Materials are similar ($0.15–0.32/ball). China’s power is slightly cheaper ($0.005–0.013 vs $0.007–0.016), labor higher ($0.05–0.12 vs Malaysia $0.04–0.08), and packaging cheaper. For 3/4-layer cast-urethane cover projects, China’s yield/scale usually lowers US landed cost overall.

What can each country mass-produce today (2/3 Surlyn vs 3/4 Urethane)?

Both can stably mass-produce 2/3-piece Surlyn; repeatable 3/4-layer Urethane mass production is concentrated in China. Malaysia shows small-volume/specialty (e.g., night-glow) and regional brands, but lacks public proof of large-scale multi-layer Urethane with consistent yields and CT/X-ray concentricity control.

China’s supply chain density—PBR cores, ZDA crosslinker, Surlyn/ionomer, in-house molds, cast-PU, pad print, and packaging—shortens validation and stabilizes yields. Malaysia supports local and regional brands, event balls, and specials like night-glow, but market signals for repeatable 3/4-layer Urethane scaling remain thin. For mainstream DTC or retail-grade multi-layer Urethane, you’ll typically see China leading on process control, mold precision, coating lines, and metrology access.

Production overlap & gaps (2/3 Surlyn; 3/4 Urethane)

Overlap is strong on 2/3-piece Surlyn; gaps widen on 3/4-layer Urethane. Malaysia can deliver small-to-mid Surlyn runs and specialty SKUs. China runs the full stack from 2-piece Surlyn to 4-layer Urethane at scale, with more consistent shell-thickness control and concentricity across batches.

| Structure | China | Malaysia | Notes |

|---|---|---|---|

| 2-piece Surlyn | High-volume mainstream | Viable at volume | Both mature; gifts/events overlap |

| 3-piece Surlyn | Mature | Limited/smaller volumes | Malaysia skews to regional/event |

| 3-layer Urethane | Core battleground | Limited evidence; small/special | China publishes multi-layer PU |

| 4-layer Urethane | Scalable with validation | No clear mass-scale signal | Higher demand on molds/process |

✔ True — Malaysia can build multi-layer Urethane samples and specials

Small-batch or specialty SKUs (e.g., night-glow) exist. However, consistent mass-scale 4-layer Urethane with high yields isn’t publicly evidenced.

✘ False — “Malaysia is broadly equivalent to China on 3/4-layer Urethane”

China shows broader, repeatable scaling, with more published multi-layer Urethane capability.

Why Urethane scaling favors China (formula/molds/process/yield)

Multi-layer Urethane favors factories with tight thermal windows and robust metrology. Cast-PU cover chemistry, mold tolerances, coating lines, and curing control must all line up, or shell thickness and concentricity drift. China’s experience curve—more active lines, CT/X-ray on floor, and ready access to coating chemistries—reduces iteration loops and improves first-pass yield.

Problem → Section: Can I secure stable mass-production on my target construction?

If you need 3/4-layer Urethane with retail-grade consistency, plan validation in China first, then evaluate secondary geographies for region-specific stories or specials.

How do per-ball costs compare: labor, materials, power, packaging?

Materials are similar ($0.15–0.32/ball). Power: China $0.005–0.013 vs Malaysia $0.007–0.016. Direct labor: Malaysia $0.04–0.08 vs China $0.05–0.12. Packaging: China $0.03–0.10 vs Malaysia $0.05–0.12. Net: China ≈ Malaysia or slightly better on complex Urethane due to yield.

Materials per ball (2/3 Surlyn; 3/4 Urethane): $0.15–0.32

Use construction and mass per layer to estimate. Typical ranges (USD/ball): 2-piece Surlyn $0.15–0.20; 3-piece Surlyn $0.15–0.22; 3-layer Urethane $0.18–0.28; 4-layer Urethane $0.20–0.32. Shell thickness sits ~0.9–1.0 mm; USGA weight limit at 45.93 g caps total grams. Surlyn and PU resin pricing are globalized; country deltas are usually marginal.

Electricity: 0.06–0.12 kWh/ball; MY $0.007–0.016; CN $0.005–0.013

Forming plus curing/printing draw ~0.06–0.12 kWh per ball. 2025 commercial tariffs imply Malaysia ~$0.11–0.135/kWh vs China ~$0.088–0.112/kWh. That’s roughly $0.007–0.016 per ball (MY) vs $0.005–0.013 (CN). Thin margin, but it stacks across SKUs.

Direct labor: MY ~$0.04–0.08; CN ~$0.05–0.12

Automation narrows the gap, but hourly rates still matter. With 0.8–1.5 minutes per ball, Malaysia commonly lands ~$0.04–0.08; China ~$0.05–0.12, depending on region and line design. Higher Chinese labor is often offset by better yields on complex Urethane builds.

Packaging: CN $0.03–0.10; MY $0.05–0.12

Small-lot print in Malaysia often prices higher than China’s ready stocks. White card single boxes or basic sleeves are more available and cheaper from China at low MOQs; Malaysia’s local print is fine but carries small-batch premiums.

| Cost pillar | China (USD/ball) | Malaysia (USD/ball) | What moves it | Yield sensitivity (±2% rework → Δ$/ball) | When it matters |

|---|---|---|---|---|---|

| Materials | 0.15–0.32 | 0.15–0.32 | Construction grams, resin mix | Surlyn: ~0.003–0.006; Urethane: ~0.004–0.010 | All builds |

| Power | 0.005–0.013 | 0.007–0.016 | Tariff × kWh per ball | ~0.0001–0.0003 | Volume lines |

| Direct labor | 0.05–0.12 | 0.04–0.08 | Takt time, automation | ~0.001–0.003 | Complex QA |

| Packaging | 0.03–0.10 | 0.05–0.12 | Print method, lot size | ~0.000–0.001 (scrap-driven) | Small lots |

✔ True — Materials are largely global-priced

Surlyn/ionomer and cast-Urethane inputs price off global markets; differences come from grams per layer and scrap rate, not country list price.

✘ False — “Malaysia has cheaper materials across the board”

Any delta is usually minor; construction and yield drive your per-ball outcome.

Will tariffs and compliance change US landed cost?

HTS 9506.32.0000: duty-free; re-check 301 each shipment. There’s no standing 301 line directly on finished balls, but actions evolve. Confirm classification and packaging HS splits to protect US landed cost; validate USGA/R&A conforming list status before launch (as of Oct 2025).

-

HTS duty baseline: 9506.32.0000 → “Free” (confirm per shipment/date).

-

301 updates: re-check before PO and before customs filing.

-

Components split: separate packaging/accessories HS codes in the PI.

-

US landed cost: document duty/fees assumptions with date stamps.

-

Compliance gate: validate USGA/R&A conforming status pre-launch.

HTS & 301: duty-free baseline and exceptions

Plan for “Free” under HTS 9506.32.0000, then confirm. As of Oct 2025, buyers still re-validate classification and any 301 updates before each shipment. Packaging kits or accessories can fall under different HTS, so list components separately in your landed-cost worksheet.

USGA monthly conforming list: acceptance logic

USGA/R&A “conforming” status is updated monthly; it’s your shortest path to tournament acceptance. Channel buyers often use it as a quality proxy. Being on-list doesn’t replace your own QA: you still need compression bands, coefficient of restitution, shell-thickness uniformity, and CT/X-ray concentricity checks.

✔ True — HTS duty-free ≠ zero risk

Duty-free baseline still requires per-shipment 301 cross-checks and correct HS for packaging/accessories to protect **US landed cost**.

✘ False — “Duty-free means no compliance work”

Classification, documentation, and USGA/R&A conforming list status remain critical.

| US import & compliance checklist | Owner | When to do it | Outcome |

|---|---|---|---|

| Confirm HTS as 9506.32.0000 | Broker | Before PO | Duty expectation set |

| Cross-check 301 applicability | Buyer | Before each shipment | Risk flagged/cleared |

| Validate USGA/R&A listing | Factory | Before launch | Event-use validation |

| Record construction grams | Factory | Pilot → Mass | Cost predictability |

| Separate packaging HS codes | Buyer | PI stage | Clean landed-cost calc |

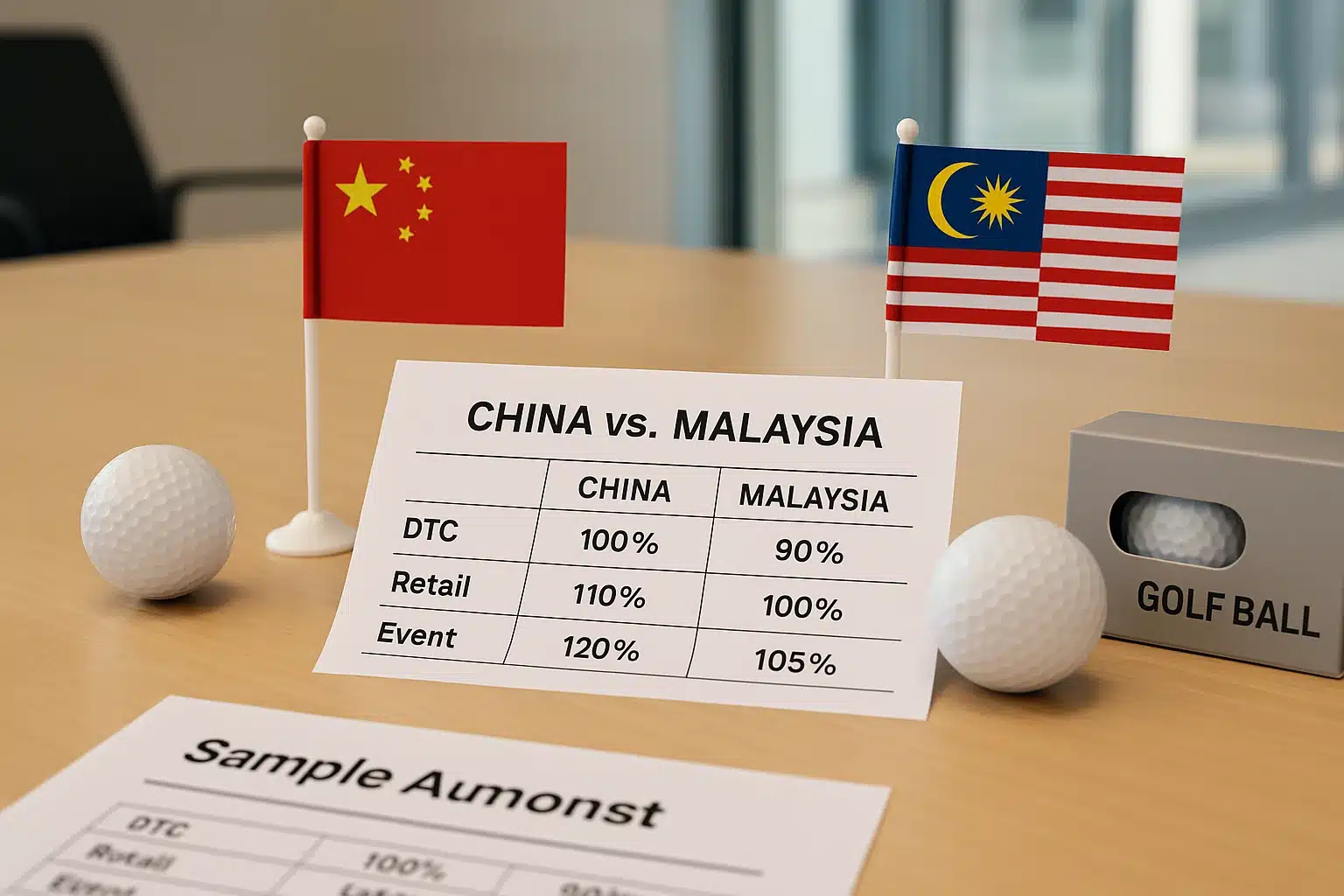

Which country fits my scenario: DTC launch vs gifts vs retail?

For multi-layer Urethane, tight schedules, and larger volumes, choose China; for events/gifts, small orders, ASEAN origin and ESG storytelling, choose Malaysia. For 2/3-piece Surlyn value SKUs, China typically wins on lead time, integrated packaging, and stability.

Scenario Matrix (Major Brands/Retail, DTC Launch, Event & Gift, Specialty Night-Glow)

Map your route to the production reality. Use the matrix below to align country choice with launch risk and validation bandwidth.

| Scenario | Best-fit country | Why it fits | Risk to watch | When to switch |

|---|---|---|---|---|

| DTC launch (3-layer Urethane) | China | Faster validation, better metrology access | Shell uniformity | If MOQ is tiny and timeline flexible |

| US/EU retail (4-layer Urethane) | China | Scaling + yield + QA toolchain | Coating temp control | If story > scale; pilot elsewhere only |

| Events/gifts (2/3 Surlyn) | Both; CN value | Faster CN packaging; MY suits regional events | Print MOQs | If ASEAN origin is required |

| Specialty/night-glow | Malaysia | Local niche & specials | Consistency | For retail-grade, validate in CN |

| ASEAN origin + ESG | Malaysia | GET green power contracts, origin label | Power premium | If cost/story tradeoff fails ROI |

Experience Factors (Yield, Stability, Validation Cycle, Test/Metrology Resources)

Experience hinges on yield and validation speed. For Urethane, line temperature control and in-house CT shorten iterations. For Surlyn gifts, print slots and kitting matter more than molding.

Problem → Section: Match my product path and tempo.

Push China when launch windows are tight; pick Malaysia when origin and narrative matter more than speed.

What MOQ and lead times should I expect in peak season?

China: 2/3-piece typically 1,000–3,600/color; 3-layer Urethane 5,000–20,000 (trial 1,000–1,500). Peak lead time 70–90 days. Malaysia: reprint ≈3 weeks; OEM with new molds 4–6+ weeks; multi-layer Urethane is project-based rather than published MOQs.

-

Peak window: April–September → book coating/print early.

-

Reprint vs OEM: separate lanes, timelines, and risks.

-

New molds: add time for steel, CMM, and coating validation.

-

Artwork lock: freeze early to secure print slots.

-

Split shipments: use pilots + staged deliveries to de-risk.

Off-Peak vs Peak Season (Apr–Sep) Differences

Book early for April–September. CN coating and print lines congest first. MY reprint lanes hold at ~3 weeks for stock balls, but new molds or complex builds stretch similarly.

Impact of New Molds/Resin and Coating Temperature Control on Lead Time

New molds and Urethane curing windows add weeks. Plan extra time for mold steel, CMM sign-off, and coating thermal validation. Build pilots with clear pass/fail thresholds.

Problem → Section: Schedule and time-to-retail.

Use the table as your baseline; lock packaging art early to avoid last-mile delays.

| Construction | China (typical MOQ) | China (manufacturing lead time) | Malaysia (typical MOQ) | Malaysia (manufacturing lead time) |

|---|---|---|---|---|

| 2-piece Surlyn | 1,000–3,600/color | 15–25 d small; 35–60 d large/new; 70–90 d peak | Event/reprint: ~1k+ | ≈3 w reprint; 4–6 w+ OEM |

| 3-piece Surlyn | 3,000–10,000/model | Same as above | Limited (print/fixed SKUs) | 3–6 w (new mold dependent) |

| 3-layer Urethane | 5,000–20,000/model (trial 1,000–1,500) | 35–60 d (new resin/coating) | No stable public MOQ | Project-based |

| 4-layer Urethane | ≥10,000/model | 45–70 d (yield-limited) | No mass signal | Project-based |

✔ True — Reprint ≠ OEM

Applying logos onto existing stock balls runs on different lanes and timelines than full OEM with new molds and custom constructions.

✘ False — “A 3-week reprint implies a 3-week OEM build”

OEM adds mold lead, validation, and coating windows.

How to verify quality quickly (before scaling orders)?

Run sample → pilot → mass with CT/X-ray checks; set shell & concentricity Cpk ≥1.33, confirm COR and compression bands before scale; use USGA-listed SKUs, then batch-verify consistency.

Pilot Sample Size & Scale-Up Thresholds

Pilot hard enough to learn, small enough to pivot. Typical gates: T0 golden sample set; T1 pilot with 300–500 balls for test/CT; go-mass when concentricity and shell-thickness Cpks meet thresholds and rework stays below your target.

Key Metrics & Acceptance Template (Compression, CT, COR)

Build a short COA that fits on one page. It should include compression bands, COR at specified speed, CT/X-ray concentricity distribution, and shell-thickness uniformity histogram.

Problem → Section: Reduce yield and consistency risk.

Share acceptance templates before pilot so the factory instruments exactly what you’ll judge later.

| COA sample fields | Method | Target | Action if out |

|---|---|---|---|

| Compression (Rast/BP units) | Standard jig | Within band | Rebalance core blend |

| COR @ mph | Calibrated rig | ≥ spec | Check cure/cover |

| CT concentricity | CT/X-ray | Cpk ≥ 1.33 | Mold alignment |

| Shell thickness | Section or CT | Cpk ≥ 1.33 | Coating window |

| Weight (g) | Precision scale | ≤45.93 g | Adjust grams |

✔ True — USGA listing speeds acceptance

It’s a baseline, not a guarantee of retail quality.

✘ False — “USGA listed means perfect quality”

You still need process control and batch consistency checks.

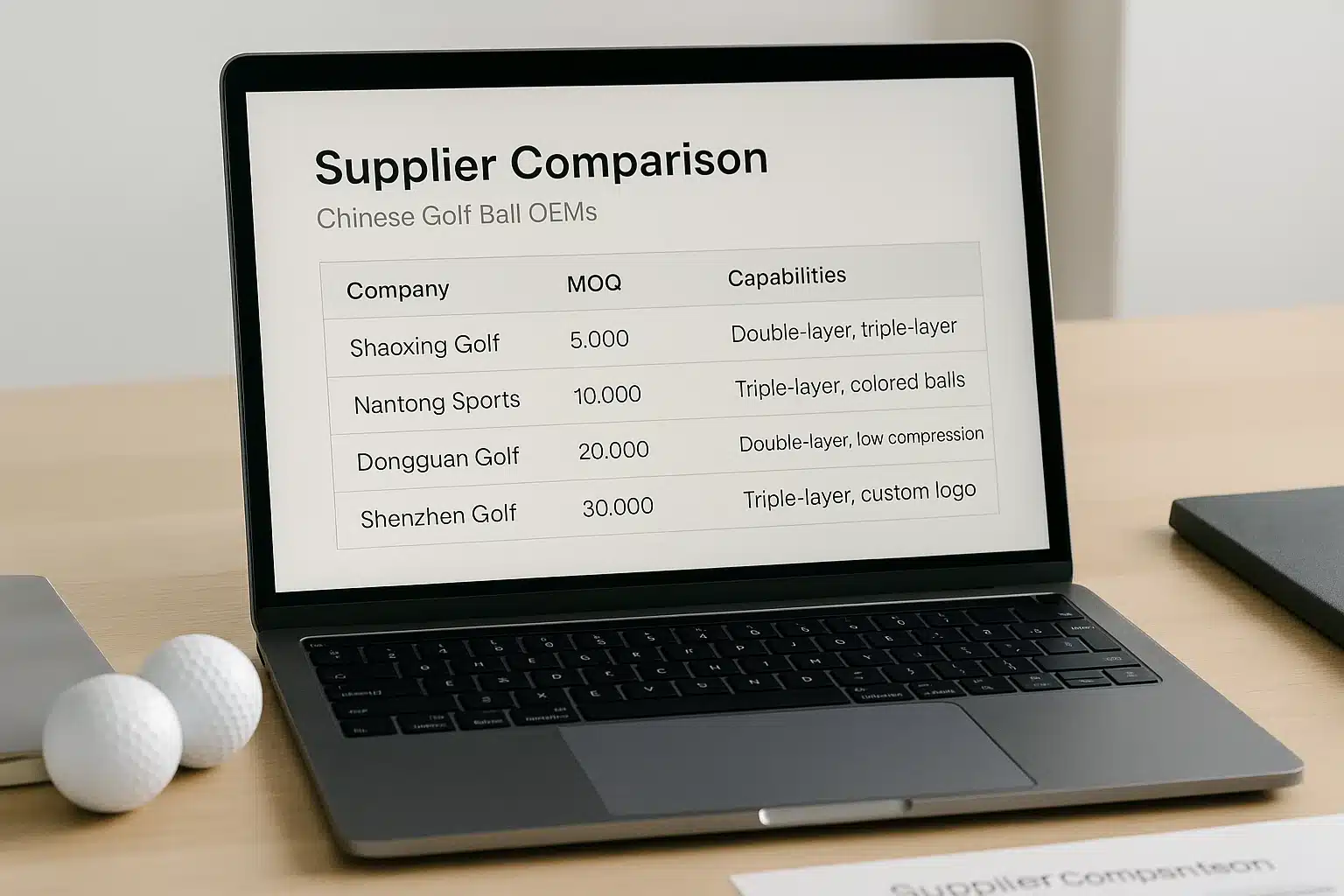

Which China OEMs serve small-to-mid orders (quick view)?

Four representative Chinese OEMs cover 2/3/4-layer—including Urethane—with trial-friendly MOQs for samples and pilots. Use this to fast-filter and initiate T0/T1 discussions.

| No. | Company | Location | Capabilities | MOQ |

|---|---|---|---|---|

| 1 | Grasbird | Hangzhou, Zhejiang | Specializes in 2-piece Surlyn balls, also makes 3-piece balls | 3,000–5,000 pcs |

| 2 | Golfara | Ningbo, Zhejiang | OEM for 2/3/4-layer balls, including Urethane-covered models | from 1,000 pcs |

| 3 | MLG Sports | Xiamen, Fujian | Produces 2/3/4/5-piece balls (Surlyn & Urethane) | 2,000–3,000 pcs |

| 4 | Shenzhen Xinjintian | Shenzhen, Guangdong | Offers 2/3/4-piece balls; claims in-house mold & production lines | 2,000–3,000 pcs |

✔ True — MOQ is negotiable

First-run pilots, split shipments, or shared print runs can lower effective MOQs.

✘ False — “Posted MOQ is fixed in stone”

Bring a forecast and packaging plan—then ask for a pilot lane.

FAQ

Will 301 tariffs hit finished golf balls to the US?

finished golf balls (HTS 9506.32.0000) are generally duty-free; re-check 301 for China each shipment.

Confirm HTS 9506.32.0000 with your broker, then verify active 301 updates before PO and before customs filing. Split packaging/accessories HS codes and reflect them in your landed-cost sheet. Keep date-stamped records per shipment (as of Oct 2025).

Are materials cheaper in Malaysia?

mostly no; Surlyn/ionomer and cast-Urethane inputs price off global markets—grams per layer and yield move cost.

Model materials by construction: 2-piece Surlyn $0.15–0.20; 3-piece $0.15–0.22; 3-layer Urethane $0.18–0.28; 4-layer $0.20–0.32. A 2-point yield hit on Urethane finishing can offset any small labor/material edge.

Can Malaysia do stable 4-layer Urethane?

not at mass scale with public evidence; small/specialty runs exist, but repeatable scaling is primarily in China.

You can pilot in Malaysia, but gate volumes and add CT/X-ray/shell-thickness thresholds. Keep a China contingency slot if retail timelines are tight.

What MOQ can I push for first run (Urethane 3-layer)?

China typically 5,000–20,000 balls/model; pilots ~1,000–1,500 are negotiable. Malaysia is project-based.

Ask for a pilot lane, split shipments, and mold amortization terms. Tie go-mass to CT and compression data.

How fast can I launch a DTC model before peak season?

lock art/molds early; China 35–60 days for new Urethane/coating (70–90 peak). Malaysia reprints ~3 weeks; OEM 4–6+ weeks.

Reverse-plan from launch; run pilot by late Q1, and book print slots once artwork is frozen.

Does USGA listing guarantee retail acceptance?

it helps a lot, but you still need batch consistency and performance within channel spec.

Maintain COAs for compression/COR and periodic CT/X-ray concentricity checks. Listing is a baseline, not a quality guarantee.

Is China consistently cheaper despite higher labor?

often yes for complex Urethane—power + yield + integrated packaging offset labor.

Total cost is a system outcome; a couple points of rework can erase labor gaps. For simple Surlyn gifts, either country works; China tends to win on value/lead time.

Can I source ASEAN origin for ESG marketing?

yes—Malaysia supports ASEAN origin and green-power (GET) narratives; model the kWh premium vs ROI.

Use origin/GET in sell-in decks if your buyers reward it. Validate that the story justifies the added cost and schedule constraints.

What’s the realistic lead time with new molds?

Malaysia 4–6+ weeks; China 35–60 days, longer in peak.

Add time for steel, CMM sign-off, and coating thermal validation. Secure backup slots and freeze artwork early.

Conclusion

China and Malaysia both handle 2/3-piece Surlyn well, but repeatable 3/4-layer Urethane is where China’s yield, metrology, and packaging integration usually lower US landed cost and time-to-retail.

If your priority is retail-grade performance on a tight calendar, pick China. If you need ASEAN origin, small event runs, or ESG storytelling, Malaysia works—just budget extra time and validate quality with CT/X-ray and clear go-mass gates.

You might also like — Where Are the Golf Ball Factories in China — And What Types Can They Produce?