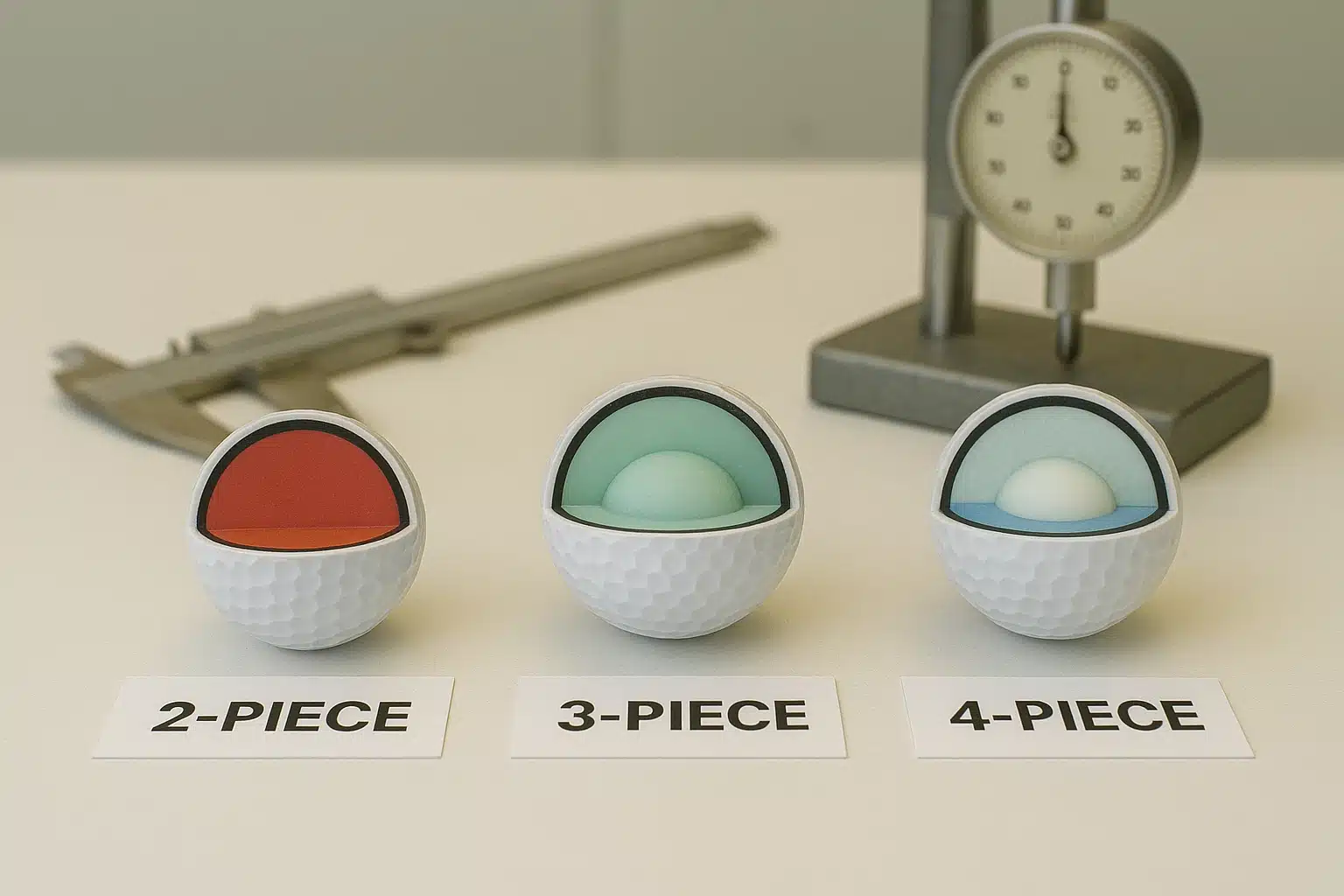

Both countries manufacture overlapping categories from 2-piece Surlyn to 4-layer urethane balls, with the deepest overlap in mid-to-high-end 3- and 4-layer urethane models. China brings scale and cost control; Korea brings tighter QA, automation, and premium positioning.

-

Product families now overlap far beyond “training balls vs tour balls.” China has matured into premium urethane and multilayer builds.

-

Korea continues to deliver top-tier urethane quality and consistency, often for flagship or brand-critical SKUs.

-

Overlap means you can dual-source a single 3- or 4-layer model across both countries if the brand playbook supports it.

-

Deciding where to place production is a function of per-ball cost, stability, and the brand value of a “Korean-made” label.

-

For new brands, overlap improves negotiating leverage and helps avoid single-point capacity bottlenecks.

Overlapping categories (2-piece to 4-piece models)

The modern overlap spans 2-piece Surlyn practice/distance balls through 3-piece Surlyn mid-tier, and into 3- and 4-layer cast-urethane tour-style balls.

China covers the full spread at volume; Korea competes strongest where precision urethane and consistent feel matter. For many brands, this means mid/high-end balls can be placed in either country without changing your fundamentals. When volumes scale, China’s cost curve remains attractive; when you want elite QA, tactile feel, and narrative value, Korea is compelling.

Product overlap snapshot

| Ball Type | China Capability | Korea Capability | Typical Notes |

|---|---|---|---|

| 2-piece Ionomer/Surlyn (practice/entry/distance) | Broad, high-volume | Present but smaller share | China is cost-optimized |

| 3-piece Ionomer/Surlyn (mid-tier) | Common across many plants | Possible but not core | Korea focuses more on premium |

| 3-layer cast-urethane | Mature capacity in premium factories | Strong competency | Compete head-to-head on quality |

| 4-layer (and 5-layer) urethane | Select premium OEMs available | Present for high-end | Korea often for flagship lines |

Key manufacturers and typical capabilities

China’s premium corridors (Yangtze River Delta, Pearl River Delta) now field urethane-capable lines and multilayer capacity; Korea’s leaders integrate high-automation molding, paint/print precision, and tight QA gates.

TaylorMade’s Korean facility lineage (via Nassau integration) underscores Korea’s place in global tour-grade supply. Meanwhile, China’s network supports broad SKUs, full finishing, and competitive lead times.

Why overlap matters for OEM buyers

Overlap expands your strategic options: cost benchmarking, risk hedging, and tiered brand architecture.

You can launch a hero SKU from Korea for halo effect while delivering volume lines from China. If a plant pauses for maintenance or capacity constraints, you can re-balance allocations without redesigning the ball architecture. Overlap also sharpens vendor pricing and service levels through credible alternatives.

✔ True — China now produces premium urethane balls at scale

Mature urethane molding, finishing lanes, and QA systems are available across multiple Chinese factories, especially in the Yangtze and Pearl River Deltas.

✘ False — “China only makes low-end golf balls”

That gap closed years ago; overlap with Korea in mid/high-end SKUs is real.

Which ball types is each country strongest at?

China excels at cost-efficient mid-tier and volume OEM (including urethane); Korea leads in high-precision, small-batch premium urethane. Choose by SKU role: scale and landed cost vs feel-critical, halo runs.

-

China: economies of scale, broad resin/ink/packaging supply chains, and flexible MOQs for brand launches and private label.

-

Korea: high automation, meticulous finishing, and consistency suitable for tour-style or flagship balls.

-

For complex multilayer designs with strict dispersion and flight windows, Korea’s process control is a differentiator.

-

For price-sensitive channels, China delivers stable COGS and better landed economics at scale.

-

Many brands deploy a split: hero SKUs or limited editions in Korea; mainstream and promo lines in China.

China’s cost-scale advantage

China provides end-to-end supply density—core/mantle resins, molds, paints, pad/ink systems, and box/kitting—driving faster iteration and lower COGS.

Plants can handle 2-piece distance balls, 3-piece Surlyn mid-tier, and 3- to 4-layer urethane at competitive MOQs. With export infrastructure and door-to-door options, China supports price-sensitive retail and subscription models without eroding margin.

Korea’s technical and brand-backed edge

Korea’s strengths show in cast-urethane quality, gloss uniformity, paint stack control, logo registration, and low defect variability.

This is valuable for tour-style feel and for brands whose positioning leans on “Made in Korea” as a trust and performance signal. Batches are often smaller but more precise, enabling limited runs and fast design tweaks without major changeover friction.

Example: split sourcing strategy for global brands

A practical approach is a tiered line: flagship urethane made in Korea, supported by mid-tier urethane or Surlyn models from China to hit margin targets.

This structure protects halo positioning while capturing volume channels. It also offers insurance against capacity constraints or geopolitical disruptions across shipping lanes, enabling agile reallocation by season.

✔ True — Korea’s premium lines can deliver exceptional consistency

Automation and QA discipline often translate into lower dispersion in compression, weight, and paint thickness across batches.

✘ False — “Higher price always equals higher quality”

Without a matching brand strategy or tour-proven spec, a premium origin alone may not lift sell-through or lifetime value.

How do labor, material, and packaging costs compare per ball?

For 3–4 layer cast-urethane balls, China’s per-ball cost averages about $1.88 versus roughly $2.51 in Korea, a 30–50% gap mainly driven by labor and energy costs; materials are directionally similar but slightly higher in Korea. Electricity is meaningful but not the primary driver.

All estimates as of Oct 2025; exclude overhead, tax, duties, and freight. Actuals vary by resin stack, finishing, automation, and volume.

-

Materials dominate, followed by labor; electricity and packaging are smaller contributors.

-

China’s materials for mid/high-end urethane: about $1.60 per ball; Korea’s: roughly $1.80, reflecting inputs and sourcing scale.

-

Typical electricity allocation: China ~$0.03 per ball; Korea ~$0.04–$0.045 depending on tariffs and processes.

-

Labor allocation swings widest: China around ~$0.20 for high-efficiency lines vs Korea around ~$0.60 for comparable processes.

-

Packaging impact is small but brand-visible: China ~$0.05 per ball, Korea ~$0.07 for similar kitting and print quality.

Material cost differences (Surlyn vs Urethane)

Surlyn builds remain cheaper; urethane cores and cover stacks drive the real premium. For 2-piece balls, materials in China often sit near ~$0.60 per ball, vs Korea at ~$0.66. For 3–4 piece urethane, China’s materials are about ~$1.60 per ball vs Korea at ~$1.80. Scaling up volumes tightens procurement, but urethane chemistries, paint stacks, and tolerances still raise the floor.

Labor and electricity comparison

Labor is the swing factor. Chinese sites with optimized staffing, multi-line operator coverage, and preventive maintenance can keep labor near ~$0.20 per ball for high-end builds. Korean sites, facing higher wages, typically land around ~$0.60 per ball. Electricity matters for molding, curing, and finishing ovens, adding roughly ~$0.03 in China and ~$0.04–$0.045 in Korea per ball, depending on plant efficiency and rate structures.

Packaging and total landed cost estimate

Packaging seldom dominates COGS but influences retail perception. Standard single-ball or sleeve boxes with simple print add around ~$0.05 per ball in China and ~$0.07 in Korea. Branded gift boxes, UV coats, or elaborate finishes can add cost and time.

Per-ball cost summary (3–4 layer urethane)

| Cost Item | China (per ball) | Korea (per ball) |

|---|---|---|

| Materials | $1.60 | $1.80 |

| Electricity | $0.03 | $0.045 |

| Labor | $0.20 | $0.60 |

| Packaging | $0.05 | $0.07 |

| Total (excl. overhead/tax/freight) | $1.88 | $2.515 |

Per-dozen view for ROI conversations

-

China: ~$22.56 per dozen (excl. overhead/tax/freight)

-

Korea: ~$30.18 per dozen (excl. overhead/tax/freight)

-

Gap: ~$7.62 per dozen, which must be offset by higher ASP, stronger channel pull, or lower defect/return rates to justify Korean origin.

Electricity contributes, but materials and labor drive COGS; see table above.

✔ True — Materials and labor dominate golf ball unit cost

Electricity is relevant for molding, curing, and paint ovens, but it’s not the primary driver of per-ball COGS.

✘ False — “Electricity is the largest cost component”

It’s typically a second-order item compared to urethane systems and labor allocation.

Does Korean manufacturing justify the higher cost?

Korean-made urethane balls justify the premium when elite feel, QA stability, small-batch agility, or brand storytelling are make-or-break. For standard volume SKUs, China’s cost-optimized structure typically wins. The answer depends on whether premium origin unlocks sell-through, halo effects, and durable pricing power.

-

Premium label effects: “Made in Korea” supports a quality narrative that some channels will pay for.

-

QA consistency: lower dispersion in weight/compression/paint thickness can reduce returns and protect ratings.

-

Small batches and limited runs: Korea’s agility helps with demos, tour validations, and special editions.

-

If the end customer won’t pay for the origin story, the cost delta compresses margin; choose China for those lines.

-

A/B pilot: validate whether premium origin lifts review scores or conversion before committing bulk volume.

Premium perception and QA benefits

When premium origin and consistency translate to reviews, fit/feel feedback, and lower defect rates, Korea’s higher base cost can generate net margin lift. This hinges on product-market fit in channels that reward origin and on communicating measurable performance attributes—not just the label.

When the cost gap is justified

Use Korea when a flagship SKU anchors your brand, a tour-style feel is non-negotiable, or when early batches need tight process discipline. It also fits brand stories where quality provenance is part of your acquisition playbook—premium pro-shop distribution, influencer fittings, and small limited releases.

When to stick with China

For price-sensitive retail, subscription programs, tournament giveaways, and promo lines, China’s cost structure preserves margin without forcing compromises. With modern urethane capability and robust finishing lanes, you can still meet demanding spec, then layer value via packaging tiers and channel pricing.

Which suppliers in China are suitable for OEM golf ball sourcing?

China offers multiple OEM options with flexible MOQs and full-layer capabilities across Surlyn and urethane. For cost-sensitive or volume-driven SKUs, these suppliers provide practical entry points and scaling paths. Combine factory audits with sample testing and pilot lots before committing main season volume.

Sample OEM references

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xintiantian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

How should brands decide between China and Korea for golf ball OEM?

Combine both: use Korea for high-end image or small-batch prototyping, and use China for mass production, cost control, and scaling. Standardize lab test protocols and color/finish specs so dual-sourcing remains consistent across seasons and channels.

-

Define your brand architecture: which SKU must carry a premium feel vs which must hit price points.

-

Quantify the willingness-to-pay for origin labeling and measure return rates by source.

-

Build a dual-factory playbook: shared BOM, approved resin/ink lists, and identical lab test methods.

-

Pilot in Korea for flagship validation; ramp in China for peak season volumes.

-

Keep a transfer protocol: document mold maintenance, paint stack, and ink registration to protect feel and look.

Decision matrix

| Buyer Type / Goal | Recommended Country Mix | Why | When to Choose |

|---|---|---|---|

| Premium brand, hero SKU | Korea-led + China support | QA consistency and halo story | Limited runs, high ASP channels |

| Value/mid-market retailer | China-led | Cost optimization at scale | Price-sensitive shelves, promos |

| New brand testing waters | Hybrid pilots | Korea for feel validation, China for MOQ | Early feedback and cash discipline |

| Seasonal distributor | China-led with Korea specials | Scale and reliable export logistics | Peak volume windows |

| Pro-shop & fittings | Korea-led | Origin story + feel performance | Influencer/demo heavy strategy |

✔ True — Consistency comes from unified BOM/specs, not geography

Align cover chemistry, dimple spec, paint stack, compression windows, and color/gloss L*a*b* ranges across plants to keep feel and appearance matched.

✘ False — “Dual-factory guarantees variance”

Variance stems from unmanaged changes and weak change control, not from running two origins.

FAQ

Are Korean-made golf balls higher quality than Chinese ones?

Quality can be higher when Korea’s automation and QA discipline align with your spec and brand goals, but China also produces premium urethane at scale. The better choice depends on your test data—compression dispersion, cover uniformity, and finish consistency—rather than stereotypes.

Korea often shines in small-batch precision, paint stack control, and stable dispersion across critical properties. This can lower returns and amplify feel perception for tour-style SKUs. China, however, now fields premium urethane lines with robust QA, and for many brands the differences can be tuned out through shared BOMs and lab protocols. Make the call using matched test lots and blinded tactile evaluations—not the factory address.

What’s the real cost difference per dozen golf balls between China and Korea?

For 3–4 layer urethane balls, China is roughly ~$22.56 per dozen vs Korea around ~$30.18 per dozen before overhead, duties, and freight. Expect a ~$7–8 gap that must be justified by higher ASP, lower returns, or marketing value.

Material and labor explain most of the spread; electricity and packaging add smaller increments. If your channels pay for premium origin or if lower defect rates preserve rating scores and reduce warranty costs, the premium can wash out or even lift margins. If your buyers are price-anchored, the gap becomes a margin headwind.

Which country’s OEM factories accept lower MOQ for custom logo balls?

Both offer low-to-moderate MOQs, but China provides broader options for pilots and scaling—from around 1,000 pieces upward—while Korea often prefers tighter, premium-oriented batches. Choose based on your test plan and rollout cadence.

China’s supplier variety enables staged launches: pilot at 1,000–3,000 units, then ramp to 10,000+ with minimal friction. Korea supports small premium batches for limited runs, brand signals, and demo programs. Align MOQs with your learning goals, not just unit economics—pilot where your feedback loop is fastest, then scale where your landed cost supports your channel.

How long is the typical lead time for China vs Korea golf ball production?

Lead time varies by season and complexity; plan buffers and lock finishing slots early. Core drivers include finishing-lane availability, seasonal peaks, resin and ink availability, packaging print queues, capacity allocations, and export routing/customs. Dual-sourcing helps hedge variability between plants and lanes.

For standard SKUs with common materials, China’s end-to-end ecosystem shortens queue times for packaging and printing. For complex urethane and special finishes, Korea can move quickly on pilot lots and limited editions, especially when you align early on paint/ink specs. Always add buffer for peak export weeks and maintain an approved alternative finish stack to avoid paint line congestion.

Can I split production between China and Korea without quality inconsistency?

Yes—if you standardize BOMs, molds, paint stacks, and QA metrics across both plants and run periodic cross-validation, dual-sourcing can deliver consistent feel and appearance. The key is change control, not geography.

Use golden samples, compression windows, weight tolerances, and color/gloss Lab ranges that both plants must meet. Conduct quarterly inter-plant round-robins: swap sample lots, measure dispersion, and correct drift promptly. Keep a shared corrective action tracker, and align on incoming material certification to reduce variability from suppliers.

Do Korean factories offer better design or R&D support than Chinese ones?

Korea often provides strong process engineering for urethane and finishing, but China also supports design iteration at scale. The best option depends on your spec, not the passport—pilot both where possible and compare iteration cycles.

For complex cover chemistries, Korea’s process stability helps crystallize spec quickly. In China, access to a wide supplier base for resins, inks, and boxes accelerates iterative runs once your design stabilizes. If your project needs rapid paint/print experiments, align with the factory that can clear finishing lanes and deliver fast turn samples.

How much extra do I pay for “Made in Korea” label per dozen?

Expect roughly a mid-single to high-single-digit dollar premium per dozen at the COGS level for 3–4 layer urethane, before duties and freight. Whether that’s worth it depends on your ASP, review scores, and channel positioning.

If retail and pro-shop partners value origin and if your marketing leverages it effectively, the premium can be recovered through higher price points and reduced returns. If your channels are price-elastic and origin messaging is weak, the premium compresses margin. Pilot with A/B pricing and monitor real-world conversion and return data.

What’s the defect rate difference between Chinese and Korean golf ball OEMs?

Averages vary by plant and spec, but Korean runs often show narrower dispersion in critical QC metrics. Chinese premium lines can match performance when specs are locked and change control is applied. Compare apples to apples with blinded test lots.

Track weight/compression variance, cover blemishes, paint voids, and logo registration. Ask for rolling 30-day and 90-day DPPM data, not just snapshots. Run acceptance sampling on incoming lots and correlate with returns and review sentiment by SKU and batch to decide where premiums genuinely pay back.

Conclusion

If your roadmap includes a flagship urethane ball whose feel and consistency must signal premium quality, Korean manufacturing can justify a higher per-dozen cost through QA and branding lift. If your growth depends on price-sensitive channels and seasonal scale, China remains the cost-optimized base for mid-tier and high-volume SKUs. Most brands will gain by combining both—prototype and halo runs in Korea, scale in China—under a unified BOM and QA framework that keeps performance and appearance consistent across seasons.

You might also like — How to Source OEM Golf Balls from China: Specs, MOQ & Lead Time