The top 4 golf ball manufacturers in Taiwan for OEM are Launch, Foremost, Kerichem/Trust and SCANNA. Taiwan leads premium multi-layer builds, but capacity is concentrated.

Who are the Top 4 golf ball manufacturers in Taiwan at a glance?

Here’s the short list I share with buyers most: Launch, Foremost, Kerichem/Trust and SCANNA. Keep this table minimal on purpose—names, locations, ball types only.

Names are for market overview only; ownership/brand ties noted where applicable.

| Manufacturer | Location (Taiwan) | Main ball types |

|---|---|---|

| Launch Technologies Co., Ltd. | Pingtung | 2-piece ionomer; 3–4-layer urethane (OEM) |

| Foremost Golf Mfg. Ltd. | Douliu (Yunlin) | Cast-urethane multi-layer (OEM) |

| Kerichem Materials Science / TRUST | Taichung Port Park | 3-piece TPU/“urethane”; ODM/D2C |

| SCANNA Industrial Co., Ltd. | Annan, Tainan | Customized/practice/special-spec balls |

Why are there only four OEM golf ball manufacturers in Taiwan?

Because true, island-based, mass-production ball manufacturers that accept OEM orders are concentrated in four entities. Trade directories often mix in brands, traders, or Taiwan-owned companies whose main capacity sits overseas—those aren’t local ball plants and shouldn’t pad a “Top-10.”

What counts as a “manufacturer” in this article?

Ball-making, not gear. I’m talking core/casing/cover/paint/print lines—an actual ball factory with repeatable processes and export readiness—not clubs, grips, tees, or a trading office.

When you shortlist, ask for pilot data: CT/X-ray slices (n≥5), dual-point COR, wedge-spin, and OOR/weight windows. If they can’t produce these, they aren’t ready to be your manufacturer.

Who gets excluded—and why?

Brand-owned lines that don’t take OEM, and Taiwan-registered groups whose real ball capacity is offshore. If the line won’t quote your SKU or the capacity lives abroad, it doesn’t serve your Taiwan OEM need.

Keep your list clean. It helps internal approvals and prevents RFQs from drifting into dead ends.

Which criteria decide the “Top 4” OEM factories?

Rank by thin-urethane capability, repeatability, validation workflow and line cadence. These four decide whether your SKU ships on time with consistent speed/spin—because pretty quotes don’t protect you from rework or missed seasons.

How do I read “thin cast-urethane capability”?

Use windows, not dots. For Tour/near-Tour targets, freeze a shell window of 0.45–0.65 mm, prove dual-point COR, and demand CT/X-ray slices for concentricity before you scale.

“Thin U” is where many good plants wobble. Without clear windows in the PO, paint and feel can look fine while spin drifts lot-to-lot.

- Shell window: 0.45–0.65 mm

- Dual-point COR windows: @38 m/s and @43 m/s

- Robot program: 1W/7I/50y wedge

- Concentricity: CT/X-ray slices (n≥5)

What consistency metrics actually matter?

Hold OOR ≤ 0.003 in at takt and weight ± 0.05 g; track ATTI 95 ± 5; aim for layer-thickness Cpk ≥ 1.33; set appearance windows (gloss/orange-peel/print density).

These are boring to read and priceless to enforce. They’re what keep retail feel steady and returns low.

- OOR: ≤ 0.003 in under real cadence

- Weight: ± 0.05 g with SPC sampling

- Compression: ATTI 95 ± 5 with drift logs

- Layer Cpk: ≥ 1.33 at pilot

- Appearance: gloss/orange-peel, print density windows

✔ True — “Ionomer” is the generic; Surlyn® is a brand

In RFQs, write “ionomer cover (e.g., Surlyn®/Iotek™)” to keep sourcing flexible and avoid single-brand lock-in.

✘ False — “Surlyn and ionomer are different categories”

Surlyn® is an ionomer brand, not a separate material family.

What MOQ & lead time are realistic in Taiwan OEM?

Expect higher MOQs and longer booking windows for cast-urethane; practice/promo lines move faster. Budget 8–12 weeks for ionomer SKUs; urethane adds validation time and line booking.

For buyers comparing Taiwan golf ball OEM MOQ, expect lower flexibility on multi-layer urethane and faster setups on ionomer/practice lines.

What should I plan for ionomer/practice projects?

Think 3k–10k per color/art as a typical MOQ range; samples are quicker and line changes are more forgiving.

Good factories will pilot smaller to prove repeatability and print quality, then roll. Keep your OOR/weight windows generous to control yield and landed cost.

What about multi-layer urethane?

Think 5k–20k per SKU. You’ll need pilot time, shell windows, robot curves, and booking windows.

Put validation conditions in the PO so seasonal slots survive and no one debates “done or not” mid-season.

How do I protect my shelf date?

Parallelize balls and boxes. Approve dielines/PANTONE while the pilot runs; book vessel space early for peak months; stage releases to keep early defects from contaminating the lot.

When in doubt, split the first PO and keep retention samples for each lot.

✔ True — MOQ reflects process setup, not “factory greed”

MOQ captures setup losses, print swaps, curing batches and QC sampling. Strong plants may pilot smaller lots to prove stability, but sustaining micro-lots forces trade-offs in price or timing.

✘ False — “If a plant is strong, it should accept any MOQ”

Unlimited micro-lots explode rework and unit cost. If you must fragment SKUs, consolidate materials and freeze artwork to reduce changeovers.

What should buyers do about risk & compliance after the 2023 Pingtung fire?

Audit chemical storage, safety processes and capacity buffers early. Taiwan’s ball capacity is concentrated; single-site shocks ripple globally—so write EHS, tracing and release discipline into the PO.

What goes on the EHS audit checklist?

MSDS, storage limits, paint/solvent handling, ventilation, extinguishers and drills—plus incident response SOPs.

Include coating durability tests and humidity controls. Ask for recent third-party EHS audits and corrective actions.

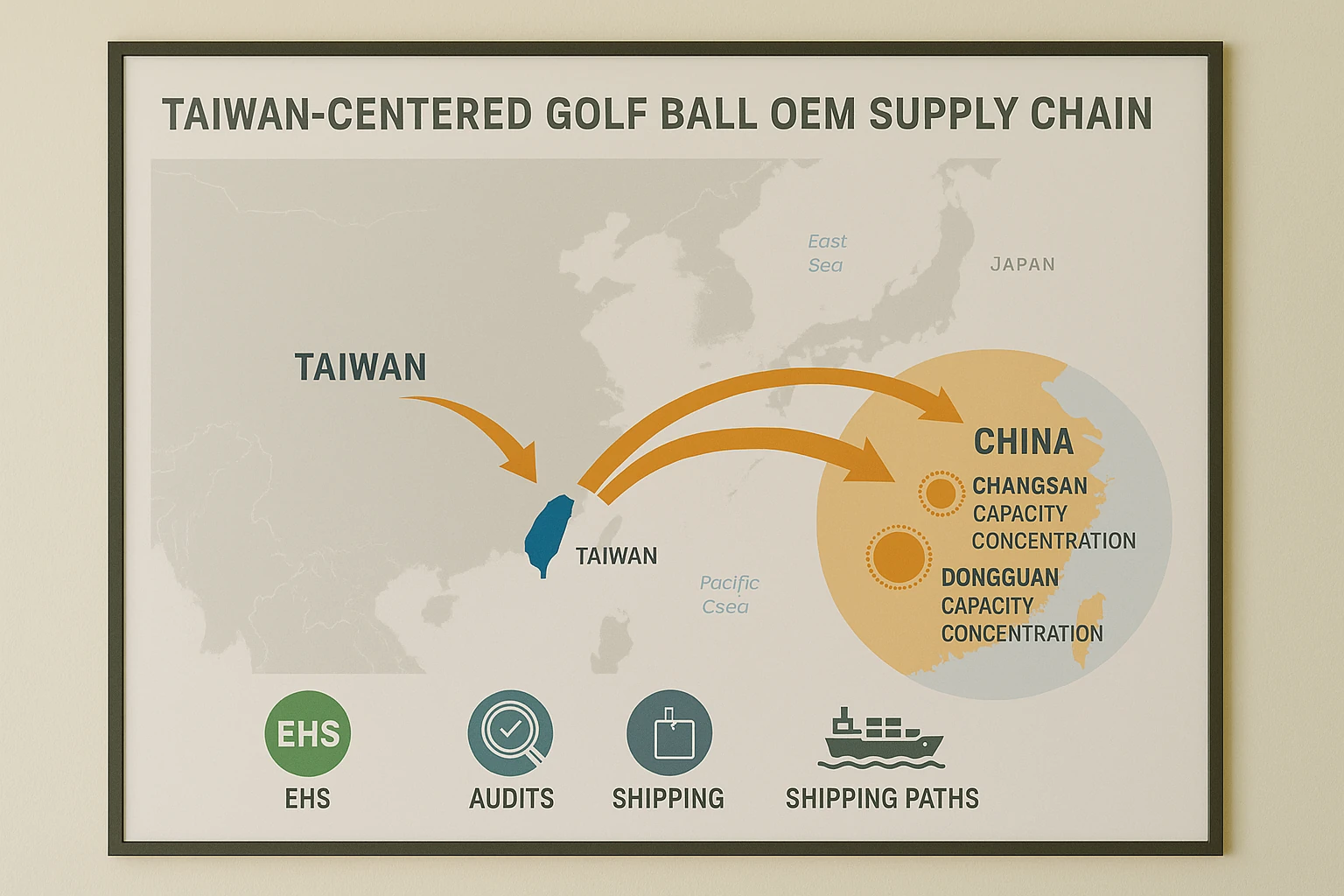

How do I buffer capacity risk?

Two plays: dual-source critical SKUs or pair Taiwan + China by project tier.

For example, keep your hero urethane ball in Taiwan and run promo/range or urgent replenishment in China. In peak season, split POs to de-risk line congestion.

How do I lock version control?

ECO levels and timing—minor ≤7 days; medium ≤15 days—plus lot retention samples, carton/pallet specs, and batch traceability.

Write pass/fail in the PO; releases stage-gated so early defects don’t contaminate the whole lot.

Taiwan vs China: when should a buyer choose which?

Use Taiwan for proven multi-layer consistency; use China for speed, lower MOQs and multi-SKU promo/practice projects. Many of my clients split early validation in China, then scale core retail in Taiwan.

When does Taiwan win?

Hero SKUs, Tour/near-Tour builds, and brand promises that live or die on feel and greenside spin.

You’ll pay more, and MOQs climb, but repeatability and long-run consistency protect P&L and reviews.

When does China win?

Price, speed, and SKU agility—2-piece/practice, colorways, LED, and gifting sets.

While China is the speed leader for promo and gifting, Taiwan still has capable range ball manufacturers when you need island-based sourcing.

Freeze common specs (artwork, carton, labeling) so both sides can run without rework.

What smart split strategies work?

Option A: pilot and urgent lots from China, scale steady cadence from Taiwan. Option B: dual-source in peak season to keep shelf dates.

If you search “OEM golf ball Taiwan,” you’ll see capacity is concentrated—this page explains how to vet the four factories and keep timelines safe.

FAQ — Short answers buyers need

Short answers you can paste into internal briefs—MOQ, lead time, Tour claims and drift control in Taiwan OEM.

Why not “Top-10” in Taiwan?

Because the island’s mass-production ball capacity sits in four OEM manufacturers.

Directories often list gear makers, traders or offshore lines—which don’t help you place an OEM ball order on Taiwan soil.

Can Taiwan build true tour-grade balls?

Yes—select plants can.

Enforce thin-urethane shells, dual-point COR, OOR/weight/compression windows and robot curves before scaling.

What lead time should I plan?

Plan 8–12 weeks for ionomer; urethane needs validation and booking windows.

Parallelize balls and boxes, book peak-season vessels early, and stage releases.

How do I avoid drift on promo/range balls?

Use generous compression/COR windows and clear paint/print tests.

Stage releases so early defects don’t contaminate the lot; strengthen cartons and pallets for export.

What’s the key takeaway for OEM buyers?

For golf ball manufacturers in Taiwan, the shortlist is four verified OEM plants. Rank by thin-urethane skill, repeatability and validation workflow; lock windows in your PO to control MOQ, samples and lead time.

What’s my conclusion for buyers comparing golf ball manufacturers in Taiwan?

Capacity in Taiwan is concentrated, which is both a strength (consistency) and a risk (single-site shocks). Use Taiwan for proven multi-layer builds and pair early validation or multi-SKU promos with China golf balls factory to protect timelines and cost.

Ready to get OEM golf ball samples & a quote from Golfara?

Smaller by design, faster by choice. Golfara fills the gaps big Taiwan plants can’t prioritize: small-lot quick turns, multi-color gifting, 2-piece/practice, and custom packaging. Low MOQ 1,000 pcs, 3-day printed samples, ≤10 working days for small-batch production, and a clear quote within 12 hours.

- Low MOQ: from 1,000 pcs

- Samples: printed in 3 business days

- Production: small batches in ≤10 working days

- Design team: logo imprint & custom packaging

- Response: ≤12 hours with detailed quote & plan

You might also like — Top 10 golf ball manufacturers in Japan for OEM