Range balls are built for practice durability and sometimes limited flight; game balls are conforming retail models for regular play; tour balls are the high-performance urethane subset within game. For B2B sourcing, origin, construction, MOQ, lead time and packaging reshape landed cost and channel fit more than EXW (Ex Works) alone.

Definitions: Range vs Game vs Tour

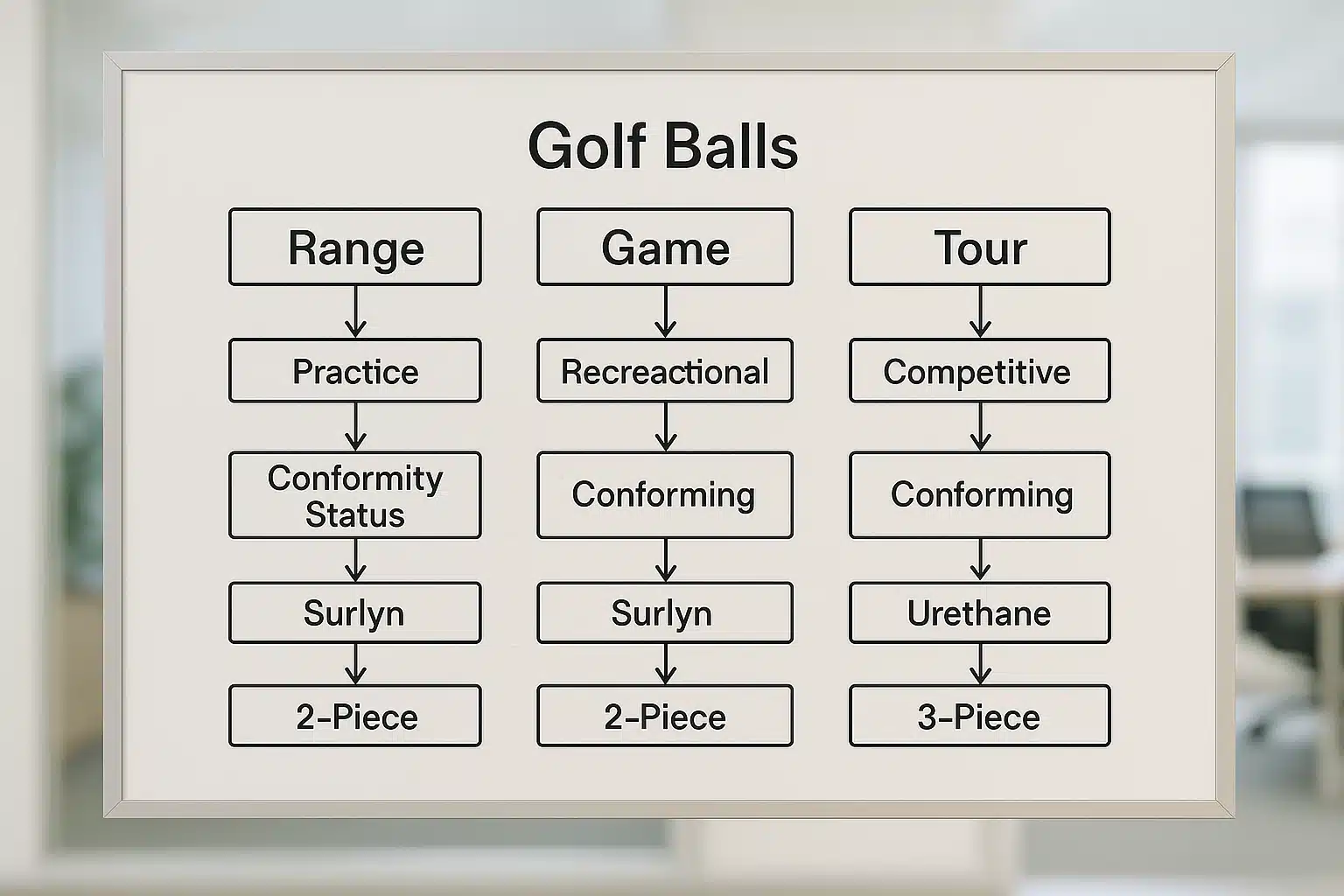

Range means practice-first durability and often limited-flight behavior, usually outside competition rules; Game means conforming models that pass the current USGA/R&A list; Tour means the urethane, high-tolerance subset inside Game for elite control. Anchor your taxonomy to usage and current list status before debating materials.

How does each category map to meaning, conformity, and build (at a glance)?

A short matrix prevents team confusion when you brief suppliers and channels. Conforming status is the red line; cover and layers tune feel, spin and durability. Range lives outside tournament play; Game spans ionomer to urethane; Tour lives inside Game and almost always uses urethane for bite.

| Category | Core Meaning | Conforming? | Typical Cover | Typical Layers |

|---|---|---|---|---|

| Range | Practice durability / high turnover; may be limited-flight | Usually No | Ionomer | 1–3 |

| Game | Competition-legal retail models | Yes (current list) | Ionomer or Urethane | 2–5 |

| Tour | High-performance inside Game (elite/low-hcp) | Yes | Urethane (cast/TPU) | 3–5 |

Does “2-piece ionomer” describe usage or only the construction?

“2-piece ionomer” describes structure and material, not usage by itself. The same 2-piece recipe can be tuned as a durable range ball or as a conforming distance-oriented game ball—if it appears on the current list. Never let shorthand like “2-piece” override the compliance gate or channel purpose.

It’s tempting to label all 2-piece balls as “practice,” but that collapses different intents. Distance game balls often keep a two-layer build for stable launch and low spin off the driver. Range variants in two pieces usually thicken the cover and harden the ionomer blend for turnover and retrieval cycles.

✔ True — “2-piece ionomer” is a structure+material label

It can be a range ball or a conforming distance game ball depending on tuning and whether it’s on the current USGA/R&A list.

✘ False — “2-piece ionomer equals practice/non-conforming”

Never conflate construction terms with usage categories.

Can a ball stamped “Practice” still be legal for tournaments?

✔ True — A “Practice” stamp can still be a conforming model

Some balls stamped “Practice” are cosmetically downgraded versions of a current-listed model and remain tournament-legal where G-3 applies. Always check the exact model name against the current USGA/R&A list.

✘ False — “Anything marked ‘Practice’ is non-conforming”

Range-only balls often carry “RANGE” or high-visibility markings and typically are not listed; don’t confuse these with practice-stamped conforming balls.

Construction & Materials

Range prioritizes thicker, harder ionomer covers and sometimes limited-flight cores to survive thousands of strikes and retrievals; Game spans 2-piece ionomer distance lines to multilayer blends; Tour typically runs 3–5 pieces with urethane covers and tighter tolerances for short-game spin and feel.

Which constructions show up most often by category, and why?

This mapping converts marketing headlines into factory options you can quote. Range favors simple or limited-flight builds; Game is broad; Tour almost always means urethane plus strict yield control. Cover chemistry and thickness shape scuff resistance, feel and wedge spin at any given compression.

| Category | Common Constructions | Cover Notes | Optimized For |

|---|---|---|---|

| Range | 1-piece; 2-piece ionomer; limited-flight | Thicker/harder ionomer | Durability, retrieval cycles, limited carry |

| Game | 2-piece ionomer; 3-piece ionomer; some 3-piece urethane | Thinner/finer cover | Stable distance, playable feel |

| Tour | 3–5-piece urethane (cast/TPU) | Urethane preferred for bite/feel | Short-game spin, control, consistency |

Is a 3-piece automatically “tour,” or does the cover still decide?

Layer count alone does not crown a tour ball. A 3-piece ionomer is usually mid-tier game with forgiveness and durability; a 3–5-piece urethane construction with tight tolerances earns tour status. When in doubt, follow: current list → cover (urethane vs ionomer) → layers → target player profile.

A thin urethane cover increases friction on partial shots, which grows spin and stopping power. Casting vs TPU also changes feel and scuff patterns. Mantle chemistry mediates launch and driver spin. Two “3-piece” balls can live in completely different categories because the cover and tolerance strategy diverge.

How do dimples, coatings and tolerance control influence results?

Dimple counts and patterns regulate lift and drag; coatings fight scuffs and yellowing; statistical process control narrows variation. Tour programs pay for tighter weight/diameter windows and symmetry, driving more consistent flight. Range programs tolerate more spread to prioritize durability and recovery speed.

In practice, coating systems can swing durability more than raw cover hardness. UV-cured clearcoats paired with urethane covers feel softer yet resist wedge cuts well. Range clears often go thicker and harder. Dimples must stay consistent across cavities and tooling life; tour balls enforce sharper rework thresholds.

On-Course Performance Differences

Range balls fly differently and bite less because they are tuned for durability and sometimes reduced carry. Game balls balance distance, launch stability and forgiveness. Tour balls push greenside spin and trajectory control with premium feel. Test with your intended gamer—range balls distort fitting and gapping.

Can we summarize launch, spin, durability and feel in one quick table?

Treat the grid as directional, not SKU promises. Launch windows and wedge bite also depend on dimples, compression and cover thickness. Durability is as much about coating as cover Shore D. Validate finalists with a launch monitor and real lies, not only mat shots in nets.

| Metric | Range (typical) | Game (typical ionomer) | Tour (urethane) |

|---|---|---|---|

| Driver launch/speed | Flatter / lower | Mid / stable | Mid-high / optimized |

| Wedge spin at 50 yd | Low | Mid | High (bite/stop) |

| Durability | Very high | Mid-high | Mid (coating chemistry matters) |

| Feel/sound | Firm/crisp | Balanced | Softer/“tour” feel |

Do limited-flight range balls distort fitting data and distance gapping?

Yes. Limited-flight or durability-tuned range balls show lower speed, altered spin and flatter flight, which understates carry and wedge bite; capture data with a premium conforming ball—ideally the player’s gamer.

✔ True — Limited-flight range balls distort fitting data

They’re tuned for durability/limited carry and often show lower speed, altered spin and flatter flight. Use premium conforming balls (or the player’s gamer) when capturing launch-monitor numbers or deciding shaft/loft.

✘ False — “Range balls are fine for distance gapping and wedge spin tests”

Practice balls under-represent carry and wedge bite, leading to wrong gapping and setup choices.

Does “soft/low compression” always mean slower and shorter for golfers?

No. “Soft” labels feel, not speed; ball speed is a system outcome—core, mantle, cover, dimples and conformance limits together decide it.

✔ True — “Soft/low compression” describes feel, not speed by itself

Ball speed is a system outcome (core, mantle, cover, dimples, IV (Initial Velocity) compliance). Many soft ionomer or urethane balls still deliver competitive driver speed; softness mainly alters impact feel and certain spin windows.

✘ False — “Soft balls are always slower and shorter”

Do not equate feel adjectives with distance; verify with launch-monitor data using the intended gamer ball.

How do wind stability and scuff resistance differ between categories?

Tour balls often hold line better in crosswinds thanks to tighter weight and symmetry control plus urethane grip on partial shots. Range balls resist scuffs best because of thicker ionomer covers and hard clears. Game balls live between those poles, trading tiny gains in bite for durability and value.

In sand or on hard range mats, thick ionomer shines. But when you need one-hop-and-stop on firm greens, urethane wins. Coating chemistry matters: some clears feel slick but resist cart-path scuffs, others feel tacky and grab the face. Ask for abrasion testing or share the target AQL (Acceptance Quality Limit) for cover defects.

Compliance: USGA/R&A List & MLR G-3

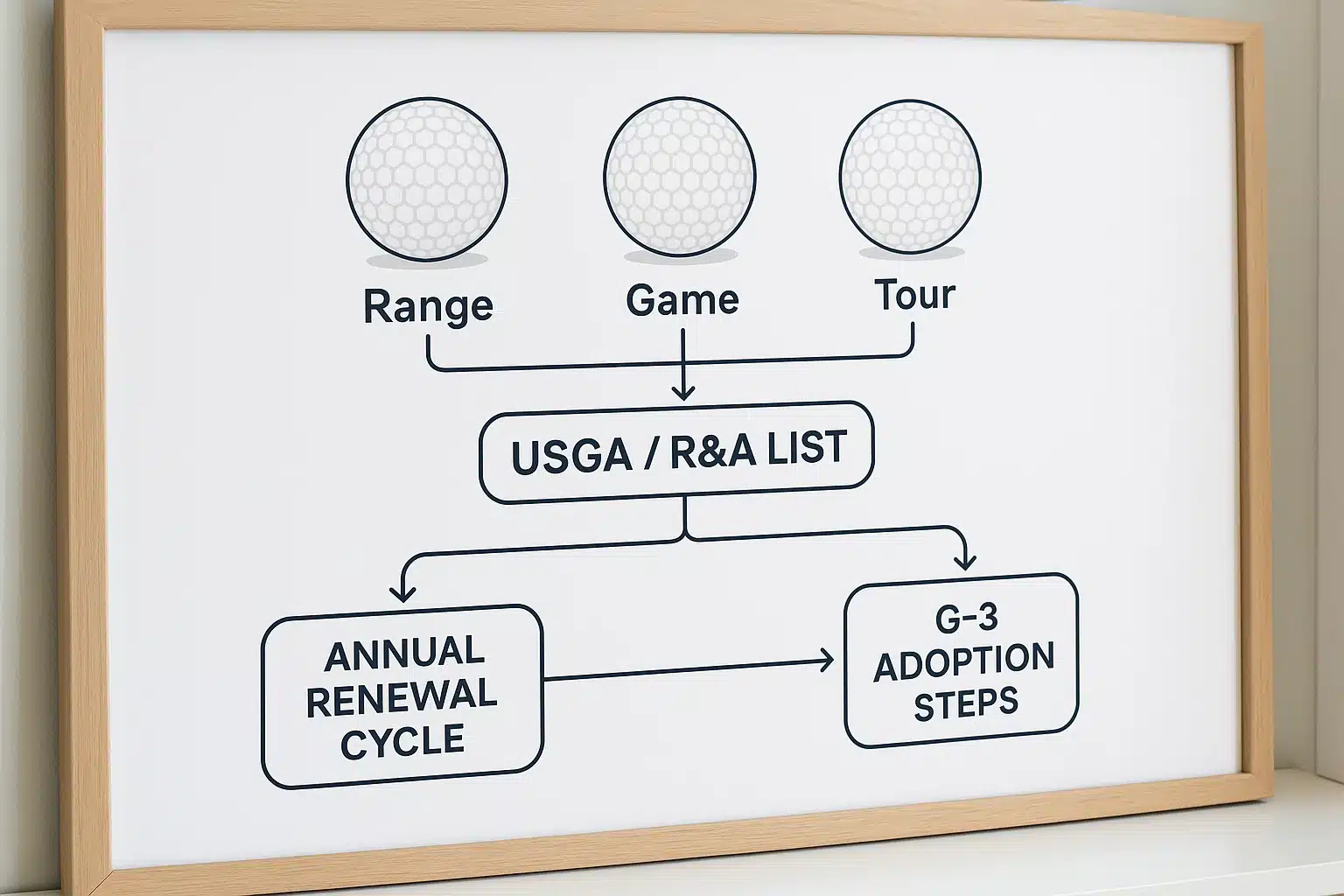

Game and tour balls must appear on the current Conforming Ball List. Many events adopt G-3, which accepts only current-listed models. Listings renew annually; missing renewal delists a model until resubmission (often with updated markings). Marketing and tournament use hinge on current status and exact naming.

Is conformance a one-time pass, or a credential you must renew every year?

It’s current-status. The list updates monthly, and manufacturers re-list annually to stay eligible. When G-3 applies, previously listed but lapsed models are not eligible. If you miss re-listing windows, resubmit—often with a new mark—to restore eligibility from the fresh effective date onward.

This is where sellers slip: “once listed, forever legal” is wrong when events adopt G-3. Treat your listing as a living credential. Keep a calendar reminder for the renewal month. Save PDFs or screenshots of the current list by model so marketing and sales can verify claims without delay.

Which naming and marketing pitfalls create the biggest risks?

Two traps dominate: claiming “conforming” without checking the current list, and changing markings while assuming it’s the “same model.” The list identifies exact names and marks. If you alter stamping, logos or play numbers materially, confirm whether it requires a new submission before you print cartons.

A safer template for copy is: “Model X appears on the current USGA/R&A Conforming Ball List as of [month/year]. Events adopting G-3 accept only current-listed models.” That phrasing anchors to reality without promising tomorrow. Train account teams to fetch the latest list before ad launches or tournament promotions.

Can a “Practice” stamp be conforming while a “RANGE” stripe is not?

Yes. “Practice” can be cosmetic grade of a listed model; “RANGE” stripes usually indicate balls intended solely for practice environments. Always check the exact model name against the current list and confirm the event’s local rules. In doubt, default to “no competitive claim” in marketing copy.

✔ True — Conformance is current-list based and renewed annually

Models must be re-listed yearly; events adopting G-3 only allow current listings. Save evidence and align copy with listing month and model mark.

✘ False — “Once listed, forever legal”

Missing renewal de-lists the model and bars it from events enforcing G-3 until it’s re-submitted and effective again.

Manufacturing Origins & Consistency

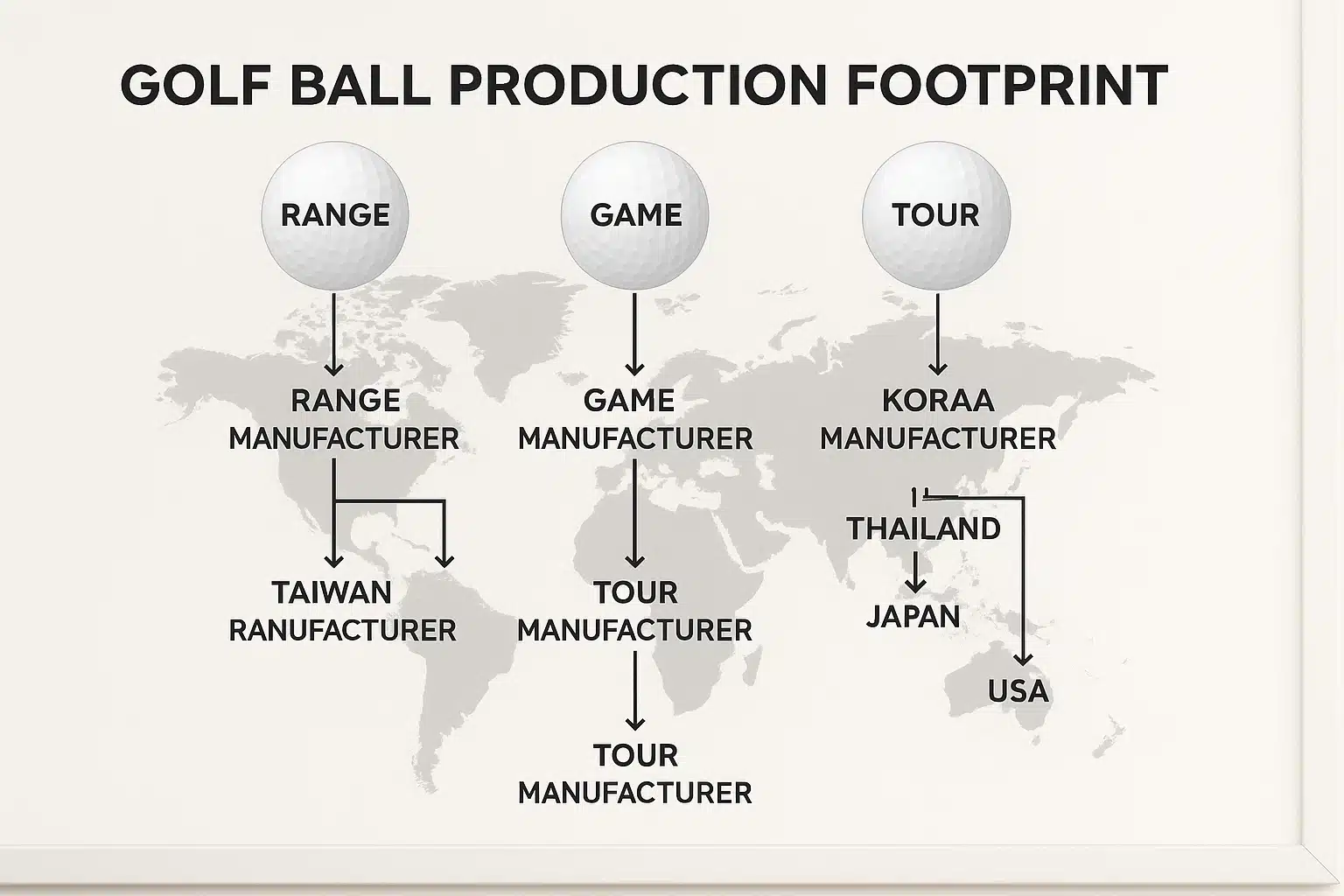

Production is Asia-led—China, Taiwan, Thailand, Vietnam, Korea, Japan—with U.S. brand plants in the mix. OEM availability, urethane capability and queue times vary by region. Treat origin as a lever for cost, MOQ and repeatability, not a quality verdict by itself; process control outruns postcode.

Which regions specialize in what, and what should buyers memorize?

Keep this compact so it fits a slide. Mainland China combines manufacturing scale with strong printing/packaging integration; Taiwan is a multi-layer OEM veteran; Thailand and Korea host brand plants; Vietnam is a fast-growing base for game lines; Japan is selective; the U.S. runs domestic flagships.

| Country/Region | Typical Role | Notes / Examples |

|---|---|---|

| China (Mainland) | High-volume range & game; some urethane | Flexible MOQs; fast artwork/packaging turns |

| Taiwan (Chinese Taipei) | Multi-layer & urethane OEM | Deep process control; capacity often pre-booked |

| Thailand | Brand plants & regional base | Tight tolerances; longer queues in peak |

| Vietnam | Growing OEM base | Balanced cost/quality for game lines |

| Korea | Urethane lines (brand-owned) | Integrated with brand portfolios |

| Japan | Premium tech & brand | High cost; selective OEM |

| USA | Brand plants | Domestic flagships; home-market priority |

Is “country = quality” a reliable rule, or do systems matter more?

Systems matter more. Supplier capability, tooling age, coating chemistries, and QA discipline drive outcomes long before country averages. Excellent urethane balls ship from multiple countries; weak outcomes appear when yield targets or inspection plans are vague. Judge factories by data, not stereotypes.

Ask for control plans (CPK (Process Capability Index) on weight/diameter), IV (Initial Velocity), and symmetry pass rates, and rework triggers on dimples and coating defects. A factory that shows hard evidence beats a famous postcode without data. Buyers who codify acceptance limits in RFQs reduce arguments and avoid “good enough” creep as lines get busy.

Costs, MOQs, Lead Times & Packaging

Costs scale with construction and region—urethane tour balls cost multiples of range/game in any country. MOQs rise with complexity and each variant; lead times follow curing and QA capacity. Printing method and retail pack can swing CBM and freight, so simulate landed cost per dozen before PO.

What EXW anchors by country and category should buyers expect?

Use the ranges as negotiation anchors, not promises. Real numbers move with cover chemistry, yields, colorways, logo passes, and seasonal capacity. Always simulate freight—CBM and dimensional weight can reverse “cheap” EXW choices, especially with tubes or blisters on air lanes.

| Country | Range (2-pc ionomer) | Game (2/3-pc ionomer) | Tour (3–4-pc urethane) |

|---|---|---|---|

| China | $0.20–0.45 | $0.45–0.90 | $1.50–2.30 |

| Vietnam | $0.30–0.55 | $0.55–1.00 | $1.70–2.60 |

| Thailand | $0.35–0.60 | $0.60–1.05 | $1.80–2.80 |

| Taiwan | $0.40–0.70 | $0.70–1.20 | $2.00–3.20 |

| USA | $1.20–2.20 | $1.60–2.80 | $2.80–4.50 |

Seasonality note: Aug–Nov is peak; book lines and lock dielines early to avoid queue slippage.

Should buyers optimize EXW unit price, or model landed cost first?

Model landed cost per dozen first. Freight is volume-driven. Tubes and blisters inflate CBM (cubic meter) and can wipe out material savings; fold-flat sleeves and dozen cartons compress volume for air/express. Compare sea vs air and lock your pack style only after a total landed-cost simulation.

✔ True — Model landed cost per dozen including CBM (cubic meter) and air-lane realities

Freight is volume-driven. Tubes/blisters inflate CBM (cubic meter) and can outweigh material savings; fold-flat sleeves/dozens compress volume for air/express. Compare sea vs. air and lock the format only after total landed-cost simulation.

✘ False — “Lowest EXW unit price wins regardless of freight”

Ignoring CBM and dimensional weight creates budget overruns. Volume, not grams, usually decides your real cost.

What are typical MOQs by region and category for a single model?

MOQs stack with complexity and with each variant (color, print and pack). Mainland factories are flexible on range and entry-game; urethane or heavy branding raises thresholds. Brand plants and premium OEMs in Thailand/Taiwan often ask for higher minimums, especially during peak seasons.

| Country | Range | Game | Tour |

|---|---|---|---|

| China | 1k–5k | 1k–3k | 3k–10k |

| Vietnam | 2k–5k | 3k–8k | 5k–20k |

| Thailand | 3k–8k | 5k–15k | 10k–50k |

| Taiwan | 3k–10k | 5k–15k | 5k–20k |

| USA | 1k–3k | 2k–5k | 5k–10k |

How long do builds take when printing runs in parallel after FA?

Cycle times scale with construction and queue depth. Use these windows for planning, then add transit and approval buffers. Printing can run in parallel after first-article sign-off, but retail cartons require dieline lock. Urethane needs curing and stricter QA, so expect longer, less flexible tails.

| Category | China | Vietnam | Thailand/Taiwan | USA |

|---|---|---|---|---|

| Range (2-pc ionomer) | 3–5 wks | 4–6 wks | 6–10 wks | 4–8 wks |

| Game (2/3-pc ionomer) | 4–6 wks | 5–7 wks | 8–12 wks | 5–8 wks |

| Tour (3/4-pc urethane) | 5–8 wks | 6–9 wks | 8–12+ wks | 6–9 wks |

Do MOQs apply to the whole order or to each variant you split?

They apply per variant. A “10,000-ball” plan fragments once you add colors, logos and pack forms. Each sub-variant has setup costs and minimums (plates, jigs, tooling). Consolidate SKUs to reduce waste, lead time and dead inventory in new channels before you test retail velocity.

✔ True — MOQs stack by model, color, marking and pack form

A “10,000-ball” plan can split into smaller sub-batches internally: each color, logo version, or packaging style may have its own MOQ and setup costs (plates, jigs, tooling). Consolidate SKUs to reduce waste and lead time.

✘ False — “One global MOQ covers every color/print/pack”

Ignoring per-variant MOQs inflates cost and pushes schedules; treat each variant as a mini-run when planning.

Which printing and packaging choices move P&L (and CBM) the most?

Pad printing rules mass OEM for logos and alignment marks; UV-DTF or UV direct shine for complex art or small lots. Packaging is the hidden lever: tubes and blisters drive CBM up; fold-flat sleeves and dozen cartons compress volume and protect margins for air and express lanes.

Printing options (compact)

| Method | Best For | Pros | Trade-offs |

|---|---|---|---|

| Pad Printing | Mass OEM | Low cost, fast | Limited gradients/photo |

| UV-DTF Transfer | Mid/Hi detail | Saturated look, durable after top-coat | More steps, slower |

| UV Direct | Small/variable | No plates, on-demand | Slower; durability ≈ clearcoat |

Retail pack choices (compact)

| Pack | Use Case | MOQ (typical) | CBM Note |

|---|---|---|---|

| 4×3-ball sleeves + dozen box | Retail standard | 500–1,000 | Fold-flat, CBM-friendly |

| PET tube (3-ball) | Promo/visual | 2,000–3,000 | Higher CBM |

| Blister (3-ball) | Mass retail | 3,000–5,000+ | Highest CBM |

Decision Tree, RFQ & FAQs

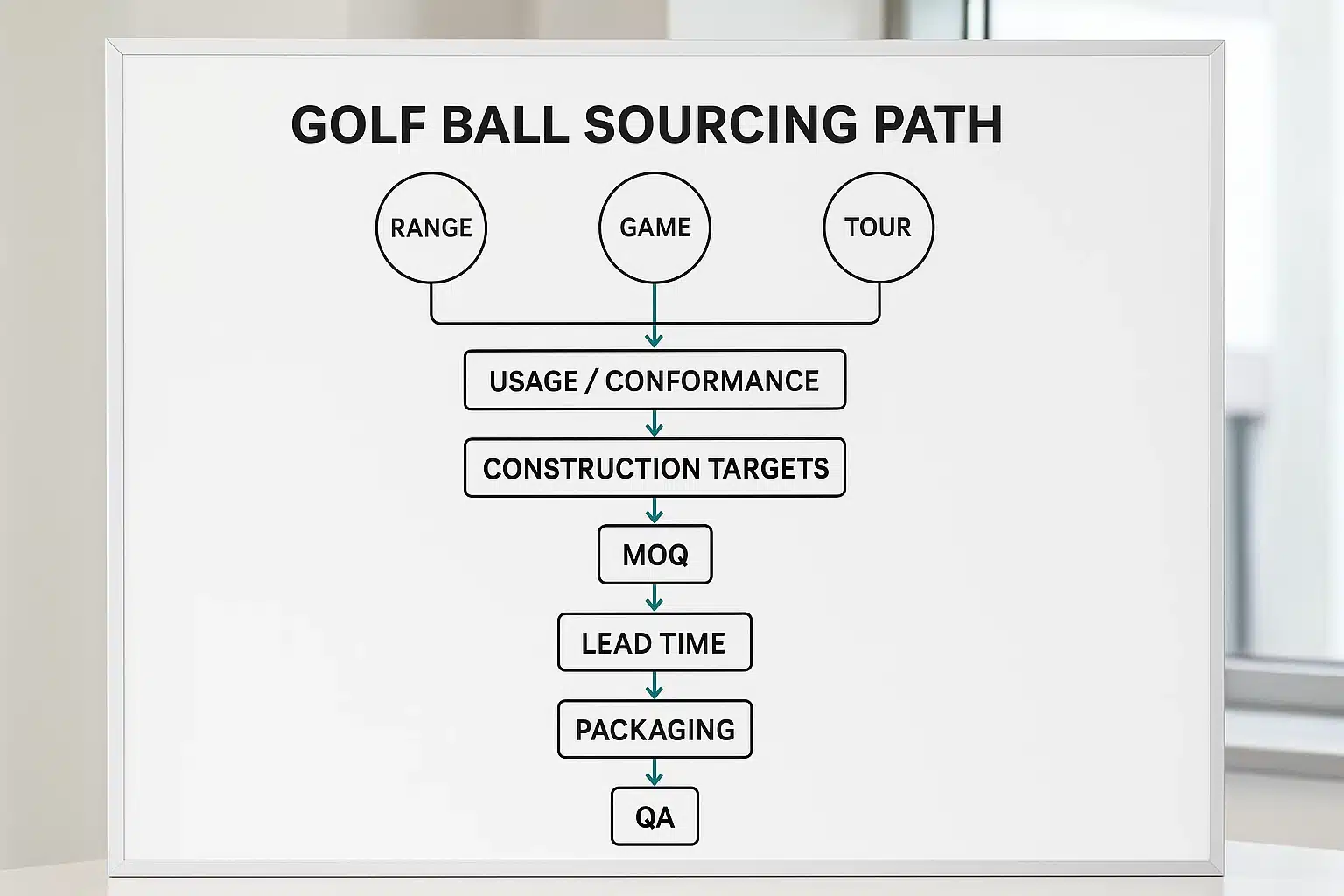

Decide usage and compliance first, then construction targets, then commercials and ops. This order avoids redesign loops and mis-aligned quotes. Freeze CTQs (Critical-to-Quality: weight, diameter, IV, AQL) early; pick printing and packaging with CBM in mind; require data trails (CPK/COA) so repeat orders remain consistent.

What is the three-step buyer decision tree from usage to purchase order?

Start by fixing category and conformance; lock construction targets; then close on MOQ, lead time, pack/printing and QA. This “usage → build → operations” sequence keeps stakeholders aligned, shortens sampling, and ensures range vs game vs tour golf balls land in the right channels at the right margins.

-

Step 1 — Usage/Conformance: Range / Limited-flight / Game (Conforming) / Tour-level

-

Step 2 — Construction Targets: Layers; cover (ionomer vs urethane; cast vs TPU); compression; spin/launch targets

-

Step 3 — Commercials & Ops: MOQ; lead time; printing/pack; CBM & freight; AQL/CPK documentation

Which use cases and channels fit each category (so sales doesn’t cross wires)?

Use the two compact tables to make merchandising clean. Range serves bays, teaching and entertainment; Game covers club play and value retail; Tour anchors flagship lines in specialty and pro shops. Mark range balls distinctly to avoid pro-shop bleed-over and returns.

Use cases (by category)

| Category | Typical Use |

|---|---|

| Range | Range bays, academies, limited-flight entertainment |

| Game | Club play, leagues, value retail distance lines |

| Tour | Professional/elite amateur play, flagship retail |

Primary channels

| Category | Primary Channels |

|---|---|

| Range | B2B to ranges/academies/entertainment venues |

| Game | Pro shops, specialty chains, e-commerce (DTC/marketplaces) |

| Tour | Brand DTC, pro shops, specialty retail; some big-box presence |

Can one concise FAQ settle the most persistent confusions?

Yes. Keep answers direct and operational. “Practice” can be conforming if it is a cosmetic grade of a current-listed model; “tour-level” marketing may not equal true tour urethane; “soft” signals feel more than speed; and refurb/lake balls vary widely. Fit with the gamer ball, not range balls.

Is a “practice” ball ever legal for tournaments?

Yes—if it’s the same current-listed model sold at retail and only cosmetically downgraded. Always cross-check the exact model on the current list and confirm whether the event adopts G-3. Range-only models with big “RANGE” markings are typically not listed and not eligible.

Does “tour-level” always mean a true tour ball?

Not necessarily. Confirm a urethane cover, the intended player profile, tighter tolerances and—if used in competition—appearance on the current list. “Tour-inspired” ionomer balls exist; they are excellent for value play but do not replicate urethane tour control around the green or in wind.

Does soft feel always reduce distance?

No. Many soft balls retain competitive driver speed; feel is not a distance guarantee. Compression interacts with core chemistry, mantle and dimples. Validate distance and spin with a launch monitor using the gamer ball and the player’s swing, not a limited-flight practice ball.

Do X-Out, refinished or lake balls conform like new retail stock?

They may not match original performance or listing status, and quality variation is common. Position them for practice/recreational use, avoid implying tour equivalence, and do not rely on them for fitting or benchmarking against your retailer SKUs.

Key Takeaways

Range equals practice durability and sometimes limited flight; Game equals conforming retail models for play; Tour equals the urethane, high-tolerance subset inside Game. Judge by current list → cover → layers. Origin shifts cost/MOQ/lead time. Packaging and printing drive CBM and landed cost. Lock specs via RFQ.

-

Choose usage & compliance first, then construction, then operations.

-

Treat EXW as an anchor—optimize landed cost per dozen with CBM factored.

-

Expect higher MOQs/lead times for urethane multi-layer; finalize artwork and dielines early.

-

Use the decision tree + RFQ template above to get apples-to-apples quotes and clean QA trails.

Conclusion

The practical difference between range, game and tour golf balls is purpose plus construction: practice durability vs conforming play vs urethane tour control. Then origin, cost, MOQ and lead time complete the sourcing picture for buyers aiming at stable margins and performance in their channels.

Since 2012, Golfara has manufactured and exported a full range of golf balls in China—from range models to game and tour-spec constructions. If you’re considering sourcing golf balls from China, feel free to contact us. Whether or not you place an order with us, we’re happy to share practical, professional advice on specs, compliance, packaging, and landed-cost planning.

- ✅ Low MOQ: from 1,000 pcs

- 🧪 Samples: printed in 3 business days

- ⚙️ Production: small batches in ≤20 working days

- 🎨 Design support: logo imprint & custom packaging

- 💬 Response: ≤12 hours with full quote & roadmap

You might also like — How to Source OEM Golf Balls from China: Specs, MOQ & Lead Time