To source OEM golf balls from China: lock specs (2-, 3-, or 4-layer, Surlyn/urethane, target compression, dimple pattern) and packaging quantity; shortlist factories via Google or B2B platforms and negotiate MOQ, price, lead time; request pre-PO samples; write product details and trade terms into the contract; arrange third-party PSI (pre-shipment inspection) before shipment.

- Lock specs and packaging

- Search factories; negotiate MOQ, price, lead time

- Request pre-PO samples

- Contract product details and trade terms

- Hire third-party PSI pre-shipment

Already set on sourcing OEM golf balls from China, but unclear on how? This guide maps your spec to the right manufacturing cluster, verifies real factories, aligns MOQ & lead time, and negotiates price with the right levers, so your first order ships smoothly.

Choose the Right China Cluster for Your Golf Ball Spec

Map by spec and timeline: choose Qingdao for cast-urethane 3–4-layer (Tour-leaning, retail consistency), Xiamen for 2–4-layer with integrated gift packaging, Ningbo/Taizhou for small-MOQ, low-cost 2-piece Surlyn runs, Dongguan/Shenzhen for rush printing/kitting.

-

Need Tour-leaning urethane consistency → Qingdao

-

Need 2–4-layer + gift packaging, faster sampling → Xiamen

-

Need small-MOQ, low-cost 2-piece Surlyn → Ningbo/Taizhou

-

Need promo rush with heavy printing/kitting → Dongguan/Shenzhen

Cluster × Core Products × Buyer Fit

| Cluster | Core products/process | Best for | MOQ/Lead time* |

|---|---|---|---|

| Qingdao (Shandong) | Cast-urethane 3–4-layer | Player/Tour-leaning retail | Med / Med–High |

| Xiamen (Fujian) | 2–4-layer + gift packaging | Mid-volume OEM/ODM | Med / Med |

| Ningbo/Taizhou (Zhejiang) | 2-piece Surlyn, color/night, range | Cost-sensitive, small lots | Low / Low–Med |

| Dongguan/Shenzhen (Guangdong) | Promo/gift sets, fast finishing | Time-critical projects | Med / Low–Med |

How to use the table: Start with the ball you need (distance, spin, feel), then pick the cluster that most often ships that construction at your quantity band. Ask each plant about its current line availability, coating windows, and print capacity during your target month. If two clusters can deliver, choose the one with the shorter inbound packaging lead and more predictable print slots

✔ True — Big plants aren’t always best for small orders

Large factories prioritize high-volume customers, set higher MOQs, and can deliver less stable lead times during peak allocations. For pilot or trial buys, smaller shops are often more flexible—lower MOQ, earlier line access, and more attentive service.

✘ False — “Bigger factory = faster and safer for every buyer”

Size doesn’t guarantee results. Capacity allocation, print/coating slot priority, MOQ policy, and responsiveness drive your outcome. Pick by fit to volume and timeline—not headcount.

Typical Processes & Common MOQ/Lead-time Ranges

-

2-piece Surlyn: MOQ typically 2,000+ pcs; some plants allow 1,000–1,500 pcs for pilot runs with price/packaging trade-offs. Lead time 20–30 days from artwork approval to ex-factory when packaging is standard. Injection cores and simpler coatings compress both cycle time and scrap risk.

-

3–4-layer urethane: MOQ typically 5,000+ pcs; some allow 1,000–1,500 pcs trial runs. Lead time 35–40 days depending on coating cure windows, line congestion, and artwork complexity. Urethane adds temperature control and tighter adhesion checks.

-

Seasonality (Aug peak & CNY): From August, most golf-ball factories enter Q4 peak; near Chinese New Year, many plants shut down ~1 month. If shipping overlaps either window, plan procurement 30+ days earlier (book lines, pre-buy packaging, lock print slots) to avoid delays.

Decision rules: primary vs backup cluster

-

Need rush or Q4 peak slot? → Favor Dongguan/Xiamen for faster kitting & pack flexibility.

-

Need Tour-grade urethane quality? → Favor Qingdao for casting/coating consistency.

-

Need lowest MOQ or pricing? → Favor Ningbo/Taizhou for flexible prints and short runs.

Find and Verify Professional “Real Factories”

Use five filters: website specificity, RFQ responsiveness, shop-floor proof, customer/market fit, and USGA/R&A evidence. Two short loops of email and samples separate real factories from traders. Data, photos, cluster addresses, and repeatable answers beat sales claims.

Check the website: is it professional and in the right cluster?

Direct answer: A credible factory publishes specs and process, not slogans.

A good site shows products by structure (2-, 3-, or 4-layer), cover (Surlyn/urethane), target compression ± tolerance, dimple pattern, printing/QC notes, and a blog explaining process. Addresses map to clusters like Qingdao, Xiamen, Ningbo/Taizhou, or Dongguan/Shenzhen; generic “sell-everything” catalogs signal trading risk.

Confirm a consistent legal entity across the footer, contact page, and any PDFs. Photos should be captioned factory shots, not stock art. If the site mixes golf balls with random sporting goods, treat them as a trader until proven otherwise.

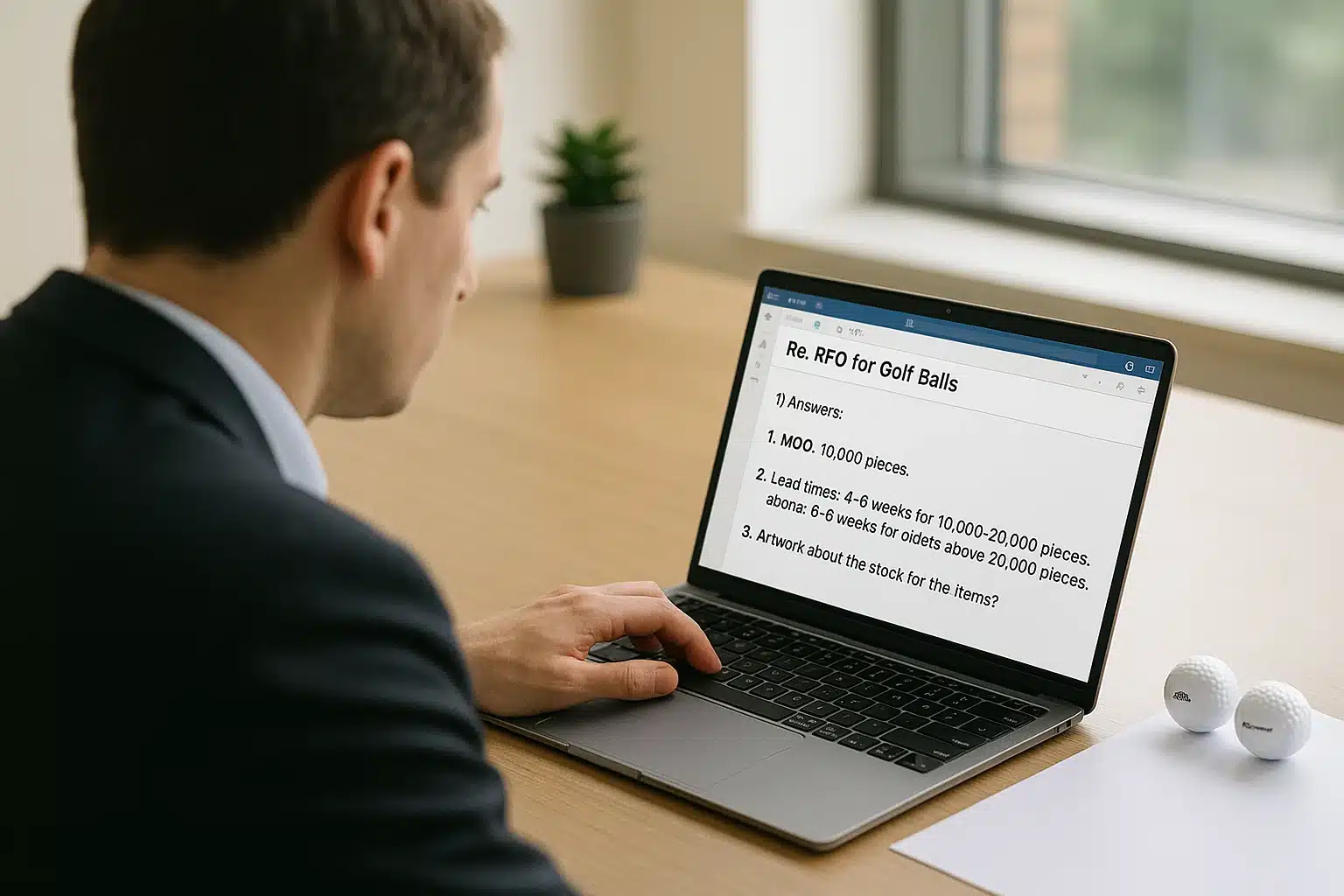

Do they answer RFQs on time—and with data?

Direct answer: If emails are late, your delivery will be too.

Expect 24–48 h replies with numbered answers, artwork questions, and preliminary MOQ/lead time bands; price-only replies or vague timing like “about a month” signal schedule risk and weak coordination.

Your RFQ should include: layers/cover, target compression ± tolerance, dimple pattern, colors/positions, registration limit, coating plan, packaging set, PSI (pre-shipment inspection) ownership, and Incoterms (FOB/DDP). If they miss RFQ deadlines, expect the same under production pressure—raise the bar or move on.

✔ True — What “lead time” actually includes

Lead time covers material prep, sampling rework, coating cure, print slots, QC buffers, and export docs—not just machine hours. Booking lines during sampling protects calendars.

✘ False — “After payment, production starts tomorrow”

Materials may need 5–10 days, molds/plates must be set, and QA gates sequenced. Rushing increases scrap and delays.

Ask for shop-floor photos or a short video

Direct answer: Real factories can show the line quickly.

Request 6–8 photos or a 60–90 s clip of in-line weighing, diameter screening, compression testing, print-registration checks, coating booths, curing ovens, and kitting—ideally time-stamped and tied to your pending sample.

What are their core products, export markets, and customer types?

Direct answer: Fit matters as much as capability.

Confirm their main builds, top export regions in the last 12 months, and customer mix (importers, wholesalers, retail chains, DTC). Ask for a one-page profile: top three SKUs by volume, typical standard MOQs (2-piece ≈ 2,000+; 3–4-layer ≈ 5,000+) and whether pilot 1,000–1,500 is possible, lead-time bands, and recent destinations.

Verify whether they handle gift packaging in-house. Promo/range buyers often do better with a Surlyn-heavy plant and fast print slots; retail/DTC buyers should favor factories that share compression/weight distributions and keep packaging supply stable.

✔ True — Higher spec doesn’t equal more professional

A factory that is No.1 in consistent 2-piece ionomer may serve your promo lineup better than a shaky 4-layer shop. Professional means fair pricing, on-time delivery, fast responses, and repeatable execution—spec alone isn’t the definition.

✘ False — “If they can do tour-grade, they’re automatically best for me”

Tour capability is a craft signal, not a service guarantee. For promo volume, the wrong “elite” partner can add cost, delay, and rework.

Can they show USGA/R&A compliance—or a plan?

Direct answer: There is no “USGA/R&A certificate”—use the official list.

For competition-legal claims, request a current USGA/R&A Conforming Ball List entry or a submission plan with dates; otherwise ask for recent lab data matching your intended build.

Have them identify the brand/model on the list that corresponds to their line and confirm unchanged materials, molds, and coating. If listing under your future brand isn’t feasible yet, accept current test data (diameter, weight, initial velocity/COR, compression) plus a dated submission plan. File these alongside ISO 9001 and material declarations.

✔ True — USGA/R&A conformance is model-specific; the current list is the authority

If a build is unchanged, prior lab data can support engineering continuity, but any competition-legal marketing should reference the current Conforming Ball List entry.

✘ False — “No fresh certificate means they’re unprofessional”

There is no certificate; recency alone isn’t the test. Match today’s build to the official list, and review measurable specs for repeat orders.

Print Decisions

Direct answer: Pad printing is cheapest at scale (after plates); UV direct has no plates and suits small/rush multi-color; decals + clear coat give premium looks but add steps. Per-position: $0.06–0.17, $0.14–0.42, $0.11–0.28.

China’s main print methods — when to use & cost

| Method | Best for | Traits | Typical unit price |

|---|---|---|---|

| Pad printing | Promo/range runs; large batches | Durable inks; limited colors; lowest cost at scale | $0.06–0.17 per color per position (per ball) |

| UV direct print (DO-UV) | Small batches; multi-color/gradients; rush jobs | No plates; fast artwork change; photo-grade detail | $0.14–0.42 per position (per ball) |

| Decal/transfer + clear coat | Gift/commemorative SKUs; large coverage; fine lines | Decal then clear-coat; premium look | $0.11–0.28 per position (per ball) |

Spec knobs that move MOQ & lead time

-

Ball color & white underbase: colored balls often need a white underbase (UV/decals) → extra pass, cost/time↑

-

Cover material: urethane covers can need adhesion promoters or plasma/corona; verify cross-hatch/solvent-rub before PO

-

Color/position count: each added color or position adds tooling, setups, checks → MOQ↑ / time↑

-

Registration limit: tighter ≤ 0.3–0.5 mm slows alignment and inspection

-

Clear-coat plan: UV clear is fast; solvent/2K needs bake/room cure → time↑

-

Artwork variety: many SKUs/small lots favor UV direct/decals; large, 1–2-color runs favor pad

✔ True — Fewer colors and one position unlock lower MOQ & earlier slots

On the first run, keeping artwork lean (1–2 colors, single position) reduces setups and checks, so factories can accept smaller MOQs and offer earlier print slots with less scrap risk.

✘ False — “UV is always cheaper”

UV saves plate fees but per-position unit price is higher. Total cost depends on colors/positions and batch size; for large, simple runs, pad printing often wins on economics.

Packaging Decisions

Direct answer: Pick packaging by channel and CBM impact, not looks alone: sleeves + dozen boxes for retail, mailers for e-commerce, mesh/OPP for ranges. Extra components raise MOQ, assembly time, and freight. Launch with standard dielines; upgrade finishes (spot-UV/foil, windows, EVA) after reorders.

China’s common packaging options — scenarios, MOQ, EXW (USD)

| Packaging | Best for (scenarios) | Typical starting MOQ | Reference unit price (USD/pc) |

|---|---|---|---|

| 3-ball sleeve (paperboard) | Offline retail, event gifting, inner layer of gift sets | 500–1,000 | $0.05–0.65 |

| Dozen box (4×sleeve) | Retail & e-commerce standard | 100–1,000 | $0.15–0.75 |

| PET/PVC tube (3-ball) | Club gifts, see-through display, e-commerce | 3,000 | $0.08–0.25 |

| Clamshell/blister (3-ball) | Warehouse clubs, supermarkets, tamper-evident | 5,000–10,000 | $0.10–0.30 |

| Nylon mesh bag (12/25/50) | Driving ranges, bulk practice packs | 500+ | $0.16–1.55 |

| OPP/zip bag (single or bulk) | Practice balls, inner poly for sets | 1,000–10,000 | $0.002–0.10 |

| Corrugated mailer (E/F-flute) | D2C e-commerce, subscriptions | 100–500 | $0.20–0.80 |

| Rigid gift box + EVA tray | Clubs, corporate gifts, VIP kits | 500–1,000 | $0.31–1.26 (box+EVA) |

| Tin/metal can | Premium gifts, membership kits | 500–3,000 | $0.20–1.06 |

| Acrylic single-ball display | Signed balls, memorabilia retail | 100–500 | $2.80–5.50 |

| PDQ/display tray | End-caps, checkout displays | 1,000+ | $0.03–0.63 |

| Shrink film/sleeve | Bundle promos, anti-scatter | 10,000 pcs/roll | $0.01+ per cut piece |

| Master carton (outer corrugated) | Cross-border shipping, 3PL | 500+ | $0.19–0.68 |

Combo reference (12-ball retail set, standard CMYK sleeves + regular dozen):

4 × 3-ball sleeves at $0.05–0.10 each + 1 × dozen box at $0.15–0.40 → materials ≈ $0.35–0.80 per set.

Premium finishes (spot-UV/foil/windows/EVA) can lift this to $1.50–3.35+ per set.

✔ True — Packaging cost is materials + volume + labor + time

Complex packaging increases CBM (freight), kitting labor, and line time—not just box cost. Start standard for speed and margins; upgrade finishes after demand is proven.

✘ False — “Fancier packaging is always better for first orders”

Overspec’d packaging often delays ship dates and erodes unit economics. Choose packaging that fits the channel and launch volume; add windows, foil, or EVA on repeat buys.

How to choose (quick mapping by channel)

-

Practice ranges / bulk: nylon mesh (12/25/50) or large OPP/zip; label + master carton.

-

Mass retail / warehouse clubs: 4×sleeve + dozen box; consider 3-ball clamshell or 12-ball blister tray for tamper-evident, shelf-ready.

-

E-commerce D2C: dozen box inside a sized mailer; add insert card/QR. Use shrink film for promo bundles.

-

High-end gifting: rigid box + EVA, tin, or wood (quote-based) for sets; acrylic box for signed balls.

Spec knobs that move cost & lead time

-

Board & print: paper weight, CMYK vs spot, foil/spot-UV, emboss/deboss → cost↑ / lead time↑

-

Inserts & trays: EVA vs pulp vs PET; die-cut complexity & tool charge → MOQ↑

-

Windows & plastics: PET windows, clamshells, tubes add CBM and require thermoforming/tooling slots.

-

Kitting steps: more components = more QC points and packing hours; include assembly labor in the quote.

How to Negotiate MOQ with Chinese Golf Ball Factories

Direct answer: Trade price, time window, and complexity for a lower MOQ—without lowering quality gates. Pay a small per-unit premium, simplify packaging/artwork, aggregate SKUs/colors, and avoid peak months. Ask dual quotes (standard MOQ vs. reduced MOQ with clear trade-offs).

Lever 1 — Pay a small premium for flexibility

What to ask: “Price two ways: (A) standard MOQ at base price, (B) reduced MOQ at a +$___/ball premium.”

Why it works: The premium covers setup loss and changeovers on small runs, so the factory doesn’t bleed margin while proving capability on your pilot order. (Quality gates unchanged: AQL/CTQ + PSI.)

Lever 2 — Show long-term intent (with credible numbers)

Share a 12-month demand plan, target channels, and launch windows (ranges are fine). Offer a repeat-PO review after the pilot if quality/delivery hit target. When the path to scale is clear, plants are far likelier to relax MOQ.

Lever 3 — Simplify packaging to unlock MOQ

Small orders choke on packaging MOQs. Example: 2,000 balls at 12/dozen need ≈167 dozen boxes, while many gift-box vendors require ≥500 units.

Workarounds: use standard sleeves/dozen dielines, white/mailers + branded label, or generic inserts for the first run; upgrade to foil/windows/EVA after reorders.

Lever 4 — Avoid peak season

From Aug–Oct many ball plants run hot for Q4 retail, and around Chinese New Year factories shut down or slow for weeks. In these windows MOQs and lead times rise. Negotiate off-peak or offer a wider ex-factory window (e.g., any date in W7–W9) to earn MOQ relief.

Lever 5 — Aggregate and de-risk the run

- Consolidate colors/positions (1–2 colors, single position) on the first PO.

- Share plates/fixtures across SKUs or merge colorways to hit one plate/one fixture thresholds.

- Accept split shipments (e.g., 1,000 air + 2,000 ocean) to ease line loading.

✔ True — MOQ comes from setup, materials, and print/kitting slots

Low MOQ becomes workable when you trade for it: a small unit-price premium, simpler artwork/packaging, a wider ship window, or aggregated colors/SKUs—while keeping AQL/CTQ + PSI unchanged.

✘ False — “MOQ is just a stubborn number”

Treating MOQ as arbitrary turns negotiation adversarial. Show concessions and a scale path; you’re more likely to get a workable pilot MOQ without weakening quality gates.

Typical OEM MOQs in China (per model / per color)

| Ball type / spec | Standard MOQ | Pilot / trial (if available) | Notes |

|---|---|---|---|

| 2-piece Surlyn (standard/retail) | 2,000+ pcs | 1,000–1,500 pcs (price/packaging trade-offs) | Good for retail/e-com ramp |

| 3-piece Surlyn (non-PU cover) | 2,000–5,000 pcs | 1,000–1,500 pcs (case-by-case) | “Distance + control”; colored shells counted per color |

| 3-piece cast-urethane (Tour-leaning) | 5,000+ pcs | 1,000–1,500 pcs (rare; pilot lots) | Some plants can run 3k with concessions |

| 4-piece urethane/composite (Tour) | 5,000+ pcs | 1,000–1,500 pcs (rare; pilot first) | New recipe/dimple → pilot first |

| RANGE balls (2-piece, durable) | 3,000–10,000 pcs | — | Driving ranges buy in bulk |

| Floating / water balls | 3,000–5,000 pcs / color | Case-by-case (often not offered) | Color counted separately |

| Night-glow / LED balls | 1,000–1,500 pcs | — (same as standard) | Blank can be lower; logoed OEM as listed |

| Matte color / dual-color shells | ≈3,000 pcs / color | — (pigment accumulation) | Pigment/ink needs color-wise accumulation |

| Plastic airflow practice balls | 1,000–1,500 pcs | — (same as standard) | Different line than true balls |

| Mini / park balls | 1,000–1,500 pcs | — (same as standard) | Entertainment/gifting sizes |

Lock Terms Before Samples: Save Time, Money, and Leverage

Direct answer: Before any samples ship, lock spec, MOQ, lead time, price basis, sample/plate fee credits, Incoterms, PSI ownership, and payment terms—or you risk “sample OK, terms fail” resets and lost leverage.

Why this step matters

-

Samples are rarely free: expect courier; custom print/pack mockups add real cost and time.

-

Approving quality before commercials weakens negotiating leverage.

-

Early alignment prevents the “sample OK, terms fail” loop and wasted rework.

What to lock before samples

-

Spec: layers/cover, target compression ± tolerance, dimple pattern; print colors/positions; coating plan & tests (cross-hatch/solvent rub; registration ≤0.5 mm).

-

Packaging: sleeve/dozen/gift dielines, board weight/finish, windows/labels/barcodes.

-

MOQ & lead time window: note peak seasons; confirm print/kitting slot availability.

-

Price basis: unit price, plate/setup, sample fee & credit rule, resample policy, quote validity & currency.

-

Incoterms & payment: FOB & DDP for the same spec.

-

Quality gates: AQL/CTQ, PSI (pre-shipment inspection) ownership, change-control ban (no material/ink/mold swaps without approval).

-

Traceability: golden sample attached to PO; retains with lot IDs.

FOB vs DDP (quick compare)

| Item | FOB | DDP |

|---|---|---|

| Price includes | Factory → port | Door-delivered (duty/tax incl.) |

| Who manages freight | Buyer | Seller/forwarder |

| Risk of surcharges | Buyer bears | Priced in (ask validity) |

| When to use | Experienced import ops | New importers / budget certainty |

Sample fees & credits

-

Line items: sample kit, plate/setup, courier, optional gift-pack mockups.

-

Credit trigger: e.g., “100% credit on PO ≥ MOQ within 60 days.”

-

Define resample triggers (off-spec compression, registration fail, adhesion fail).

-

Clarify ownership & storage location of plates/fixtures after PO.

Practical guardrails

-

Timeline: 7–10 business days for simple pad-print samples; longer for multi-color urethane or gift packs.

-

Ask for ladder quotes (1k / 1.5k / 3k) before sampling; tie sample-fee credits to PO size.

✔ True — Locking commercials first saves time and protects leverage

Agreeing on spec, MOQ, price basis, payment, and PSI before samples avoids costly resets and keeps you in control when the sample meets quality targets.

✘ False — “We’ll finalize price after samples”

Once quality is confirmed, your bargaining power drops. Set terms up front so a good sample converts to a clean, fast PO—not a renegotiation.

✅ Key Takeaway

Sourcing OEM golf balls from China isn’t hard—if you get the basics right:

Lock your spec early, pre-book print and packaging slots, trade complexity for MOQ, and enforce AQL/CTQ + PSI. Always compare FOB vs DDP before placing your PO.

Get these right, and your first order can be smooth and stress-free.

🏷️ Golfara: Custom Golf Balls with Fast Lead Times

At Golfara, we specialize in OEM golf balls for the US, EU, Japan, and Korea. Reach out freely, and we’d love to help you:

- ✅ Low MOQ: from 1,000 pcs

- 🧪 Samples: printed in 3 business days

- ⚙️ Production: small batches in ≤20 working days

- 🎨 Design support: logo imprint & custom packaging

- 💬 Response: ≤12 hours with full quote & roadmap

You might also like — How to Purchase OEM Golf Balls in Asia?