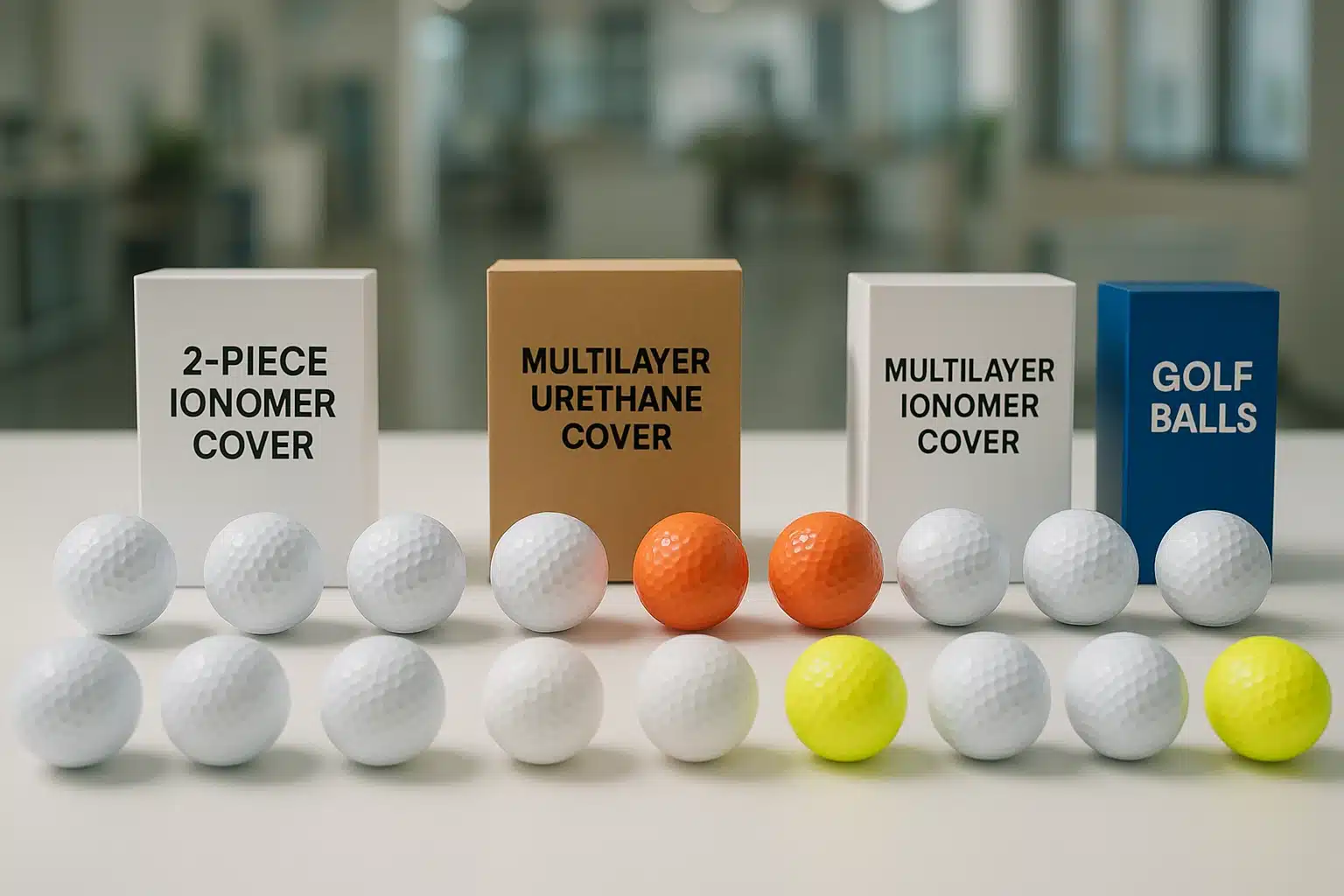

Some budget and OEM lines—and select batches from well-known brands—are among the golf balls manufactured in China. Chinese plants build 2-piece ionomer (e.g., Surlyn®) through multi-layer urethane balls. Quality is line-specific. Always confirm the box origin for your batch and verify model-level USGA/R&A compliance before you scale.

Are well-known brands made in China? (Reliability & verification)

Several global and DTC brands manufacture in China (and nearby Vietnam/Thailand/Taiwan); some Kirkland batches show “Made in China.” Reliability depends on process control, tooling, curing, coating and inspection—not country of origin.

Are well-known brands’ balls ever produced in China?

Yes—by batch and sometimes by color or revision. Check the current outer box for country of origin; production footprints shift as brands balance cost, capacity, and risk.

Treat each revision as its own data point. Track batch codes and keep retain samples so you can compare dispersion, compression, and cover durability across sources.

How should buyers verify origin and performance before committing volume?

Inspect the box label, file a Certificate of Origin (COO) with your PO, and request shipping documents. Validate the exact model name on the current USGA/R&A Conforming Golf Ball List

Add first-article and pilot-lot checks on weight/diameter symmetry, initial velocity, and flight windows at driver/7-iron/wedge speeds.

Does country matter less than capability?

Yes—capability beats country. Consistency comes from frozen BOMs, tight concentricity, stable urethane casting, and disciplined final inspection.

Ask for proof—CPK on weight/diameter (≥1.33), SPC control charts, and cover-thickness histograms across pilot and recent mass runs. Select factories that sustain these metrics over time, not just a single golden sample.

Origin & Compliance Checklist

-

Check box “Made in …” by batch/color.

-

File COO + shipping docs with the PO.

-

Match exact model string on the current USGA/R&A Conforming Golf Ball List.

-

Archive label artwork & test summaries; calendarize annual renewal.

Capabilities & categories (what Chinese factories can produce)

China can mass-produce 1–5 layer golf balls with ionomer, TPU, and cast-urethane covers—spanning range, game, and tour categories. Integrated lines (core → mantle → cover → coating/print → packaging) support colored/matte finishes and private-label kitting at mid-to-high volumes.

Terminology: Covers include ionomer (e.g., Surlyn®), TPU (thermoplastic urethane), and cast-urethane (thermoset). We use “urethane” generically; specify TPU vs cast-urethane when relevant.

What layers and covers are typical from Chinese OEM lines?

Mainstream builds include 2-piece ionomer for durability/value and 3–4-piece urethane for spin/feel; some plants run 5-layer tour SKUs. Cast-urethane is preferred for premium greenside control and cut resistance.

Leading factories can hold compression windows, concentricity, and cover thickness via SPC (Statistical Process Control). Freeze cover chemistry, dimple tool, finish, print method, and compression targets at RFQ.

How do Range, Game, and Tour categories map to production?

Range = 1–2-piece ionomer (with some limited-flight 3-piece); Game = 2–3-piece ionomer or 3–5-piece urethane; Tour = 3–5-layer cast-urethane with tighter tolerances.

Tour windows are narrower—cure time, mantle thickness, and symmetry must be proven. Ask for CTQ (Critical to Quality) definitions and CPK (Process Capability Index) baselines on weight, diameter, and cover thickness.

What production capabilities enable scalable private labels?

Qualified plants integrate ball-making with coating, pad/UV printing, and retail/gift packaging, enabling short changeovers and flexible MOQs.

This supports seasonal colors, matte finishes, and logo variants without re-qualifying multiple vendors. For e-commerce kits and event bundles, leverage tubes/sleeves, EVA trays, and custom boxes to compress timelines.

Lightweight summary table — builds and usage

| Category | Typical build | Cover | Primary use | Buyer notes |

|---|---|---|---|---|

| Range / Limited-flight | 1–2-piece | Ionomer | Practice | Lowest cost; high durability |

| Game / Conforming | 2–3-piece | Ionomer or urethane | Retail/league play | Balanced price & feel |

| Tour / Premium | 3–5-piece | Cast-urethane | Performance | Tight tolerances; SPC required |

Locations & supply-chain strengths (factory clusters)

Factories cluster in Guangdong’s Pearl River Delta (PRD), Xiamen/Quanzhou, and East China (Ningbo/Suzhou/Jiangsu). These belts combine cores, coating, printing, packaging, and export logistics—shorter lead times, flexible MOQs, and smoother container flow.

Why is the Guangdong PRD cluster so efficient?

High vendor density creates short shuttles between core-making, coating, printing, and packaging, cutting cycle time and risk.

For range/game volumes, PRD offers fast tooling turnaround and rapid color changes; for pilot tour runs, proximity to coating and test labs accelerates iteration and PPAP (Production Part Approval Process).

What do Xiamen/Quanzhou add?

Xiamen/Quanzhou excel in kit components (EVA trays, paper sets) and giftable bundles; several lines run 2–4-layer cores reliably.

If your program includes sleeves/tubes/accessories or event gifts, this belt can simplify kitting and reduce re-pack labor.

How does East China support replenishment?

Ningbo/Suzhou/Changshu/Nantong bring robust packaging ecosystems and port access—ideal for steady e-commerce flows.

When forecasts are predictable, East China’s packaging/logistics strengths keep inventory consistent and presentation uniform.

Cluster snapshot — advantages at a glance

| Region | Representative cities | Strengths | Best fit |

|---|---|---|---|

| South China (PRD) | Dongguan/Shenzhen/Huizhou/Zhongshan | Ball + coating/print + gift-box ecosystem | Range/Game volumes; Tour pilots |

| Minnan | Xiamen/Quanzhou | Bundles, 2–4-layer capacity | Promo sets, giftable SKUs |

| East China | Ningbo/Suzhou/Changshu/Nantong | Packaging & export logistics | E-commerce, steady replenishment |

Cost benchmarks & how to quote apples-to-apples

Yes. On average, China and Vietnam provide the strongest price-performance—especially for multi-layer urethane. Taiwan/Thailand excel in cast-urethane consistency, while the US/Japan carry higher labor/energy/regulatory costs. Keep one pricing “dial” consistent across RFQs to avoid confusion.

How do unit costs compare by country for common builds?

Use these EXW ranges for budgeting; actuals depend on spec, tolerances, clearcoat, and yield. Keep compression, cover material, dimple tool, and packaging constant across quotes.

| Category / Country | China | Japan | Taiwan | Thailand | Vietnam | USA |

|---|---|---|---|---|---|---|

| 2-piece ionomer | $0.20–0.45 | $0.80–1.60 | $0.40–0.70 | $0.35–0.60 | $0.30–0.55 | $1.20–2.20 |

| 3-piece urethane | $1.10–1.80 | $1.70–3.20 | $1.60–2.40 | $1.70–2.60 | $1.50–2.40 | $2.40–3.80 |

| 4-piece urethane | $1.50–2.30 | $2.20–4.20 | $2.00–3.20 | $1.80–2.80 | $1.70–2.60 | $2.80–4.50 |

What actually drives the cost gap?

Labor/energy, supply-chain density, resin pricing (ionomer vs urethane), equipment depreciation, and yield.

Taiwan/Thailand often show extremely stable cast-urethane yields (you pay a small premium for uniformity). China/Vietnam win on blended economics—especially at higher urethane volumes and full-kit bundles.

Buying mechanics: MOQs, lead times & scheduling

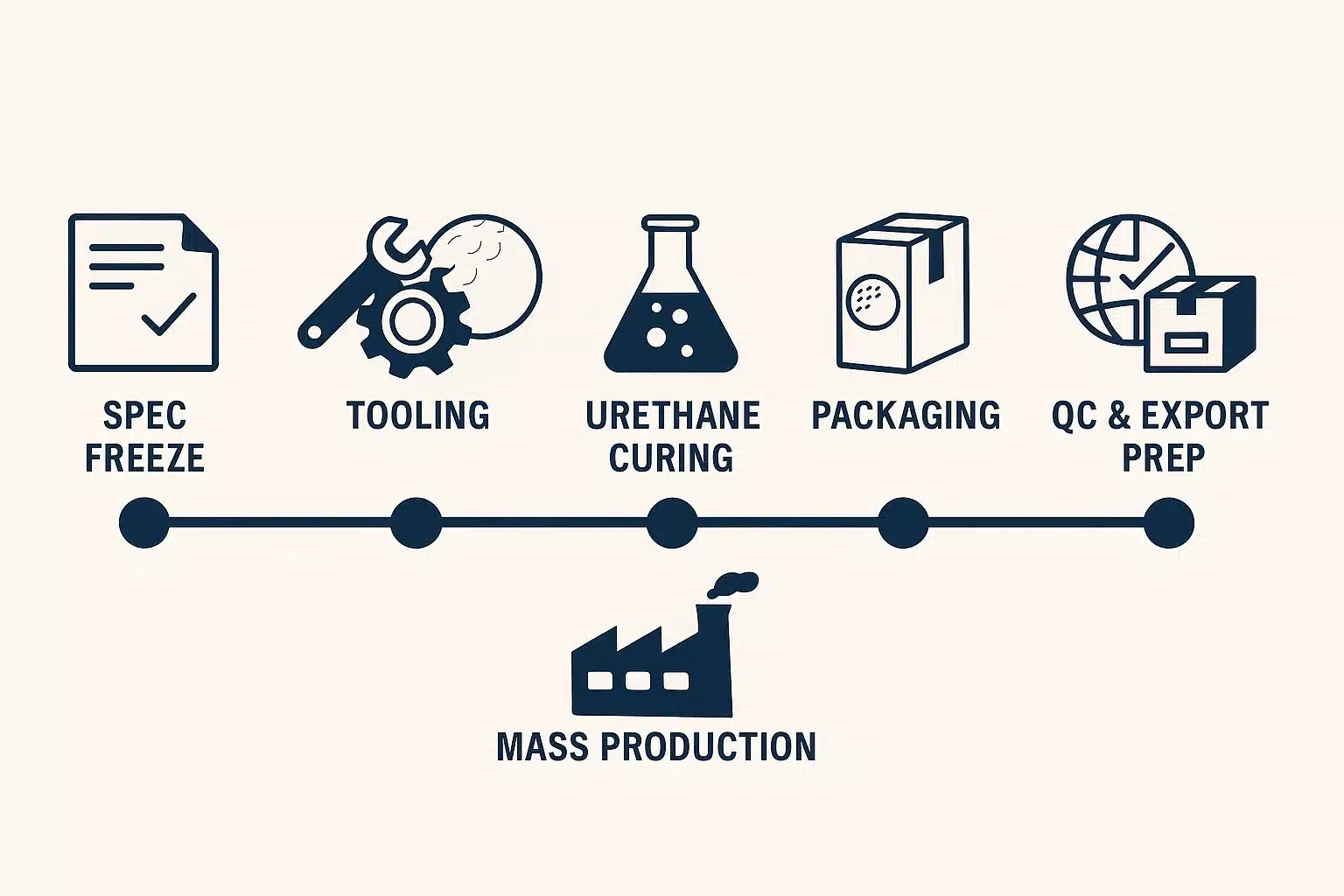

Pilot MOQs of 500–1,000 balls per model/color are realistic; standard runs trend higher. Plan ~1 week for samples after spec freeze and 3–6 weeks for mass production, depending on layers/cover, curing, and seasonality (ex-works; ocean not included).

What are realistic MOQs by category?

Range (2-piece): 1,000–5,000; Game (2/3-piece): 1,000–3,000; Tour (3/4-piece urethane): 3,000–10,000.

Some plants accept 500–1,000 for trials. Use separate MOQs by color/finish and align packaging runs (tubes/boxes) with resin batch sizes to avoid waste.

How long do sampling and mass production actually take?

Typical timelines: samples 7–21 days; mass production 3–8 weeks after approval, longer for cast-urethane curing and validation.

Parallel-path outer packaging and booking to save time. Keep buffer for QC, labeling, and export paperwork—especially in peak seasons.

What practical steps keep schedule and budget safe?

Freeze specs early, control drawing revisions, and schedule third-party inspections against your AQL (Acceptance Quality Limit).

Share launch dates and replenishment cadence so factories reserve line slots, stage urethane/ionomer, and kit packaging on time.

✔ True — What “lead time” actually includes

Lead time isn’t just production days. It includes material sourcing, QC buffer, packing prep, and sometimes customs readiness. Accurate planning means accounting for all parts of the timeline.

✘ False — “Once I pay, production starts right away”

Materials may need 5–10 days, tooling must be set, and line slots arranged. Rushing risks lower quality or missed shipping windows.

Compliance & contracts (USGA/R&A + sourcing workflow)

Yes. Conformity is model-based, not country-based. If the exact model name appears on the current USGA/R&A Conforming Golf Ball List, it’s legal for play. Some events adopt Model Local Rule G-3 and only accept models on the current list—plan renewals on your sales calendar.

How does the USGA/R&A Conforming Golf Ball List process work?

USGA/R&A assess weight, diameter, symmetry, initial velocity, and flight. The list updates monthly and renews annually by model name.

Country of origin does not factor into legality. Confirm your label and model string match exactly, and archive test summaries for each revision to avoid delisting surprises.

What contract language protects compliance?

Contract clause (copyable): “The exact model name must appear on the current USGA/R&A Conforming Golf Ball List at time of shipment, and Supplier will maintain annual renewal. Any material, process, or label change requires prior written approval and re-validation.”

Re-validation triggers (add these to your PO)

-

Coating/clearcoat change, color/ink change, or label text/layout change

-

Core/mantle formulation or supplier change; dimple tool change or refurbishment

-

Compression target or cover material (ionomer/TPU/cast-urethane) change

-

Factory relocation, line transfer, or new subcontractor involvement

✔ Clarification — certificates and samples aren’t blanket approvals

Lab reports validate a specific sample or lot only. Keep batch-level QC, retains, and re-validation when materials, processes, labels, or tooling change. Require notification within 5 business days and right to hold shipment pending re-test.

✘ Pitfall — “Once listed, always legal”

Models can be dropped if **renewal lapses** or **label/model strings** no longer match. Always check the **current** list before each shipment under Model Local Rule G-3 events.

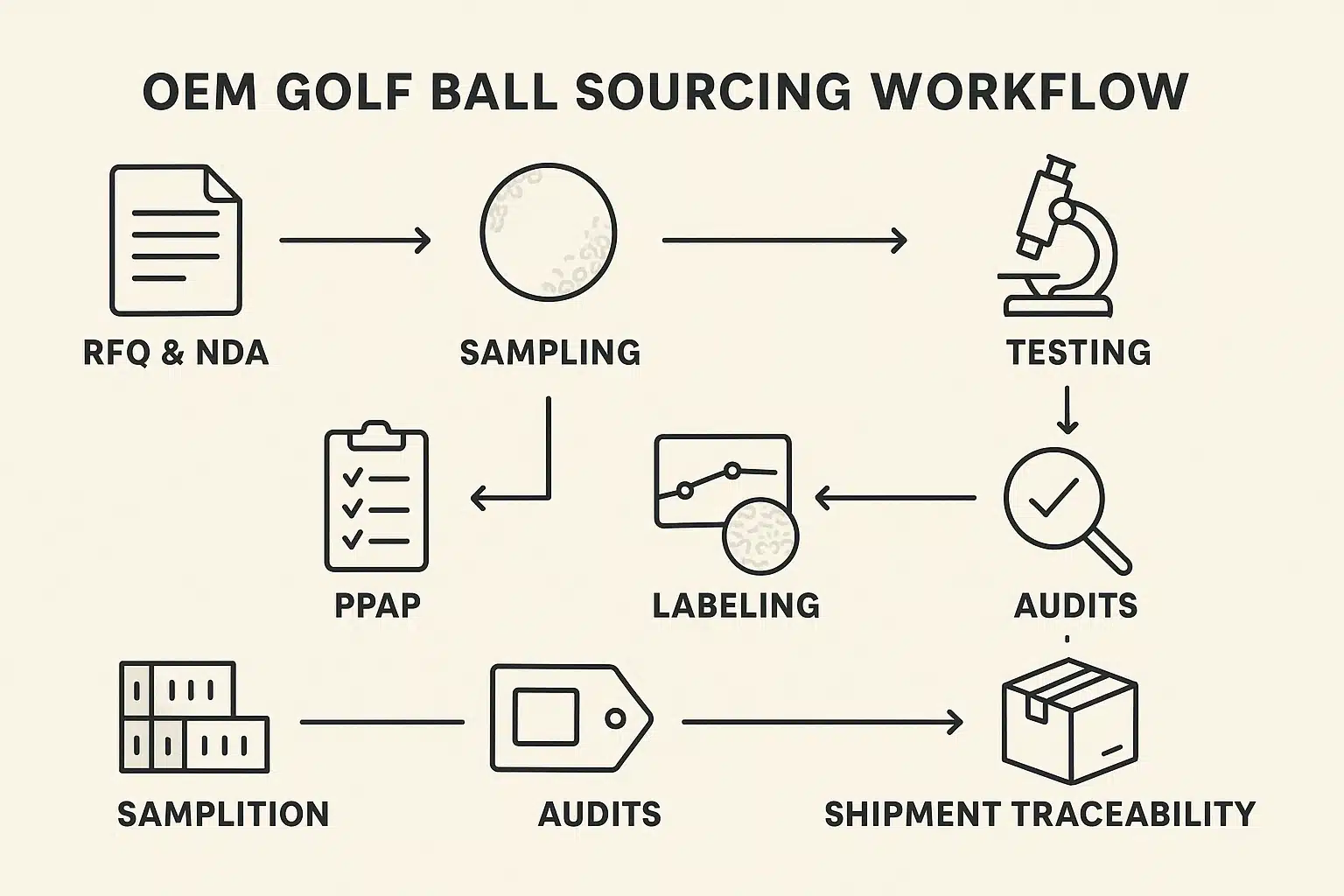

Sourcing workflow (steps)

Gate the journey: RFQ with frozen specs → NDA + pilot samples → USGA/R&A tolerance checks → PPAP (Production Part Approval Process) small-lot run → SPC (Statistical Process Control) with AQL at scale and full traceability. This protects your label, margins, and the end-user experience across seasons.

What must be frozen in the spec before RFQ?

Lock layers, cover material (ionomer/TPU/cast-urethane), compression targets, color/finish, print, and packaging.

Add testing expectations (ball speed, spin windows, landing-area dispersion) and the competitor set. Share annual volume and replenishment cadence so the factory can plan resin, coating, and packaging—and quote realistic MOQs.

How do you validate stability with PPAP/SPC and AQL?

Run a small PPAP lot to confirm capability (CTQ—Critical to Quality—and CPK—Process Capability Index) on weight/diameter/concentricity and on-course flight.

Implement SPC and AQL at incoming/outgoing. Keep batch retains, lot coding, and COO paperwork aligned with each shipment for traceability.

Do factory audits still matter after the first pass?

Yes—audits aren’t one-and-done. Ongoing process reviews, capacity checks, and social-compliance follow-ups predict long-term delivery and quality stability. Pair periodic audits with KPI reviews (yield, rework, on-time performance) and corrective-action tracking.

Appendix: Short FAQs

Are Kirkland golf balls made in China?

Some batches—including certain colors or revisions—have shown “Made in China”; origin can vary by batch. Always check the current packaging and file COO/shipping documents. Treat models independently regarding the USGA/R&A Conforming Golf Ball List.

Do Chinese factories produce tour-grade urethane balls?

Yes. Several plants cast urethane and run multi-layer constructions at scale; the bar is process capability, not geography. For tour intent, insist on cast-urethane lines, frozen BOMs, and documented CPK on critical dimensions.

What’s a realistic first order for a new private label?

Start with 500–1,000 balls per model/color to validate tooling, cure, and print consistency, then ramp. This contains risk while you collect PPAP/SPC data and refine packaging. Plan MOQs to match resin batch sizes and print-plate minimums.

How do I verify compliance quickly?

Search the USGA/R&A Conforming Golf Ball List for your exact model name and compare label strings; archive a PDF with your PO. Add a renewal reminder to your marketing calendar and re-test when you change coatings or colors.

Key Takeaway + Conclusion

China offers full-spectrum capability—from value ionomer to tour-grade cast-urethane—backed by dense supply chains and model-level USGA/R&A compliance. Verify origin by batch, validate the exact model, then scale through PPAP/SPC to achieve premium consistency at competitive landed costs.

For OEM buyers, sourcing golf balls in China balances capability, cost, and compliance. Freeze specs, confirm model-level legality, and build a gated ramp-up. That’s how you secure tour-grade performance with dependable supply and strong margins—consistently across batches.

You might also like — How to Source OEM Golf Balls from China: Specs, MOQ & Lead Time